«Bomberman» strategy: arcade spirit in every deal

The cryptocurrency market is a complex and multifaceted labyrinth where success depends on the ability to analyze, forecast, and act with precision. The Bomberman strategy, which we will discuss, is a systematic approach inspired by the dynamics and logic of the classic arcade game. It encourages traders to view the market as a space where every step requires calculation, and every tool is a “bomb” capable of breaking through barriers or causing losses.

Introduction: Why Bomberman?

Bomberman, the iconic game of the 1980s, became a symbol of strategic thinking. Its essence lies in thoughtful actions: players had to not only destroy obstacles but also avoid traps, plan routes, and find exits from increasingly complex mazes. The cryptocurrency market, with its high volatility, unpredictability, and numerous “enemies” — from panic selling to manipulation schemes — requires a similar approach.

The Bomberman strategy offers traders and investors a way to systematize their actions using clear rules and technical analysis tools. In this article, we will explore how to apply this strategy in practice, what risks to consider, and how to avoid falling into the trap of one’s own decisions.

Core principles of the Bomberman strategy

1. The maze as a market metaphor

The cryptocurrency market is a complex system where each timeframe, trend, or segment requires an individual approach. Like in a maze, it is crucial not only to move forward but also to analyze the surroundings to avoid dead ends.

2. Tools as the foundation of success

In the Bomberman strategy, indicators play a key role as “tools” for analysis. They help determine the strength of a trend, support and resistance levels, as well as moments when the market is ready for a reversal.

3. Enemies and traps

In the market, enemies can be both external factors (regulators, whale manipulations) and internal ones — emotions such as greed or fear. The strategy teaches how to recognize and avoid them, maintaining composure.

4. Finding Optimal Exit Points

Every level in the maze ends with an exit. In this strategy, it is the moment to lock in profits or exit a losing position to preserve capital for future trades.

Strategy Tools:

1. Balance of Power (BOP)

The Balance of Power (BOP) is an indicator that assesses the ratio of buyer and seller strength. It fluctuates around the zero line: positive values indicate a bullish trend, while negative values suggest a bearish trend.

How to Use:

- On the M30 (30-minute) timeframe, monitor moments when BOP shows buyer pressure.

- Enter a trade or average a position if there are signs of a trend reversal in the desired direction.

2. Mean Reversion Channel

The Mean Reversion Channel is an indicator that helps identify overbought and oversold zones. It is based on the theory of mean reversion: the price tends to return to its average level after strong movements.

How to Use:

- On the 15-minute timeframe, look for support and resistance levels.

- Enter a trade when the price approaches the channel boundaries, expecting a return to the mean.

Exiting a trade occurs when the price reaches the opposite boundary of the Mean Reversion Channel. This makes the trading process as simple and intuitive as possible: we move from support to resistance and vice versa, without resorting to complex calculations.

This approach allows for an objective assessment of the situation and actions within clear rules, eliminating emotional decisions and unnecessary assumptions.

3. Donchian Channel

The Donchian Channel is an indicator that displays the range of price changes over a specified time period. It helps determine volatility and key levels.

How to Use:

- On the 5-minute timeframe, monitor breakouts of the upper or lower channel boundaries.

- Use these signals to enter a trade.

Leveraged trading and margin management

The Bomberman strategy involves using x5 leverage, which increases potential profits but also requires heightened attention to risk management. To maintain positions, it is recommended to maintain a margin ratio of 1:1, or ideally 1:2. This provides additional protection against sharp market fluctuations and reduces the likelihood of liquidation.

