Binance Trading Bot by Veles — increase your profitability

In the world of cryptocurrency trading, where split-second decisions can either destroy or uplift your finances, trading bots are becoming indispensable tools.

Binance, one of the leading cryptocurrency exchanges, offers the ability to use trading bots that provide users with a convenient and secure way to automate trading. In this article, we will take a look at the best trading bots for Binance, their advantages and disadvantages, and tips on how to use them.

Top 5 Best Trading Bots

For Binance Exchange

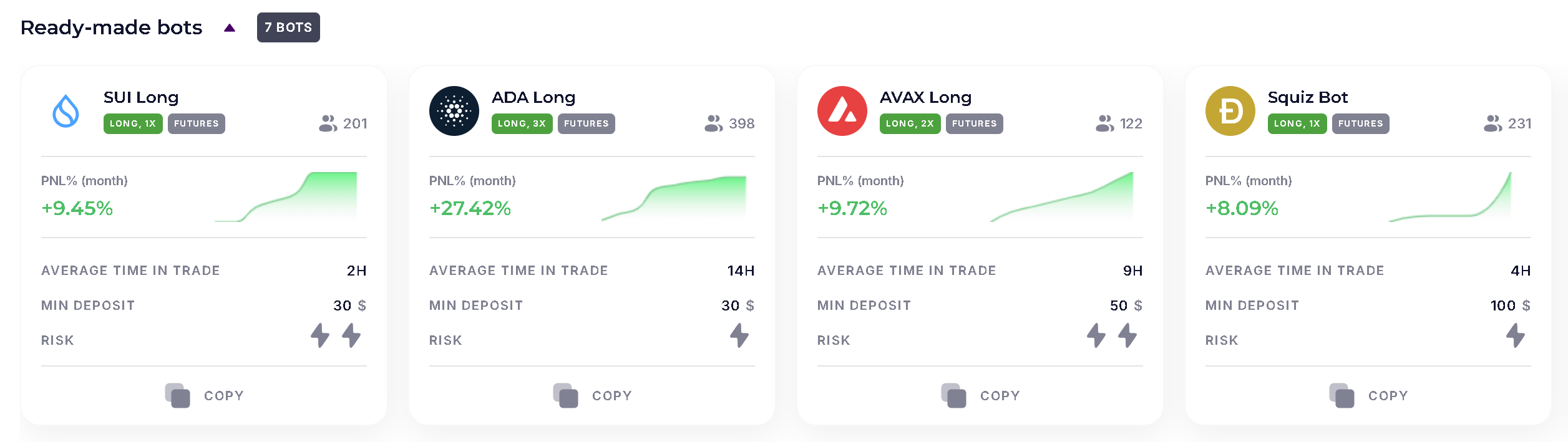

| Bot | Chart | PNL% (Month) | Average Time In a Deal | Minimum Deposit | Risk | |

|---|---|---|---|---|---|---|

| SUI Long | | +9% | 2H | $30 | | Try |

| AVAX Long | | +12% | 9H | $50 | | Try |

| Squiz Bot | | +7% | 4D | $100 | | Try |

| ETH Long | | +15% | 7H | $300 | | Try |

| BTC Long | | +9% | 3D | $1000 | | Try |

Binance trading bots are automated programmes designed to enhance cryptocurrency trading on the Binance platform. These bots use algorithmic intelligence to execute trades, manage portfolios and optimise strategies with high efficiency. Using trading bots allows traders to save time, reduce emotional biases, and potentially improve trading results. In addition, these bots do not have any paid subscriptions.

The Veles platform allows users to create their own trading bots by customising entry and exit parameters and combining different indicators to develop unique strategies.

Flexibility and diversification

The platform is adaptable to any trading strategy, from short-term operations to long-term investments. Traders can access over 2,000 trading instruments, providing ample opportunities for diversification.

