Blockchain Technology: What is this and how it works?

The simplest and most straightforward answer to the question of what a blockchain is is the following: a blockchain is a file in which all transactions ever made with cryptocurrency are recorded.

This definition is far from complete. It lacks mention of the most important principles of operation, without which a file with information about transactions cannot be called a blockchain. Namely:

-

the information in the file is written as blocks;

-

the file is distributed, i.e. it is stored on multiple computers simultaneously and synchronized between them;

-

the information is recorded in strict accordance with the consensus principles established for cryptocurrency.

Together with these principles, everything seems not so simple and clear anymore. So let’s start by memorizing the base (blockchain is a file where records of absolutely all transactions are stored), and then, based on it, let’s move on to the details. In fact, it is not difficult to understand them at all.

What is blockchain

Imagine that we have created digital money (for our computer game, for internal payments in our company, or for our government). And we want to know exactly

-

who transferred who, when, to whom and how much money;

-

who has how much money now.

For this purpose, we start recording all money transfers in a book. Since money is digital, the book will also be digital. That is, not just a book, but a database. This database we call the blockchain. And we set a rule: a transaction is considered to be valid only when there is a record of it in the database.

According to this rule, every time a certain Tatiana transfers money to a certain Alexei, she must enter information about it in our book. If there is no record, the money is not considered transferred. Anyone who opens the ledger will know that the money still belongs to Alice.

So, the blockchain is the only reliable source of information about all the transfers of money we create. It also makes it a reliable source of information about who owns what amounts at any given moment.

How blockchain works

This approach to keeping transaction records has several vulnerabilities.

-

If anyone can write a transaction record in the ledger, then Masha, who wants to hurt Tatiana, can write in the ledger, “Tatiana transferred all her money to Alexei.

-

After some time Tatiana can secretly tear out a page from the book with the record that she transferred money to Alexei. And on a new page write that she transferred this money not to Alexei, but to Dan.

-

If the book is destroyed, it will be impossible to verify who should have how much money.

Blockchains solve these problems based on the following principles.

-

Only someone who can prove that they have access to the disposition of the money can make a record of the money transfer. In an encrypted database, access is accomplished using an encryption key. Only someone who has the key to an address can enter information about money transfers from that address into the book. Thus, Masha will not be able to transfer money to Tatiana.

-

Each “page” (block) starts with the hash of the previous “page” (block). A hash is a unique cryptographic fingerprint of the data. Even if the data in a block is slightly changed, much less deleted, the hash that the next block starts with will not match the previous block. This will compromise the integrity of the blockchain, and everyone will be able to see in which particular block the incorrect change occurred. Thus, Tatiana will not be able to discreetly destroy the old record or correct it.

-

Anyone can save the blockchain to their computer and synchronize its current state with other devices: adding new blocks (“pages” of transaction records) to it as they appear on the network. Even if a few copies are destroyed, the rest will remain. Anyone can make new copies of them and continue to keep a record of transactions. In this way, blockchain is virtually impossible to destroy.

The essence of blockchain is that records are added to it not one by one, but in whole blocks. It can be compared to regularly pasting new filled pages into a book. This is why the blockchain is called a block chain.

Transaction senders add their records to “pages” that have not yet been glued into the ledger. When a block is added to the blockchain, that block’s validator (or miner) checks to make sure that all transactions follow the rules of the cryptocurrency. For example, it checks that each sender has signed their transaction with the correct key from the address they are trying to send money from. Only transactions that comply with the rules will go into the blockchain and be written to the blockchain along with it.

The main pros and cons of blockchain

Blockchain is a robust technology that offers a number of advantages over traditional systems.

-

The essence of blockchain technology, its decentralized nature eliminates the need for a controlling authority. Each person, with a copy of the blockchain file on their own computer, can personally control that the information in the blockchain follows the rules and is not altered. The blockchain system was the first technical solution that made information absolutely impossible to falsify.

-

The transparency of the blockchain contributes to an open financial system in which deception becomes meaningless. After all, in any situation it is easy to check where, where and when money was transferred.

-

Blockchain technology eliminates the need for intermediaries in financial transactions. Banks, interbank clearing systems, international payment systems, and money transfer systems all consume a huge amount of resources and increase the cost of maintaining the financial system. Blockchain replaces this in simple ways, leaving only one intermediary: the miner or validator of the blockchain. A blockchain-based financial system,

-

consumes far fewer resources than a traditional banking system,

-

has fewer points of failure and creates fewer obstacles to transactions,

-

making money transactions cheaper.

But from these advantages come the disadvantages of blockchain technology.

Independent control means independent responsibility. If a seller releases goods based on a transaction that is not in the blockchain or a transaction with fake tokens, no one will be able to help him get the money he is owed. In addition, the need to independently control a transaction raises the requirements for the level of technical knowledge of participants in financial transactions.

