FOMO and FUD in Trading and Crypto: What They Are and How They Affect the Market

In finance, there are many aspects that influence the outcome. Emotions are part of the human factor and possibly the main cause of bad decisions and losses. FUD and FOMO in turn, directly affect or will affect anyone who finds themselves in cryptocurrency, so it is important to know how to deal with these phenomena.

What is FUD

FUD (Fear, Uncertainty, Doubt) is an information influence strategy to spread negative rumors, false news, or exaggerated criticism. In the cryptocurrency world, FUD is often used to manipulate prices: panic sell-offs of assets reduce their value, allowing large players to buy at low prices.

Examples of FUD in cryptocurrency:

-

False news about cryptocurrency bans in major countries.

-

Throwing in information about the possible bankruptcy of popular crypto exchanges.

-

Spreading rumors about hacker attacks on blockchains and smart contracts.

What is FOMO

FOMO (Fear of Missing Out) is an emotional state in which investors and traders start buying assets in fear of missing out on a profitable trend. In the crypto market, FOMO can lead to excessive volatility and sharp price spikes.

Signs of FOMO:

-

A sudden rapid upward price movement.

-

Mass euphoria and discussion of the asset on social media and social networks.

-

Increased interest by retail investors in buying the cryptocurrency.

Psychological triggers of FOMO

- Social validation

People tend to copy the behavior of others. When the media or social media says that “everyone” is capitalizing on the rise of cryptocurrencies, people are motivated to join in.

- Fear of lost profits

Psychologically, people are more afraid of missing out on potential gains than losing money. This causes them to act impulsively and enter the market at the peak of the price.

- Hype and hype

Media, Influencers and Telegram feeds can fuel hype by creating the illusion that a certain asset is a “train that’s leaving”.

- Crowd Effect

When many investors buy an asset, there is a perception that “it’s safe.” People are influenced by public opinion and buy an asset even if they don’t understand its value.

- Fear of being “left behind”

If an asset is advertised as “rare”, its value in the eyes of investors increases. For example, a limited bitcoin issue (21 million) increases the fear of FOMO.

- Quick profits and success stories

Stories of how someone bought bitcoin for $100 and became a millionaire create the illusion that it can happen again.

Examples of FOMO in the crypto market

1. Bitcoin in 2017 ($20,000)

In December 2017, the price of bitcoin soared from $3,000 to $20,000. The media kept saying that BTC would soon be worth $100,000. Millions of people who didn’t understand crypto started buying up bitcoin at the peak. The result - a drop to $3,000 in 2018 and major losses for those who bought on the hype.

2. Dogecoin and Ilon Musk (2021)

When Ilon Musk started actively tweeting about Dogecoin, the price of the asset jumped up sharply. Many people bought DOGE on emotion, hoping for a rise to $1. However, after an appearance on “SNL”, Musk called Dogecoin a “hype” and the price collapsed.

3. NFT boom (2021-2022)

Many investors bought expensive NFTs, hoping for them to rise in value. Collections that were selling for millions depreciated dramatically after the decline in interest in NFTs.

4. Terra (LUNA) and UST (2022).

The Terra project was positioned as a “stable cryptocurrency.” Millions of people invested in LUNA and UST, believing in “guaranteed” growth. When the system collapsed, people lost billions of dollars.

