Whitepaper in Crypto: What It Is and Why It Matters

In the vastness of cryptocurrency, the Whitepaper (white paper) is a fundamental material when launching new projects. This document contains a detailed description of the technology, goals, tokenomics and other important aspects of a crypto project. Interested investors and users turn to the Whitepaper to understand how promising the project is, what problems it solves and what benefits it brings. In this article, we will look at what a Whitepaper is, its differences from a Roadmap, how it is used in the crypto industry, and what elements should be paid attention to when analyzing it.

What is a Whitepaper?

Whitepaper is an official document of a project working in cryptocurrency, which contains detailed information about its technical realization, goals and prospects. Usually, a Whitepaper includes a description of the problem the project is solving, technical aspects, tokenization details and development plans. It is the first and most important document to read before investing in a cryptocurrency or blockchain startup.

Whitepaper vs. Roadmap - what to look at?

Although Whitepaper and Roadmap are closely related, they have different functions. A Whitepaper is a strategic document containing the theoretical basis of a project, while a Roadmap is an action plan with development milestones and timelines.

It is important for investors to consider both documents: Whitepaper helps to assess the technical soundness and uniqueness of the idea, and Roadmap - the realism of its realization and compliance with deadlines.

How Whitepaper is used in crypto projects

1. Whitepaper at the project startup stage

In the early stages, the Whitepaper plays a paramount role in establishing credibility for the team and the project, as well as attracting initial funding.

1.1 Attracting investors and funds

-

The main purpose of the whitepaper is to explain what problem the project solves and how it does it.

-

It is important to show competitive advantages and unique technologies.

-

Detailed tokenomics helps investors evaluate how tokens are distributed and what their functions are.

-

Institutional investors, venture capital funds and private investors analyze the Whitepaper before investing in the project.

1.2 Conducting an ICO/IDO/IEO

The Whitepaper is the basis for conducting an initial token offering:

-

ICO (Initial Coin Offering) - An initial token offering to raise funds.

-

IDO (Initial DEX Offering) - opening token trading on decentralized exchanges.

-

IEO (Initial Exchange Offering) - placement of tokens on centralized exchanges.

2. Whitepaper in the process of development and growth of the project

After a successful launch, the Whitepaper continues to be used as an important document for the team, community and partners.

2.1 Developer’s Guide

-

Defines the technical architecture of the project.

-

Helps to create smart contracts as it contains key tokenization parameters.

-

Defines the consensus algorithm (Proof-of-Work, Proof-of-Stake, etc.).

-

Can be used for publication in academic journals (e.g. bitcoin originally appeared as an academic paper by Satoshi Nakamoto).

2.2 Roadmap and Adaptation

-

Whitepaper often includes a Roadmap, but the document may be updated as the project evolves.

-

If the project faces new challenges, the team may revise the technical or economic part.

-

For example, Ethereum was originally conceived as a PoW blockchain but later switched to PoS - such changes may be reflected in an updated Whitepaper.

2.3 Working with regulators

-

In some countries, having a quality Whitepaper helps to avoid legal problems.

-

The document can be used to prove the legality of the project to regulators.

-

The Whitepaper must comply with securities laws if the token has investment characteristics.

3. Whitepaper in the marketing and user engagement process

This document also plays an important role in promoting the project.

3.1 Community Engagement

-

Helps to explain to users why they need the token.

-

Demonstrates the principles of decentralization and community management.

-

Shows mechanisms for staking, farming, voting, and other features that attract users.

3.2 Engaging partners and exchanges

-

Whitepaper helps centralized and decentralized exchanges evaluate a project before listing.

-

Companies that want to partner with a blockchain startup analyze Whitepaper to understand the integration potential.

4. Whitepaper as the project updates and scales.

As the project evolves, the Whitepaper may be updated or expanded.

4.1 Release a new version of the Whitepaper (V2.0 and beyond)

-

If the project has changed technical architecture, a new Whitepaper is required.

-

If the tokenomics model changes (e.g., introducing new burn-in mechanisms), it is important to update the document.

-

If a project moves to a new blockchain platform, this should be reflected in an updated Whitepaper.

4.2 Forking and launching new networks

-

If a project makes a hardfork (e.g. Ethereum → Ethereum Classic), a new Whitepaper is created.

-

If second layers (Layer 2) are introduced, their mechanics should be detailed in the documentation.

