Cryptocurrency or stocks - where is it better to invest?

Cryptocurrencies have become an extremely tempting investment for many investors, especially with the advent of ETFs (exchange traded funds). After peaking at around $3 trillion in 2021, the total value of all these digital currencies is around $2.3 trillion, according to CoinMarketCap.com. Among them, Bitcoin is the most popular, with a capitalization of over $1 trillion.

The rapid increase in the value of cryptocurrencies makes many investors think about accumulating them in their portfolios. However, it is important to realize that stocks and cryptocurrencies are fundamentally different assets and any profit in the capital market is opposed to risk.

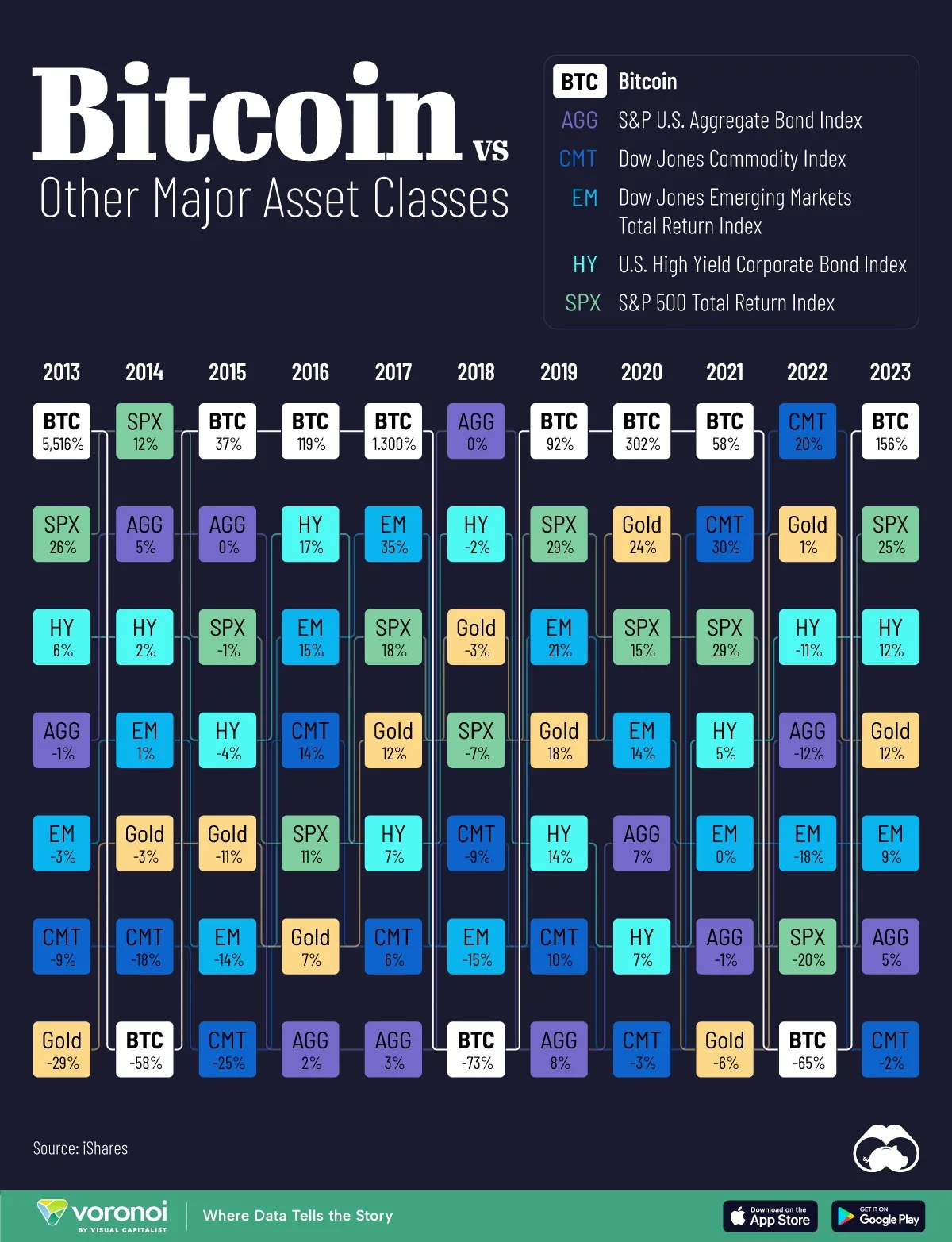

Bitcoin returns vs major asset classes. Source iShares.

