Bitcoin Trading Bots

There is no single bitcoin market; different trading platforms may offer slightly more or slightly less dollars for one bitcoin. But thanks to arbitrage opportunities, prices on different platforms differ slightly, the general trend: local trends for bitcoin are changing, while the global trend remains upward for many years.

Good bitcoin trading bots are bots that take this feature of the market into account and do not play against it, do not short bitcoin.

Shorting bitcoin can also be profitable sometimes. But this is a momentary profit. In the long term, shorting bitcoin has always turned out to be a losing strategy.

Top 5 Best Trading Bots

for Bitcoin

| Bot | Chart | PNL% (Month) | Average Time In a Deal | Minimum Deposit | Risk | |

|---|---|---|---|---|---|---|

| BTC Long | | +9% | 16H | $1000 | | Try |

| BTC Long |  | +7% | 14H | $1000 | | Try |

| BTC Long |  | +8% | 2D | $1000 | | Try |

| BTC Long |  | +15% | 18H | $1000 | | Try |

| BTC Long | | +9% | 3D | $1000 | | Try |

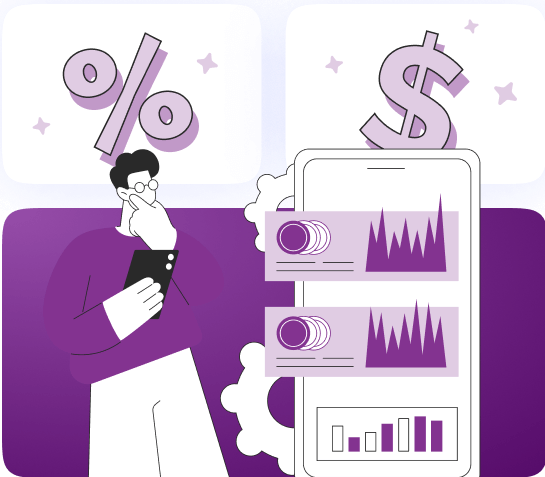

A bitcoin bot is a trading robot configured to constantly monitor the bitcoin exchange rate and decide when it is time to buy and when it is time to sell. If the bot assesses the situation on the market as suitable for buying or selling, it can notify the trader about it or perform all the necessary actions for him: make the necessary transaction without human participation.

Bitcoin bots on the Veles platform buy and sell bitcoins completely independently, and no action is required from us, except for the initial configuration of the bot.

How do Bitcoin bots work?

Bitcoin bot on the Veles platform can work according to two algorithms: LONG and SHORT.

LONG will never sell more bitcoins than it previously bought. His aggregate market position can be either bullish (aiming to profit from a rising rate) or zero.

SHORT, on the other hand, sells bitcoins first and then buys them back at a lower price.

As we said above, the SHORT strategy for trading bitcoins is not as winning as LONG. However, if you expect the rate to drop and want to capitalize on it, Veles allows you to configure a bitcoin bot to use the SHORT algorithm.

The bitcoin bot can work in one of three trading modes: conservative, moderate and aggressive. In conservative mode, the bot makes fewer trades and uses a smaller share of the deposit for each of them. Thus, it reinsures itself and reduces risks. In the aggressive mode, on the contrary, the bot tries to use maximum opportunities and does not leave the deposit idle: money must work. In the moderate mode, the bot tries to find a balance between these two options.

The bitcoin bot on the Veles platform can use filters to more deliberately determine the moments for trades. Filters are technical analysis indicators or signals received from the Trading View platform. Maximum flexibility of settings allows everyone to choose the most understandable and suitable for him principles of bitcoin bot. And detailed descriptions of each filter on the Veles website can help.

Finally, the bitcoin bot can report on its work by sending notifications to the trader in Telegram about each transaction.

Register on the Veles platform

Connect the exchange in the usual way or via fast-API

Choose a ready-made bot or customize it yourself

Now let's put it into practice

Our prices

For payment of commissions for the use of trading bots Veles is used account, which is opened on the platform itself. Each user opens such an account at the time of registration.

