Cryptocurrency Portfolio: How to set up?

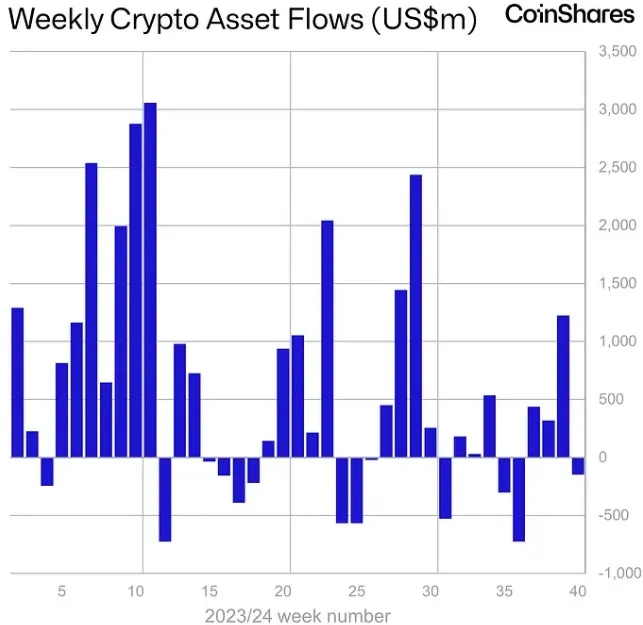

In 2024, the cryptocurrency market continues to develop, providing more and more opportunities for those who are ready to invest their funds in it. Even in the United States, where the state regulates financial activity very conservatively, in 2024 there are funds designed specifically for investing in cryptocurrency. According to Coinshares, such funds are more likely to experience asset inflows than asset outflows. The screenshot shows a chart of inflows into and outflows from such funds.

Despite the prospects, such investments are associated with significant risks due to the high volatility of cryptocurrencies. To reduce risks and increase the probability of profit, it is important to properly compile a cryptocurrency portfolio.

What is a crypto portfolio

Buying cryptocurrencies is not an investment in the strict sense. Unlike classic investments, when funds are transferred to a business in exchange for a share in its profits, the purchase of cryptocurrency does not imply such agreements. For this reason, cryptocurrencies should not be called an investment instrument in the traditional sense. Nevertheless, many people use the term “investment” to refer to purchases of cryptocurrencies, and later in the text we will sometimes use this word for convenience.

A cryptocurrency portfolio is a collection of digital assets purchased to generate returns and diversify risk. Including assets with different levels of risk and volatility in the portfolio allows you to minimize losses in case of a fall in the value of one cryptocurrency.

Creating a cryptocurrency portfolio is a process that requires serious analysis of each asset, understanding the market situation and choosing a strategy that will meet the individual goals of the asset owner and his risk tolerance.

Classification of crypto portfolios

The main parameters by which portfolios can be categorized are asset balance, owner’s attitude to risk and asset holding period.

By balance

Balanced portfolios include assets with varying degrees of risk. Cryptocurrencies such as bitcoin and ether are considered to be more stable and predictable assets, while memcoins and GameFi tokens are more volatile: they go through periods of explosive growth, but can also demonstrate a decline in value to almost zero.

A balanced portfolio allows you to reduce risks, as a drop in the value of one asset can be compensated by the growth of other assets.

Unbalanced portfolios are most often filled with cryptocurrencies from the same segment: for example, RWA (real asset tokenization) or Layer2 (layers on top of the underlying blockchains). This can be a profitable strategy if one guesses at the choice of segment. However, such portfolios are exposed to greater risks, as a fall in the value of all assets from the same segment can occur simultaneously.

According to the investor’s attitude to risk

Conservative portfolios are portfolios of asset owners who prefer to reduce risk. They usually include time-tested and more stable cryptocurrencies with high market capitalization, such as bitcoin and ether. These assets are less susceptible to sudden price fluctuations, which will allow you to keep a significant portion of your funds even in the event of a negative market situation.

Moderate portfolios are put together by asset owners who are willing to take some risk in order to maximize potential returns. In their portfolios they include not only stable assets, but also some more volatile altcoins that can bring high profits. This still leaves a portion of the portfolio in large, less risky assets.

