Gate.io Trading Bot by Veles

On the Gate io exchange, bots could be launched almost from the moment of its creation. At least, in the "Internet Archive" on the very first snapshot of the exchange's website, taken in October 2017, we see a link to the page with API documentation. And API is a special interface for connecting external applications, which is most often used precisely for the automation of trading operations, that is, for trading with the help of bots.

But back then, in 2017, the exchange offered only API to launch bots. And each trader had to independently write the code of his bot, and then run this bot on a separate server. Of course, to launch bots at that time, you could also use special platforms that allow you to easily and conveniently create, customize, test bots and provide hosting for them.

Today, an example of a multifunctional platform for algorithmic trading is Veles, where you can run ready-made bots or create a new bot manually with many individual settings. However, at that time Veles did not exist yet, and other similar platforms were not developed enough. Therefore, trading with the help of bots was only available to traders with a serious technical background.

Top 5 Best Trading Bots

For Gate.io Exchange

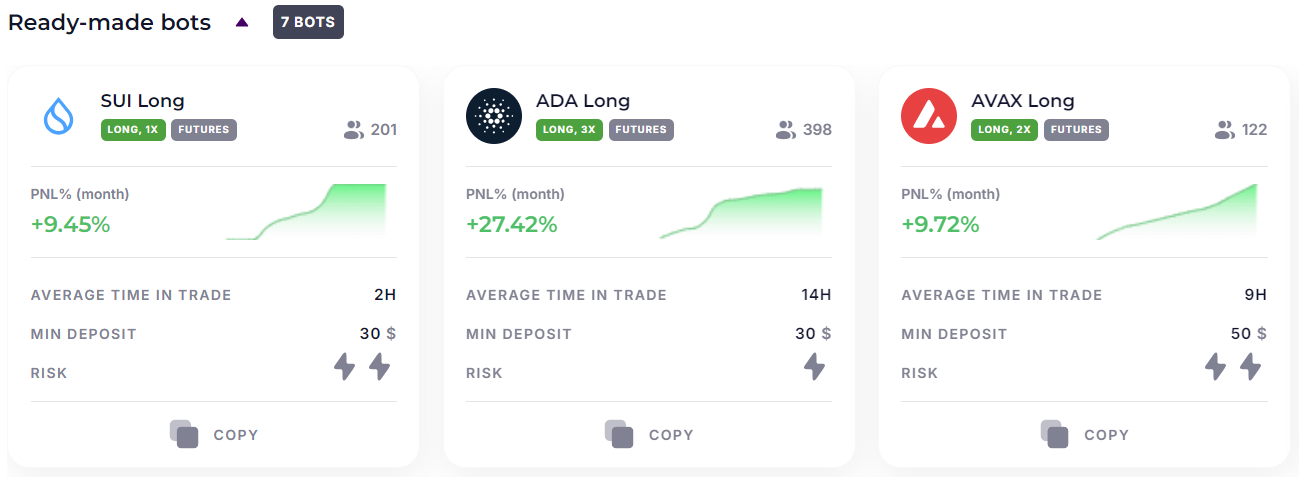

| Bot | Chart | PNL% (Month) | Average Time In a Deal | Minimum Deposit | Risk | |

|---|---|---|---|---|---|---|

| SUI Long | | +9% | 2H | $30 | | Try |

| AVAX Long | | +12% | 9H | $50 | | Try |

| Squiz Bot | | +7% | 4D | $100 | | Try |

| ETH Long | | +15% | 7H | $300 | | Try |

| BTC Long | | +9% | 3D | $1000 | | Try |

Unlike a live trader, a bot is active around the clock, and therefore it makes more trades. And the more trades, the more commission the exchange receives. For the sake of this, it is not a pity to allocate the best places for information about bots in the site interface and to provide bots with server capacities necessary for their uninterrupted work.