The main elements of a Whitepaper

For a Whitepaper to be informative and compelling, it must include a number of essential elements:

1. Introduction

The introduction is a brief overview of the project that should immediately interest the reader.

What it includes:

-

Problem definition: what existing problem is being addressed?

-

Solution Summary: how does the project propose to solve this problem?

-

Unique features: how is the project different from competitors?

-

Key objectives: the main vision and mission of the project.

Example:

“Our project proposes an innovative consensus algorithm that improves network scalability without compromising security.”

2. Problem Statement

This explains in detail the specific problem facing the crypto industry or a particular market.

Which includes:

-

Current shortcomings of other blockchain projects.

-

A description of user or business pain.

-

An analysis of the market and confirmation that the problem does exist (may include statistics and research).

Example:

“Most blockchains face a trilemma problem: it is impossible to provide decentralization, security and scalability at the same time. Our project solves this problem using Sharding technology.”

3. Solution & Technology Overview

This section details how the project solves the stated problem.

What is included:

-

Technical description of the project (if it is related to blockchain, smart contracts, DeFi, NFT, etc.).

-

Innovation compared to competitors.

-

Technical advantages (speed, security, interoperability, etc.).

-

Use cases - who will use the technology and how.

Example:

“Our blockchain uses a new Proof-of-Stake mechanism with dynamically adjusted rewards to minimize energy consumption and maintain high transaction speeds.”

4. Technical Architecture

This is where the project goes into technical details and describes its infrastructure.

What it includes:

-

Consensus algorithm (Proof-of-Work, Proof-of-Stake, Delegated PoS, etc.).

-

Blockchain structure (sidechains, levels of scalability, Layer 2 solutions).

-

Use of smart contracts and their functions.

-

Integration with other blockchains (bridges, cross-chain interaction).

-

Security system and defense mechanisms against attacks.

Example:

“The blockchain uses a hybrid PoS+BFT mechanism that combines the high security of Byzantine Fault Tolerance (BFT) with the efficiency of PoS.”

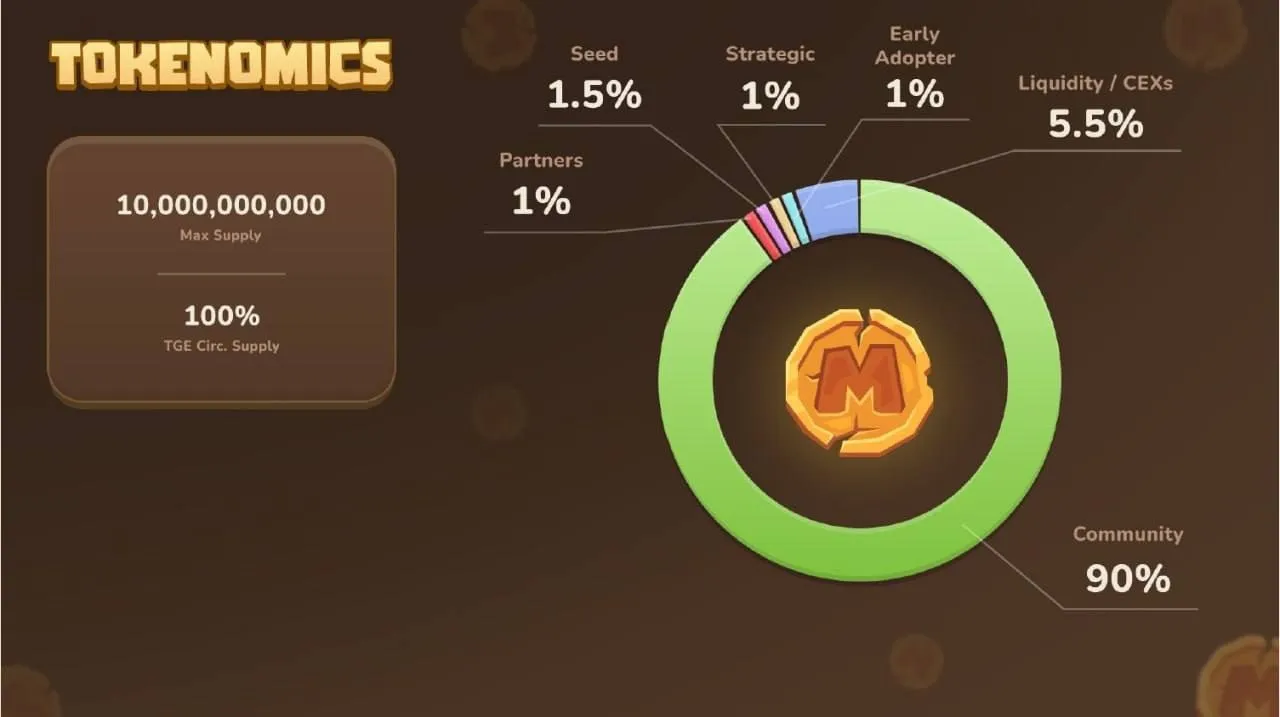

5. Tokenomics (Tokenomics).

One of the most important sections that explains the economic model of a token.

