Tron | TRX Trading Bots

The cryptocurrency market (crypto trading) is very active. Even when dealing with such cryptocurrencies, which are not the leaders in terms of trading volume, traders have to face a whole army of competitors, each of whom would like to take their share of money from the market. To be successful, traders need to use effective tools. One of such tools is automated bots for TRON (TRX) trading. On major exchanges, transactions on this coin are conducted every one or two seconds, and it is extremely difficult to interact with such a market without a bot.

In this article, we will look at the best bots that will help traders automate processes and increase profits.

Top 5 best trading bots for TRON

| Bot | Chart | PNL% (Month) | Average Time In a Deal | Minimum Deposit | Risk | |

|---|---|---|---|---|---|---|

TRX MFI + ADX | | +12% | 5D | $1000 | | Try |

TRX BB + RSI | | +13% | 3D | $1000 | | Try |

TRX MRC | | +14% | 6D | $1000 | | Try |

TRX BB + ADX | | +17% | 13D | $1000 | | Try |

TRX Diver | | +28% | 3D | $1000 | | Try |

TRX MFI + ADX

Long 1x Futures

TRX BB + RSI

Long 1x Futures

TRX BB + ADX

Long 1x Futures

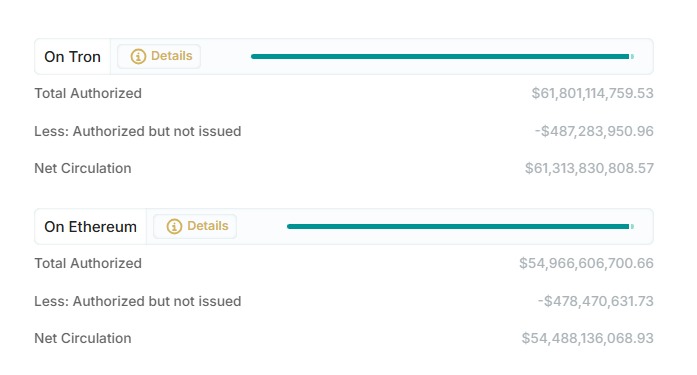

TRON bot is a software that allows users to automate the trading process of the TRON (TRX) cryptocurrency. This cryptocurrency appeared in 2017 as one of the "killers of Etherium" - a development promising faster and cheaper smart contracts than in the ETH network. Several such potential "killers" were created at that time (we can, for example, remember EOS and NEO), but only Tron managed to dislodge Etherium from the pedestal in at least one important aspect: the Tron network is now issuing more USDT stablecoins than the Ethereum network.

We would hardly be wrong if we assume that today a person offering payment in "crypto" most often means USDT TRC-20. USDT tokens in the tron network are one of the most sought-after crypto assets in practice. And since payment of token transfer fees in this network is accepted only in TRON (TRX) coins, the demand for TRC-20 tokens leads to the demand for TRON coin. It is bought a lot and often.

TRON bots place orders to buy and sell TRX on exchanges based on predefined parameters and strategies, which allows them to perform trading operations without user participation. This is especially useful for traders who cannot constantly monitor changes in the market and react to price changes in a timely manner.

The tron bots on the Veles platform buy and sell tron completely independently, and no action is required of us other than the initial setup of the bot.

How do Tron bots work?

TRON bots in their work use various strategies such as DCA (value averaging), Grid (order grid), "sniper bot" (search for consolidation zones and pivot points) and others. They analyze data from the market in real time and enter trades based on algorithms. The user can customize bot parameters depending on his strategy: choose a cryptocurrency pair (TRX/USDT, TRX/BTC, etc.), set the volume of buying and selling, set conditions for opening and closing trades.

Register on the Veles platform

Connect the exchange manually or via fast-API

Choose a ready-made bot or customize it yourself

Now let's put it into practice

Our prices

For payment of commissions for the use of trading bots Veles is used account, which is opened on the platform itself. Each user opens such an account at the time of registration.

Payment occurs only when the bots bring profit. 20% of this profit will be deducted from the balance of your Veles account, but no more than 50 USDT per month for one type of trade.

For the bot to be able to open a position, you need funds in this account. That's why you need to fund your account before launching the bot. You can be sure that a deposit of 100 USDT per month will be enough even in case of the most profitable trading on both spot and futures trading bots combined.

We take a commission of 20% from the profit you get when trading bot, but no more than $50 per calendar month

To trade with bots, it is important to choose exchanges that support automated trading. TRON bots can be used on all the crypto exchanges Veles cooperates with:

All of these platforms provide access to a multitude of tools and features for TRX trading. Users can integrate their trading robots with the exchange via API, allowing them to automatically execute trades using the funds in their exchange account.

Types of bots

DCA bot

DCA bot is the most simple and straightforward TRX bot. It helps traders minimize risk by buying TRX on a regular basis in small batches, regardless of market conditions. This strategy reduces the impact of market volatility and allows the trader to average the purchase price. The bot automatically buys the asset at fixed intervals, which makes trading stable and less risky.

Over the last year, the TRX/USD exchange rate has shown steady growth, which means that traders using the DCA-bot for this pair would have accumulated a position with an average entry point significantly lower than the current market price.

Grid bot

Grid bot is a popular tool for working in volatile markets, creating a grid of buy and sell orders at certain levels, which allows it to trade within a price range. This method is ideal for markets where the exchange rate tends to revert to the mean: for example, TRX/BTC.

Grid bot can generate profits through multiple trades when the price changes:

- buy TRX for 225 satoshis, then sell it for 250;

- buy again for 225, then buy again for 200;

- sell half of it for 225 and then sell the other half for 250;

- repeat buying and selling every time the exchange rate changes by 25 satoshis.

Pros and Cons

Pros

Automation: bots allow you to trade around the clock, and this is really important in the crypto market, which works without breaks and weekends.

Efficiency: bots can be customized for strategies whose complexity would make them difficult to implement manually.

Reducing emotions: bots eliminate the emotional component from the trading process, and this gives more stable results.

Access to different exchanges at the same time: without bots it would be difficult to keep track of all exchanges at once.

Cons

Dependence on settings: if you configure the bot according to a market forecast that turns out to be wrong, it can lead to losses.

Security risks: users should be careful when creating API keys and not give bots on exchanges more authority than they need (for bots on the Veles platform this is irrelevant, as the platform will in any case allow the bot to be configured only for trading, not for transferring and withdrawing funds).

Lack of flexibility: automated bots cannot adapt to sudden changes in the market.

Platform statistics

$ 79 743 086

User profit

47 349 316

Cycles closed

$ 418 429 395

Total deposit of bots

Conclusion

TRON bots are a handy tool for traders who are looking for a way to automate their trading processes and reduce risk. There are different types of bots that can be customized for different strategies. However, it is important to remember that proper customization and market understanding play a key role in the success of automated trading.

F.A.Q

Tron trading bots are designed to execute trades in the spot and futures market. They can apply various strategies such as short-term action trading, medium-term swing trading and accumulative investment trading.

These bots focus on market data and execute trades according to predefined parameters, which helps traders to manage their positions effectively and increase profits. Build your own robot or take a ready-made one from the selection of bots for specific cryptocurrencies.