Bybit Crypto Listings: New Coins and Trading Opportunities

Cryptocurrency exchange Bybit is one of the most popular platforms for trading cryptocurrencies. It regularly expands its list of available instruments by adding new tokens, many of which are exclusive and go public for the first time on this particular exchange. This process, known as listing, becomes the beginning of life for most token projects.

What is listing - in simple words

Cryptocurrency listing is the process of adding a new asset to the trading platform. After a successful listing, exchange users are able to buy, sell and exchange the new cryptocurrency. This is an important stage for the project, as availability on a major exchange increases investor confidence and promotes liquidity.

How to find new listings on ByBit

To track new listings on Bybit, you can use several methods:

-

Official website and blog - the news section on the platform is regularly updated with information about new coins.

-

Social networks and forums - Twitter, Telegram and other resources often publish announcements of future listings.

-

Bybit Launchpad section - a platform for initial placement of new tokens.

-

The “Bybit Launchpool” section - a platform to provide liquidity for tokens that will produce listings.

-

Monitoring major announcements - keep up with press releases from individual projects and updates in the cryptocurrency industry.

Listing coins on ByBit - selection criteria

Listing coins on the Bybit exchange involves a careful selection of projects based on a number of key criteria:

-

Business model and project goals: The potential of the cryptocurrency and its usefulness to traders are evaluated.

-

Technical characteristics: The speed, scalability and reliability of the project’s blockchain network are analyzed.

-

Capitalization and trading volume: Market capitalization and trading volumes on other exchanges are taken into account to assess the popularity and interest of traders.

-

Security: The level of protection of the token against fraud and cyberattacks is checked.

-

Regulatory Compliance: The project must comply with local and international rules and regulations.

Bybit has also implemented strict delisting protocols and conducts regular audits of projects to ensure compliance and maintain user security. To simplify the listing application process, Bybit has introduced a new application form for projects seeking listing on the spot market from June 24, 2024.

In this way, the exchange aims to create a safe and transparent platform by carefully selecting projects for listing based on the aforementioned criteria.