But do ordinary traders need bots? It all depends on the trading strategy that traders follow:

- if we make a decision on each trade, weighing all pros and cons,

- if we evaluate the news background, youtubers' forecasts from fresh videos and other indicators that cannot be formalized,

- or, on the contrary, if we rely solely on our own gut feeling, the bot will be useless for us;

- if we have a clear plan of action (for example, if the price has fallen by 5% - buy, if the price has risen by 10% - sell),

- if we actively use technical analysis indicators,

- or if we trade according to signals, repeating trades of successful traders, a bot can make our tasks much easier.

In some cases, a bot can even do almost all routine work for us: track price movements, monitor indicators, receive signals and open trades based on them. In any strategy where there is a specific algorithm of actions, bots will be useful to us.

Flexibility and diversification

The platform is adaptable to any trading strategy, from short-term operations to long-term investments. Traders can access more than 2000 trading instruments, which provides ample opportunities for diversification.

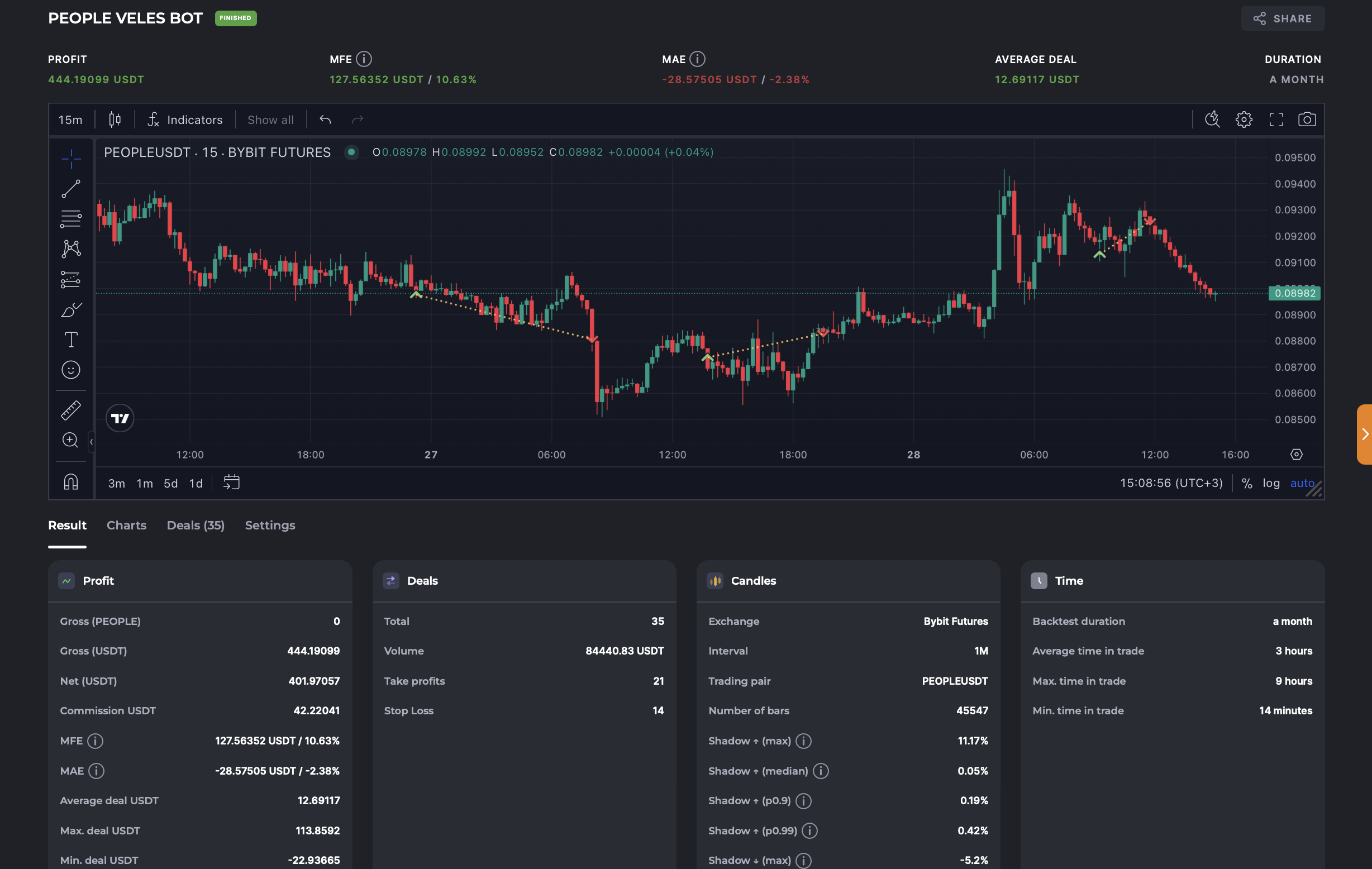

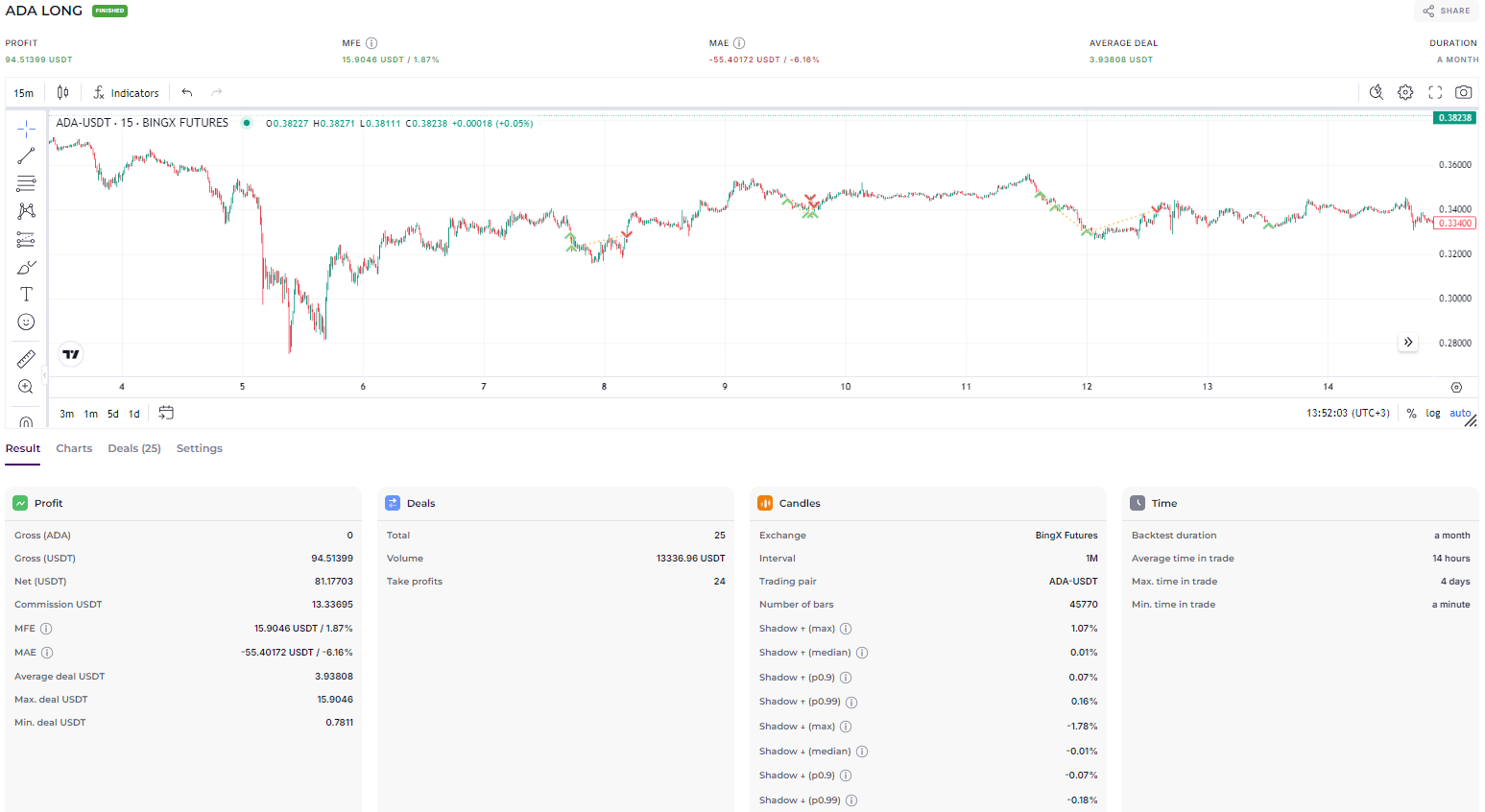

Advanced testing