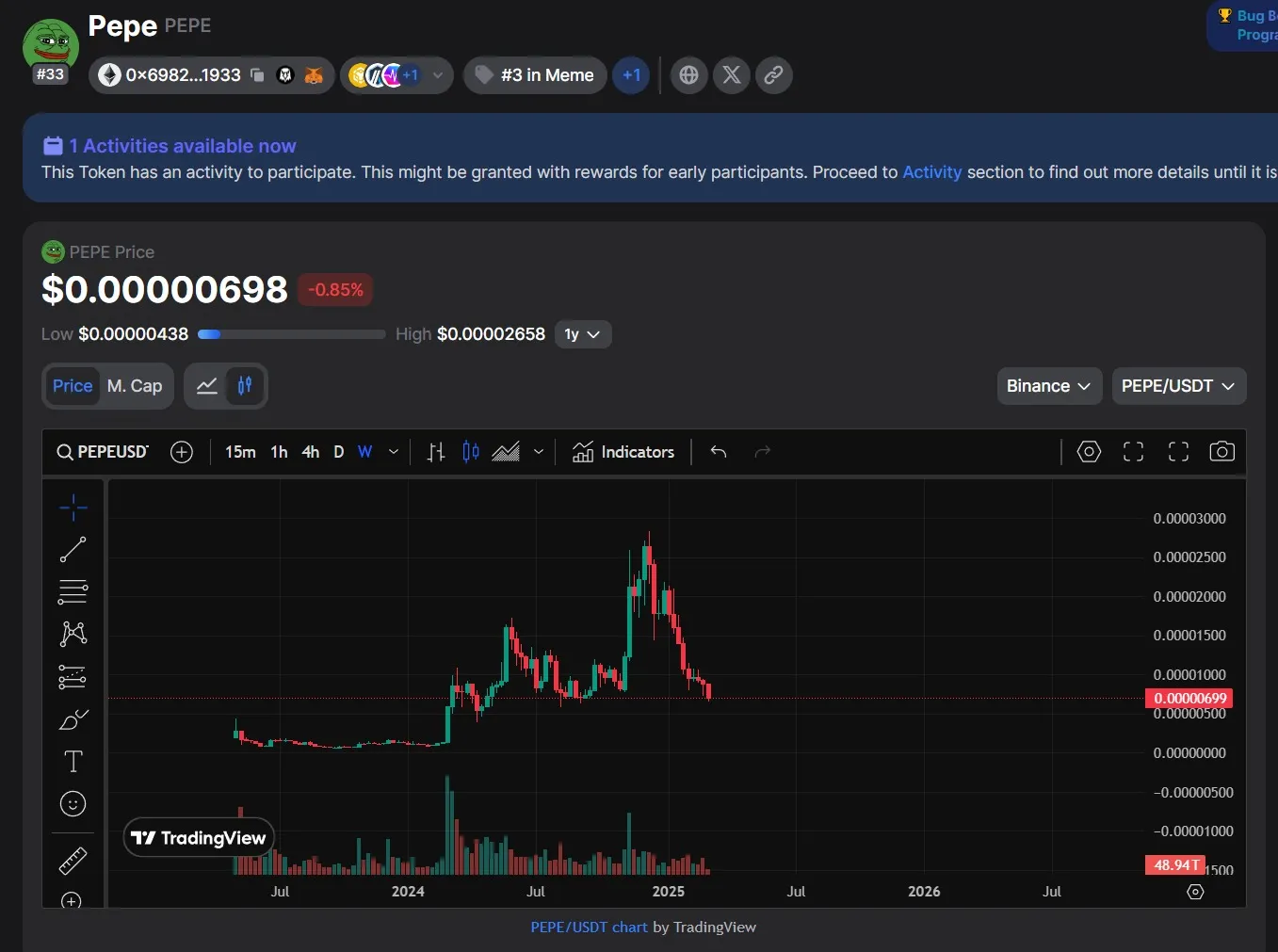

5. PEPE and Memcoins (2023)

PEPE and other memcoins soared hundreds of percent in a matter of days. Newcomers bought them, hoping for the “next Dogecoin,” but many assets collapsed, leaving investors at a loss.

6. Airdrops and Retrodrops (2023 - 2024)

After the successful releases of many fundamental projects in 2022-2023 and airdrop campaigns where users received thousands of dollars in drops for simple actions at little cost. A huge number of crypto enthusiasts and beginners, having seen this, started to get involved in all projects without analyzing them in detail in the hope of getting huge rewards. As a result, only a small part of all the projects released in 2024 was able to justify the investment and somehow reward users.

7. Tap-to-earn (2024).

In January 2024, Notcoin, a well-known clicker, was launched in Telegram. The release of tapalki was accompanied by hype, but a small number of really believers in the idea of the project and a good airdrop of tokens. After successful listing on all major centralized exchanges, including Binance, users on average received from 50 to several thousand dollars just for clicks on the screen, without investment. Following this precedent, Notcoin essentially launched a narrative of tapalks on Telegram, with many new users participating in hopes of similar large rewards. However, as practice has shown, only a few came close to similar success, while the rest of the projects simply disappointed.

