Crypto Bull Run: What Is It and When to Expect the Next Bull Run in 2025?

In the world of finance and investment, the term “Bull Run” refers to a steady rise in asset prices, in this case, cryptocurrencies. The term comes from the English “bull” (bull), which symbolizes an assertive and powerful market growth. Historically, the concept of bull market originated in traditional stock exchanges and moved into the crypto industry with the emergence of bitcoin. The first significant bullruns in cryptocurrencies occurred in 2013, 2017, and 2021, when the value of bitcoin and altcoins reached new all-time highs.

Bullrun - what is it?

Bullrun (Bull Run) is a period during which the cryptocurrency market shows a prolonged increase in prices. During this period, investors actively buy up digital assets, which further pushes the value of coins upward. Bullrun is accompanied by increased media attention, growth in the number of new participants and increased liquidity in the market.

Bull Run 2025: forecasts and expectations of experts

Many analysts predict that 2025 could be the year of another bull run. The main factors contributing to the bull run are:

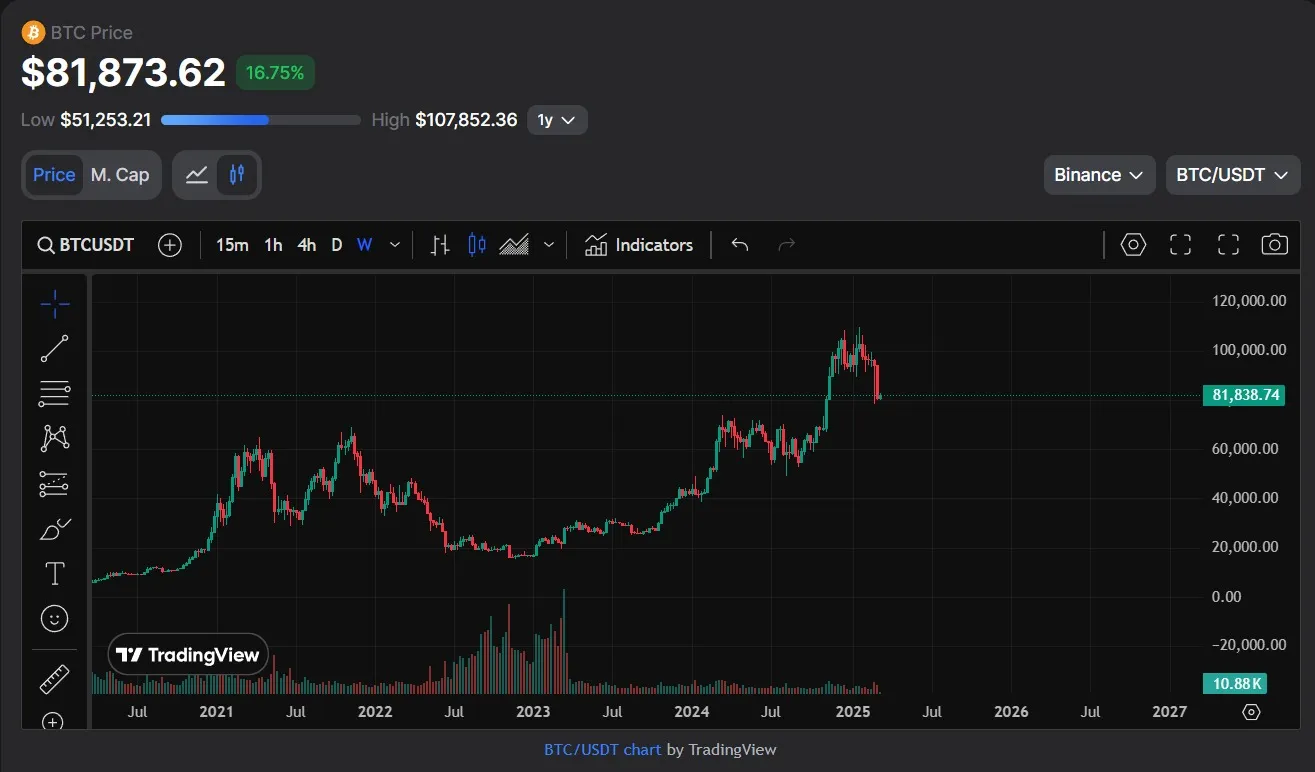

1. Bitcoin price growth

Analysts are predicting that the bitcoin price could reach new all-time highs. Predictions vary, but many expect the bitcoin price to exceed $100,000, with some predicting a rise to $200,000 or higher.

2. Institutional acceptance and adoption

Large financial institutions and corporations are expected to continue to adopt cryptocurrencies into their business models. Possible announcements of strategic bitcoin reserves from G7 or BRICS countries are possible, highlighting the recognition of bitcoin as an asset to preserve value.

