Solana Trading Bots

Solana, one of the fastest growing blockchain platforms, is attracting more and more attention from traders due to its high transaction speed and low fees. Consequently, many automated trading solutions are emerging to help traders manage their assets efficiently.

Automating trading in the cryptocurrency market allows traders to spend more time on real life, while maintaining internal harmony and a stable emotional state.

Algotrading allows you to digitize and program your trading strategy, eliminating all unnecessary details. Beauty in minimalism. It was, is and will always be so.

Top 5 best trading bots

for Solana

| Bot | Chart | PNL% (Month) | Average Time In a Deal | Minimum Deposit | Risk | |

|---|---|---|---|---|---|---|

SOL MRC+ADX | | +21% | 2D | $1000 | | Try |

SOL risk | | +21% | 15H | $1000 | | Try |

SOL Diver | | +25% | 9D | $1000 | | Try |

SOL MRC+RSI | | +31% | 2D | $1000 | | Try |

SOL Channel | | +31% | 3D | $1000 | | Try |

Solana bots are algorithms set up to generate profits by speculating on the price of a given asset.

The cryptocommunity considers Solana to be a rather weighty asset and the next step in the evolution of bitcoin and cryptocurrencies. This fact is necessary to reinforce confidence in this asset and that it can be safely traded without fear of scam.

The asset has managed to cover a distance of almost 2000% in less than a year. This is an impressive performance and a strong indication that this asset can and should be traded.

The Solana bots on the Veles platform buy and sell coins completely independently and no action is required from us other than the initial setup of the bot.

How do Solana bots work?

Solana bots function based on predefined algorithms and strategies. They can monitor market changes in real time, analyze charts and indicators such as trading volume and volatility to make decisions to buy or sell assets.

The main steps of Solana bots include:

1. Data collection: Bots analyze data on prices, trading volumes and other market conditions.

2. Data Analysis: Based on the collected data, the bots use algorithms to determine the best entry and exit points into the market.

3. Trade Execution: Once a decision is made, the bot automatically executes trades on the selected exchange.

4. Risk Management: Many bots also offer risk management features such as setting stop-loss and take-profit to minimize losses.

Register on the Veles platform

Connect the exchange manually or via fast-API

Choose a ready-made bot or customize it yourself

Now let's put it into practice

Our fees

For payment of commissions for the use of trading bots Veles is used account, which is opened on the platform itself. Each user opens such an account at the time of registration.

Payment occurs only when the bots bring profit. 20% of this profit will be deducted from the balance of your Veles account, but no more than 50 USDT per month for one type of trade.

For the bot to be able to open a position, you need funds in this account. That's why you need to fund your account before launching the bot. You can be sure that a deposit of 100 USDT per month will be enough even in case of the most profitable trading on both spot and futures trading bots combined.

Please note: your funds on the exchange can be used by the bot only as you have specified in the settings: that is, to use them for trading transactions under the market conditions you have chosen. The bot cannot do anything else with the assets you have placed on the exchange.

We take a commission of 20% from the profit you get when trading bot, but no more than $50 per calendar month.

There are several popular exchanges where you can use Solana bots for automated trading. These include:

- Binance: One of the largest exchanges that supports many trading pairs with Solana.

- Bybit: A platform that is popular among professional traders and offers advanced trading tools.

- OKX: An exchange known for its reliability and support for various cryptocurrencies, including Solana.