Users can conduct backtests to evaluate their strategies on historical data and calculate profit-to-loss ratios. A huge array of candlestick and indicator combinations gives traders a deep understanding of the market, helping them make informed decisions.

Proven ready-made bots

Ready-made cryptocurrency bots are available on the Veles platform with customizations that have been proven to work in practice. These bots can save traders time and effort by providing them with ready-made strategies that have already shown positive results.

Advantages of using trading bots:

- Elimination of the human factor. No more impulsive decisions, postponing stop losses or prematurely exiting a position. Bots act exclusively according to the algorithm set by you.

- Freeing up your time. Forget about endless market monitoring and nights spent at the computer. Bots monitor your assets while you are doing your favorite things.

- Discipline and control. Bots work according to your rules, helping you stick to your trading plan and protecting your deposit.

What are the risks of using trading bots?

On the Gate.io exchange, you can create your own bot or use someone else's. Each of these options has risks.

When creating a bot on our own, we put in it those flaws that are inherent in our trading strategy, which we may not see until the bot starts to bring us losses.

When using someone else's bot, we have to rely on the knowledge and experience of the person who created the bot.

Each bot implements some trading strategy, and this strategy may be wrong. Before launching a bot, it would be good to backtest it, but the Gate.io exchange does not allow you to do this. And even on the statistics pages of existing bots we are shown only 90 days of history. This is obviously not enough to analyze the bot's efficiency. Therefore, it will be safer and more reliable to use not the bot of the Gate exchange, but the Veles bot, with the possibility of a detailed backtest.

We take 20% commission from the profit you get while trading with the bot, but not more than $50 per calendar month

Connecting to Gate.io

Connecting Veles to Gate.io is incredibly easy thanks to our One-Click Connection feature. Here are step-by-step instructions that will save you from having to manually create API keys:

- Go to the API key management or bot creation page on the Veles platform.

- Click "Add API Key" and select Gate.io.

- Now click "Connect in one click".

- Authorize in your account.

- Allow OpenAPI creation and confirm the request.

- On the page that opens, click "Confirm" at the very bottom.

All necessary permissions for the full operation of the key will be automatically set, which will provide you with a smooth and fast connection.

