Automatic trading on RSI, CCI, and ADX

Brief description of the trading bot

- Trades with 7x leverage and a deposit of 50 USDT or more.

- Uses a combination of indicators: RSI, CCI, and ADX for accurate entries.

- Grid strategy with 5 orders, which reduces risks.

- Automatic take profit and stop loss to protect capital.

Launch the Veles bot right now

Risk management

Trading with 7x leverage can bring high returns, but it also carries increased risks. To minimize losses, follow the basic rules of risk management:

- Limit your deposit on the bot – work with an amount that you are psychologically prepared to lose without damaging your deposit.

- Use a stop loss (-3%) — automatic position closure will limit losses.

- Avoid excessive concentration on a single asset — diversification reduces dependence on the volatility of a single coin.

- Withdraw profits regularly — lock in part of your income to reduce the impact of drawdowns.

You can learn more about reducing risks when trading futures in our guide.

How does the strategy work?

This bot trades assets only in long positions (buying), using three key indicators:

- RSI (30 minutes) < 30 – signals oversold conditions.

- CCI (30 minutes) < -100 – confirms a strong downtrend.

- ADX (15 minutes) > 40 – indicates high trend strength.

When all conditions converge, the bot begins to gradually build up its position through a grid of orders. This allows you to lower the average entry price and increase the profitability of the trade.

Why these indicators for trading?

- RSI helps to find reversal points.

- CCI amplifies the RSI signal, filtering out false triggers.

- ADX confirms that the trend is strong enough to enter.

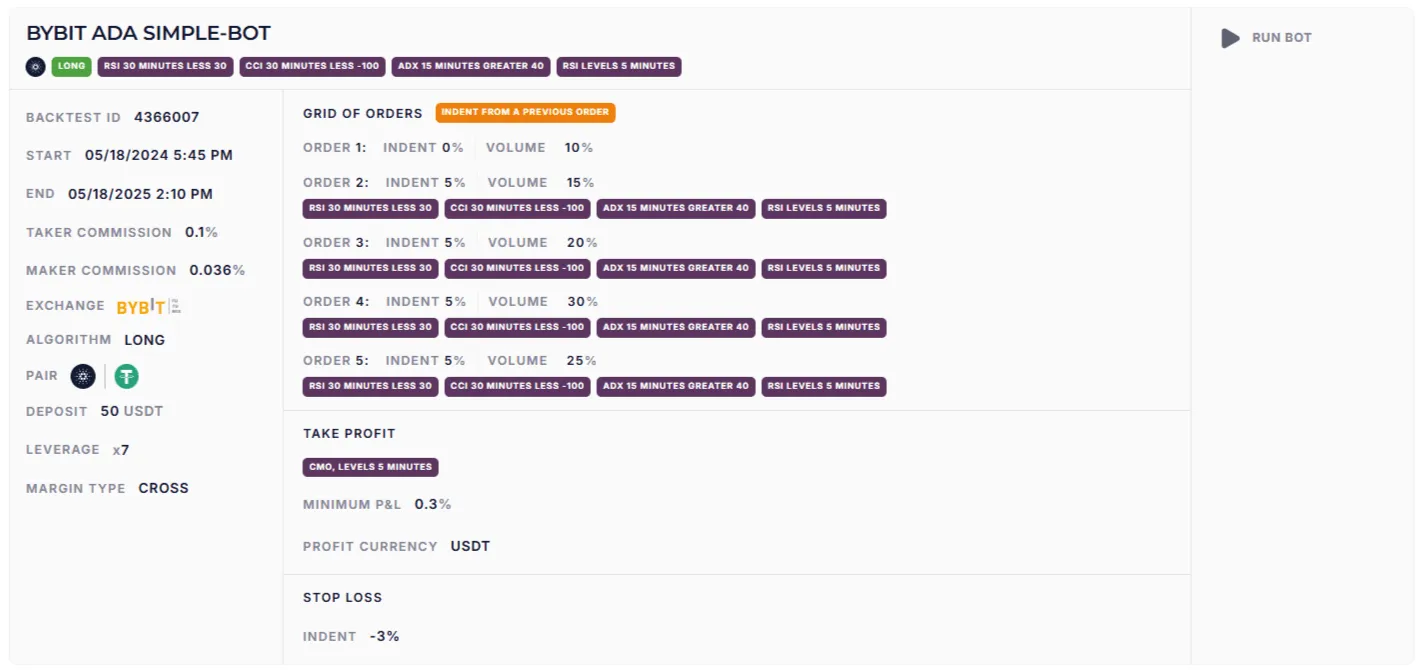

Details of the exchange trading strategy

1. Capital management

Deposit: from 50 USDT.

Leverage: x7 (moderate risk).

Margin type: cross (flexible management).

2. Order grid

(screen)

The further the price goes down, the greater the position volume—this lowers the average entry price and increases the chances of profit when the price rebounds.

3. Exit from the position

- Take profit: triggered by the CMO indicator (5 minutes).