3. Altcoin development

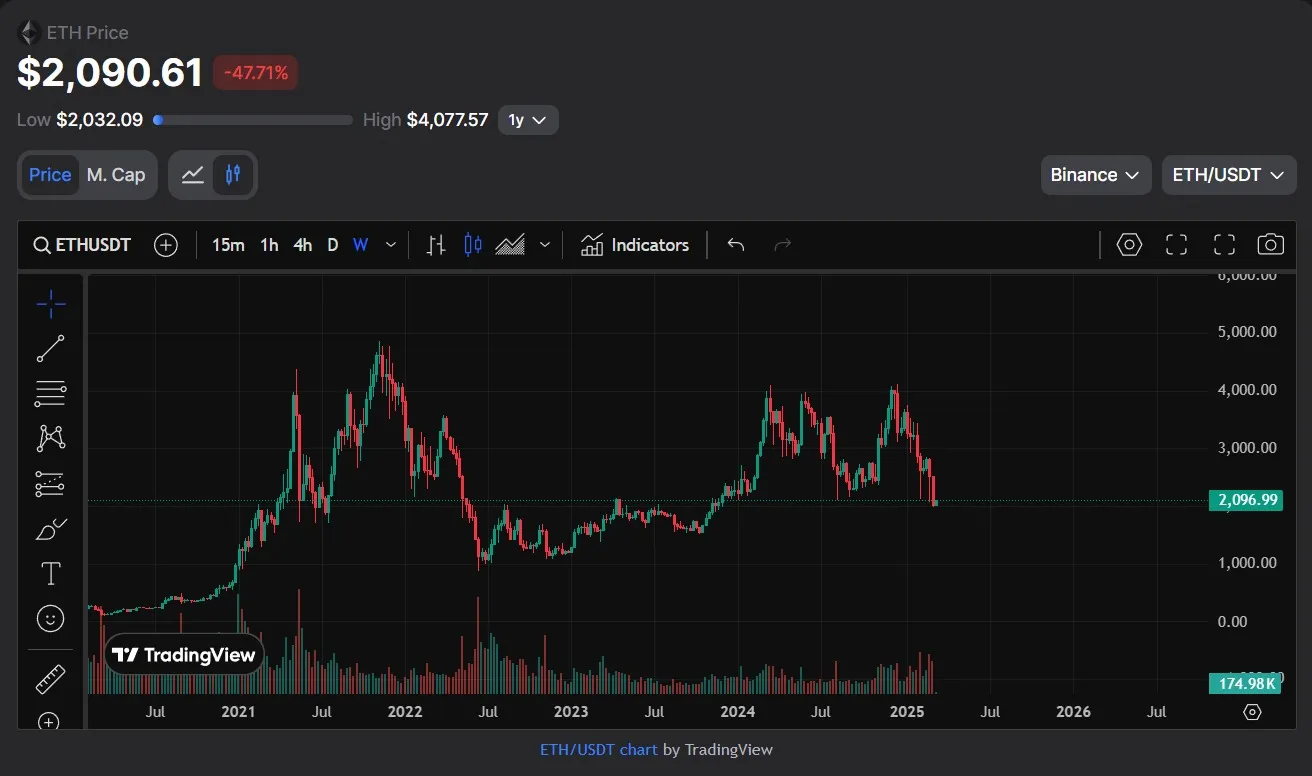

Alternative cryptocurrencies (altcoins) may also show significant growth. Projects such as Solana (SOL), Ethereum (ETH), Ripple (XRP) are expected to attract the attention of investors due to their technological innovations and ecosystem expansion.

4. Innovation and technological advancements

Advancements in technologies such as decentralized finance (DeFi), non-fungible tokens (NFT), and integration of artificial intelligence (AI) in blockchain will create new growth opportunities for the cryptocurrency market. These innovations can attract new users and investors, further contributing to the expansion of the market.

5. Regulatory clarity and support

Governments and regulators are expected to provide clearer rules and guidelines for the cryptocurrency industry, which may increase investor confidence and promote mass adoption of digital assets.

6. Potential corrections and volatility

Despite the optimistic outlook, experts warn of potential corrections and continued market volatility. Investors are advised to be cautious and consider the risks associated with investing in cryptocurrencies.

Overall, forecasts for 2025 point to continued growth and development of the cryptocurrency market, supported by technological innovation, institutional adoption, and increased application of blockchain technology in various industries.

Signs of the beginning of a bullrun in cryptocurrency

The main indicators of the beginning of a bullish trend include:

1. Increased institutional investment

When large companies, hedge funds and banks begin to actively invest in cryptocurrencies, it indicates growing interest and recognition of digital assets as a promising asset class.

Examples of signs:

-

The emergence of news of bitcoin purchases by large corporations (e.g. Tesla or MicroStrategy).

-

The launch of exchange-traded funds (ETFs) focused on bitcoin or other cryptocurrencies.

2. Bitcoin (BTC) price growth

Bitcoin is traditionally an indicator of the general state of the crypto market. The start of its steady growth often signals the beginning of a bullrun.

Signs:

-

Bitcoin overcomes important resistance levels (e.g. $50,000, $100,000).

-

The price growth is accompanied by an increase in trading volumes.

-

Formation of a stable uptrend on the chart.

3. altcoin activation (Altcoin Season)

When bitcoin begins to stabilize at certain levels, investors switch their attention to altcoins. During this period, cryptocurrencies such as Ethereum (ETH), Solana (SOL), Cardano (ADA), and others experience massive growth.

Signs:

-

The growth of altcoin dominance (ETH/BTC, SOL/BTC show positive dynamics).

