Bybit trading bot by Veles

In the world of cryptocurrency trading, automation is becoming increasingly important. Traders strive to utilise all the opportunities of the market, which operates around the clock. For this purpose, they resort to the help of trading bots - smart assistants for automating trading strategies based on pre-defined parameters.

In this article, we will highlight the main aspects of trading bots for the Bybit platform. We will analyse in detail how they work, their different types, as well as their advantages and potential disadvantages. In addition, we will dispel common questions related to these automated trading tools.

Top 5 Best Trading Bots

For Bybit Exchange

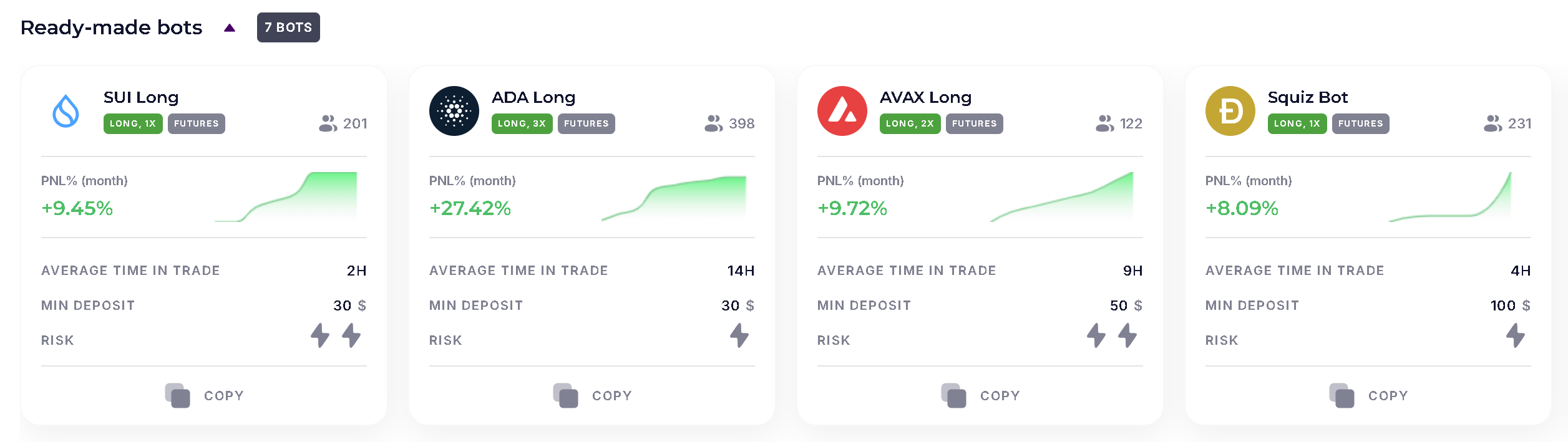

| Bot | Chart | PNL% (Month) | Average Time In a Deal | Minimum Deposit | Risk | |

|---|---|---|---|---|---|---|

| SUI Long | | +9% | 2H | $30 | | Try |

| AVAX Long | | +12% | 9H | $50 | | Try |

| Squiz Bot | | +7% | 4D | $100 | | Try |

| ETH Long | | +15% | 7H | $300 | | Try |

| BTC Long | | +9% | 3D | $1000 | | Try |

These are automated algorithmic programmes to execute trading strategies on the Bybit crypto exchange. These bots can work on a continuous basis, which compensates for the human traders' limitations. They can execute different strategies, from simple to complex, depending on the user's needs and preferences.

The Veles platform allows users to create their own trading bots by customising entry and exit parameters and combining different indicators to develop unique strategies.

Flexibility and diversification

The platform is adaptable to any trading strategy, from short-term operations to long-term investments. Traders can access over 2,000 trading instruments, providing ample opportunities for diversification.

