What is a Launchpad in simple words

Crypto Launchpad is a platform for launching new cryptocurrency projects that helps developers raise funding and users invest early in promising coins before they go public on exchanges. Simply put, Launchpad is a launchpad where early token sales take place. Here, investors get a chance to buy coins before listing at a lower price, expecting the value to increase after the project goes to market. To understand what a lunchepad in cryptocurrency is, you can think of it as analogous to an initial public offering (IPO), but in a decentralized environment.

How a Launchpad works

To understand how a lunchepad in cryptocurrency works, it is important to envision it as a technology and investment platform where the interests of blockchain project developers and early investors intersect.

- Project selection

- Announcing terms of participation

- Participant registration

- Token listing

Launchpad’s work begins with project selection. The platform checks it for reliability, analyzes the whitepaper, checks the team, goals, tokenomics, and legal purity. This is a kind of filter that not all startups go through. Once approved, the project is put on the list of upcoming launches.

Next comes the announcement of the date of the Launchpad and the terms of participation. These conditions include the price of the token, the total number of coins that will be available for sale and technical requirements for the user. Most often, KYC - identity verification - is required to meet the requirements of regulators. In addition, some platforms require holding or steaking native tokens, such as BNB for Binance Launchpad or POLS for Polkastarter.

In the next step, the registration of participants begins. Usually users apply for participation, fixing their interest. Sometimes a lottery is involved - allocating slots to all participants randomly. More modern platforms use a tier system, where the more tokens you hold, the higher your tier and the greater your chance of getting allocation. On launch day, the allocation begins. Participants either receive tokens immediately or with a vesting period (gradual unlocking). This is done to avoid high volatility when the token goes public. Some platforms also implement mechanisms to protect against draining/manipulation, such as a limit on the number of coins that can be sold in the first few days.

Finally, listing occurs - the moment when the token appears on a public exchange and becomes available for trading. This is where most traders show interest, and often the price rises sharply. This is why investors are so eager to participate in lunchepads - they get a chance to buy the coin at a lower price before the mass demand starts.

Why do you need lunchepads

Some may ask: Why do you need a lunchepad? And it is needed to connect startups and investors, as well as to realize a number of important functions.

First of all, a lunchepad in cryptocurrency solves the main problem of any startup - access to an audience and liquidity. For the project team, Launchpad becomes a kind of showcase, which is immediately looked at by tens or even hundreds of thousands of potential investors. Placement on a proven platform (such as Binance Launchpad, DAO Maker, Polkastarter and others) serves as a kind of trust seal. It means that the project has been audited, technical documentation verified, team analyzed, and legally compliant. For young teams, it’s a chance not just to raise money, but to do it quickly and with a global reach.

For investors, a lunchepad is an opportunity to get access to tokens at a very early stage, even before they go public. And we are not talking about small discounts here, but about real chances to buy an asset at a price ten times lower than what will be on the exchange after listing. Many curious cryptans sooner or later ask themselves the question: Where do they buy coins before listing? So that’s the answer - on the lunchepads.

Lunchpads also serve the function of filtering and analyzing. In the world of crypto, where hundreds of tokens appear every day, it’s hard to know which ones are worth paying attention to. Platforms offering lunchepad services take on some of this analytical work, screening out fraudulent or technically weak projects. As a result, users get a higher quality of selected startups.

The network marketing effect is no less important. Projects launched via Launchpad receive not only funds, but also the support of a community ready to share, discuss, and promote the token in social networks. This is especially important for projects that build their economics based on tokens that depend on user activity.

You also need to understand the difference between launching and listing a cryptocurrency. Launching is when a project first offers its tokens to users via a lunchepad, while listing is the subsequent placement of the token on an exchange where it becomes freely tradable. The lunchepad is thus the first step where interest is created, the price is formed and the initial distribution takes place. In 2025, against the backdrop of an increasingly mature crypto market, lunchespads fulfill another important function: control. Participants don’t just invest, they go through KYC, study the whitepaper, monitor the vesting and technical conditions, thus inadvertently making the market less chaotic and reducing the risk of scam.

Examples of popular Launchpads

In the cryptocurrency market by 2025, a group of reliable and reputable platforms has formed, which have earned the trust of both projects and investors. These crypto platforms not only give the opportunity to buy tokens at the earliest stage, but also provide auditing of projects, protect users and create high competition among startups. Let’s take a closer look at the most popular and recognizable lunchepads.

