Trading bot HTX on the Veles platform

HTX exchange was known under a different name for a long time - Huobi - and rebranded in September 2023 - after ten years of successful work in the crypto industry.

A serious advantage of the HTX exchange over other trading platforms is the ability to trade small amounts without providing identification documents. In general, HTX is oriented to the mass user and the set of functions is practically no different from other major exchanges. It has everything that users of modern crypto exchanges are used to: from spot and futures trading to assistance in obtaining passive income.

HTX also offers automation tools: copy-trading and trading bots (robots). But the bots in the exchange application are realized quite simply. All a trader can do is to select the order grid boundaries and set the number of orders within the grid. Additionally, you can set "stop loss" and "take profit". They are understood here as the total amount of loss and profit, after reaching which the bot should be disabled.

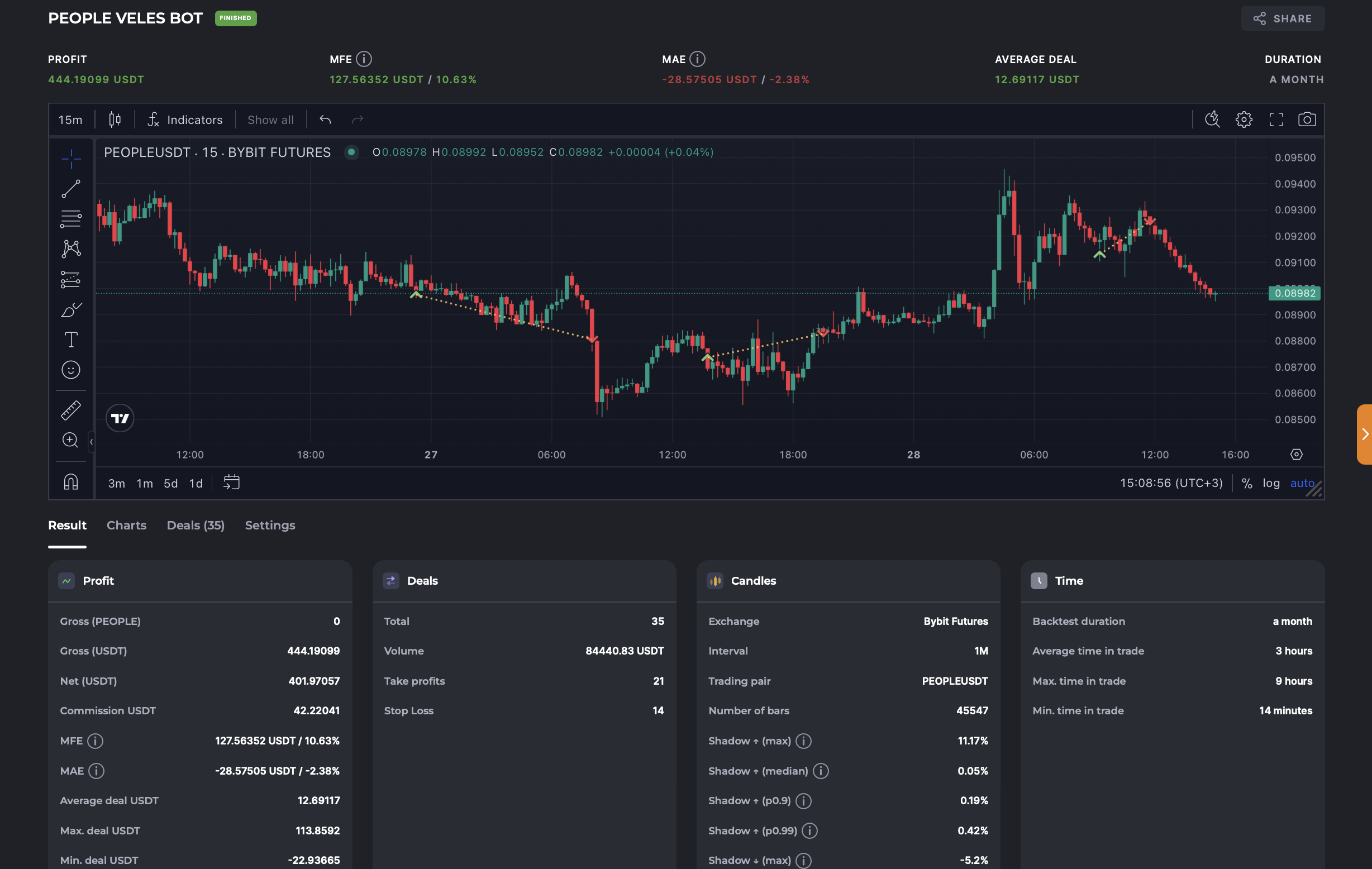

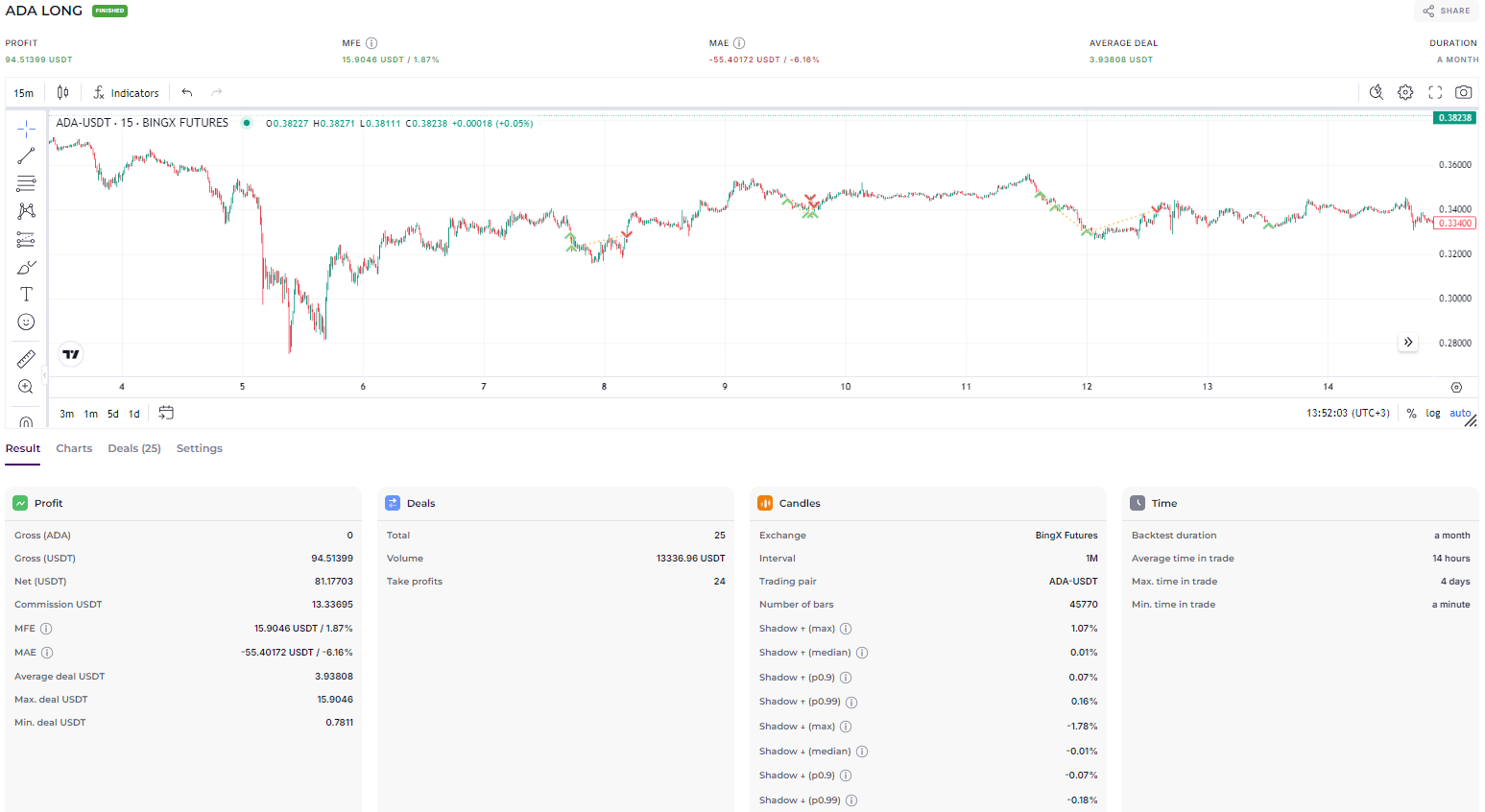

Trading bots for HTX will be much more effective to create and run on the Veles platform, as they have more flexible settings. In addition, the platform provides the ability to conduct backtests to determine the effectiveness of your strategies on historical data.

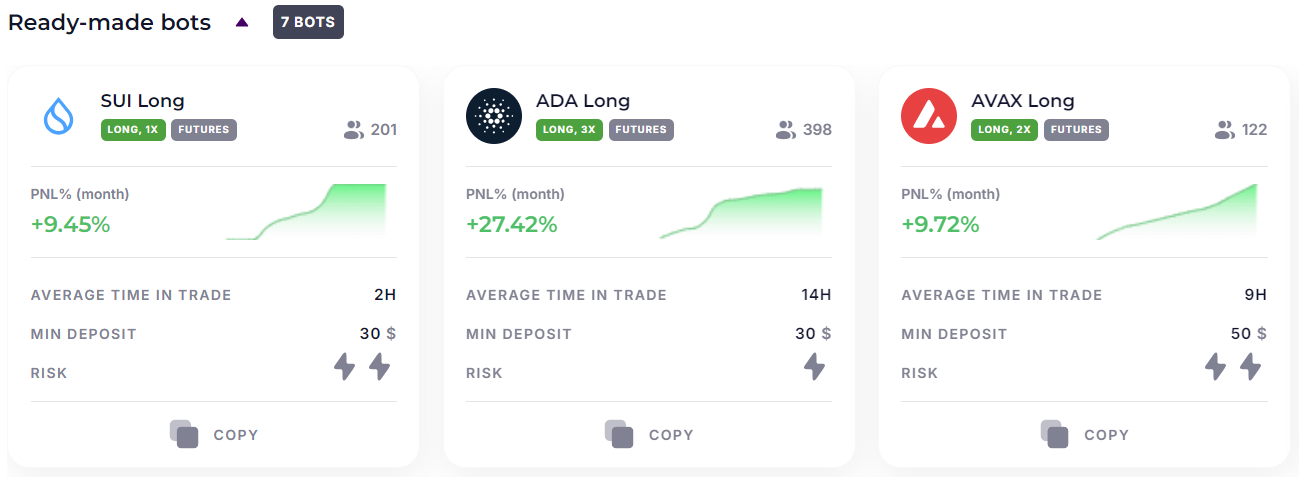

Top 5 Best Trading Bots

For HTX Exchange

| Bot | Chart | PNL% (Month) | Average Time In a Deal | Minimum Deposit | Risk | |

|---|---|---|---|---|---|---|

| SUI Long | | +9% | 2H | $30 | | Try |

| AVAX Long | | +12% | 9H | $100 | | Try |

| Squiz Bot | | +7% | 4D | $100 | | Try |

| ETH Long | | +15% | 7H | $600 | | Try |

| BTC Long | | +9% | 3D | $1000 | | Try |

You can use any trading bots available on the Veles platform to trade on the HTX exchange. For example, you can take ready-made bots from the showcase. You just need to make sure that the cryptocurrency, with which the selected bot works, is available on the HTX exchange.

At the same time, it is not necessarily a complete match of the trading pair, for which the bot is initially configured, with the trading pair used by you on the exchange. For example, if in the initial settings you see that the bot trades on Binance in the pair BTC/FDUSD, but on the HTX exchange there is no such pair, you can safely configure it to trade in the pair BTC/USDT. There will be no difference in principle, because both FDUSD and USDT are dollar-stablecoins.