-

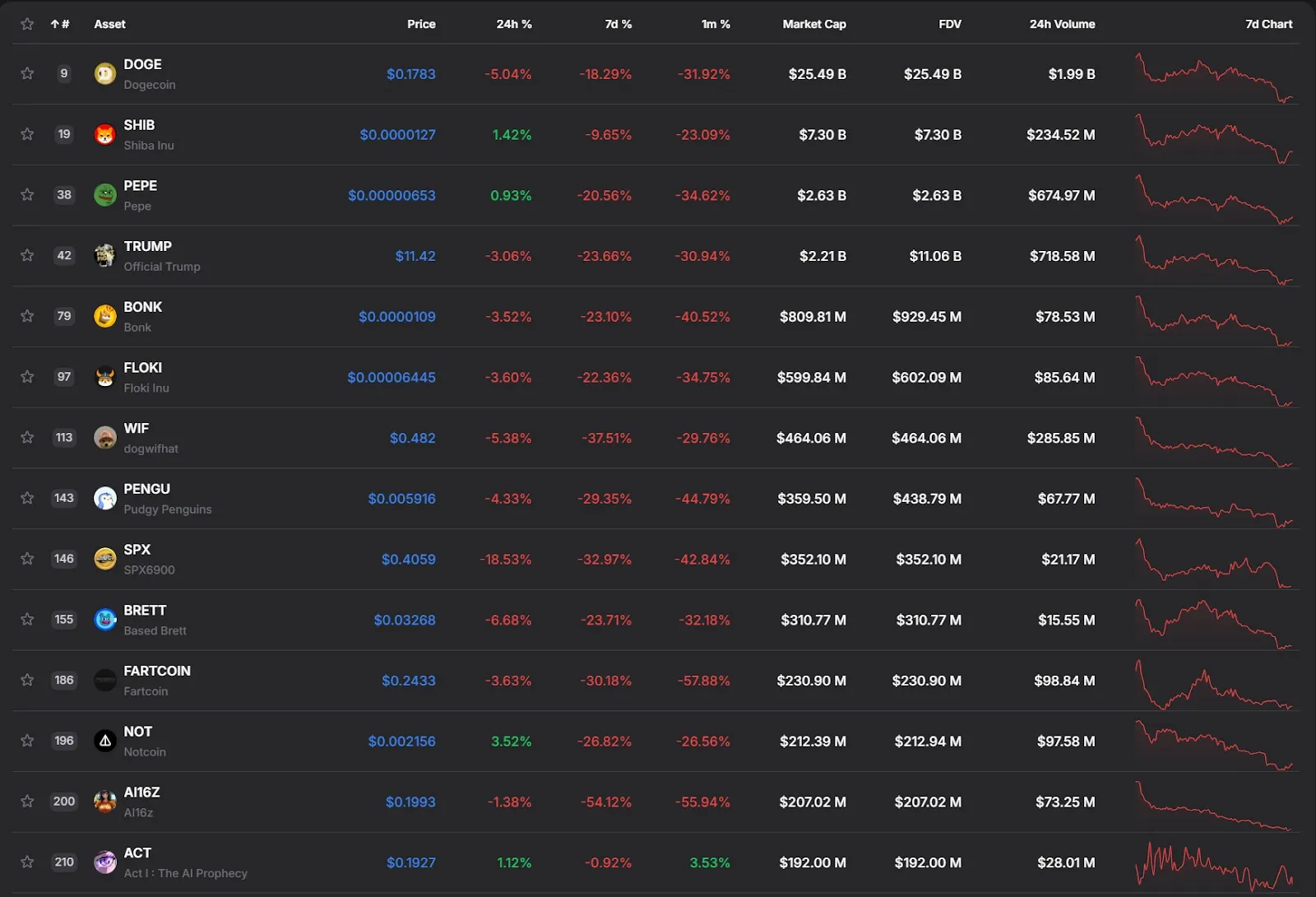

Growth of DeFi-tokens, NFT-platforms and meme-coins (DOGE, SHIB).

4. Increase in market capitalization

Overall crypto market capitalization is rising sharply as new investors and big players invest in cryptocurrency assets.

Signs:

-

A dramatic increase in total market capitalization (from $1 trillion to $3 trillion or higher).

-

Renewal of historical highs in the value of major cryptocurrencies.

5. Increased activity on crypto exchanges

Trading volumes on centralized (Binance, Bybit, OKX, HTX, Gate. io, BingX) and decentralized (Uniswap, PancakeSwap, StonFi) exchanges increase dramatically.

Signs:

-

Increase in daily trading volume.

-

Increase in new user registrations.

6. Mass interest in cryptocurrencies (FOMO)

When regular investors start actively buying cryptocurrencies due to fear of missing out on profits (FOMO - Fear of Missing Out), it often signals the beginning of a bullrun.

Signs:

-

Increase in search queries for “buy bitcoin”, “best cryptocurrencies to invest in”.

-

Increase in discussions on Reddit, Twitter, Telegram.

7. Favorable news background

When the media actively publishes positive news about cryptocurrencies, it can serve as a catalyst for a massive influx of investors.

