Best Crypto Trading Strategies

Cryptocurrency trading attracts many people due to its high volatility and potentially high returns. However, in order to succeed, it is important to use a structured approach based on a well-developed strategy. This article will explain the best trading strategies that can be applied in crypto trading and how to choose the right one.

Trading strategy - what it is

A trading strategy is a certain list of trading rules and principles that a trader should adhere to when making transactions with various trading instruments. It includes specific criteria for entering and exiting trades, risk management and capital allocation. A properly developed strategy helps a trader to minimize emotional factors influencing trading decisions and to follow logic and market analysis.

What a trading strategy consists of

Every trading strategy includes key elements:

1. Goal setting

Before you start trading, it is important to set clear goals:

-

How much profit do you want to make?

-

What level of risk is acceptable to you?

-

Do you plan to trade short-term or long-term?

2. Analyze the market

A trading strategy should be based on market analysis. There are two main approaches:

-

Fundamental analysis: Studying external factors such as economic events, news, regulations and demand for cryptocurrency.

-

Technical Analysis: Analysis performed using price charts, trading volumes and indicators to predict market movements.

3. Entry and Exit Criteria

Traders need to determine in advance under what conditions they will open and close trades. This helps to avoid making decisions based on emotions.

4. Risk management

Effective risk management is the basis for profitable trading. It includes:

-

Setting automatic stop loss and take profit limits in trades to limit losses and lock in profits.

-

Determining trade size: Never risk all of your capital in a trade.

-

Diversification: Invest in different assets to reduce the impact of losses on one asset.

5. Timeframes

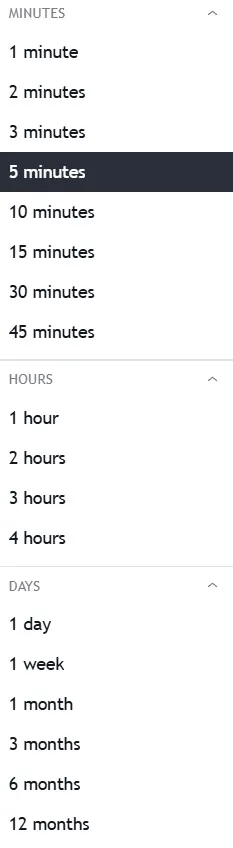

The strategy should specify timeframes for analyzing and trading:

-

Short-term: from a few minutes to an hour (suitable for scalping and day trading).

-

Medium-term: from a few days to weeks (swing trading).

-

Long-term: months to several years (holding).

6. Tools and indicators

The use of technical analysis tools helps the trader to analyze before entering a trade.

7. Control and monitoring

A strategy should include regular monitoring of the market and your positions. This is important to respond quickly to changes in market conditions.

8. Feedback and optimization

After each trade or series of trades, a trader should analyze:

-

What worked and what didn’t?

-

What mistakes were made?

-

Can the strategy be improved?

9. Psychological preparation

Emotions such as fear and greed often cause losses. A successful strategy takes this factor into account and helps the trader maintain discipline. For example, following predetermined entry and exit rules prevents impulsive decisions.

10. Adaptability of the strategy

The cryptocurrency market is constantly changing, so a strategy should be flexible and subject to regular adjustments. It is important to take into account new trends, laws and economic factors.

Types of trading strategies

Trading strategies can be divided into two main categories: active and passive.

Types of trading strategies

Trading strategies can be divided into two main categories: active and passive.

Active trading strategies

Active strategies involve constant analysis and decision making in the market. They involve a higher level of involvement and are suitable for experienced traders.

1. Day trading

Day trading is based on executing trades within one trading day and excludes carrying trades to the next day.

Advantages:

-

Minimization of risks associated with overnight price fluctuations.

-

Possibility to use short-term trends.

Disadvantages:

-

Requires constant presence at the monitor.

-

High transaction costs.

Key aspects: Use of indicators (RSI, MACD), volume and news background analysis.

2. Swing trading

Swing trading involves making trades and staying in them for long periods (several days to weeks) to capitalize on short-term price fluctuations.

Advantages:

-

Suitable for traders who don’t have time for constant monitoring.

-

Utilization of more consistent trends.

Disadvantages:

- Risk of unpredictable events while holding a position.

Key aspects: Technical analysis, support and resistance levels.

3. Trend trading

Trend trading is based on identifying the current market direction (uptrend, downtrend or sideways trend) and opening positions in its direction.