Transparency is often abused to take the coins sent by a person under the pretext of combating money laundering without providing anything in return. To combat this, private blockchains are emerging, where no one can trace transactions and accuse the sender of cryptocurrency that his coins or tokens were once involved in criminal activity.

If the only intermediary in any financial transactions is the miner (block validator), then the critical questions to answer when creating a new blockchain are: who will be mining (adding blocks) on it, and how to incentivize him to do it honestly, in strict accordance with the original rules. Not every blockchain ecosystem is able to find incentives for mining or fair validation. Somewhere there is not enough mining capacity, and hackers take advantage of this to spoof information. And somewhere validators themselves are accused of altering data.

Where blockchain can be used

Initially, blockchain was supposed to be used only for the financial sphere. It was for this purpose that Satoshi Nakamoto created it, and it was for this purpose that blockchain was introduced into the system of the first cryptocurrency, Bitcoin.

In the financial sphere, the applications of blockchain are clear.

-

Blockchain gives you the ability to manage your money without anyone else’s permission. With honest miners, all you need to send a transaction is a key to the address.

-

Blockchain reliably certifies that your money is your money.

-

Blockchain helps to verify where your money is being spent (e.g., by children, subsidized recipients, or governments).

-

Blockchain makes it easy to prove that a transfer of money has taken place.

-

Blockchain makes it possible to verify what specific coins or tokens were transferred in a transaction.

But blockchain technology can be used in any area where there is a need for immutable information (e.g., in medicine or many government processes) or for simplified addition of new data to a common database (e.g., when registering property transfers or voting). The point is that many blockchains allow you to add additional information to a transaction and thus bring something other than information about the movement of finances into the blockchain.

Popular blockchain platforms

Bitcoin was the first blockchain platform. The first blockchain platform was Bitcoin, followed by copycat blockchains with blockchains that differed little from it (Lightcoin, Neimcoin), and later blockchains that offered additional features:

-

Monero is a blockchain on which mining on specialized devices (asics) is impossible, and anyone with a video card can become a miner;

-

Efirium, Tron, Solana and other blockchains where much more complex smart contracts can be created;

-

Polkadot, TON and Avalanche - blockchain systems that distribute transactions across multiple chains to optimize resources.

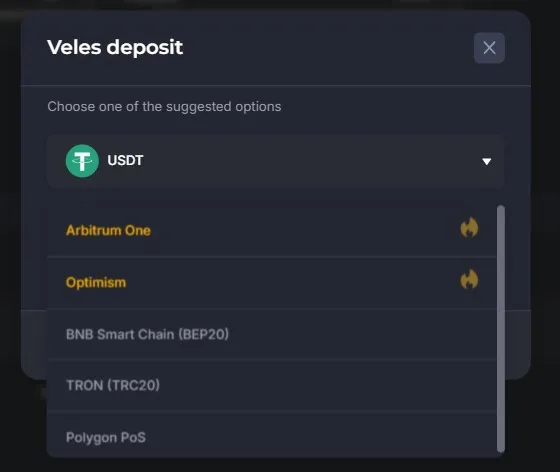

For example, multiple blockchains can be used to fund an account on the Veles platform. For example, the popular USDT token can be sent to your account through the BNB Smart Chain and TRON blockchains, as well as through the second-level networks (add-ons on top of the Ethereum blockchain): Arbitrum, Optimism and Polygon.

If choosing a blockchain to fund your Veles account seems difficult, you can ask for help from the site’s support team. They will be happy to help you.

And the major exchanges Veles works with support even more different blockchains. On the one hand, this can create additional difficulties when choosing, but on the other hand, it increases the number of assets available for trading, and therefore expands the range of tools and opportunities to earn money with the help of trading bots Veles.

Prospects for this technology

Due to its transparency, reliable storage and immutability of records, blockchain has great prospects for development and spreading as a major financial technology of the future. Its use may be particularly relevant for combating shadow finance.

Most blockchains store information about all transactions forever. This makes it too risky for criminals to use this technology. After all, even if tracking technologies are not able to catch criminals using the blockchain now, the information about their actions in the blockchain will not go anywhere. Sooner or later, the technology will improve and the criminal will be tracked down.

If we move all financial transactions to public blockchains, there will be no way to transfer criminal money. But governments adopting digital currencies prefer private blockchains, where only central banks and intelligence agencies have access to information. The closed nature of such blockchains significantly reduces the prospects for this technology.

Conclusion

Blockchain is, in simple words, a way of distributed storage of financial information, i.e. data on who owns what cryptocurrency and who transferred what cryptocurrency to where. The basic principles of blockchain are

-

immutability - recording of information in the form of blocks, each of which refers to the previous one, which makes editing any block practically impossible;

-

decentralization - storage of the database on many computers around the world;

-

openness - free access to the database for everyone for an unlimited period of time.