Examples:

-

Bitcoin-ETF approval in the US.

-

Major integrations of blockchain technology in business.

-

Adoption of cryptocurrencies as a means of payment by large companies.

8. Regulatory improvements

Clarity from governments and regulators can spur investor interest.

Signs:

-

Enactment of positive laws on cryptocurrencies.

-

Simplification of taxation and regulations for cryptocurrency exchanges.

Impact of Bull Run on the cryptocurrency market

Positive effects:

-

Popularization of cryptocurrencies - attracting new users and increasing the number of crypto-asset holders.

-

Infrastructure development - growth in the number of crypto exchanges, DeFi protocols and new blockchain projects.

-

Institutional acceptance - acceptance of cryptocurrencies by traditional finance, increase in investor confidence.

Negative effects:

-

High volatility - sharp price spikes and corrections.

-

Bubble risk - growth of speculative assets and subsequent collapse.

-

Risk of fraud - appearance of scam projects and pyramid schemes.

Bitcoin’s role in shaping the bullrun

Bitcoin (BTC) is the main catalyst for the bull market (BullRun) in the crypto industry. Its dominant position, influence on other crypto assets, and connection to macroeconomic factors make BTC the centerpiece of every growth cycle.

Why Bitcoin is launching a BullRun:

1. Market Dominance

-

Bitcoin holds 40-60% of the total crypto market capitalization.

-

Its movement sets trends for other cryptocurrencies, especially altcoins.

-

Many investors view BTC as an indicator of the overall health of the market.

2. Bitcoin Halving and its impact

-

Halving is the process of halving the reward for a block on the Bitcoin network, which occurs every four years.

-

After a Halving, the supply of BTC decreases, which creates a shortage and leads to an increase in price.

-

Historically, each BullRun has started 6-12 months after a halving:

-

2012 - Halving → BullRun in 2013 (BTC from $12 to $1,100).

-

2016 - halving → BullRun in 2017 (BTC from $650 to $20,000).

-

2020 - halving → BullRun in 2021 (BTC from $8,000 to $69,000).

-

2024 - next halving (new growth expected).

3. Institutional investment inflows

- Bitcoin’s bull market is attracting large funds and corporations such as:

-

MicroStrategy (owns 190,000 BTC).

-

Tesla (invested $1.5 billion in 2021).

-

BlackRock (launching a BTC ETF in 2024).

- Institutional money creates additional demand and pushes the price up.

4. Bitcoin ETF launch and legalization

-

Bitcoin ETFs allow investors to buy BTC through the stock markets, which increases demand.

-

In 2024, the first Spot Bitcoin ETF in the US was approved, an important trigger for the new BullRun.

-

Legal recognition of BTC in different countries (El Salvador, Hong Kong, UAE) reduces risks and attracts new investors.

Macroeconomic factors

-

Devaluation of fiat currencies (inflation) makes BTC attractive as “digital gold”.

-

Banking crises (as in 2023 with Silicon Valley Bank) make investors look for safe assets.

-

Fed policies (low rates and money printing) are fueling the growth of speculative assets, including BTC.

Bitcoin’s impact on altcoins and DeFi:

1. The domino effect on altcoins

-

BullRun starts with BTC rising, but then capital flows into altcoins.

-

An indicator of the start of the “altseason” (Altseason) is when BTC’s dominance drops below 50%.

-

The strongest altcoins in BullRun are Ethereum (ETH), Solana (SOL), Ripple (XRP) and memcoins (DOGE, PEPE, SHIBA).

2. DeFi and Web3 development

-

The growth of BTC is leading to the development of decentralized finance (DeFi) and smart contracts.

-

Blockchains with DeFi applications (Ethereum, Binance Smart Chain, Arbitrum) are getting more liquidity.

-

New technologies are emerging (e.g. Bitcoin Ordinals - NFT in the BTC network).

