What is cumulative profit for and how should it be tracked?

An important part of trading is the introduction of personal trading statistics. It is thanks to this that a trader realizes when he should work on his mistakes, and when, on the contrary, he should start using more volume than he had before. Without the introduction of statistics, profitable distance trading is impossible and never will be.

Cumulative profit is a visual reflection on the chart of trader’s profits and losses for a certain period of time. This tool gives an understanding to the trader whether he is moving in the right direction or not.

In trading, cumulative profit fulfills several important functions:

1. analyzing the efficiency of trading. Tracking cumulative profit allows a trader to evaluate the overall profitability of his trading operations for a certain period of time. This helps to understand how successful the chosen trading strategy is.

2. Risk Management. Analyzing cumulative profit helps a trader to identify periods of unprofitable trades and take measures to reduce them, as well as to assess the acceptable level of risk.

3. motivation and self-evaluation. Observing the growth of cumulative profit inspires the trader, increases his confidence and stimulates him to further improve the trading system.

4. Trade planning. Cumulative profit helps the trader to set realistic profitability goals and allocate capital.

5. Calculation of trading indicators. On the basis of cumulative profit a trader can calculate such important indicators as profitability and drawdown ratio.

Thus, cumulative profit is a key indicator of trader’s success, allows him to evaluate the effectiveness of his trading strategy and manage risks. It is the most important tool for achieving long-term financial success in trading.

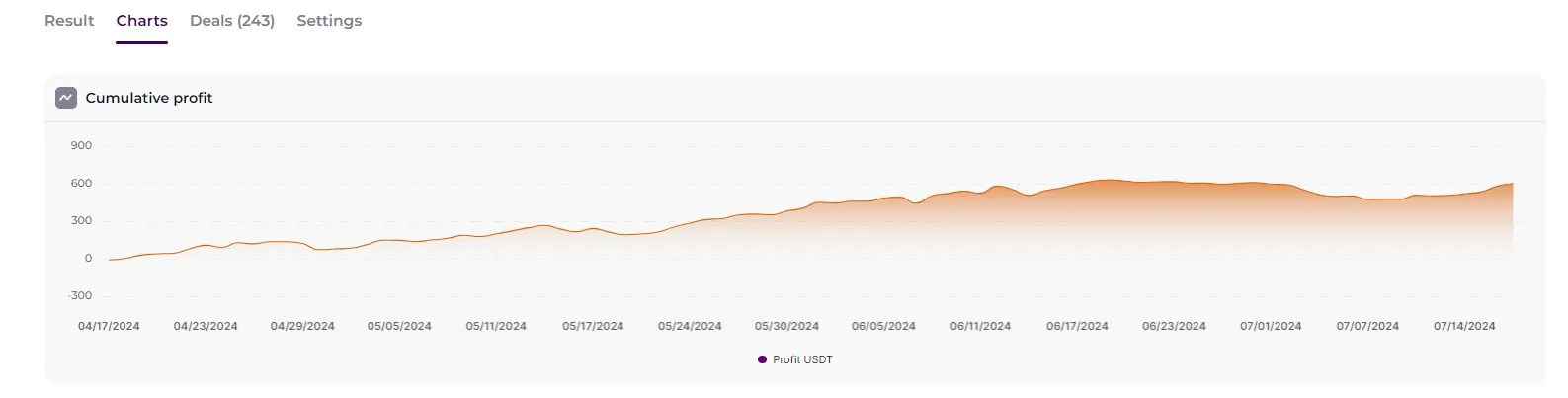

On the Veles trading bot creation platform, cumulative profit is available in the settings backtests in the Charts block.

Showing the profitability of the settings on the chart will give insight into whether the bot should be run with the selected settings or whether it is worth making adjustments. You can also evaluate in which time period the trading algorithms were the most profitable and study why this was the case.

Having collected the right amount of trading statistics of asset performance and income and expenses, you can understand when to enter trades and under what circumstances.