OKX trading bot by Veles

Automation in the modern world is the key to success for the vast majority of businesses. That is why cryptocurrency traders actively use trading bots to make transactions and increase the efficiency of their strategies. OKX exchange offers various solutions for trading using bots, which allows you to simplify the trading process and reduce risks. In this article, we will analyze what OKX trading bots are, how they work, and what types are available on the exchange.

Top 5 Best Trading Bots

For OKX Exchange

| Bot | Chart | PNL% (Month) | Average Time In a Deal | Minimum Deposit | Risk | |

|---|---|---|---|---|---|---|

| SUI Long | | +9% | 2H | $30 | | Try |

| AVAX Long | | +12% | 9H | $50 | | Try |

| Squiz Bot | | +7% | 4D | $100 | | Try |

| ETH Long | | +15% | 7H | $300 | | Try |

| BTC Long | | +9% | 3D | $1000 | | Try |

OKX bots are special programs that can automatically buy and sell cryptocurrency based on customized rules and parameters. They are used by traders in order not to miss profitable opportunities, especially when they cannot constantly monitor the market. This is convenient for both beginners and experienced users who want to automate complex trading strategies. The main advantage of such bots is their ability to act 24/7 without human intervention, reacting to changes in the market situation and performing scheduled operations.

Flexibility and diversification

The platform is adaptable to any trading strategy, from short-term operations to long-term investments. Traders can access more than 2000 trading instruments, which provides ample opportunities for diversification.