Advantages:

-

Easy to implement.

-

High probability of successful trades at strong trends.

Disadvantages:

- Losses at sharp trend reversals.

Key aspects: Use of moving averages, channels and trend lines.

4. Scalping

Scalping involves making small profits through many quick intraday trades.

Advantages:

-

Fast profits.

-

Independence from long-term market movements.

Disadvantages:

-

High workload and stress.

-

High commission values.

Key aspects: High liquidity of assets, minimal spreads.

5. Volume Weighted Average Price (VWAP)

The VWAP strategy uses the weighted average price of an asset for a certain period, taking into account the volume of transactions.

Advantages:

-

Accuracy in identifying a favorable price.

-

Suitable for large trading volumes.

Disadvantages:

- Requires in-depth volume analysis.

Key Aspects: It is used on highly liquid assets.

6. Spread trading

Spread trading is trading the difference between the prices of two related assets.

Advantages:

-

Reduction of risk in hedging.

-

Possibility of using correlation.

Disadvantages:

-

Limited profits.

-

Requires in-depth knowledge of assets.

Key aspects: Use of fundamental analysis.

7. Pullback strategy

Pullback involves entering a trade on a price pullback before the trend continues.

Advantages:

-

High profit potential when the entry point is correctly identified.

-

Allows you to trade within the trend.

Disadvantages:

- Risk of false signals.

Key aspects: Use of support and resistance levels.

8. Buying in equal parts (averaging)

Averaging consists in buying an asset in equal parts at certain intervals regardless of its current price.

Advantages:

-

Reducing the impact of volatility.

-

Suitable for long-term investments.

Disadvantages:

- Risk of decline in the value of the asset.

Key aspects: Long-term approach, regular investments.

Passive investment strategies

Passive strategies focus on long-term asset retention and minimal involvement in the trading process.

1. Holding

Holding is the purchase of an asset for the purpose of holding it for the long term.

Advantages:

-

Simplicity of implementation.

-

No need for frequent monitoring.

Disadvantages:

- Risk of a significant drop in price.

Key Aspects: Selection of assets with high growth potential.

2. index investment

Index investing involves buying assets included in a specific cryptocurrency index.

Advantages:

-

Risk diversification.

-

Less dependence on the volatility of a single asset.

Disadvantages:

- Limited profit growth compared to individual assets.

Key Aspects: Choosing a reliable index.

How to choose a trading strategy

Choosing a trading strategy is one of the key steps towards successful trading. It depends on many factors, including your level of experience, financial goals, and attitude toward risk:

1. Assess your goals and time frame

Before choosing a strategy, it’s important to determine what you want to accomplish.

-

Short-term goals: If you want to make profits in a short period of time, choose active strategies such as day trading or scalping.

-

Long-term goals: For investors with a horizon of several years, passive strategies such as holding or index investing are appropriate.

2. Determine your level of experience

Your understanding of the market influences your choice of strategy.

-

Beginners: It is recommended to start with simple strategies such as averaging or holding as they are less risky and do not require in-depth knowledge.

-

Experienced traders: Can use complex strategies such as VWAP, spread trading or trend trading.

3. Assess your risk tolerance

Some strategies involve a high level of risk but have potentially large profits.

-

Low risk: Suitable for passive strategies, like index investing.

-

High risk: You may opt for scalping or day trading, provided you are prepared for significant capital fluctuations.

4. Analyze your available time

The amount of time you can devote to trading alone determines the choice of strategy.

-

Full-time: Active strategies such as day trading will require more time and attention.

-

Part-time: A swing trading strategy will allow you to analyze the market once every few days.

-

Minimum time: Holding or index investing is suitable for those who do not have a lot of time to be in the market.

5. Explore financial resources

Some strategies require more capital for effective implementation.

-

Limited budget: Averaging and holding require less investment.

-

Large capital: Scalping and spread trading allow you to operate effectively with large capital because they provide the ability to sustain costs.

6. Test strategies with backtests

Before applying a strategy in the real market, test it using Veles backtests. This will allow you to:

-

Understand how it works.

-

Evaluate the potential results.

-

Prepare for real trading without financial risks.

7. Take into account market conditions

Each strategy works better in certain market conditions:

-

Trending market: Trend trading, swing trading are suitable.

-

Side market: Scalping or spread trading strategies are suitable.

