BingX trading bot by Veles

Crypto trading is a bottomless well for a beginner: the further you go, the more details come out. Someone gets burned with his first memcoin, someone keeps only BTC (Bitcoin) in his portfolio. Someone trades $10 on a spot in fear of the debt collectors knocking after losing leverage. Let's avoid unnecessary waste of nerves and time, and most importantly - increase profits.

In this article we talk about how to automate the trading process with the help of bots. We will analyze the varieties, principles of operation and step-by-step creation on the example of the exchange "BingX". We will also tell you about additional bots with improved functionality.

Top 5 Best Trading Bots

For BingX Exchange

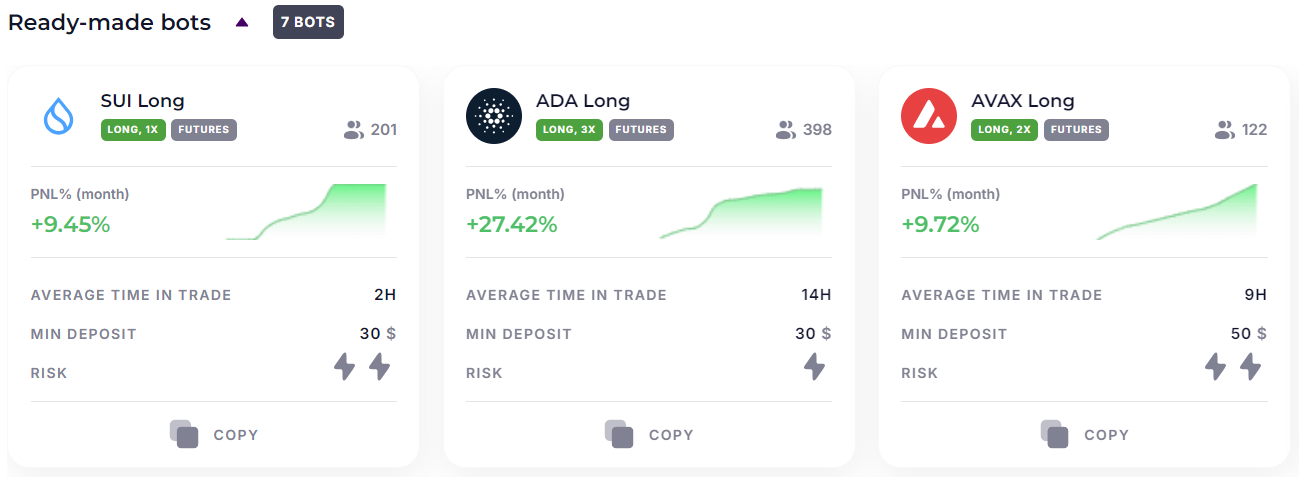

| Bot | Chart | PNL% (Month) | Average Time In a Deal | Minimum Deposit | Risk | |

|---|---|---|---|---|---|---|

| SUI Long | | +9% | 2H | $30 | | Try |

| AVAX Long | | +12% | 9H | $50 | | Try |

| Squiz Bot | | +7% | 4D | $100 | | Try |

| ETH Long | | +15% | 7H | $300 | | Try |

| BTC Long | | +9% | 3D | $1000 | | Try |

These are automated algorithmic programs to execute trading strategies on the BingX crypto exchange. These bots can work on a continuous basis, which compensates for the human traders' limitations. They can execute different strategies, from simple to complex, depending on the user's needs and preferences.

The Veles platform allows users to create their own trading bots by customizing entry and exit parameters and combining different indicators to develop unique strategies.

Flexibility and diversification

The platform is adaptable to any trading strategy, from short-term operations to long-term investments. Traders can access more than 2000 trading instruments, which provides ample opportunities for diversification.