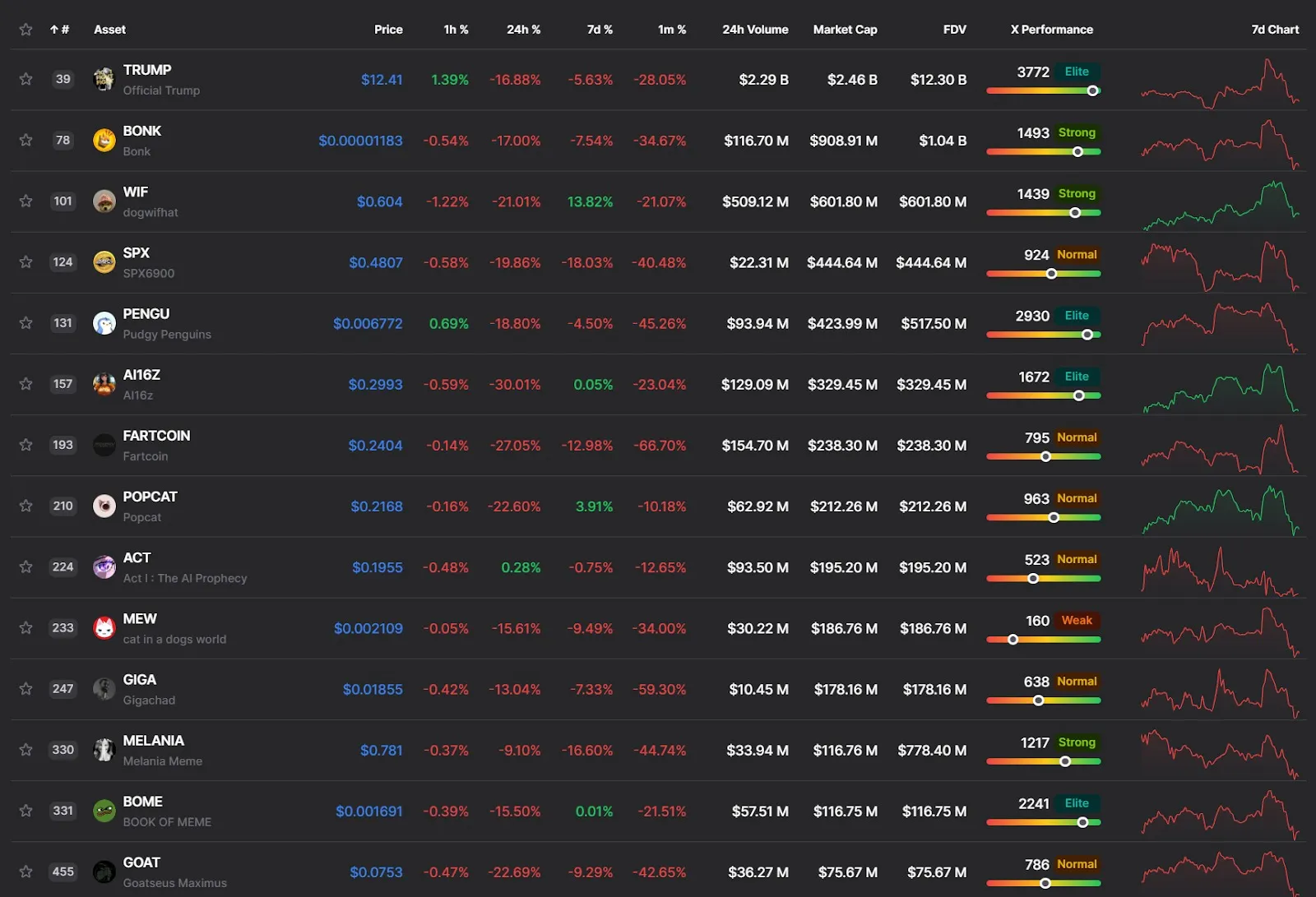

8. Memcoins on Solana (2024 - 2025)

In late 2024 and early 2025, there was a memcoin boom in the Solana ecosystem. Tokens launched on Pump.Fun could grow from a few million capitalization to several hundred million or even billions of dollars. After such precedents, a large influx of users and liquidity into the Solana blockchain began. Users inspired by the successes or embraced by FOMO began investing in memcoins, most of which were empty or scam, causing many to lose large amounts of funds.

The impact of FUD and FOMO on trader behavior

How FOMO affects traders:

1. Impulsive buying at the peak

-

A trader sees that the price of an asset is rising and does not want to “miss out on profits”.

-

He enters the trade without analyzing it, often buying at the very peak.

-

The result: losses after correction or collapse.

2. Ignoring the strategy

-

Because of euphoria, a trader may forget about risk management.

-

He does not put stop-losses, takes too large positions.

-

The result: increased risks and possible deposit drain.

3. The “next bitcoin” syndrome

-

Buying assets that “promise” to become the new BTC, ETH.

-

Investing in memcoins and HYIP tokens without fundamental analysis.

-

Bottom line: 99% of such assets depreciate.

4. Overestimation of short-term trends

-

Seeing the growth of an asset, a trader believes that it will be eternal.

-

He invests large sums without noticing the signs of market reversal.

-

Bottom line: the market reverses sharply, the trader loses money.

How FUD affects traders:

1. Panic selling

-

Seeing negative news, traders sell the asset without understanding the situation.

-

Bottom line: they often sell at the very bottom, when big players buy up the cheap asset.

2. Manipulation by “whales”

-

Large investors can create a FUD to crash the price and buy the asset cheaper.