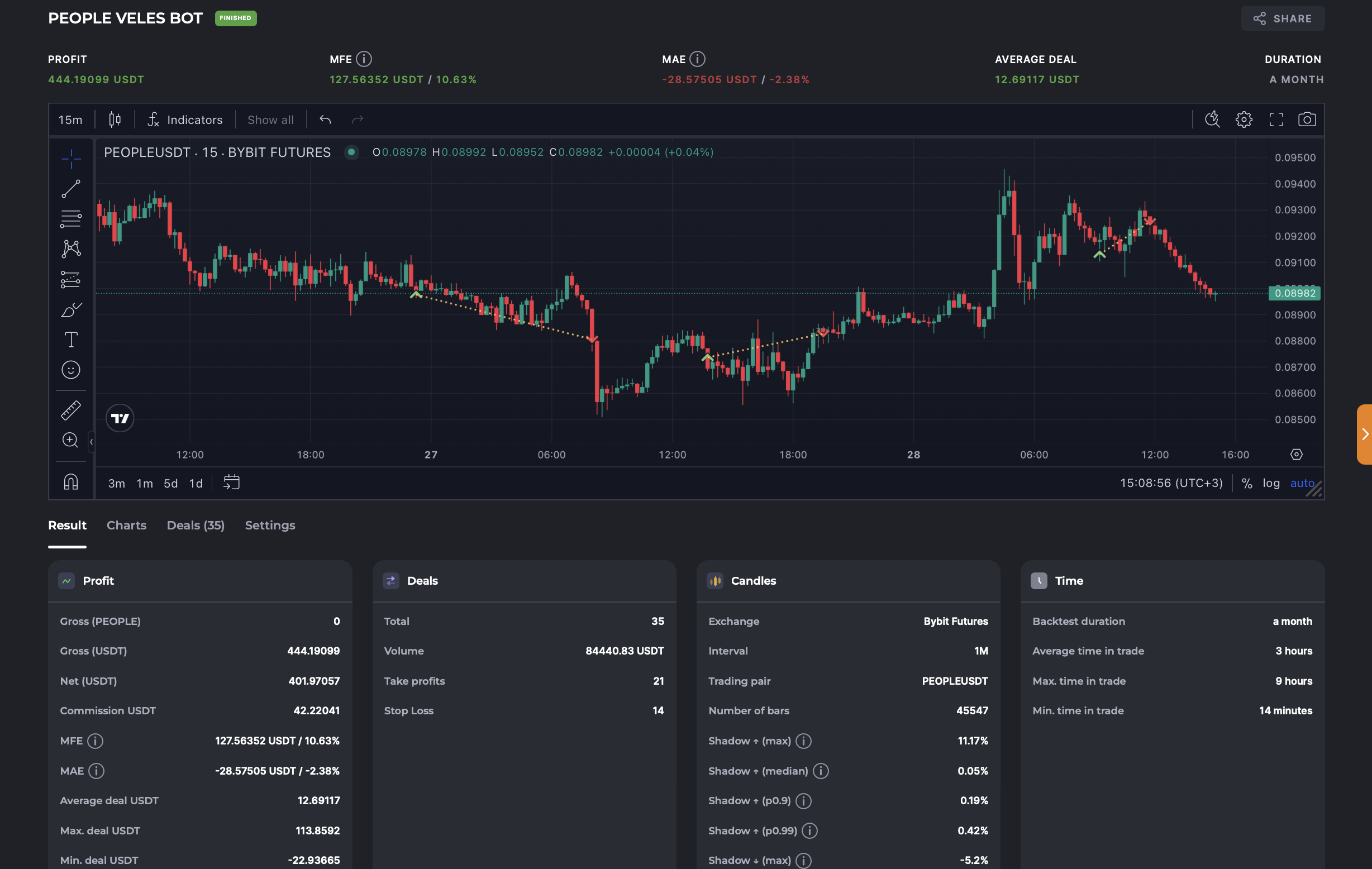

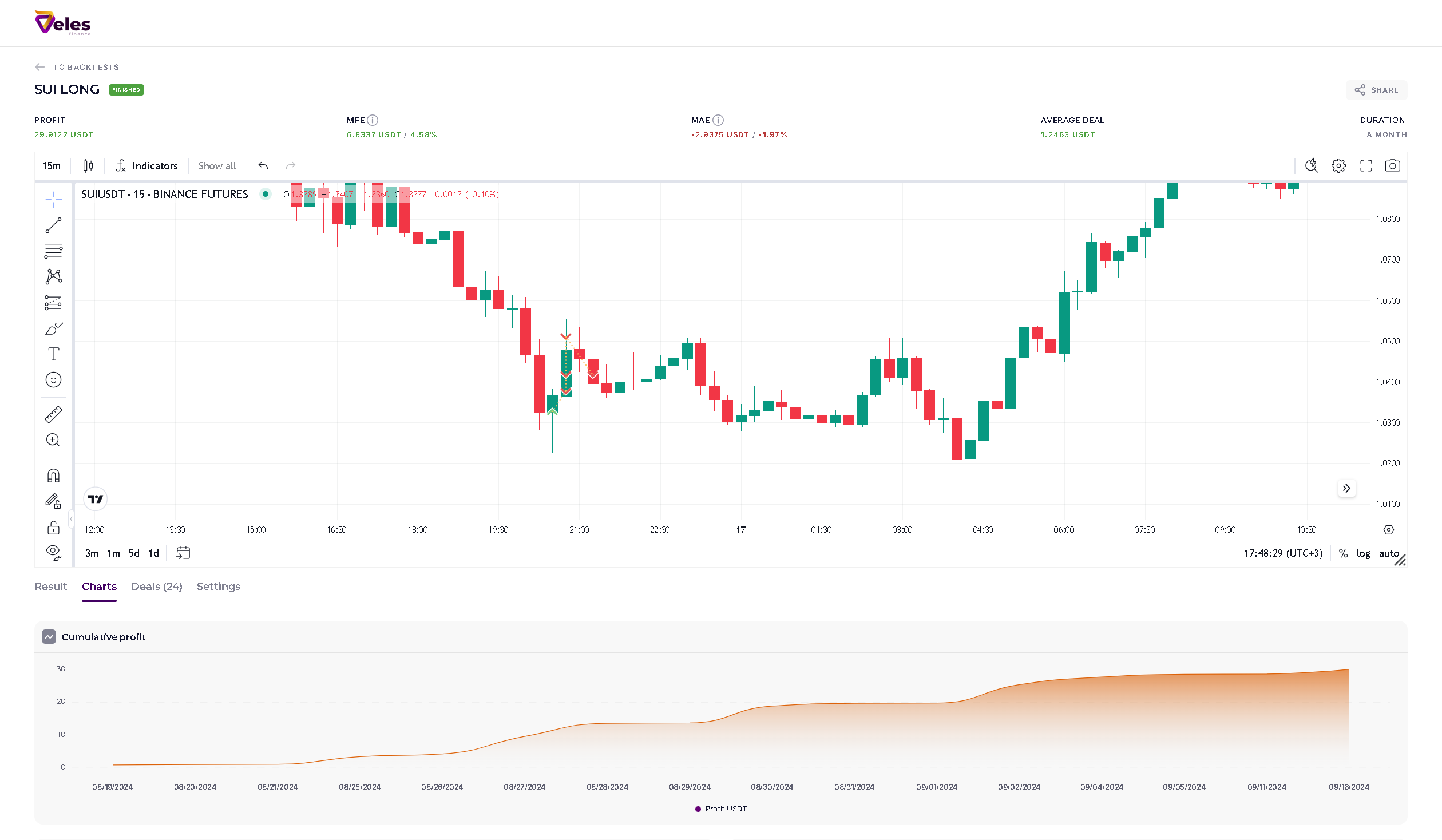

Advanced testing

Users can conduct backtests to evaluate their strategies on historical data and calculate profit-to-loss ratios. A huge array of candlestick and indicator combinations gives traders a deep understanding of the market, helping them make informed decisions.

Proven ready-made bots

Ready-made cryptocurrency bots are available on the Veles platform with settings that are proven to work in practice. These bots can save traders time and effort by providing them with ready-made strategies that have already shown positive results.

Advantages of using trading bots:

Elimination of the human factor. No more impulsive decisions, postponing stop loss or prematurely exiting a position. Bots act exclusively according to the algorithm set by you.