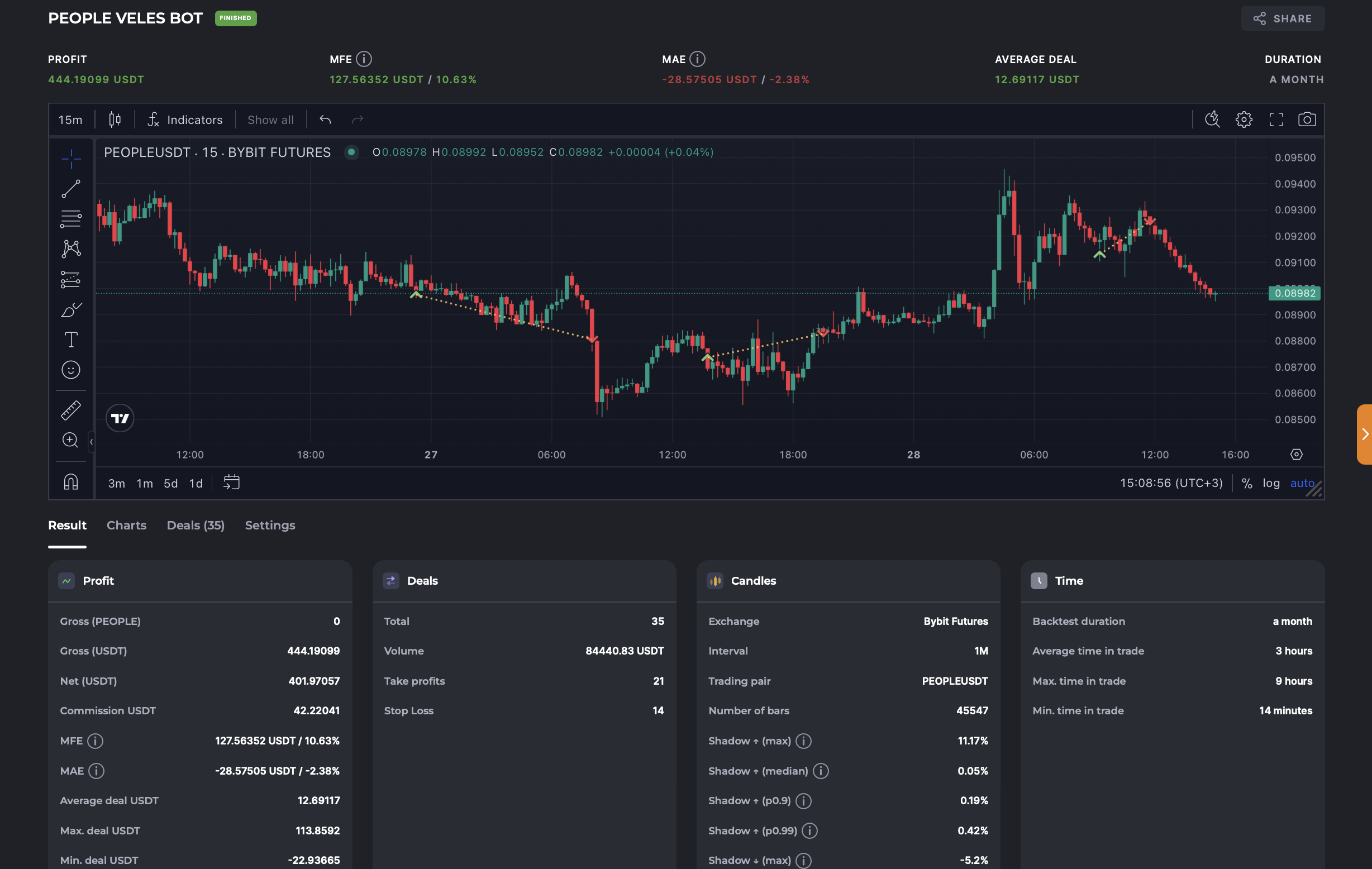

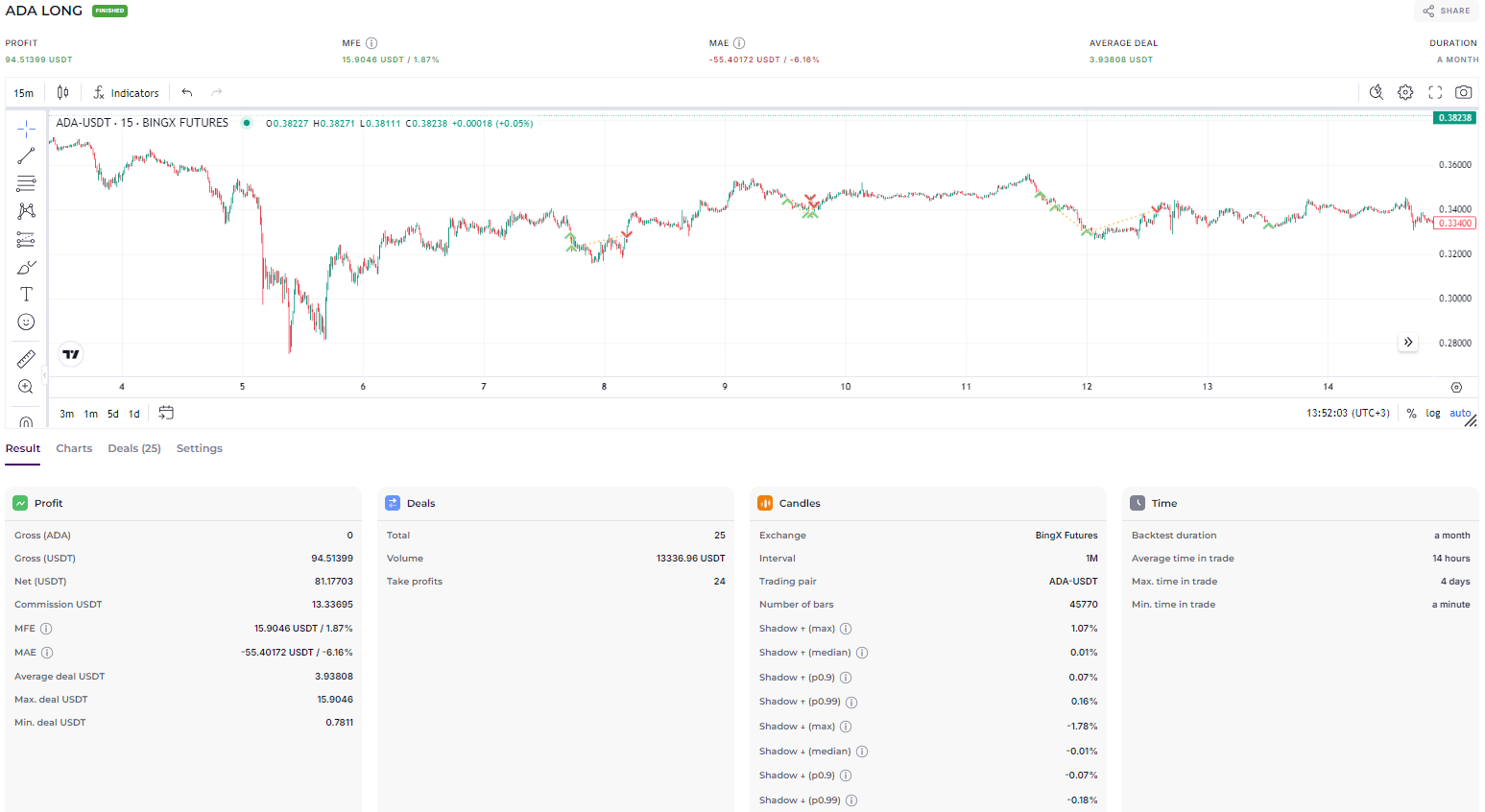

Advanced testing

Users can conduct backtests to evaluate their strategies on historical data and calculate profit-to-loss ratios. A huge array of candlestick and indicator combinations gives traders a deep understanding of the market, helping them make informed decisions.