8. Diversify approaches

Do not limit yourself to one strategy. Combine them depending on the situation:

-

Use active strategies during periods of high volatility.

-

Use passive strategies for long-term investments.

9. Focus on your strengths

-

If you are good at analyzing data, choose strategies based on technical analysis.

-

If you have a better understanding of fundamentals, look for trend-following strategies.

10. Constantly analyze and improve

The market changes and even the best strategy can lose effectiveness.

-

Analyze your trading results regularly.

-

Modify your strategy depending on new market conditions.

Ways of strategy realization

To trade cryptocurrency, a trader needs not only to choose the right strategy, but also to implement it competently. This involves the use of modern tools, platforms and risk management methods. The main aspects are:

1. Choosing a trading platform

To implement a cryptocurrency strategy, you need to choose a suitable platform that will provide tools for analyzing and executing trades.

Major exchanges include Binance, Bybit, OKX, HTX, Gate. io and BingX.

-

Support a large selection of cryptocurrencies.

-

Provide a wide range of different tools for technical analysis.

-

Provide high liquidity in the markets.

Decentralized exchanges (DEX): Uniswap, PancakeSwap.

-

Suitable for early stage token trading.

-

They do not require verification, but have less liquidity.

2. Using trading bots

Automated solutions, such as Veles trading bots, provide highly efficient solutions for automated trading of multiple cryptocurrencies in the futures and spot markets according to their own set parameters and strategies or according to those already ready and proven in the market.

Advantages:

-

24/7 operation.

-

Minimization of the human factor.

-

Ability to customize any complex algorithms and strategies.

Example of use: In a scalping strategy, the bot automatically closes trades when the specified profit level is reached.

3. Manual trade management

Suitable for traders who prefer to control the market themselves.

Tools for analysis:

-

TradingView: A platform designed to analyze charts and apply indicators.

-

Cryptocurrency calculators: For calculating returns and commissions.

Approaches:

-

Day Trading: Monitoring charts throughout the day to quickly enter and exit positions.

-

Trend Trading: Using indicators, such as Moving Average or MACD, to determine the direction of price movement.

4. Using backtests

It is recommended to trade and learn the strategy using backtests before trading for real money.

Features:

-

Trading using virtual funds.

-

No financial risks.

-

Analyzing the effectiveness of the strategy in real market conditions.

5. Risk management

Realization of any strategy is impossible without a clear risk management system.

Risk management tools:

-

Stop Loss: Setting the level at which a trade will automatically close to minimize losses.

-

Take Profit: Fixing profit at a predetermined price.

-

Limit order entry: Entering the market only when a certain price level is reached.

Risk Management Rules:

-

Do not risk more than 1-2% of your deposit in a single trade.

-

Diversify your portfolio: Distribute your funds among several cryptocurrencies.

6. Adapt your strategy to market conditions

The cryptocurrency market is highly volatile, which requires flexibility.

News monitoring:

- Watch for updates on new laws, partnerships, or hacking attacks.

Regular strategy adjustments:

-

If volatility is rising, move to shorter-term strategies.

-

If price movements are stable, it is better to use trend trading.

7. Social and Copytrading Platforms

Beginners can implement a strategy by copying the trades of professionals.

Copytrading platforms:

- Binance and Bybit exchanges provide copytrading opportunities for users.

Benefit: Does not require extensive market knowledge or significant trading experience.

8. Use of analytics and signals

Platforms with trading signals help traders make decisions based on the data they receive from experts.

Example: For trend trading, a signal of rising bitcoin activity on major exchanges can be a trigger to open a position.

Conclusion

Cryptocurrency trading requires discipline and a well-designed strategy. Success is achieved by choosing the right strategy, managing risk and constantly analyzing the market. Use the

suggested approaches to create your own effective trading method.

FAQ

1. What does the term trading strategy mean?

It is a set of rules that help a trader make informed trading decisions when making trades

2. What strategies are suitable for beginners?

Passive strategies such as holding or averaging are suitable for beginners.

3. What should I choose: active or passive strategy?

It depends on your experience, time and risk tolerance.

4. What are the risks of engaging in active trading?

Increased volatility of cryptocurrencies, possible price manipulation and frequent mistakes due to emotional decisions.

5. Can trading be automated?

Yes, with the help of trading bots, such as those from Veles Finance, which offer full automation of the trading process.