What it includes:

-

The type of token (ERC-20, BEP-20, proprietary blockchain, etc.).

-

Total number of tokens and their distribution.

-

Uses of the token (staking, payment of fees, management, access to features).

-

Inflation/deflation mechanisms (token burning, halving).

-

Rewards for participation (investors, validators, miners, etc.).

Example of token distribution:

-

30% - to early investors

-

25% for the team and developers

-

20% - marketing and ecosystem

-

15% - staking rewards

-

10% - reserve fund

Example mechanics:

“The token is used to pay commissions on the network, and a portion of the commissions are burned, creating a deflationary model.”

6. Roadmap

A plan to develop the project over the coming months and years.

What it includes:

-

Key milestones and dates.

-

Testnet and main blockchain launch.

-

Integrations, partnerships, marketing campaigns.

-

Going public on exchanges.

Example:

-

Q1 2025 - Testnet launch

-

Q2 2025 - IDO

-

Q3 2025 - Launch main network

-

Q4 2025 - Listing on major exchanges

7. Team & Partners

Information about developers, advisors and partners.

What’s included:

-

Biographies of founders and key developers.

-

Experience in blockchain and finance.

-

Partners and supporting funds.

Example:

“Our team is led by [First Name Last Name], a former Google developer with 10 years of blockchain development experience.”

8. Legal & Compliance

Explains the legal aspects of the project.

Which includes:

-

Jurisdiction of incorporation.

-

Compliance with regulatory requirements (KYC/AML).

-

Description of investment risks.

Example:

“The token is not a security and is not subject to SEC regulation.”

9. Contact & Resources

A final section with useful links.

What is included:

-

Official website.

-

Whitepaper PDF version.

-

GitHub and technical documentation.

-

Social networks and community (Telegram, Discord, Twitter).

What’s worth paying attention to?

Tokenomics

Tokenomics is one of the most important aspects of Whitepaper. It includes:

-

The total volume of tokens issued.

-

The distribution system (to developers, investors, users).

-

Conditions of inflation or deflation.

-

Ways to utilize the token in the project ecosystem.

Roadmap

The project development plan should be clear and realistic. It is important to look at:

-

Whether there are specific deadlines for milestones.

-

Whether previous milestones have been realized on time.

-

How ambitious and achievable the goals are.

References to other projects

Some projects reference competitors or are inspired by other people’s solutions. This can be a plus if proven technologies are borrowed, but it can also indicate a lack of originality.

Partners

Having known partners increases the credibility of the project. If Whitepaper declares cooperation with large companies or funds, it is worth checking the reliability of this information.

Conclusion

Whitepaper is a fundamental document of any cryptoproject, and neither the project team and partners nor a competent user can do without it. When studying the Whitepaper, it is important to pay attention to tokenomics, roadmap, partners and technical implementation. However, even the most competently drafted document does not guarantee the success of the project, so it is always worth analyzing it thoroughly before investing.

FAQ

1. What should be in the Whitepaper?

Whitepaper should include: problem description, technical solutions, tokenomics, team information, roadmap, partners and market analytics.

2. How does the Whitepaper affect credibility?

The more detailed and transparent the project is presented, the higher the level of trust among investors and the community. A well-structured Whitepaper demonstrates the professionalism of the team.

3. What is a Whitepaper for?

Whitepaper helps investors and users to understand the goals, technology and prospects of a project and whether it is worth investing in it.

4. How often is the Whitepaper updated?

The frequency of updates depends on the development of the project. It is usually adjusted when there are changes in technology, strategy or tokenomics structure.

5. What should I pay attention to when reviewing the Whitepaper?

It is important to analyze: the realism of the goals, the economic model of the token, the competence of the team, the correspondence of the declared partners to reality and the existence of a clear development plan.