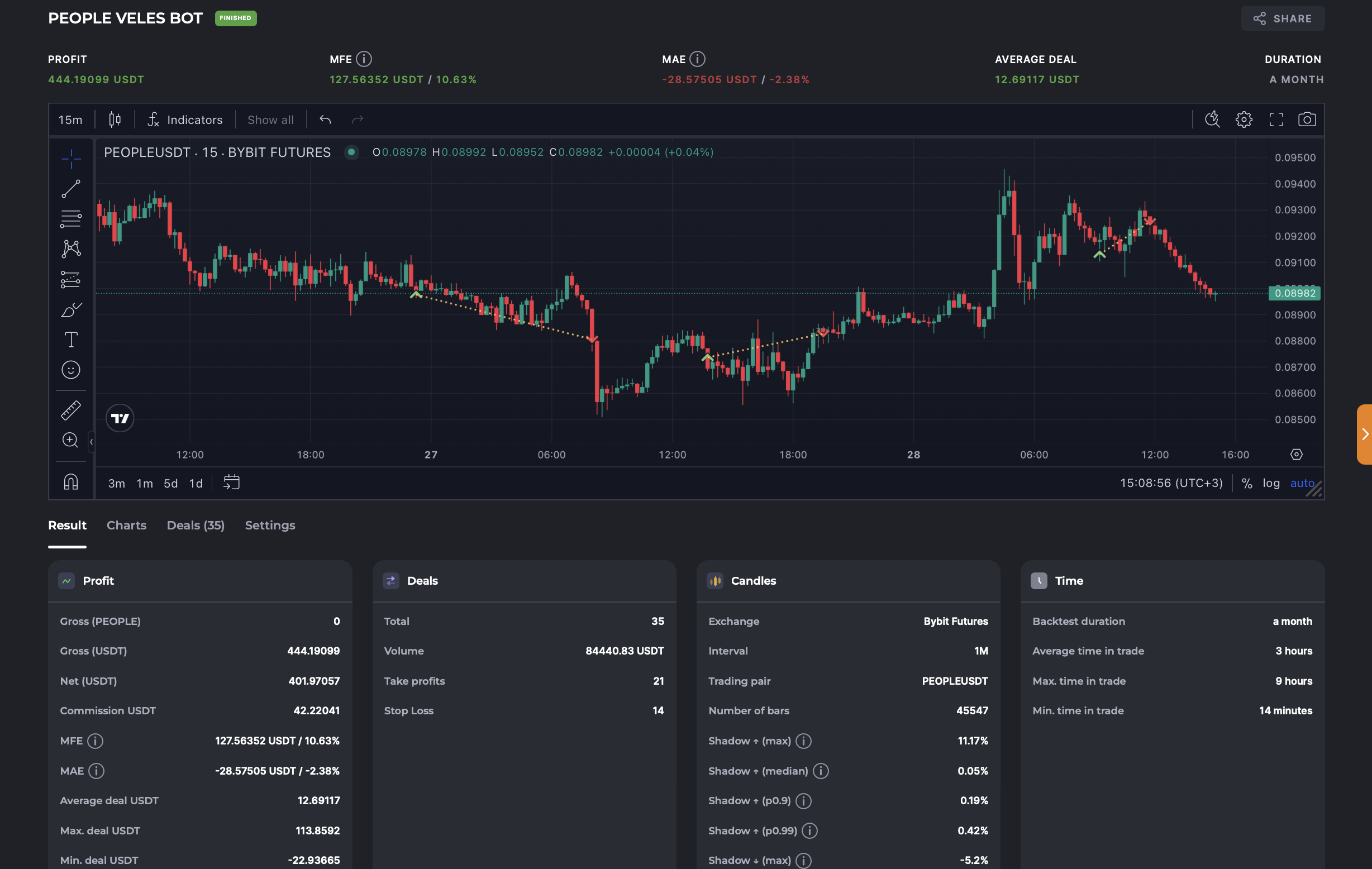

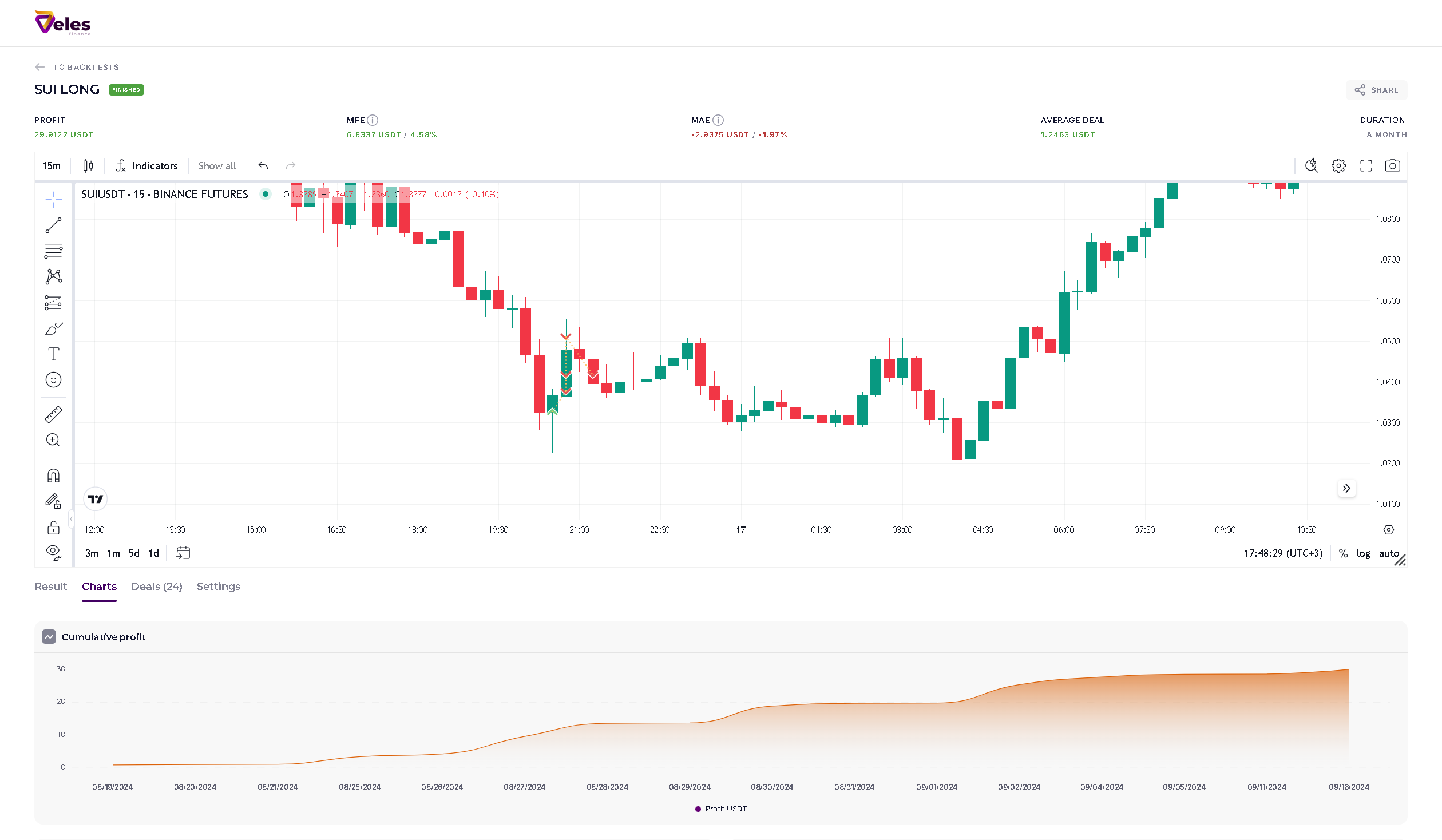

Advanced testing

Users can conduct backtests to evaluate their strategies on historical data and calculate profit-to-loss ratios. A huge array of candlestick and indicator combinations gives traders a deep understanding of the market, helping them make informed decisions.