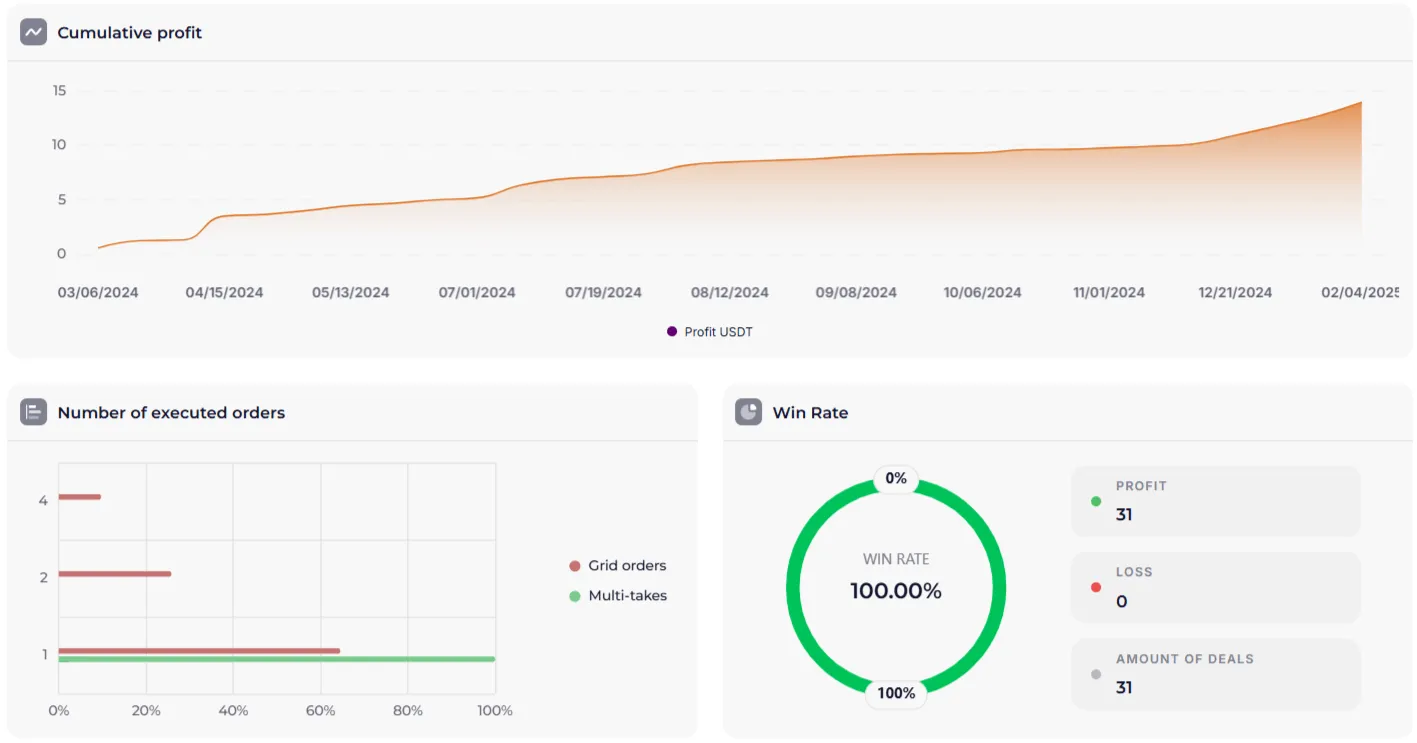

Strategy Results on Historical Data

Let’s look at the results the Bomberman strategy has delivered on historical data:

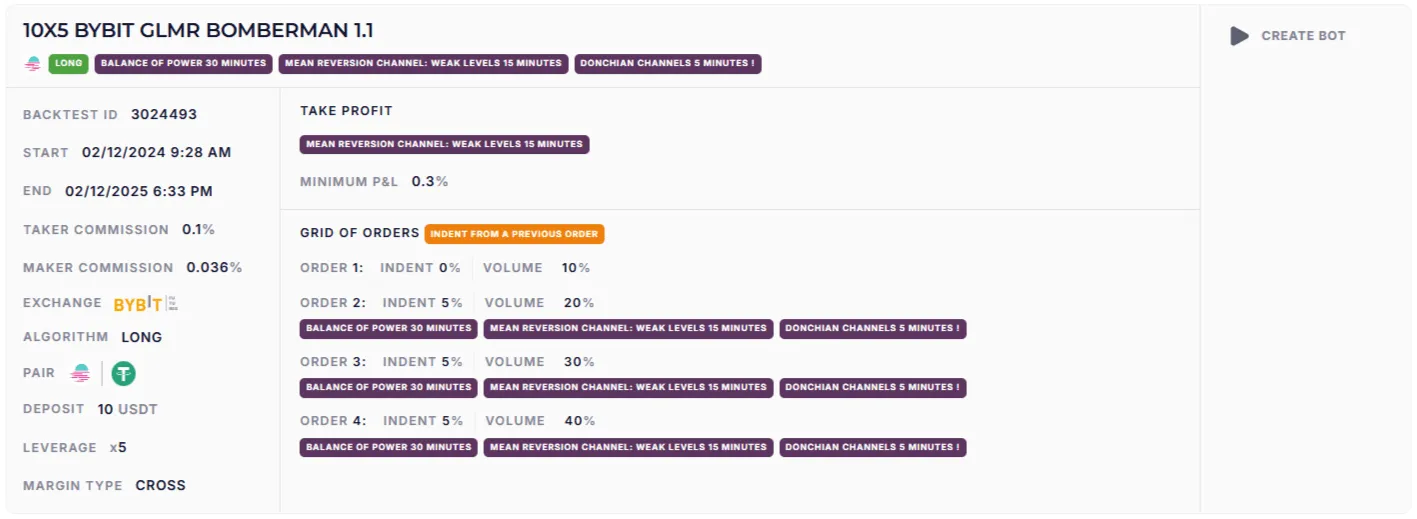

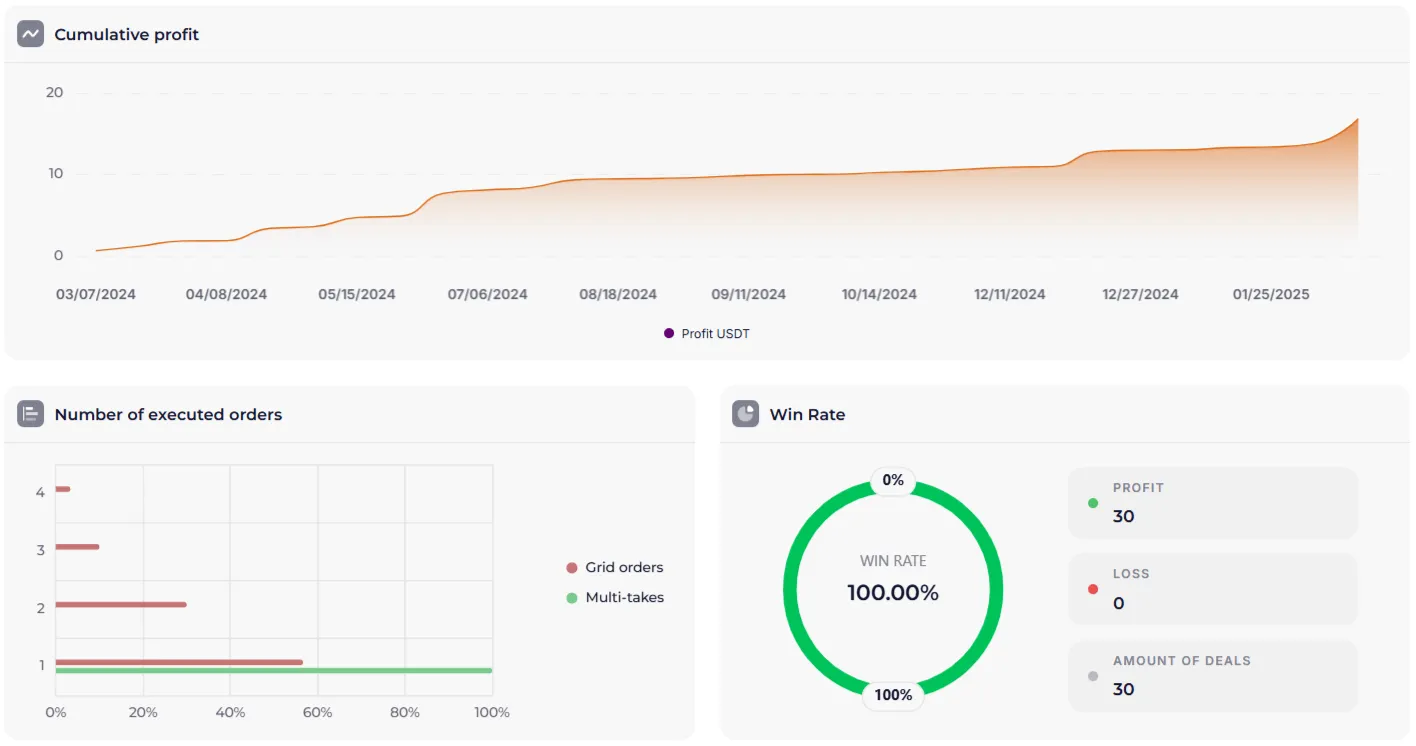

10X5 BYBIT GLMR BOMBERMAN 1.1 (~160% per annum)