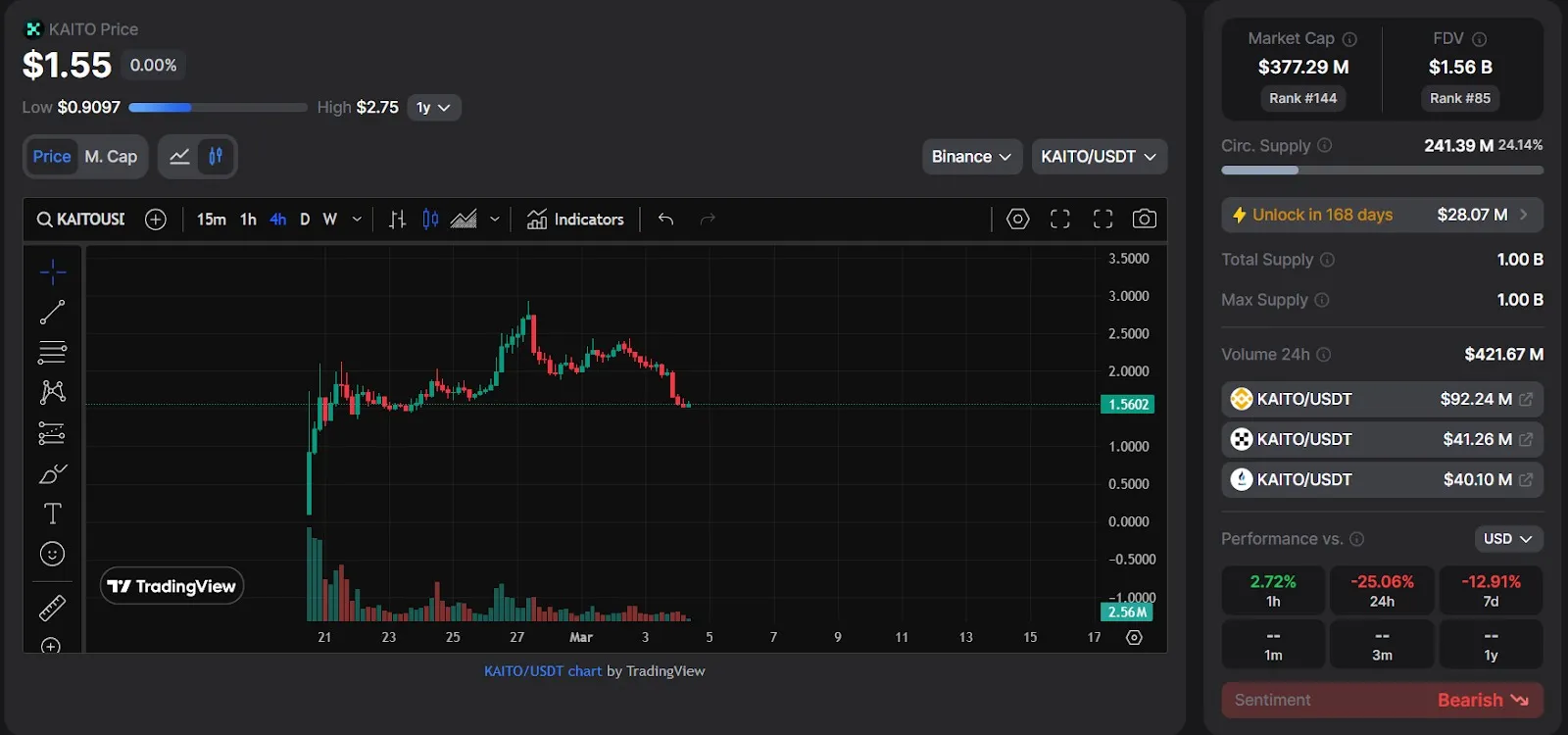

KAITO

KAITO is a cryptocurrency related to artificial intelligence technologies in the blockchain industry. Its addition on ByBit is due to the high prospect of AI industry, active community support and recent token airdrop.