Freeing up your time. Forget about endless market monitoring and nights spent at the computer. Bots monitor your assets while you are doing your favourite things.

Discipline and control. Bots work according to your rules, helping you stick to your trading plan and protecting your deposit.

How do trading bots work on Bybit?

Trading bots on Bybit's platform interact with the exchange via an API (application programming interface). These bots carefully analyse market data, including asset values, trading volume and technical indicators. Based on pre-set parameters such as timeframes, order volumes and other critical indicators, they execute trades.

Once market conditions meet the set criteria, the bot automatically executes trades. This allows traders to save time and effort, as well as minimise the likelihood of emotional errors that can occur when trading manually.

We take 20% commission from the profit you get while trading with the bot, but not more than $50 per calendar month

Connection to Bybit

Connecting Veles to Bybit is incredibly easy thanks to our One-Click Connect feature. Here are step-by-step instructions that will save you from having to manually create API keys:

- Go to the API keys management page or create a bot on the Veles platform.

- Click 'Add API Key' and select Bybit.

- Now click 'Connect in one click.'

- Authorise in your account.

- Allow OpenAPI creation and confirm the request.

- On the page that opens, click 'Confirm' at the very bottom.

All the necessary permissions for full operation of the key will be automatically set, which will provide you with a smooth and fast connection.

Register on Veles platform

Connect the exchange in the usual way or via fast-API

Choose a ready-made bot or customise it by yourself

Now let's put it into practice

Types of bots for Bybit

Automated DCA-strategy

Dollar-Cost Averaging (DCA) – is a trading strategy in which investors regularly purchase a certain amount of cryptocurrency, ignoring the current value of the asset. DCA-bots automate this process, allowing traders to focus on other aspects of trading, minimising the impact of market volatility and reducing the risk of large losses.

Futures Bot

Futures-grid bots specialise in trading futures contracts on the Bybit exchange. They scan market data and execute trades according to set parameters, allowing traders to optimise the management of their positions, minimising the associated risks.

They are divided into 2 trading algorithms:

- Long bot performs exclusively purchases (buy), trying to acquire the asset cheaper and lock in profits when the value rises.

- Shorting bot opens trades only for selling (sell) within a set range and is suitable for tokens that are in a downtrend (channel).

Spot bot

Spot trading bots are created to execute cryptocurrency trades on the Bybit spot market. They can apply various strategies such as short-term action trading, medium-term swing trading, and accumulative investment trading. These bots focus on market data and execute trades according to predefined parameters, which helps traders to manage their positions efficiently and increase profits.

Pros and Cons

Pros

24/7 monitoring: Trading bots operate 24/7, allowing traders not to miss potential opportunities. They automatically execute trades according to market conditions, ensuring a constant presence in the market.

Eliminating emotional factors: Emotions can be detrimental to good trading, leading to hasty decisions and losses. Trading bots make transactions based on predefined rules and strategies, eliminating the influence of emotional factors.

Speed and agility: Trading bots are able to analyse market data in real time and execute trades in a matter of milliseconds. This gives traders a significant advantage by allowing them to react instantly to market fluctuations and make decisions without delay. Bots eliminate the need for manual intervention, allowing traders to capitalise on market opportunities in a timely manner.

Cons

Limited adaptability: Bots cannot adapt to market changes as quickly as a human and may continue to execute trades that are no longer profitable.

Technical knowledge: Setting up a trading bot may require basic knowledge, including an understanding of trading strategies and the cryptocurrency market.

Need for constant operation: The bot must be constantly running, which requires the computer to be switched on constantly and its operation to be monitored periodically.

Platform statistics

$ 79 743 086

User profit

47 349 316

Cycles closed

$ 418 429 395

Total deposit of bots

Conclusion

Trading bots for Bybit are an effective tool for traders looking to automate their trading strategies and increase profitability. However, keep in mind that robots are not a guarantee of success and require careful adjustment of several parameters and constant monitoring. Test the bot thoroughly or choose a proven off-the-shelf bot before you start using it.