Register on Veles platform

Connect the exchange in the usual way or via fast-API

Choose a ready-made bot or customise it by yourself

Now let's put it into practice

Types of bots for Gate.io

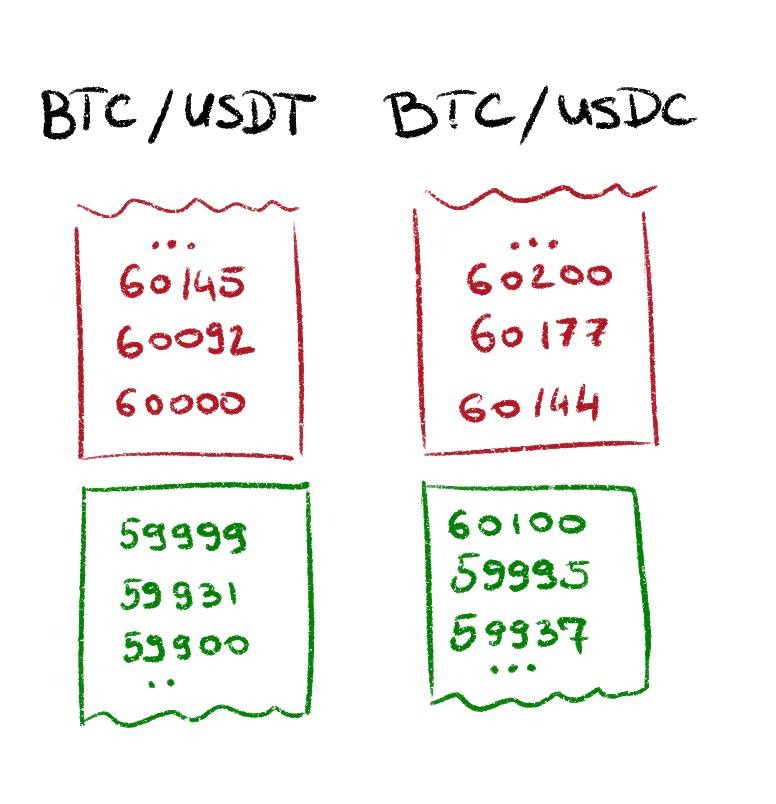

Bots for arbitrage strategies

Arbitrage is one of the lowest risk types of trading. This strategy consists in catching moments when an asset can be bought cheaper and immediately sold more expensive.

For example, on the Gate.io exchange there are two trading pairs: BTC/USDT and BTC/USDC. And at some point it may happen that in the stack of one of them will appear a sell order at a price of 60,000, and in the other - a buy order at a price of 60,100. At that point, you can send two market orders to the exchange:

with the first order to buy bitcoin for one stablecoin at a price of 60,000,

and the second order to sell bitcoin for another stablecoin at 60,100.

You cannot do without bots in arbitrage. You can't track such situations with your eyes, and you can't send two orders at the same time. And even if you can track and send them, someone else's bot will still catch more of these moments and will send orders to the exchange faster in order to be able to take advantage of these moments.

Bots for market making

Market making is a strategy in which you can generate stable profits with relatively low risk. It is best suited for a "flat market", i.e. a market where price fluctuations are insignificant. Examples of flat markets in crypto are USDC/USDT and WBTC/BTC.

A market maker places his limit orders on either side of the current market price and waits for them to be executed. The orders are placed a short distance away to cover the exchange's commission costs. For example,

a buy limit order at 0.997,

a sell limit order at 1.003.

When the buy order is executed, the purchased asset is immediately put up for sale, and vice versa.

Everything is simple and clear, you don't need much intelligence. The bot can easily handle it without our participation. But we are unlikely to do it without the bot's participation. No one wants to sit in front of the screen day and night and move orders from buy to sell and back again like a robot.

Bots for copytrading (social or mirror trading)

In copytrading (in English - copytrading or social trading), we make trades on the exchange that have just been made on another account by someone who is an authority for us and whose success we want to repeat. In other words, we subscribe to signals about orders executed in the accounts of successful traders, and our bot receives messages from the exchange in a language it understands: "Account 7637, exchange done," and sends the exchange a command: "execute". As a result, the same order is executed on our account. And we do not need to get involved in this process, nor do we need to participate in it.