Proven ready-made bots

Ready-made cryptocurrency bots are available on the Veles platform with customizations that have been proven to work in practice. These bots can save traders time and effort by providing them with ready-made strategies that have already shown positive results.

Advantages of using trading bots:

- Elimination of the human factor. No more impulsive decisions, postponing stop losses or prematurely exiting a position. Bots act exclusively according to the algorithm set by you.

- Freeing up your time. Forget about endless market monitoring and nights spent at the computer. Bots monitor your assets while you are doing your favorite things.

- Discipline and control. Bots work according to your rules, helping you stick to your trading plan and protecting your deposit.

How do trading bots work on BingX?

Trading bots on the BingX platform interact with the exchange through an API (Application Programming Interface). These bots carefully analyze market data, including asset values, trading volume and technical indicators. Based on pre-set parameters such as timeframes, order volumes and other critical indicators, they execute trades.

Once market conditions meet the set criteria, the bot automatically executes trades. This allows traders to save time and effort, as well as minimize the likelihood of emotional errors that can occur when trading manually.

We take 20% commission from the profit you get while trading with the bot, but not more than $50 per calendar month

Connecting to BingX

Connecting Veles to BingX is incredibly easy thanks to our One-Click Connection feature. Here are step-by-step instructions that will save you from having to manually create API keys:

- Go to the API keys management page or create a bot on the Veles platform.

- Click "Add API Key" and select BingX.

- Now click "Connect in one click."

- Authorize in your account.

- Allow OpenAPI creation and confirm the request.

- On the page that opens, click "Confirm" at the very bottom.

All necessary permissions for the full operation of the key will be automatically set, which will provide you with a smooth and fast connection.

Register on Veles platform

Connect the exchange in the usual way or via fast-API

Choose a ready-made bot or customise it by yourself

Now let's put it into practice

Types of bots for BingX

Infinite spot grid

Let's assume that you are actively using the spot grid. Once again you set a price range on ETH with an upper limit of $10,000 and a lower limit of $3,000, and then you go to bed. The next morning you see that the market price of Ether has exceeded $25,000. Yes, you still made money, but several times less. How does the infinite grid solve this problem?

It erases the upper boundary, leaving the lower boundary low. So you will continue to make profits as long as the price keeps going up. Without any limits. At the same time, the system works with restraint even with active growth in order to save the amount.

The infinite grid is used in bull markets or in an uptrend.

Spot grid

In the case of spot trading, the process looks simpler, but it does not lose efficiency. The bot buys the asset cheaper and sells it more expensive.

The initial capital is distributed on the chart around the market price. As soon as it reaches the upper limit, the bot will immediately sell everything. Similarly, at the lower boundary, it will actively buy back. The user's profit is in the difference between: buying lower and selling higher.

As in the case of futures trading, the spot grid will come in handy in a volatile market when prices have strong dynamics.

Futures grid

The system we have already analyzed is used as a basis: we divide the asset into several parts and let it float. The price goes up - sell, the price goes down - buy. And so on in a circle.

The futures grid is integrated into this system and includes long/short (up and down) directions. Let's explain by example. A user places sell orders every $10 above the current market price. Every time the price rises by 10$, we make a profit.

When creating the grid, we specify the number of elements. Each element is a bot hand taking profits. If the price went up 7 times and we had 6 elements, then we will not make a profit for the seventh.

At the same time, leverage allows us to make our initial 10$ a more serious bill: 20$, 50$ or 100$. In this case, we can either lose faster or make more money. If emotional swings aren't for you, the second kind of grid-bot is just about it.

Platform statistics

$ 79 743 086

User profit

47 349 316

Cycles closed

$ 418 429 395

Total deposit of bots

Conclusion

Trading bots for BingX are an effective tool for traders looking to automate their trading strategies and increase profitability. However, keep in mind that robots are not a guarantee of success and require careful customization of several parameters and constant monitoring. Test the bot thoroughly or choose a proven off-the-shelf bot before you start using it.