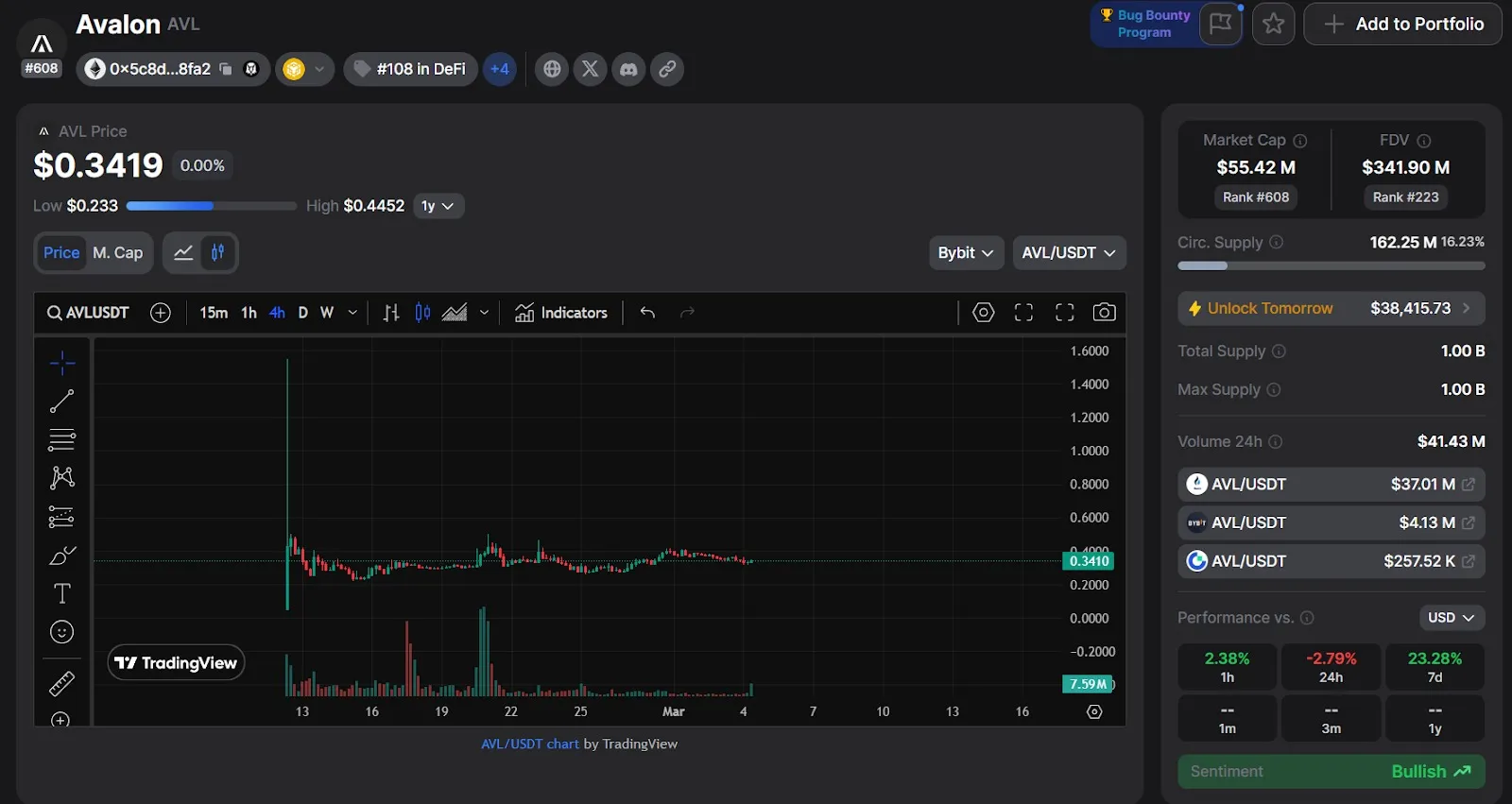

AVL

AVL is a token focused on solutions for decentralized finance (DeFi). ByBit chose it because of its high transaction speed and active adoption in the financial sector.