In this article, we will look at the main differences between stocks and cryptocurrency, and compare the pros and cons of investing in each of these assets.

Key differences between stocks and cryptocurrency

•Regulation and protection

Shares of companies are regulated by government agencies, which protects investors. Companies are required to provide financial statements, undergo audits, and comply with legal requirements. Cryptocurrencies, on the other hand, do not yet have this good level of regulation. This makes them more risky as investors can face fraud and lack of protection of their rights.

• Fundamentals

Company stocks have fundamentals such as earnings, revenue, dividends, and assets. These metrics help investors evaluate the value of a stock and make informed decisions. Cryptocurrencies, on the other hand, have no such metrics. Their value is determined solely by supply and demand in the market.

• Volatility

Cryptocurrencies are famous for their high degree of volatility. Their prices can change dramatically in short periods of time. While stocks can also exhibit fluctuations, they tend to be less abrupt and more predictable.

• Liquidity

Company stocks tend to have high liquidity, especially if they are traded on major stock exchanges. Cryptocurrencies can also be liquid, but their liquidity can vary greatly depending on the specific cryptocurrency and exchange.

• Technology

The main functions of stocks are capital gains, dividends and voting rights. Cryptocurrencies, on the other hand, are based on blockchain technology, which turns them into “programmable money”. This opens up the possibility of creating smart contracts, decentralized applications and various DeFi (decentralized finance) products.

Investing in cryptocurrency: advantages and disadvantages

Advantages

- High speculative returns: Cryptocurrencies are able to show significant growth in a short period of time. For example, bitcoin has increased in value by hundreds of percent over the past year.

- Ease of use: Cryptocurrencies do not require in-depth analysis of company financials; it is enough to monitor market supply and demand.

- Anonymity: Cryptocurrencies offer a high level of anonymity, which attracts many investors.

- Global accessibility: Cryptocurrencies can be bought and sold from anywhere in the world, making them accessible to a wide audience.

Disadvantages

- High risk price fluctuations make cryptocurrencies risky to invest in.

- Lack of regulation: Cryptocurrencies currently have no clear regulatory framework, which increases the likelihood of fraud and losses.

- Technical difficulties: Investing in cryptocurrencies requires some technical knowledge, which can be difficult for beginners.

- Risk of hacking: Cryptocurrency exchanges and wallets can be attacked by hackers, which can lead to loss of funds.

Investing in shares: advantages and disadvantages

Advantages

- Regulation and protection: Company stocks are monitored by government agencies, which protects investors.

- Fundamentals: Stocks have metrics such as earnings, revenue, and dividends, which helps investors make informed decisions.

- Long-term stability: Stocks can provide steady income in the form of dividends and growth in value.

- Diversification: Investors can spread their money across different stocks and industries.

Disadvantages

- Volatility: Stocks can also be subject to fluctuations, especially in times of economic instability.

- Commissions and Taxes: Investing in stocks involves brokerage commissions and income taxes.

- Complexity of analysis: Successful investing requires in-depth analysis of company financials and market conditions.

- Bankruptcy risk: Companies may go bankrupt, resulting in a loss of investment.

Conclusion

In a high-risk environment, both equities and cryptocurrencies can be important components of a diversified portfolio. Comparing these instruments on returns alone without considering risk, investment size and time horizon may not be effective.

Cryptocurrencies can offer high returns, but they also come with serious risks. Stocks, on the other hand, offer a more stable and regulated investment vehicle, although they too can be volatile and require careful analysis. Ultimately, the choice between cryptocurrencies and stocks depends on your investment goals, risk tolerance level and ability to analyze.

“The first rule of investing is don’t lose (money). And the second rule of investing is don’t forget the first rule. And those are all the rules that exist.” Warren Buffett

Frequently Asked Questions

1. Which asset is riskier - cryptocurrency or stocks?

Cryptocurrencies are riskier because of their high volatility and lack of regulation. Stocks can also be risky, but they are regulated and have fundamentals.

2. Where can I trade stocks?

You can trade stocks through a brokerage firm. T-bank (Tinkoff) and BCS are among the most active today.

3. Where can I trade cryptocurrencies?

Among the most popular and liquid crypto exchanges are Binance, Coinbase and OKX. You can also trade on our Veles.Finance platform.

4. Is there a correlation (relationship) between the price of cryptocurrencies and stocks?

There are market situations when prices do correlate, but this is not a permanent phenomenon.