Types of bots

Grid Bots

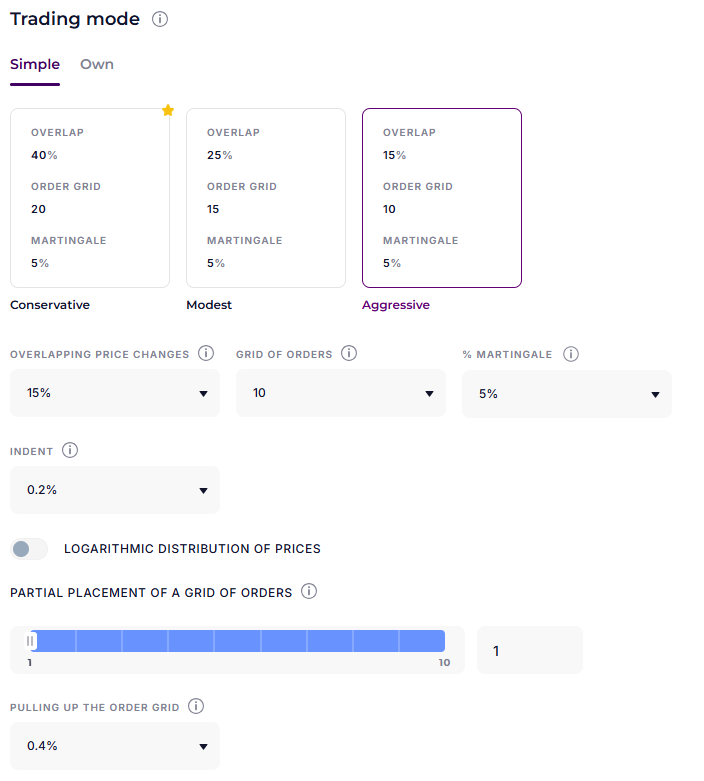

Grid bots will place orders to buy and sell the asset and pick volatility in price channels. On medium timeframes, the solana is in a sideways trend and therefore trading from support and resistance is ideal for your capital. On the Veles platform, functionality is available for any grid trading strategy, and there is also the possibility to comply with individual risk management criteria.

Distribute the order grid in a way that is as safe as possible for your deposit.

DCA Bots

With the help of trending algorithms, you can customize the intervals for buying the asset, as well as the order amounts. The bot will gradually build up the position and coolly wait for your desired potential. Globally, the asset is in an uptrend, this can be seen on the older timeframes, and on top of that there is potential for further movement.

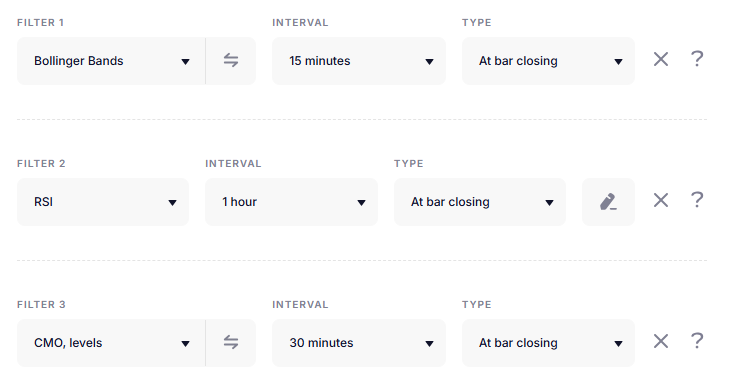

Bots for trading in a general sense

In addition to grid and trend variants, there is also a traditional variant of algo-trading, where a trader selects a trading strategy, indicators and calculates the potential of a deal for himself.

Thanks to the rich selection of tools, you can build a bot for any trading strategy, launch it and quietly go about your business.

Pros and Cons

Pros

Automation: Bots can work 24/7 without interruptions, which allows traders not to miss profitable opportunities.

Reducing emotions: Using algorithmic trading helps minimize the influence of emotions on decision making.

Access to data: Bots can process huge amounts of data and execute transactions faster than humans.

Cons

Risks: Trading bots can fail, especially in volatile market conditions. It is not always possible to predict how the market will behave.

Dependence on technology: If a bot or platform fails, it can lead to losses.

Knowledge Needed: Effective use of bots requires knowledge of trading strategies and an understanding of market performance.

Platform statistics

$ 79 743 086

User profit

47 349 316

Cycles closed

$ 418 429 395

Total deposit of bots

Conclusion

Using Solana bots can be a great tool to increase the efficiency of trading on the platform. However, it is important to keep in mind the risks and drawbacks associated with automated trading. Carefully researching the market, strategies, and opportunities that bots provide will help you make informed decisions and increase your chances of success in the world of cryptocurrencies.

F.A.Q

Solana trading bots are designed to execute trades in the spot and futures market. They can apply various strategies such as short-term action trading, medium-term swing trading and accumulative investment trading.

These bots focus on market data and execute trades according to predefined parameters, which helps traders to manage their positions effectively and increase profits. Build your own robot or take a ready-made one from the selection of bots for specific cryptocurrencies.