Aggressive portfolios are put together by people actively seeking opportunities to maximize returns. Such portfolios may include many high-risk assets, such as memcoins that grow only on a wave of hype. Often such portfolios bet on coins with low capitalization, which can quickly increase in value, but can also sharply depreciate.

By investment timeframe

Short-term portfolios are formed by those who want to profit within a few weeks or months. The owner of such a portfolio can actively trade cryptocurrencies, using price fluctuations to make a quick buck.

If active manual trading is not your format, then the ideal solution for a short-term portfolio can be Veles automated trading bots, which can be set up to generate additional profits from short-term fluctuations. They will buy a new batch of cryptocurrency when the price becomes even more favorable to buy, and sell the purchased cryptocurrency when the price rises.

Medium-term portfolios are designed to last six months to a year. They include assets that can show stable growth during this period, but the owner is willing to tolerate temporary drawdowns. It is also convenient to use Veles bots with medium-term portfolios, because in periods of drawdowns they can, without the participation of the portfolio owner, complete the position and thereby improve the entry point to maximize profit at the subsequent sale.

Long-term portfolios are made for several years and are focused on long-term growth of assets. Usually such portfolios include large cryptocurrencies such as bitcoin and ether, which have shown stable growth over several years.

How to choose assets for a cryptocurrency portfolio

When adding an asset to a portfolio, the most important thing is to answer the question: who can I sell it to later.

Not every crypto is liquid. A portfolio can be made up of assets such as:

-

Bitcoin. Demand for it is driven by the unprecedented processing power of miners, which protects the blockchain from hacking. There is no more secure way to store savings than storing it in the Bitcoin blockchain, where no one can confiscate or freeze assets. In addition, Bitcoin is the only cryptocurrency whose exchange to the dollar at the market rate is guaranteed by the government (in El Salvador). With the growing understanding of these facts, the demand for bitcoins will only increase, so you won’t have any problems selling the coins you bought.

-

Ethereum. This is the coin used to pay for the operation of decentralized applications and smart contracts, both in the Ethereum core network and in some layer 2 networks (e.g. Base). As long as the dApps and smart contracts on these networks are running, there will still be demand for ether, and you will be able to sell the coins you buy.

-

Polkadot. This coin is used to pay commissions in interconnected blockchain networks. If a new cryptoproject is not ready to maintain its own blockchain on its own, it can join Polkadot’s ready-made ecosystem, which provides it with additional security. Since supporting an independent blockchain is a very complex task (even large projects like TON and Solana often experience failures), there will continue to be a need for ecosystems that enable new blockchains to be incorporated into a reliable network. And with it, the demand for the coins needed to pay the fees of that network will continue.

-

Binance Coin (BNB). This coin allows you to get a discount on the commissions of the largest cryptocurrency exchange Binance and participate in the distribution of some of the new tokens that are released on the exchange. As long as Binance remains popular, the demand for BNB isn’t going anywhere.

At the same time, if you take the tokens of other crypto exchanges, there may be problems with them. For example, the Storm Trade exchange on the TON platform has recently been gaining popularity. It, like Binance, issues its own tokens, but you can only use such tokens for steaking to earn income in the tokens themselves. The tokens are not used for anything else. Therefore, the income in STORM tokens is ephemeral. What can be done with the tokens received? Nothing. You can try to sell them. But who will buy them and why? While there is no answer to this question, the token’s prospects are vague.

The same goes for tokens of clicker games (NOT, HMSTR, BLUM and others) and memcoins (PEPE, DOGS, CATS, etc.). There is only demand for them from speculators. But if the rate rises, speculators will not buy: they buy assets at a low price, and at a high price they prefer to sell. Therefore, you should not count on speculative demand when forming a portfolio of cryptocurrencies. You need to look for someone other than speculators who can provide demand for the asset you are interested in.

And only when you have made a list of cryptocurrencies for which you are sure that there is demand for them and you will be able to sell them later, it is worth moving on to assessing the prospects that the demand will grow, and the price along with it.