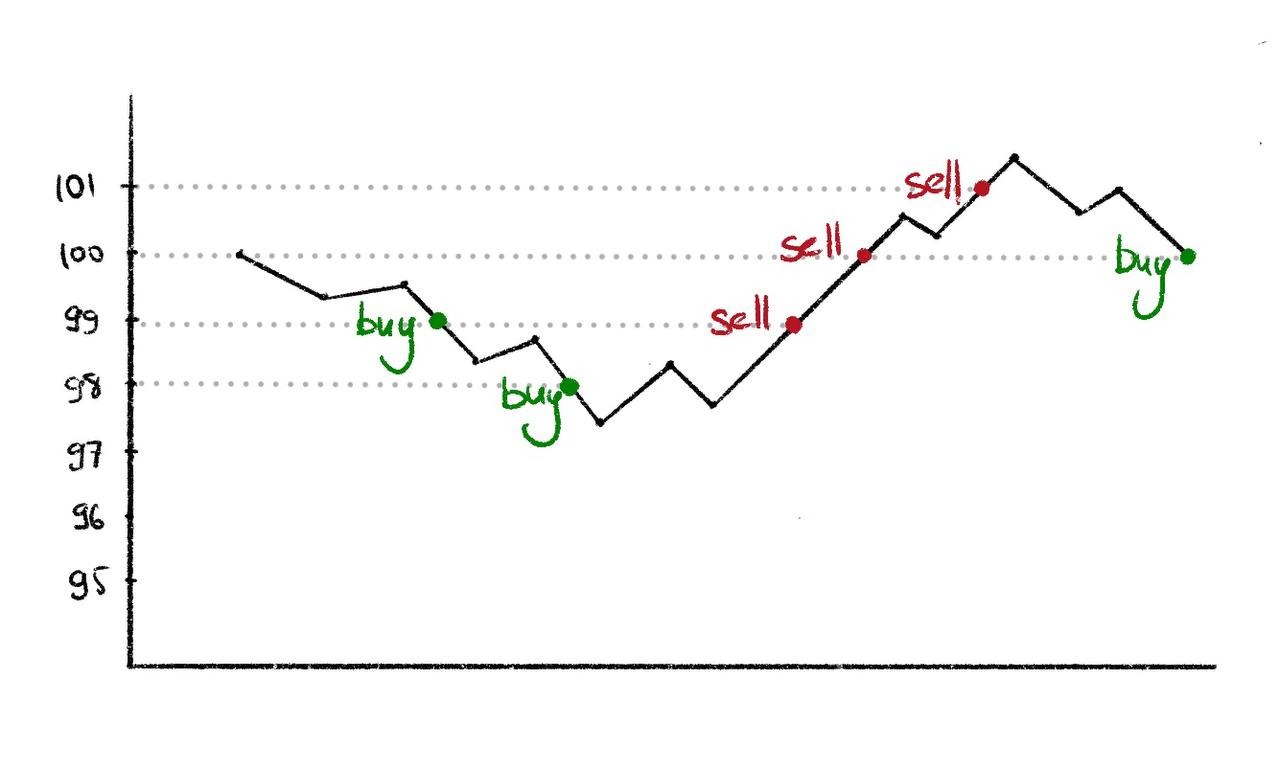

Bots with grid trading (quantitative trading strategy)

The grid is very similar to market making. Only in it, not two orders are initially placed, but several (five, ten or even one hundred) on both sides of the current market price. For example, buy orders are placed at prices 1%, 2%, 3%, 4% and 5% below the current price, and sell orders are placed above the current price at the same distance. When a buy order is executed, a sell order is immediately placed at 1% more expensive. And when a sell order is triggered, a buy order is placed at a price 1% lower.

A bot can also cope with such a job better than a human. Therefore, the grid is one of the most popular strategies used when trading with bots. Solutions for it are presented on all exchanges that provide clients with the service of trading with bots. A variety of grid bots (including those for their own setups found by the trader) are also available on specialized platforms such as veles.finance.

Bots with a mean reversion strategy

The mean reversion strategy is also called averaging. Its idea is that the price cannot go too far without serious bounces or pullbacks. And if we continue to open positions against the trend when the price moves against our forecast, shifting the average entry price each time, then during the correction the rate will definitely return to this average price, and we will be able to close the position at least without a loss.

When using this strategy, the main advantage of the bot is its stress resistance. It does not notice the drawdown, does not get upset and does not panic, but continues to increase the position volume in a disciplined manner until the trend reverses.

Platform statistics

$ 79 743 086

User profit

47 349 316

Cycles closed

$ 418 429 395

Total deposit of bots

Conclusion

Trading bots are a great tool for automating repetitive actions. And it is great that the Gate.io exchange has made it possible to use bots. But when a bot is aimed at implementing a certain strategy, it is necessary to check this strategy on historical data. And the impossibility of such a check is the biggest disadvantage of bots on the Gate.io exchange. However, on the Veles platform such a feature is available and allows you to conduct even annual backtests on your strategies in order to identify their effectiveness. Still, it is better to use specialized, more advanced platforms to set up and run trading bots. Especially since Gate.io provides API for connecting such platforms to traders' accounts, and on the Veles platform, connecting the API key of the Gate.io exchange is a simple enough process.