Binance Launchpad

One of the most recognizable and influential launchpads in the world. Binance Launchpad operates inside the largest crypto exchange Binance and provides access to exclusive tokensales. Due to its huge user base and strict selection procedure, projects hosted on this platform have a high degree of trust. To participate, you need to hold BNB tokens for a certain period before launching. Binance provides automatic token allocation proportional to the number of BNB tokens held on the participant’s balance. Examples of well-known projects launched here are Axie Infinity (AXS), Stepn (GMT), Polygon (MATIC).

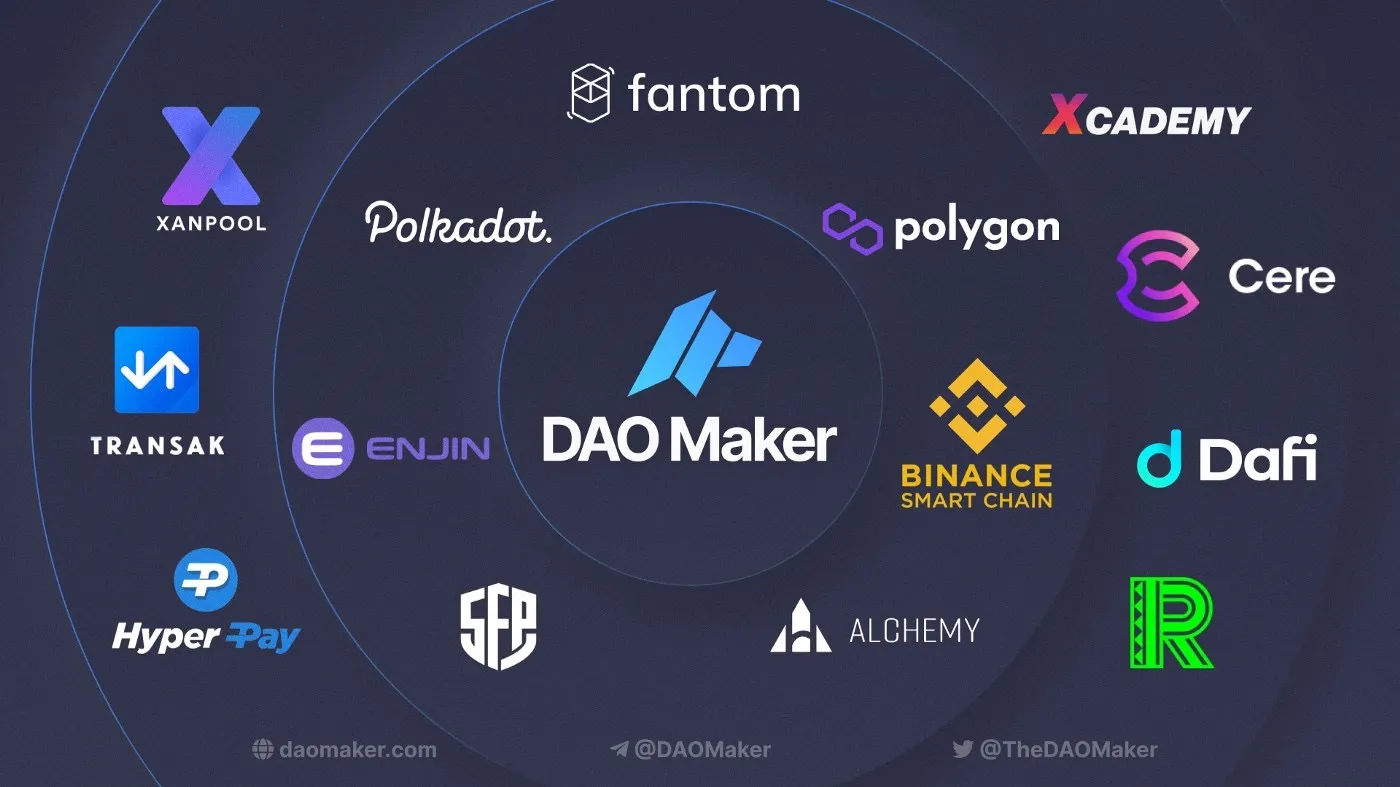

DAO Maker

One of the most respected decentralized lunchepads focused on long-term community and sustainable projects. DAO Maker is popular due to its SHO (Strong Holder Offering) format, where participation goes to those who steadily hold tokens rather than those who simply invest. In order to participate, you need to steak DAO tokens. The platform has a tier system where the more DAOs you have, the higher the chance of getting access to the sale. DAO Maker features detailed project analysis, transparency, and frequent vesting, which reduces post-listing volatility.