Proven ready-made bots

Ready-made cryptocurrency bots are available on the Veles platform with settings that are proven to work in practice. These bots can save traders time and effort by providing them with ready-made strategies that have already shown positive results.

Advantages of using trading bots:

- Elimination of the human factor. No more impulsive decisions, postponing stop loss or prematurely exiting a position. Bots act exclusively according to the algorithm set by you.

- Freeing up your time. Forget about endless market monitoring and nights spent at the computer. Bots monitor your assets while you are doing your favourite things.

- Discipline and control. Bots work according to your rules, helping you stick to your trading plan and protecting your deposit.

How do trading bots work on Binance?

Trading bots on Binance are powered by algorithms that analyse market data and execute trades according to predetermined parameters. These parameters can include price levels, trading volumes and other conditions that determine when and how the bot should execute orders. Bots can be configured to execute various strategies, such as futures trading and spot trading.

We take 20% commission from the profit you get while trading with the bot, but not more than $50 per calendar month

Connection to Binance

Connecting Veles to Binance is incredibly easy thanks to our One-Click Connect feature. Here are step-by-step instructions that will save you from having to manually create API keys:

- Go to the API keys management page or create a bot on the Veles platform.

- Click 'Add API Key' and select Binance.

- Now click 'Connect in one click.'

- Authorise in your account.

- Allow OpenAPI creation and confirm the request.

- On the page that opens, click 'Confirm' at the very bottom.

All the necessary permissions for full operation of the key will be automatically set, which will provide you with a smooth and fast connection.

Register on Veles platform

Connect the exchange in the usual way or via fast-API

Choose a ready-made bot or customise it by yourself

Now let's put it into practice

Types of bots for Binance

Automated DCA-strategy

DCA (Dollar-Cost Averaging) is a classic investment strategy in which you buy a certain amount of cryptocurrency at regular intervals, regardless of the market price. This approach is particularly useful in a volatile market.

Futures Bot

Futures bots are designed to trade futures and work similarly to spot bots, but with leverage.

They use a 'buy cheap, sell high' strategy and can be set up for neutral, long or short positions. Futures bots allow traders to capitalise on opportunities in the futures market and potentially improve their trading performance.

Spot bot

Spot bots operate in the spot market, buying and selling cryptocurrencies depending on current market conditions. They can be configured to execute various strategies such as grid trading, where the bot creates a grid of orders around the current price and executes them depending on the price movement.

Pros and Cons

Pros

Strategy diversity and risk management: Algorithmic bots can use different approaches and set stop loss levels to limit losses and optimise profits.

Objectivity: Bots are immune to human emotions, which helps to avoid rash decisions and make informed trading strategies.

Fast and accurate: Bots analyse huge amounts of market data in real time, making instant decisions.

Continuous work: The cryptocurrency market has no weekends, so algorithmic bots can make trades even in your absence.

Cons

Missed opportunities: If the price of an asset deviates from the range set by the bot, you may forfeit potential profits.

Automated trades can play against you: Bots execute trades based on pre-programmed parameters that may not always match market conditions.

No guarantee of profitability: No bot guarantees profit, so it is important to consider the risks.

Platform statistics

$ 79 743 086

User profit

47 349 316

Cycles closed

$ 418 429 395

Total deposit of bots

Conclusion

Trading bots for Binance are a powerful tool to automate cryptocurrency trading. They offer many benefits such as 24/7 operation, speed and efficiency, and emotionally neutral solutions. However, it is important to remember that bots do not guarantee profits and require constant monitoring and management. When used correctly, trading bots can significantly improve your trading performance and help you achieve your financial goals.