Altcoins and their behavior during the Bull Run

The main stages of altcoin growth during BullRun are:

1. Initial stage - Bitcoin dominance

-

BullRun starts with the rise of Bitcoin as it is the first to attract institutional and retail investments.

-

At this point, altcoins grow slower and sometimes even decline relative to BTC.

-

Bitcoin’s dominance (BTC’s share of total market capitalization) grows and can reach 60-70%.

2. The middle stage - altseason (Altseason)

-

When BTC reaches new highs and stabilizes, some capital starts to flow into altcoins.

-

During this period, many altcoins show sharp price spikes, overtaking Bitcoin in terms of profitability.

-

The dominance of BTC begins to decline, falling below 50%.

-

New trends begin to form - DeFi, NFT, GameFi, Layer 2 solutions and others.

3. Late stage - market peak and overheating

-

Altcoins reach their peak values, some show 10x-100x growth.

-

Speculative projects, pumps and dumps start to appear.

-

Retail investors enter the market en masse, leading to excessive overheating.

-

After reaching the maximum, the market collapses sharply - the Bear Market begins.

Altcoin categories and their behavior during BullRun:

1. Ethereum (ETH) and Layer 1 blockchains

-

Ethereum (ETH) traditionally follows Bitcoin, but after BTC stabilizes, it starts to grow faster.

-

Layer 1 blockchains (Solana, Avalanche, BNB, Cardano) compete with Ethereum and are getting a lot of attention.

-

The high demand for their tokens is driven by the development of DeFi and NFT platforms.

-

Example: BullRun 2021 ETH went from $100 to $4,800, Solana went from $2 to $260.

2. DeFi tokens (Decentralized Finance)

-

Decentralized finance (Uniswap, Aave, Curve, MakerDAO) is becoming popular in the bull market.

-

Increased liquidity in DeFi protocols is driving up the prices of their native tokens.

-

Example: Uniswap (UNI) goes from $2 to $44 in 2021, Aave goes from $50 to $600.

3. NFT and GameFi tokens

-

GameFi tokens (Axie Infinity, The Sandbox, Decentraland) are showing massive growth.

-

The NFT boom is driving up the prices of platform tokens (Flow, Immutable X, Chiliz).

-

Example: Axie Infinity (AXS) went from $0.50 to $160 in 2021.

4. Layer 2 solutions and infrastructure projects

-

Layer 2 networks (Polygon, Arbitrum, Optimism) are getting attention due to lower fees and faster transactions.

-

Oracles (Chainlink), data warehouses (Filecoin, Arweave) and other infrastructure tokens are also on the rise.

5. Memcoins and HYIP projects.

-

Dogecoin, Shiba Inu and other memcoins are showing explosive growth due to the media effect.

-

Most of these tokens have no fundamental value, but speculation can bring high profits.

-

Example: Dogecoin went from $0.005 to $0.74 in 2021.

Conclusion

Bullrun is a time of a large number of omnichannel opportunities in the cryptocurrency market due to the influx of cash, and with it, widespread activity. However, it is important for investors, traders and speculators to keep in mind the possible risks, not to succumb to the hype and to act strictly according to their system, observing all the rules.

FAQ

1. How long does a bullrun usually last in the cryptocurrency market?

The duration of a bullrun varies, but on average lasts from a few months to two years.

2. What factors can trigger the start of a bullish trend?

The main factors are positive news, institutional product launches, increased cryptocurrency adoption and macroeconomic conditions.

3. How can you tell if the bullrun has ended and a bear market is beginning?

The main signs of the end of a bullrun are declining trading volumes, massive profit taking by investors and sharp price corrections.

4. Is it worth investing in cryptocurrencies during a bullrun?

Investing during a bull market can be profitable, but it is important to follow a risk management strategy and not invest at the highs.

5. What are the risks for investors during a bull market?

The main risks are high volatility, possible market manipulation, sudden corrections and capital losses if assets are not properly managed.