-

Bottom line: retail traders lose money, big players increase profits.

3. Fear of any corrections

-

Even small declines seem to traders as “the beginning of a crash”.

-

They exit positions too early, missing out on future growth.

-

Bottom line: lost profits.

4. Decreased confidence in the market

-

Constant FUD makes traders nervous, they stop trusting the market.

-

Bottom line: they may miss out on good investment opportunities.

How to counteract FUD and FOMO

How to counter FOMO:

1. Adhere to a clear plan and strategy

Solution:

-

Determine entry and exit goals for the trade.

-

Apply risk management by investing only the amount you are willing to lose.

-

Diversify the portfolio by not betting on a single asset.

Example:

Instead of spontaneously buying a cryptocurrency on strong growth, you should set entry and exit levels in advance.

2. Do not make decisions under crowd pressure

Solution:

-

Evaluate the asset based on fundamental analysis rather than market emotions.

-

Verify information from multiple sources.

-

Do not rely on the opinion of influencers and social media without critical thinking.

Example:

If a cryptocurrency has grown 500% in a day, it doesn’t mean that its growth will continue. It may be a temporary hype or manipulation.

3. Use limit orders

Solution:

-

Buy assets at predetermined prices, not the market price.

-

Avoid impulsive market entries on strong moves.

Example:

Instead of buying bitcoin at the highs, it is better to set a limit order at a more favorable price and wait for a correction.

4. Recognize the cyclical nature of the market

Solution:

-

Realize that periods of ups and downs are inevitable.

-

Analyze past market cycles to avoid making mistakes.

Example:

In 2017, bitcoin rose to $20,000, then fell to $3,000. In 2021, the situation repeated itself.

5. Develop discipline

Solution:

-

Limit the time spent tracking prices.

-

Trade according to predetermined rules.

-

Capture mistakes and adjust strategy.

Example:

If there is a feeling of urgency to buy an asset, it is better to pause, analyze the market and only then make a decision.

How to counter FUD:

1. Check sources of information

Solution:

-

Don’t trust rumors and clickbait headlines.

-

Evaluate who is spreading the news and for what purpose.

Example:

Rumors of a bitcoin ban in China appeared many times, but each time turned out to be a temporary factor, after which the market recovered.

2. focus on the long term

Solution:

-

Evaluate the asset in terms of its technology and fundamentals.

-

Realize that short-term fluctuations do not always reflect the real value of a project.

Example:

Ethereum fell from $4,800 to $900 in 2022, but its technology continued to evolve and the price later rose.

3. Don’t panic during corrections

Solution:

-

Evaluate whether the current drop is justified.

-

Use support levels and technical analysis.

Example:

If an asset drops sharply by 10-20%, it may be a temporary correction and not a sign of a global crisis.

4. Diversify the portfolio

Solution:

-

Don’t invest all of your capital in one asset.

-

Keep some capital in stablecoins or less volatile assets.

Example:

If all funds are invested in one project, its collapse will result in a loss of capital. Diversification reduces this risk.

5. Ignore short-term market noise

Solution:

-

Don’t react to every piece of news with panic.

-

Keep your focus on long-term trends.

Example:

When the media announces the “death of cryptocurrency,” it is often a temporary crisis after which the market recovers.

Importance of technical analysis

Technical analysis helps to:

-

Identify support and resistance levels.

-

Identify trends and patterns that indicate potential price movements.

-

Filter out false signals and avoid falling for mass hysteria.

The role of social media

Social media is a major source of FUD and FOMO. To avoid being influenced:

-

Verify information from reliable sources.

-

Analyze not only emotions but also project fundamentals.

-

Avoid blindly following influencers.

Conclusion

FUD and FOMO can lead to rash decisions, loss of capital and increased market volatility. In order to trade successfully, it is important to develop discipline, analyze the market, and not give in to emotions, as these two phenomena will walk beside you throughout your time in both cryptocurrency and the world of finance in general.

FAQ

1. What is FUD and FOMO in cryptocurrency?

FUD (fear, uncertainty, doubt) is a strategy to manipulate the market through negative information. FOMO (fear of missing out) is the irrational desire to buy an asset due to massive hype.

2. How do FUD and FOMO affect trading behavior?

They can lead to panic selling, buying at the peak of the price, losing money due to impulsive decisions and increased market volatility.

3. What are the psychological triggers that cause FOMO in the crypto market?

The main triggers are: social proof, fear of missing out, euphoria of success, and a sense of limited supply.

4. What strategies help to counter FUD and FOMO?

Key strategies: developing a trading plan, using stop losses, emotional discipline, and objective market analysis.