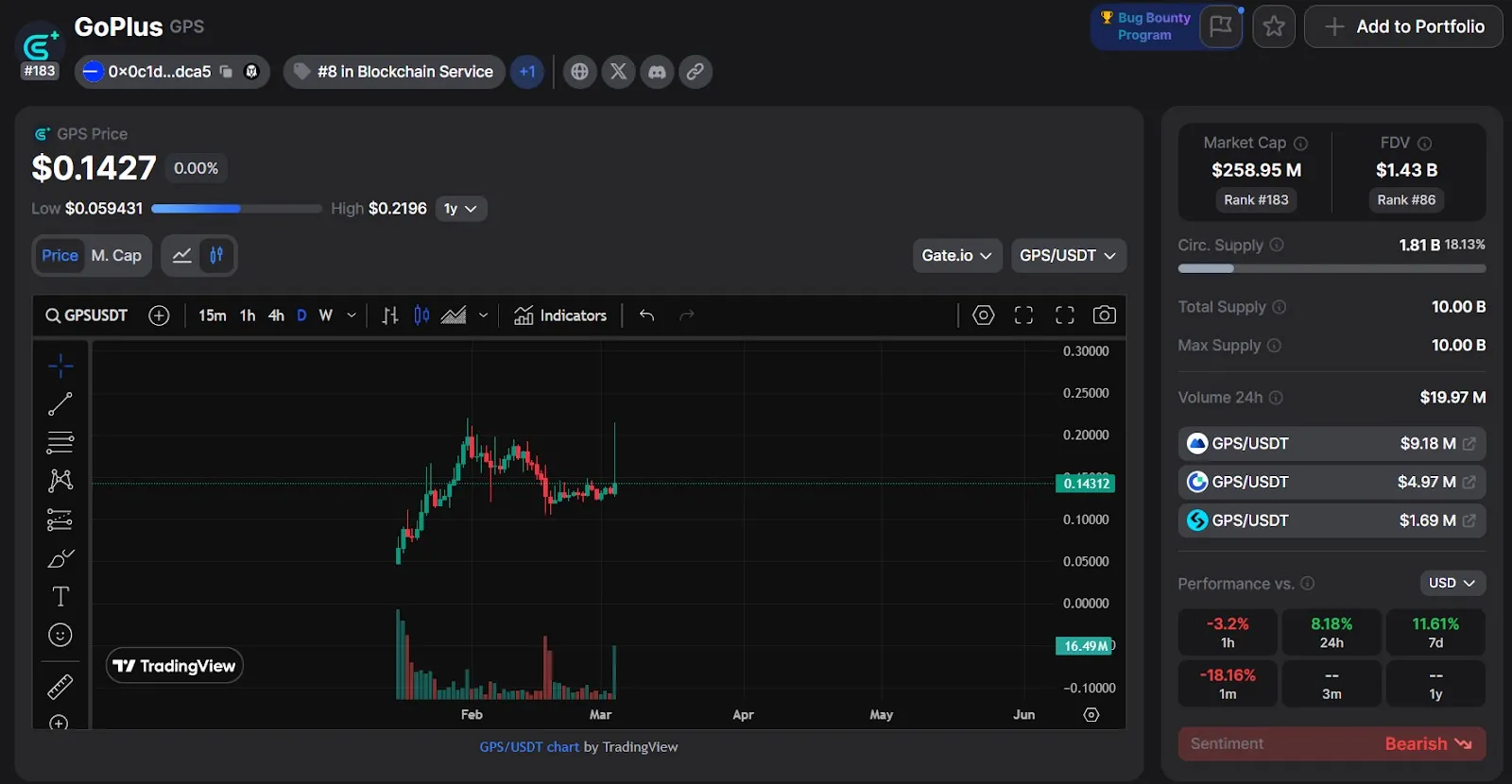

GPS

GPS is the first decentralized security layer of Web3. The project’s technologies are widely used in the world of cryptocurrencies, so Bybit could not ignore this project.

Crypto listing on Baybit - market impact

1. Impact on token price and liquidity:

-

Price increase: Often after listing on a major exchange such as Bybit, there is a significant increase in the price of the token. This is due to the increased availability of the asset to a wide audience of investors and traders. For example, after listing on Upbit, the MNT token saw a 64.24% increase.

-

Increased liquidity: Listing on Bybit increases the liquidity of the token, providing more opportunities for trading and attracting institutional investors.

2. Impact on market trends and perception:

-

Recognition and trust: Listing on a reputable exchange such as Bybit can increase the credibility of a project, signaling its reliability and potential.

-

Impact on related projects: A successful listing and subsequent price increase can stimulate interest in similar projects or tokens in the same industry.

3. Impact on investor strategy:

-

Analyzing listings: Investors can use information about upcoming listings on Bybit to make investment decisions, expecting a price increase after listing.

-

Portfolio diversification: Listing of new tokens provides investors with more opportunities to diversify and participate in promising projects.

4. Impact on overall market dynamics:

-

Increased activity: New listings on Bybit can draw attention to specific market sectors, increasing overall trading activity and volumes.

-

Trend formation: Successful listings can establish new trends, influencing market directions and investor preferences.

Thus, listing a cryptocurrency on Bybit has a multifaceted impact on the market, contributing to the price and liquidity of the token, shaping market trends and influencing investor strategies.

Listing and delisting system

Bybit Exchange has implemented an updated cryptocurrency listing and delisting system aimed at increasing transparency and security for users.

Listing Process:

-

Pre-market mechanism: Bybit has introduced a pre-market system to prevent market manipulation and ensure an orderly trading environment.

-

Ongoing monitoring: The exchange regularly audits projects to ensure that they meet the set requirements and standards.

Delisting Process:

-

Delisting Criteria: Bybit may delist a token or trading pair for reasons including, but not limited to:

-

Extraordinary market conditions.

-

Risks to users.

-

Hardforks or changes to the structure of the token.

-

Poor development quality or project termination.

-

Fraudulent activities that mislead users or the exchange.

-

-

User notification: When a delisting decision is made, Bybit notifies users in advance via email and in-app notifications, recommending appropriate action.

-

Post-Delisting Procedure: Deposits and withdrawals of a given token may be suspended after the token is removed from the listing. Users are given time to withdraw funds before the token transactions are finally halted.

Thus, the updated listing and delisting system on Bybit aims to create a safer and more transparent trading environment, protecting users’ interests and maintaining the platform’s high standards.

Conclusion

The listing of cryptocurrencies on Bybit directly affects the price of the asset and investors. Due to the exchange’s careful selection of coins, security and high liquidity is ensured for users and the project going forward. New assets get a wide audience, and traders get the opportunity to work with promising projects. You can follow new listings through ByBit’s official sources so that you don’t miss out on profitable opportunities.

FAQ

1. What is a cryptocurrency listing on the ByBit exchange?

Listing is the process of adding a new cryptocurrency to the list of traded assets on the ByBit platform.

2. How can I find out about new listings on ByBit in advance?

You can follow the official website, social media, the exchange’s blog and Bybit Launchpad section, as well as subscribe to newsletters.

3. What criteria does ByBit use to select coins for listing?

The exchange evaluates a project’s technological reliability, liquidity, team competence, community support, and legal transparency.

4. How does listing on ByBit differ from other crypto exchanges?

ByBit offers a strict selection of assets, a reliable security system and a high level of liquidity, as well as the opportunity to participate in Launchpad.

5. How does listing on ByBit affect the price and trading volume of cryptocurrency?

After listing, the price of an asset often increases due to increased demand, and trading volumes increase dramatically due to the influx of new traders.