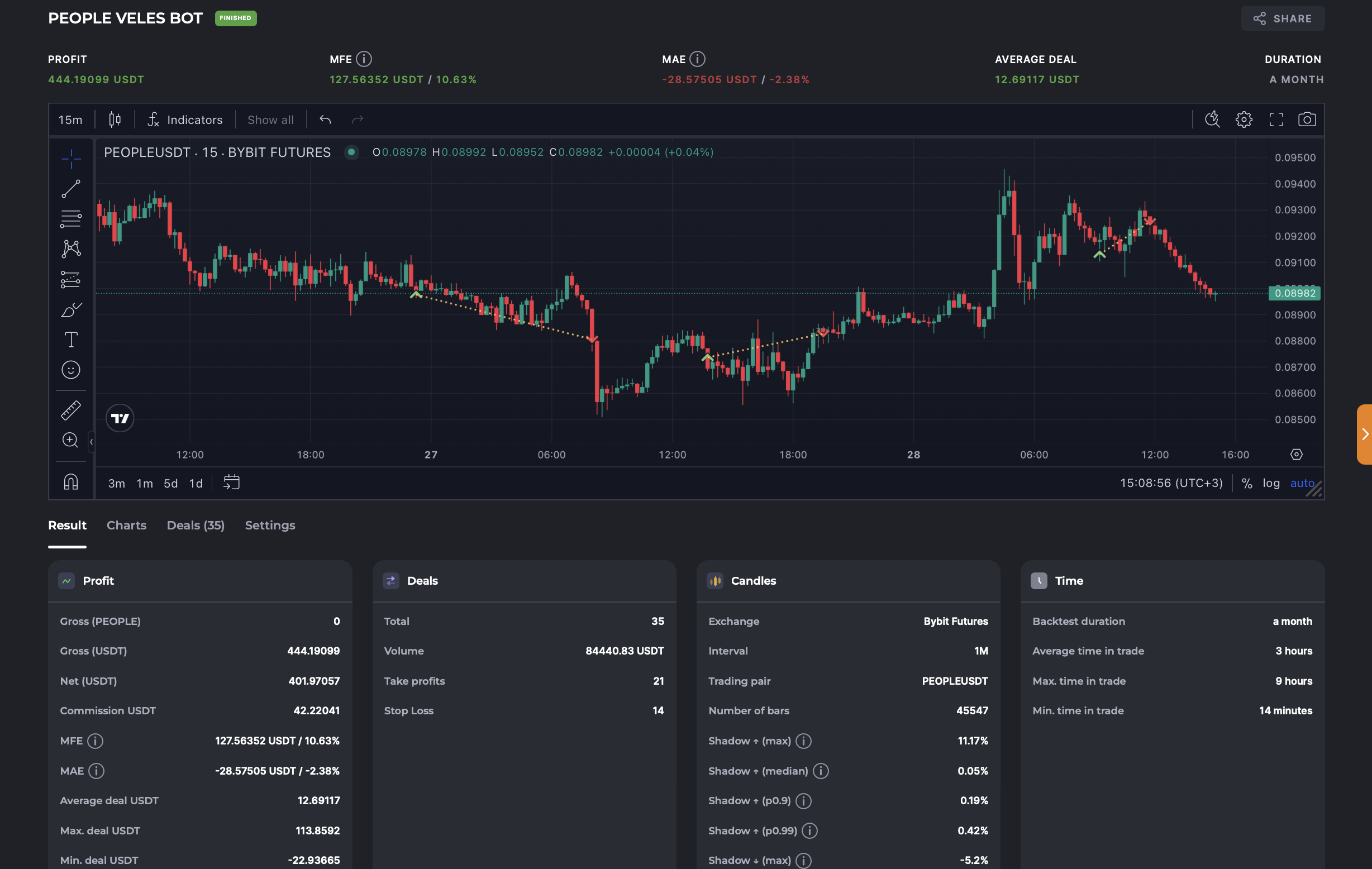

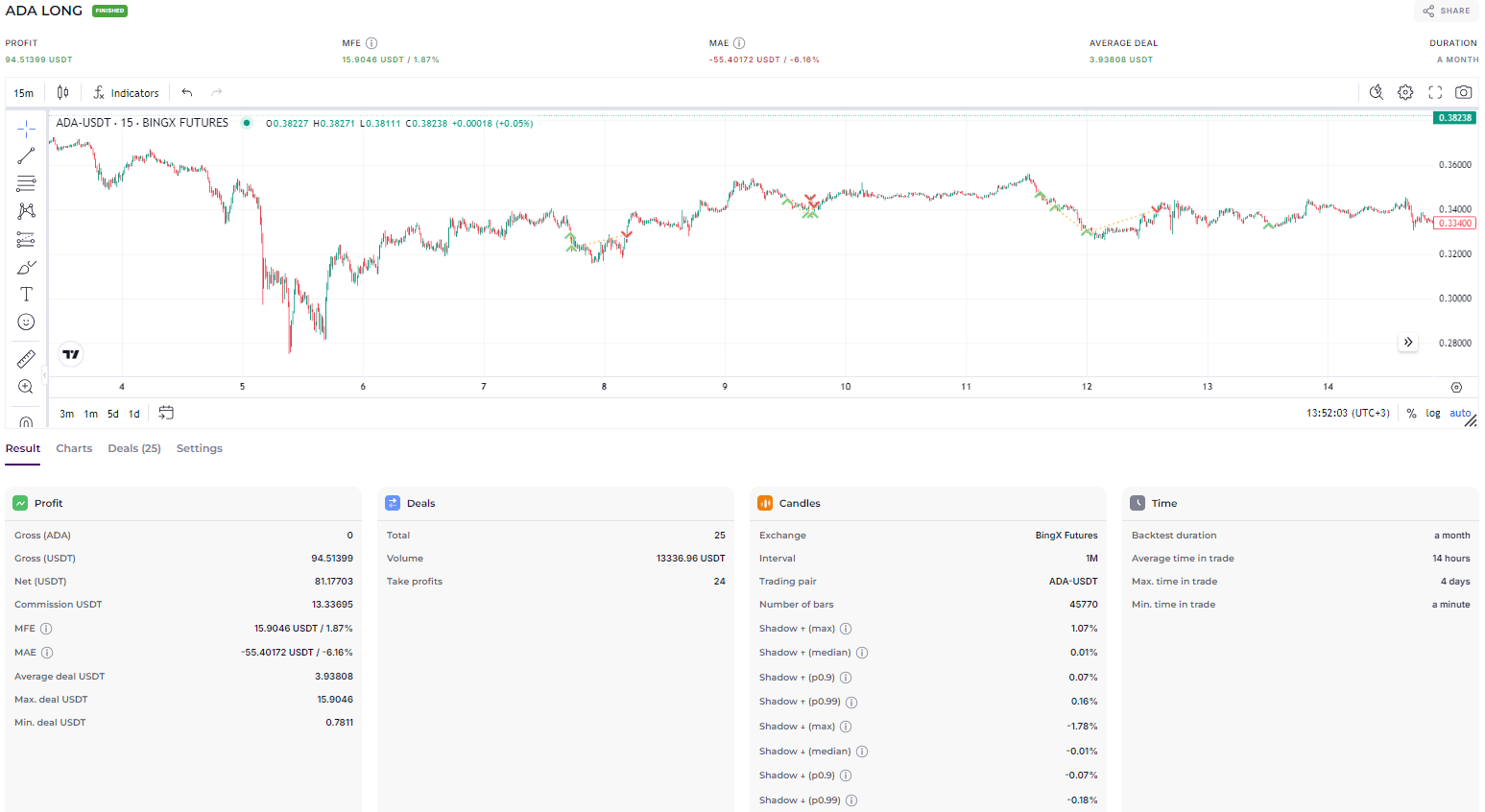

Advanced testing

Users can conduct backtests to evaluate their strategies on historical data and calculate profit-to-loss ratios. A huge array of candlestick and indicator combinations gives traders a deep understanding of the market, helping them make informed decisions.

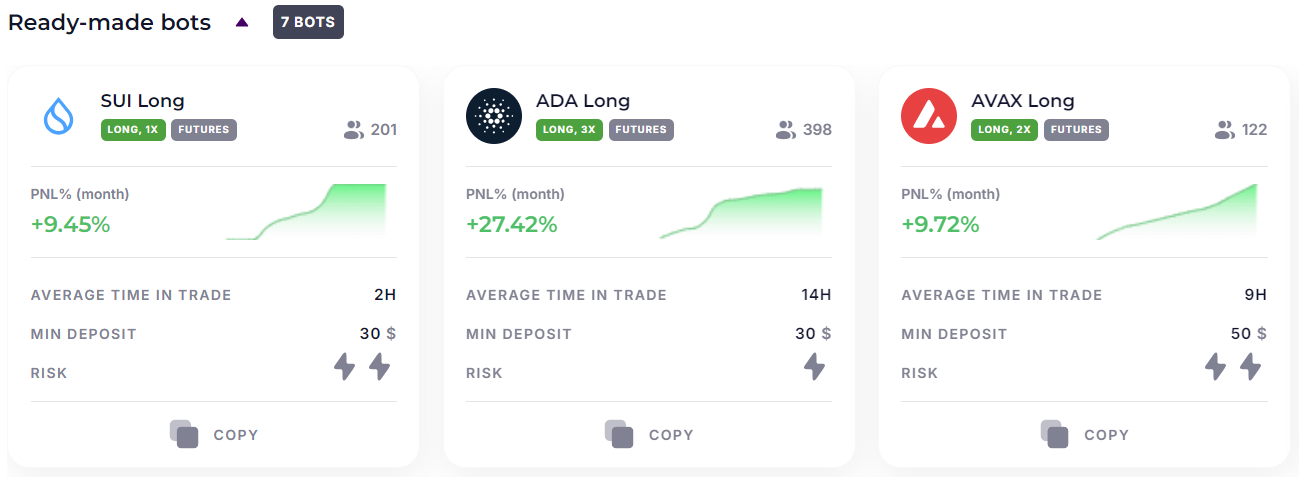

Proven ready-made bots

Ready-made cryptocurrency bots are available on the Veles platform with customizations that are proven to work in practice. These bots can save traders time and effort by providing them with ready-made strategies that have already shown positive results.

Benefits of using trading bots:

Elimination of the human factor. No more impulsive decisions, postponing stop loss or prematurely exiting a position. Bots act exclusively according to the algorithm set by you.

Freeing up your time. Forget about endless market monitoring and nights spent at the computer. Bots monitor your assets while you are doing your favorite things.

Discipline and control. Bots work according to your rules, helping you stick to your trading plan and protecting your deposit.

How do trading bots work on OKX?

Bots work by analyzing market data and performing operations according to predefined strategies. They can automatically buy and sell assets using algorithms that determine the best times to enter and exit trades. Bots work around the clock, which is especially important in cryptocurrency markets that do not close on weekends and holidays. Their main goal is to maximize profits and minimize losses.

Traders can set bot parameters such as buy and sell levels, risk management strategy and trade volumes. Bots can work with different types of assets, including spot market and derivatives, which gives flexibility to use different strategies.