Tips for building and maintaining a crypto portfolio

Before the start of 2024, a crypto portfolio contest was launched on the Bitcointalk forum. According to its terms, four cryptocurrencies can be added to the portfolio, which should be made for 1000 USD,

-

you can add four cryptocurrencies,

-

you can’t include bitcoin,

-

and only one stablecoin.

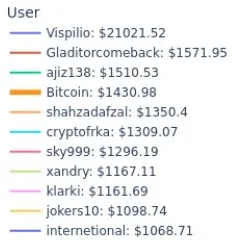

There are 39 portfolios participating in the contest. The 40th portfolio is a portfolio that is 100% made up of bitcoins. And throughout the year 2024, the bitcoin portfolio is consistently in the top 5.

The vast majority of altcoins chosen by the contestants are inferior to bitcoin in terms of profitability. At the time of this writing, $1,000 invested in bitcoin at the beginning of the year would have turned into $1,430.98 USD. And only 3 out of 39 altcoin and stablecoin portfolios would have produced a higher result. True, one of them would have increased the initial capital by 21 times.

The leader of the competitive rating took Black, Nola, SPX6900 and ChartAI tokens in his portfolio. Three of the four tokens have fallen a lot since the beginning of the year, but the growth of one of them (SPX6900) has repeatedly covered the losses from the drawdown of the others.

As we can see, sometimes choosing little-known cryptocurrencies can lead to impressive results. But in most cases, choosing proven solutions is optimal. Yes, they do not bring much profit, but this profit can be increased if you connect Veles trading bots to your exchange account (one bot for each cryptocurrency in the portfolio) and configure them to make additional purchases of selected cryptocurrencies when their prices fall and sell them when they rise.

Also, having formed a portfolio and waiting for an increase in at least one of the assets, you can run on the Veles platform a bot configured for the “spot short” strategy. It will sell the asset, the rate of which has grown, and then will buy it on corrections. In this case, you can either increase the total volume of assets in the portfolio (i.e. buy more than was sold) or fix the profit on each cycle of “selling-buying”.

Crypto portfolio trackers to keep track of your assets

To effectively manage a cryptocurrency portfolio, it can be necessary to keep track of real-time changes in the value of cryptocurrencies and keep a record of your investments. Here are a few popular trackers that provide such features:

-

CoinTracker. It integrates with most major exchanges and cryptocurrency wallets, allowing you to automatically update the value of your assets. The app provides handy reports and analytics to monitor changes in the market.

-

Blockfolio. It allows asset owners to not only monitor price changes, but also receive up-to-date news about the cryptocurrency market, which helps to stay informed and make timely decisions.

-

Delta. This tracker allows you to follow the dynamics of assets, receive reports and analytics, as well as track changes in value on different cryptocurrency exchanges.

You can also use the Veles bot as a tracker. If you configure it to increase and decrease positions when price levels important to you are reached and enable notifications about transactions, you will receive notifications about all changes in your portfolio in Telegram. And in addition to this, such a “tracker” will bring profit from rate fluctuations.

Conclusion

Creating a cryptocurrency portfolio in 2024 is a responsible and complex task that requires a deep understanding of the market and a careful approach to asset selection. It is important to properly allocate funds between different types of cryptocurrencies, take into account the degree of asset volatility and keep an eye on new trends.

Regular rebalancing with the help of Veles trading bots will help manage your portfolio more efficiently, increasing profits when rates fluctuate.

Frequently Asked Questions

1. How much of my portfolio should I allocate to bitcoin?

This depends on your strategy. Bitcoin maximalists allocate 100%. Such a “portfolio” will not be balanced, but history shows that this decision can be justified. Bitcoin outperforms most altcoins over the long haul.

2. Is it possible to create a portfolio of only altcoins?

You can, but in most cases it only yields results in the short term. Even on a one-year horizon, altcoin portfolios tend to lose out to bitcoin in growth. But if you guess and find the very altcoin that will “shoot”, the final profit can be many times higher.

3. How much can I start building a crypto portfolio?

You can start with any amount, but for full diversification it is recommended to have at least a few hundred dollars. The main thing is to properly distribute funds between different assets.