Polkastarter

Polkastarter specializes in multi-blockchain projects and offers users a user-friendly interface and teams flexible startup terms. It has become particularly popular in the heyday of DeFi and GameFi. Here, POLS tokens are also required to participate, which can be held in a wallet or staked. The platform conducts token distribution through a whitelisting form, where selected users receive allocations. Examples of successful projects include SuperFarm, Ethernity Chain, and Chain Guardians.

TrustPad

This platform offers a decentralized lunchepad with high security and a convenient level system. TrustPad supports multiple networks: BNB Chain, Ethereum, Solana, Avalanche, and others. Participation also requires the purchase and holding of TPAD tokens. The platform emphasizes transparency and qualitative verification of startups, as well as convenient integration with wallets and user interface. It is characterized by a democratic distribution system, accessible even to small investors.

GameFi Launchpad

A specialized lunchepad for gaming blockchain projects that gained notoriety amidst the rapid growth of GameFi and Metaverse. GameFi enables early stage investment in gaming tokens, NFTs and virtual assets. To participate, you must pass KYC and use GAFI tokens. The platform offers a tier system, depending on the number of tokens held by the user. Game projects launched here often provide additional bonuses - access to closed alpha testing or exclusive NFTs. Well-known projects include Sidus Heroes, CryptoBlades Kingdoms, and Kryptomon.

Each of these platforms has its own peculiarities, distribution approach, level system and requirements. But one thing they have in common is that they are the place to buy coins before they are listed, providing access to crypto assets before they go public on exchanges. That’s why they are the foundation in early investing and the formation of new crypto market leaders. You should orient yourself when choosing a lunchepad not only on the rating of lunchepads, but also on the investor’s goals, capital size and preferences in the types of projects.

How to Participate in a Launchpad

Despite its apparent simplicity, participation in a Launchpad requires attention to detail and compliance with certain conditions. Let’s understand step-by-step:

- Selecting a platform

- Registering on the platform

- Fulfilling the conditions of the Launchpad

- Registering in the project Launchpad

- Waiting for results

First of all, you need to choose the right platform. There are many 2025 Launchpads and each of them has its own rules. Binance Launchpad, Bybit Launchpad, DAO Maker, Polkastarter, TrustPad - all of them differ in requirements for participants, format of token distribution and type of projects. When choosing one, you should be guided by the rating of launchpads, as well as the history of successful launches and the reputation of the platform itself.

The next step is registration on the platform. This step involves creating an account and going through the KYC (Know Your Customer) procedure, i.e. confirming your identity. This is a prerequisite for almost all major lunchepads, especially if the platform is centralized. Identity verification is necessary to prevent multi-accounts and to comply with legal requirements in different countries.

After verification, the technical conditions for participation must be met. Typically, lunchepads require staking or holding native tokens of the platform. Such a condition is necessary in order to create a minimum entry threshold and protect the platform from speculative users. The more tokens a user has, the higher his access level and the higher the chance of getting allocation.

When the preparatory phase of a particular IDO or IEO starts, it is necessary to register for participation in the project. The platform announces the start date, token price, available volume and purchase currency (e.g. USDT, ETH or BUSD) in advance. Registration can be open or on a first-come-first-served basis, and sometimes in a lottery format, where the distribution of slots, as we said earlier, depends on the level of the user.

At the moment of the start, the fixation or debiting of funds from the balance and the distribution of tokens takes place. Some platforms allow you to get tokens into your wallet immediately, while others apply the concept of vesting. This prevents sharp price collapses and creates conditions for a more stable growth of the project. Vesting terms are always prescribed in advance, so it is worth studying them before participating.

Lunchpads in 2025

Against the backdrop of a rapidly developing crypto market, crypto lunches in 2025 have become an integral part of early investment strategies. More and more projects are opting for decentralized launches, using IDO (Initial DEX Offering) and IEO (Initial Exchange Offering) as a form of capital raising. Competition among platforms is growing and requirements for participants are becoming more transparent. Investors are increasingly focusing on the rating of lunchepads, assessing the reliability and profitability of past launches. Launchpads have long ago transformed into ecosystems where not only profit is important, but also the long-term sustainability of the project.

FAQ

What is a cryptocurrency lunchepad?

It is an initial token offering platform where investors can participate in early sales of crypto projects before listing.

Why do you need a lunchepad?

To kick-start a project and give investors access to tokens at a favorable price at an early stage.

Is a lunchepad in crypto safe?

Safety depends on the reputation of the platform. Major platforms like Binance or DAO Maker audit projects.

What is the difference between launching and listing a cryptocurrency?

Launching is placing a token through a Launchpad, while listing is adding it to exchanges for trading.

Where do people buy coins before listing?

On lunchepads, where token sales take place before they are released to the open market.