We take 20% commission from the profit you get while trading with the bot, but not more than $50 per calendar month

Connecting to OKX

Connecting Veles to OKX is incredibly easy thanks to our One-Click Connection feature. Here are step-by-step instructions that will save you from having to manually create API keys:

- Go to the API key management or bot creation page on the Veles platform.

- Click "Add API key" and select OKX.

- Now click "Connect in one click".

- Authorize in your account.

- Allow OpenAPI creation and confirm the request.

- On the page that opens, click "Confirm" at the very bottom.

All necessary permissions for the full operation of the key will be automatically set, which will provide you with a smooth and fast connection.

Register on Veles platform

Connect the exchange in the usual way or via fast-API

Choose a ready-made bot or customise it by yourself

Now let's put it into practice

Types of bots for OKX

Spot grid-bot

Grid-bot is designed for buying and selling assets on the spot market. It works on the grid principle, automatically placing buy and sell orders at different prices. This allows you to capitalize on price fluctuations in the market. This type of software is well suited for the accumulation phase of the market, i.e. when there is a long consolidation at plus or minus the same levels, without sharp pumps and dumps.

Therefore, when, as traders say, the market "treads" in place, spot robots are able to "catch bottoms and highs", i.e. buy and sell at the best rate. The main disadvantage of the work - if there is a breakdown of the level or any sharp movement of the rate, you can incur losses. This, by the way, can be avoided by setting stop-loss levels.

Futures grid-bot

This robot acts similarly to the spot robot but works on the futures markets. It helps to utilize market volatility for profit, but with the added risk associated with futures contracts.

In simple words, it is the opposite of spot trading. It is optimal to use it during sharp rate fluctuations. Profit on futures can be greater than on spot, but the risks of losses are higher. It works mainly on short and super short timeframes.

DCA spot trading bot (Martingale)

The Dollar Cost Averaging (DCA) bot helps to average out asset purchases by buying assets in small batches at regular intervals. This strategy minimizes the risks of buying assets at the price peak. Martingale works strictly mathematically, if after the first purchase the price has gone further down, the position size is increased by a given percentage. This works as position averaging.

It should be taken into account that such tactics can lead to losses on prolonged dumps. Martingale can also be used during the consolidation phase of the market.

Price lock bot

This bot locks the price at a certain level, which can be useful for those who want to protect their assets from large rate fluctuations. This software is good for beginners or conservative traders.

Smart Portfolio Bot

Allows you to automatically distribute assets according to pre-configured parameters, helping to maintain a balanced portfolio. It is optimal for forming medium-term and long-term altcoin portfolios. Here you can not only form a portfolio, but also rebalance coins in it as market conditions change.

Repeat Purchase Bot

This bot automatically makes regular purchases of cryptocurrency at predetermined times. Useful for those who want to invest equal amounts of money over a certain period. Also a relatively conservative robot that targets long timeframes and helps to accumulate an alt position.

Arbitrage trading bot

Arbitrage bots monitor price differences on different exchanges and make trades to take advantage of these discrepancies. This is a complex but profitable strategy for experienced users. There are a lot of nuances here and it should be taken into account that the so-called "bundles" (favorable differences in the rates of one trading pair) do not last long. Therefore, arbitrage robots require more attention than other software. And of course, they are suitable only for experienced traders.

Pros and Cons

Pros

Can execute complex strategies that are difficult to implement manually. And it is difficult for a trader to keep more than 3-5 positions/levels in their head at the same time.

Bots react faster to market changes. No trade can be closed by hand faster than a robot can.

Ability to make trades 24/7 without trader's participation

Cons

For some users, setting up a bot can be complicated.

Despite automation, bots require periodic monitoring. For example, if you go away for a long time, and during this time a force majeure occurs on the market, for example, high volatility - it can lead to losses.

Misconfiguration of the bot can lead to losses.

Platform statistics

$ 79 743 086

User profit

47 349 316

Cycles closed

$ 418 429 395

Total deposit of bots

Conclusion

A bot on OKX is a powerful tool that helps traders automate their operations and make profits even without constant market monitoring. However, their use requires careful configuration and periodic monitoring to minimize risks. Before starting your activity in this sphere, you should thoroughly study different software options, the main market players, and the mechanics of working on exchanges.