https://veles.finance/share/WNqAa

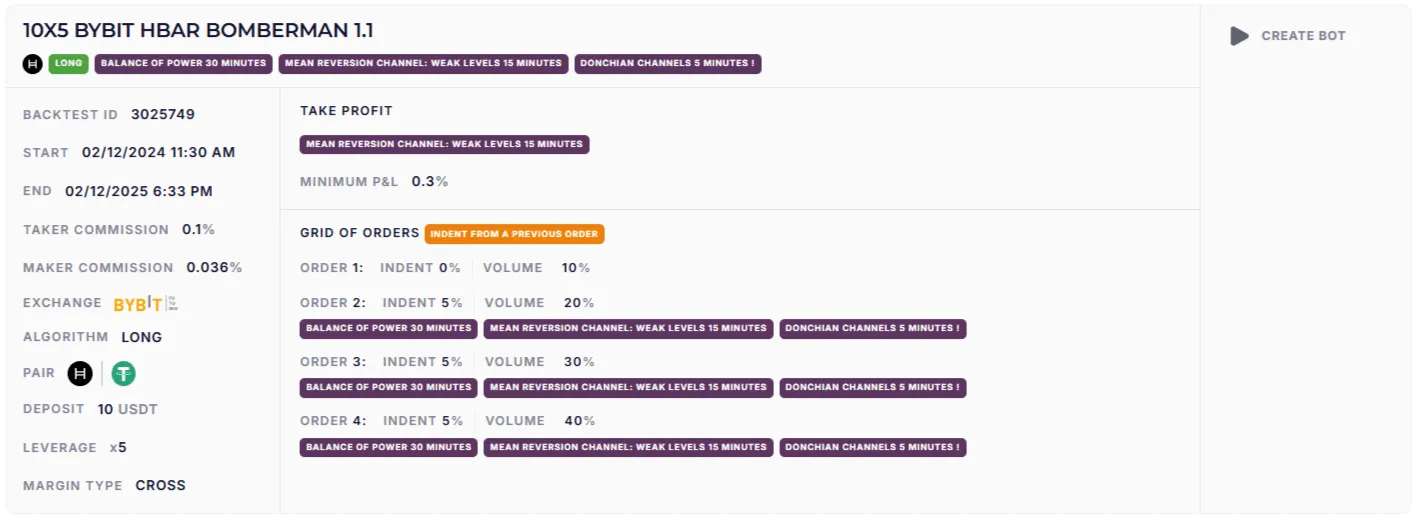

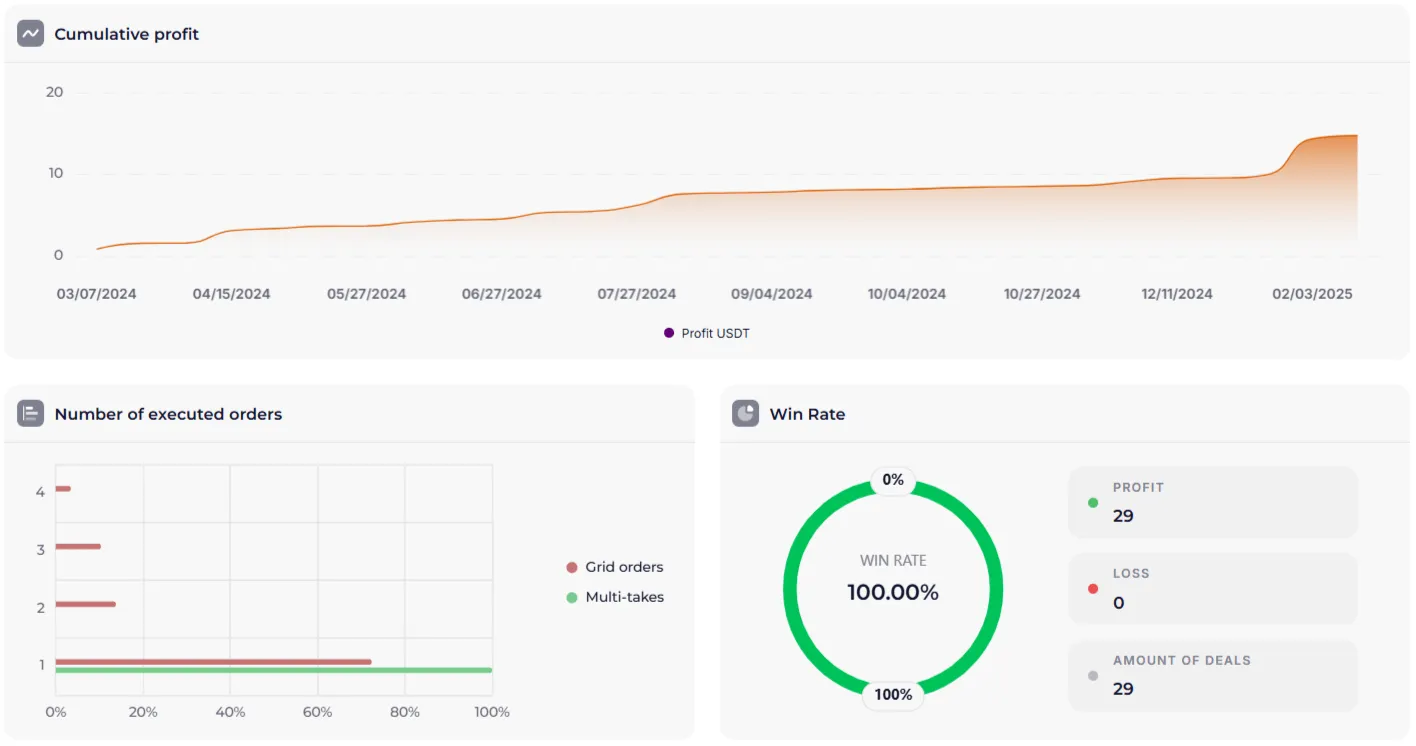

10X5 BYBIT HBAR BOMBERMAN 1.1 (~140% per annum)

https://veles.finance/share/SmZXJ

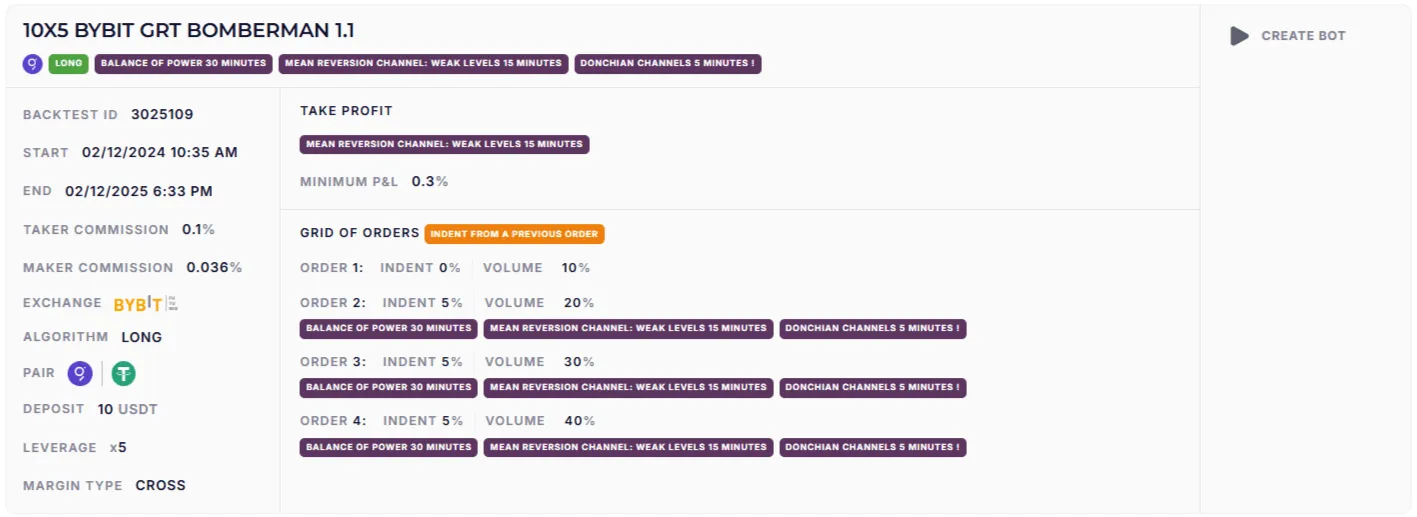

10X5 BYBIT GRT BOMBERMAN 1.1 (~130% per annum)

https://veles.finance/share/VbrHI

These results demonstrate the strategy’s stability over the long term.

Conclusion

The Bomberman strategy is a systematic approach to trading in the cryptocurrency market. It combines technical analysis, risk management, and discipline, making it universal and adaptive. The use of indicators such as BOP, Mean Reversion Channel, and Donchian Channel not only helps identify entry points but also minimizes risks.

Key Recommendations:

1. Allocate no more than 1% of the total deposit to a single bot.

2. Use the bot quantity limitation feature in trades to avoid excessive risk.

3. Strictly follow the strategy rules and avoid emotional decisions.

This strategy is suitable for traders who seek clarity and structure in their actions. It serves as a reminder that success in the market is not a matter of chance but the result of analysis, planning, and control.