- Minimum profit: 0.3% per trade.

- Stop loss: -3%.

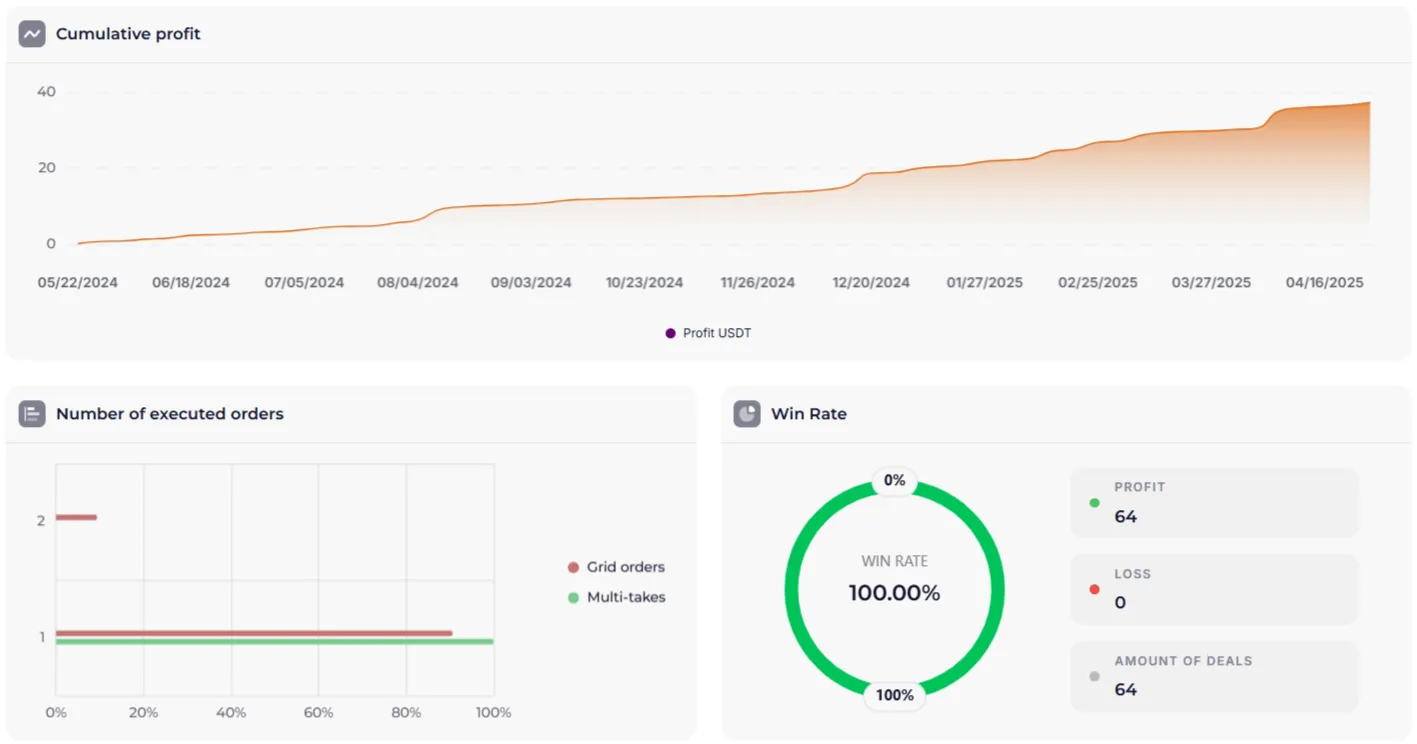

Strategy backtests:

Why is this trading strategy effective?

✅ False signal filtering – the bot waits for three indicators to converge, which reduces the risk of unsuccessful entries.

✅ Grid approach – even if the price temporarily drops, subsequent orders improve the average price.

✅ Automation – no need to monitor charts, the bot does everything itself.

Simple trading bot from Veles

This strategy combines proven indicators and smart capital management, making it accessible even to beginners. If you want to automate your trading, this bot is a great option to start with.

Trading cryptocurrencies involves risks. Don’t allocate more to the bot than you are prepared to lose and follow risk management practices.

FAQ: a brief overview

Q: What is a pivot point?

A: It is a level on the chart where the trend may change direction. The bot uses indicators (RSI, CCI) to find such moments.

Q: Why are indicators needed?

A: They help analyze the market: RSI and CCI show oversold conditions, while ADX shows the strength of the trend. The combination reduces false signals.

Q: Why a grid of 5 orders?

A: This distributes the risk: if the price falls, new orders improve the average entry price, increasing the chances of exiting the trade faster with the best result.

Q: How does the -3% stop loss work?

A: If the loss reaches 3% of the deposit, the bot automatically closes the position, protecting the capital.

Q: Is it possible to trade without leverage (x1)?

A: Yes, but x7 increases the potential profit (and risks). Always follow risk management.

Q: How often does the bot open trades?

A: Only when all indicator conditions are met — this minimizes excessive activity.