Payment occurs only when the bots bring profit. 20% of this profit will be deducted from the balance of your Veles account, but no more than 50 USDT per month for one type of trade.

For the bot to be able to open a position, you need funds in this account. That's why you need to fund your account before launching the bot. You can be sure that a deposit of 100 USDT per month will be enough even in case of the most profitable trading on both spot and futures trading bots combined.

Please note: your funds on the exchange can be used by the bot only as you have specified in the settings: that is, to use them for trading transactions under the market conditions you have chosen. The bot cannot do anything else with the assets you have placed on the exchange.

We take a commission of 20% from the profit you get when trading bot, but no more than $50 per calendar month.

The most important thing a bot needs to trade is a cryptocurrency exchange account, funds on it, and an API key to manage those funds.

Bitcoin is the most famous cryptocurrency, and it is traded on all Veles partner exchanges. You can safely choose any of them: bitcoin-bot can be customized for each.

The basis for all exchanges is the same. The nuances may be associated only with the choice of trading pair.

- On the Binance exchange, you can trade bitcoin to the Brazilian real, Japanese yen, Turkish lira and a number of other fiat currencies.

- On the Bybit exchange, only the euro is available from fiat currencies. The exchange does not charge a commission for trading bitcoin in pair to the USD Coin token.

- On the OKX exchange, bitcoin is traded against the UAE dirham, among other currencies.

On other exchanges (BingX, Gate, HTX), an attentive trader will find their own peculiarities, inherent only to these platforms.

And, of course, all cryptocurrency exchanges offer bitcoin trading to the most popular stablecoin - USDT.

Types of bots

DCA

No one knows where the price will go in the near future, so the DCA bot simply buys bitcoins at regular intervals (for example, once an hour or once a week) at the price available at the auction and expects to be able to sell them at a higher price in the future. And historical data shows that these expectations have so far always proved to be justified.

Grid

Grid trading is trading in a grid or lattice. A grid bot places several buy orders at rates lower than the current market price. When an order is triggered, the bot places a sell order at a higher rate. After the sale, the bot again places a buy order. Thus, the bot always operates with a grid of several buy and sell orders, gaining profit from rate fluctuations.

Pros and Сons

Pros

Round-the-clock mode: No need to sit at the monitor 24/7. The bot monitors the market, catching profitable moments even when you are sleeping.

Speed and efficiency: The bot reacts faster than a human to market changes, does not miss fleeting opportunities and captures profits in seconds.

Cold calculation instead of emotion: The bot works according to a set program, does not give in to panic or greed, does not make human errors.

Routine Automation: Price tracking, timely entry, risk control - all this is done by a bot, freeing you from routine.

Customizable strategies: You define the rules of the game. From simple strategies to complex algorithms, everything is under your control.

Сons

Market Risks: In the event of sharp drops or high volatility, the bot can compound losses if not set up correctly.

Need for monitoring: A bot is not a panacea. It is necessary to regularly monitor its work, adjust strategies, and adapt them to changing market conditions.

Technical complexity: Setting up a bot requires an understanding of trading strategies and technical subtleties. Not every beginner can cope with it.

Platform statistics

$ 79 743 086

User profit

47 349 316

Cycles closed

$ 418 429 395

Total deposit of bots

Conclusion

Bitcoin bots can automate and simplify the bitcoin trading process. The stable growth of bitcoin over the years demonstrates the advantage of a long-term approach, and bots can apply this principle with high efficiency: buy when bitcoin is cheaper and sell when it is more expensive.

F.A.Q

Bitcoin trading bots are designed to execute trades in the spot and futures market. They can apply various strategies such as short-term action trading, medium-term swing trading, and accumulative investment trading.

These bots focus on market data and execute trades according to predefined parameters, which helps traders to manage their positions effectively and increase profits. Build your own robot or get a ready-made one from the selection of bots for specific cryptocurrencies.