Flexibility and diversification

The platform is adaptable to any trading strategy, from short-term operations to long-term investments. Traders can access more than 2000 trading instruments, which provides ample opportunities for diversification.

Advanced testing

Users can conduct backtests to evaluate their strategies on historical data and calculate profit-to-loss ratios. A huge array of candlestick and indicator combinations gives traders a deep understanding of the market, helping them make informed decisions.

Proven ready-made bots

Ready-made cryptocurrency bots are available on the Veles platform with customizations that are proven to work in practice. These bots can save traders time and effort by providing them with ready-made strategies that have already shown positive results.

Benefits of using trading bots:

- Elimination of the human factor. No more impulsive decisions, postponing stop loss or prematurely exiting a position. Bots act exclusively according to the algorithm set by you.

- Freeing up your time. Forget about endless market monitoring and nights spent at the computer. Bots monitor your assets while you are doing your favorite things.

- Discipline and control. Bots work according to your rules, helping you stick to your trading plan and protecting your deposit.

How do trading bots work on HTX?

Trading bots on the HTX platform interact with the exchange through an API (application programming interface). These bots carefully analyze market data, including asset values, trading volume and technical indicators. Based on pre-set parameters such as timeframes, order volumes and other critical indicators, they execute trades.

Once market conditions meet the set criteria, the bot automatically executes trades. This allows traders to save time and effort, as well as minimize the likelihood of emotional errors that can occur when trading manually.

We take 20% commission from the profit you get while trading with the bot, but not more than $50 per calendar month

Connecting to HTX

Connecting Veles to HTX is incredibly easy thanks to our One-Click Connection feature. Here are step-by-step instructions that will save you from having to manually create API keys:

- Go to the API key management or bot creation page on the Veles platform.

- Click "Add API key" and select HTX.

- Now click "Connect in one click".

- Authorize in your account.

- Allow OpenAPI creation and confirm the request.

- On the page that opens, click "Confirm" at the very bottom.

All necessary permissions for the full operation of the key will be automatically set, which will provide you with a smooth and fast connection.

Register on Veles platform

Connect the exchange in the usual way or via fast-API

Choose a ready-made bot or customise it by yourself

Now let's put it into practice

Types of bots for HTX

Trend bots

As a rule, they follow the crowd, opening positions when the price starts moving up or down. They actively buy up the asset during corrections, waiting for the trend to continue. However, if the trend weakens or the price moves against it, they reduce the position or close it completely.

Countertrend bots

These bots, on the contrary, "go against the tide", trying to profit from short-term market corrections. They open a position against the trend, expecting it to weaken, and close it during a correction when the price retreats from the trend.

Neutral bots

They are not tied to any direction and open positions based on certain algorithms and indicators, regardless of which direction the price is moving. They can open positions on both breakouts and corrections.

Pros and cons

Pros

Bots are easily customizable to your individual preferences. You can choose different strategies, set risk limits and optimize profits.

Your bots are not subject to emotion, fear or greed. They follow a clearly defined strategy, helping you avoid impulsive and irrational decisions.

Bots analyze huge amounts of data in fractions of a second, reacting to market changes instantly. This allows you to capture short-term opportunities that are not available to humans.

Your bots work around the clock without requiring your input. While you sleep, rest or do other things, they analyze the market and make trades, providing you with round-the-clock income.

Cons

If the price of a cryptocurrency deviates from a given range, the bot may miss a profitable buying or selling opportunity.

Sometimes an algorithm can mismatch market changes due to previously set parameters, which can lead to unprofitable trades.

No bot guarantees 100% profit.

Platform statistics

$ 79 743 086

User profit

47 349 316

Cycles closed

$ 418 429 395

Total deposit of bots

Conclusion

Using trading bots on HTX can be a great solution for beginners and experienced traders. However, for maximum flexibility and efficiency, it is worth considering the Veles platform, which allows for detailed customization of bot settings and improved automated trading results.