Top altcoins of 2025: which tokens deserve attention

Altcoins (alternative coins) are cryptocurrencies that were created after Bitcoin. While Bitcoin remains the leader among cryptocurrencies, many altcoins offer improvements in transaction speed, privacy, scalability, and smart contract functionality.

Altcoins can be divided into several categories:

-

Smart contract platforms (e.g. Ethereum, Solana).

-

Private cryptocurrencies (e.g. Monero, Zcash).

-

DeFi tokens (e.g. Uniswap, Aave).

-

NFT tokens (e.g. Flow, Tezos).

-

Memcoins (e.g. Trump, Fartcoin).

Top 5 promising altcoins

Among the vast number of new and old altcoins, it is worth highlighting the top 5 most promising ones.

Ethereum - the king of smart contracts

Ethereum (ETH) is not just an altcoin, but an entire platform for creating decentralized applications (dApps) using smart contracts. Ethereum continues to dominate the DeFi and NFT space and has a large developer community. In 2025, Ethereum expects further optimization with the Ethereum 2.0 update, which will make the network more scalable and energy efficient. This is a great choice for investors interested in the long term.

Solana is fast and scalable

Solana (SOL) is an altcoin that has become known for its fast transaction speeds and low fees. Unlike Ethereum, Solana uses a unique Proof of History (PoH) algorithm that allows it to process thousands of transactions per second. This makes Solana an ideal platform for mainstream use cases including games, DeFi, and decentralized applications.

Chainlink - oracles for DeFi

Chainlink (LINK) is a project that provides oracles that allow smart contracts to interact with the real world. These oracles provide data on prices, weather, sports scores, and many other parameters that are critical to decentralized finance (DeFi). With DeFi growing in popularity in 2025, Chainlink continues to be an important player in the ecosystem.

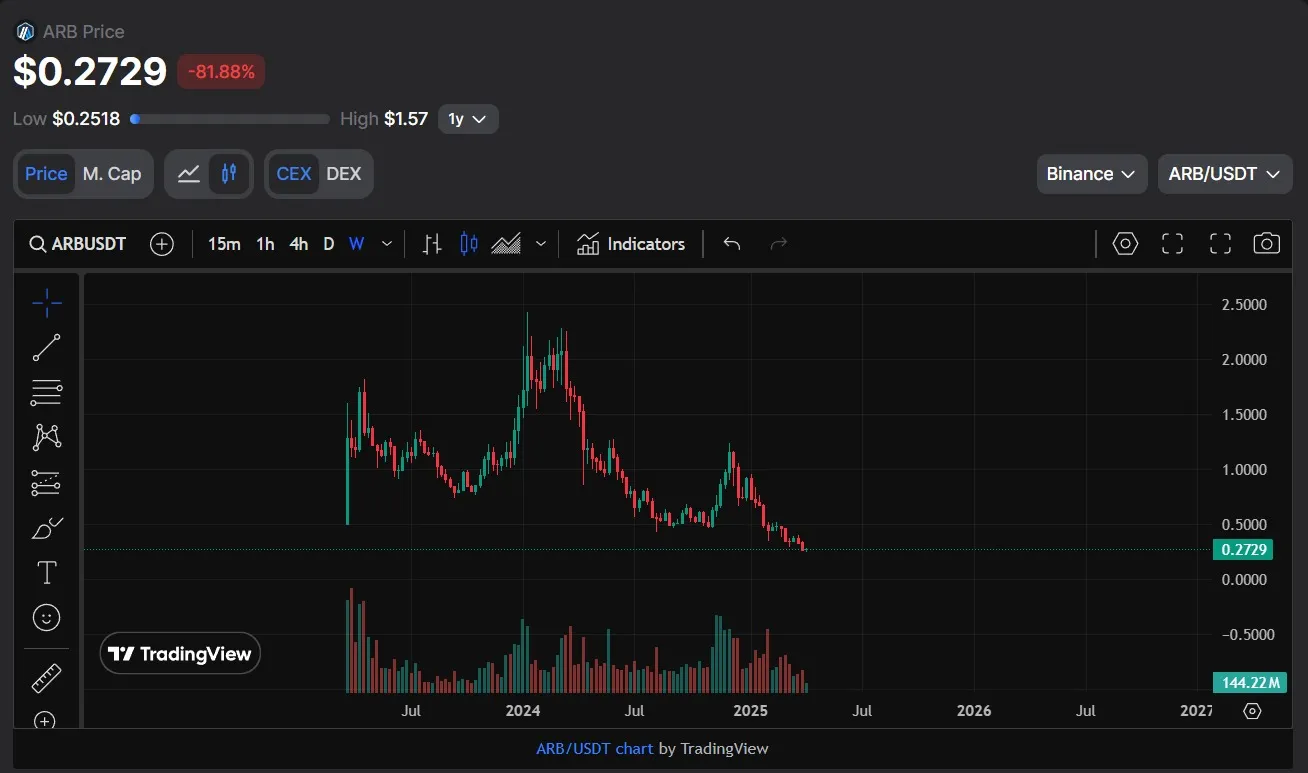

Arbitrum - Layer 2 with an active ecosystem

Arbitrum is a Layer 2 solution for Ethereum that significantly reduces transaction fees and increases network bandwidth. With its help, Ethereum will be able to scale without losing security and decentralization. Arbitrum is actively expanding its ecosystem, and in 2025 it could become an indispensable solution for Ethereum users.

Render (RNDR) - AI and GPUs in blockchain

Render (RNDR) is an altcoin that utilizes the blockchain to distribute graphics processing unit (GPU) power in the cloud. This allows users to rent computing power for rendering 3D graphics, video, and other media applications. With the growing interest in artificial intelligence and virtual reality, Render could become an important player in the market in 2025.

Second-tier altcoins worth keeping an eye on

“Second-tier altcoins” are cryptocurrencies that are not in the top 10 in terms of market capitalization, but still have strong growth potential.

Top second-tier altcoins to watch out for:

1. Injective Protocol (INJ).

Refers to decentralized finance (DeFi) and is an ultra-fast DEX with the ability to create its own derivatives and markets.

Why to watch: actively developing, high community participation, integrations with Cosmos and Layer-2.

2. Celestia (TIA).

Belongs to the modular blockchain group, data availability and is the first modular network to simplify the launch of its own blockchains.

Why to watch: new paradigm (modular blockchains), support from major players, part of the Cosmos ecosystem.

3. Arweave (AR)

The field of decentralized data storage and permanent (perpetual) storage of information.

Why to watch: in demand in NFT, archiving, Web3; collaboration with Internet Archive and others.

4. Moonbeam (GLMR).

Has Ethereum and Polkadot compatibility, and does dApp compatibility with Ethereum on the Polkadot network.

Why to watch: evolving with Polkadot, potentially favorable position as a bridge between ecosystems.

5. Ocean Protocol (OCEAN)

The project belongs to the data marketplace and provides decentralized data exchange with the possibility of monetization.

Why to watch: AI and Big Data trends require robust data trading platforms.

How to build a portfolio with altcoins

1. Determine the goal of the portfolio

Before assembling a portfolio, it’s important to understand what you need it for:

Capital growth - focus on tokens with high potential, but also with risks.

Value preservation - focus on more stable and proven altcoins.

Speculative portfolio - bet on early, experimental projects.

2. Make an asset allocation

You need to allocate a percentage of what proportion of the portfolio will be held by a particular altcoin.

3. Diversify by sector

You should not invest in only one segment. Spread your capital across different areas:

-

DeFi (financial applications on blockchain)

-

Game projects and meta-universes (GameFi)

-

AI and data processing

-

Data storage

-

Web3 infrastructure

-

Tier 1 and Tier 2 blockchains

-

Privacy and private networks

4. Project analysis

When selecting altcoins, you need to evaluate them on a number of criteria:

-

Market capitalization - reflects the potential for further growth

-

Trading volume and capitalization of altcoins - indicates interest and liquidity

-

List of exchanges - the presence of major exchanges indicates accessibility and trust

-

Community - number of followers, activity on social networks and forums

-

Partnerships and integrations - connections with other projects, investors

5. Buying strategy

There are several approaches to buying altcoins:

DCA (averaging) - regular purchases for the same amount, regardless of price

Buying by levels - enter at technically justified levels (after correction, at support)

Combined approach - buy the main part according to DCA and part according to market signals.

FAQ

1. What are altcoins in cryptocurrency?

Altcoins are cryptocurrencies other than Bitcoin that offer improved features and capabilities for users, including smart contracts, DeFi, and other innovations.

2. Why are altcoins falling?

Altcoin prices can fall due to changes in market conditions, decreased investor interest, regulatory changes, or technical issues with projects.

3. Which altcoins are promising in 2025?

Ethereum, Solana, Chainlink, Arbitrum and Render are some of the most promising altcoins for 2025.

4. What is altcoin dominance?

Altcoin dominance is a metric that shows the share of altcoins in the total cryptocurrency market capitalization compared to Bitcoin, there is also an inverse metric - bitcoin to altcoin dominance.

5. How to know which altcoins will grow?

To analyze promising altcoins, it is worth studying their market capitalization, technological innovations, development team and investor interest. Use altcoin chart, altcoin index to follow price dynamics and trends.