Crypto Listing: What It Is and How to Make Money from New Coins

One of the most anticipated events in the cryptocurrency market is the token listing. This procedure is important not only for the project team, airdroppers, but also for traders who have the listing trading as part of their trading system, as they know how to potentially make money on it.

Cryptocurrency listing - what it is

Cryptocurrency listing is the process of adding a digital asset to an exchange, allowing users to buy, sell and trade that coin. This stage is important for a crypto project because it increases its liquidity, recognizability and attracts new investors.

What are the stages of listing new cryptocurrencies?

The process of listing a cryptocurrency follows several key steps:

1. Preparatory stage

This stage includes developing a cryptocurrency project and preparing for the listing application.

1.1 Project and token development

-

Definition of the cryptocurrency concept (utility token, security token, etc.).

-

Development of tokenomics (economic model of the token).

-

Choosing a blockchain (Ethereum, BNB Chain, Solana, etc.) or creating your own.

-

Writing a smart contract (if the token works on a third-party blockchain).

-

Conducting security testing of the smart contract.

1.2 Formation of the team and roadmap

-

Creation and formalization of the project team.

-

Developing a roadmap for the project.

-

Engaging consultants and lawyers to work with exchanges.

1.3 Creation of documentation

-

Whitepaper (technical description of the project).

-

One-pager (brief token presentation).

-

Tokenomics (token distribution model).

-

Technical audit (e.g. from CertiK, Hacken, etc.).

-

Regulatory compliance (depending on jurisdiction).

2. Exchange selection

The choice of exchange depends on several factors:

-

Type of exchange: CEX ((Binance, Bybit, OKX, HTX, Gate. io, BingX) or DEX (Uniswap, PancakeSwap, SushiSwap, StonFi).

-

Cost of listing (on top CEXs can reach hundreds of thousands of dollars).

-

Reputation of the exchange and its trading volumes.

-

Requirements for projects.

Also taken into account:

-

Supported blockchains.

-

Need for marketing activity prior to listing.

-

Lunchpad or IDO/IEO capability on this platform.

3. Applying for listing

After selecting an exchange, it is necessary to apply for listing.

3.1 Filling out the exchange form

Most centralized exchanges have application forms (e.g. Binance Listing Application). They include:

-

Basic information about the project.

-

Information about the team.

-

Whitepaper and roadmap.

-

Legal status.

-

Community and marketing activity.

3.2 Negotiations with the exchange

If the exchange is interested, the negotiation process begins:

-

The exchange may request additional documents.

-

The project may be invited for an interview with the exchange team.

-

Listing conditions are discussed (paid or free, amount of liquidity, marketing).

4. Passing audits and inspections

Most exchanges require smart contract audits (for tokens on third-party blockchains) and regulatory compliance checks.

-

The exchange may require a report from an audit firm (CertiK, Quantstamp, etc.).

-

Tokenomics, token issuance and distribution mechanism are analyzed.

-

Verification of the project team for fraudulent activities.

-

Verification of trading volumes and activity in social networks.

5. Organization of the marketing campaign

Before listing, it is important to attract attention to the project:

-

Partnering with Influencers and Bloggers.

-

Conducting Airdrop and Bounty programs.

-

Creating an active community in Telegram, Twitter, Discord.

-

Placing announcements on CoinMarketCap, CoinGecko and other platforms.

-

AMA-sessions (Q&A) with exchange users.

6. Listing on the exchange

6.1 Listing of token and trading pairs

After approval and fulfillment of all conditions, the exchange adds the token to the list of available assets.

-

Trading pairs are selected (e.g. BTC, ETH, USDT, BNB).

-

Market makers (liquidity providers) are set up.

-

The date and time of trading start are determined.

6.2 Launch of trading and initial liquidity

-

On the listing day, the exchange opens deposits.

-

After some time, trading starts.

-

Sometimes in the first minutes/hours there are strong price fluctuations due to speculation.

7. Post-listing support

Listing is not the final stage, but just the beginning of the exchange.

7.1 Liquidity support

-

Connecting market makers (so that there are no sudden price jumps).

-

Holding trading contests.

7.2 Project updates

-

Regular news and updates for the community.

-

Development of the ecosystem (e.g. steaking, DeFi products).

-

Introduction of new functionality.

7.3 Listing on other exchanges

-

After success on the first exchange, listing on new exchanges can be considered.

-

The more exchanges, the higher the liquidity and popularity of the token.

What affects listing approval

Exchanges evaluate many factors when considering a listing application:

-

Technological innovativeness - the uniqueness and promise of the project.

-

Trading volume and liquidity - how active and in demand the token is.

-

Legal cleanliness - compliance with legal requirements.

-

Team reputation - experience of developers and their previous projects.

-

Community and support - the presence of active users and interest in the coin.

Cost of listing new cryptocurrencies

The cost of listing depends on the exchange and can range from a few thousand to millions of dollars. For example:

-

Small exchanges - $10,000 to $50,000.

-

Medium exchanges - $100,000 - $500,000.

-

Top exchanges - $1,000,000 and up.

Additional costs may include marketing campaigns, listing fees, and audit costs.

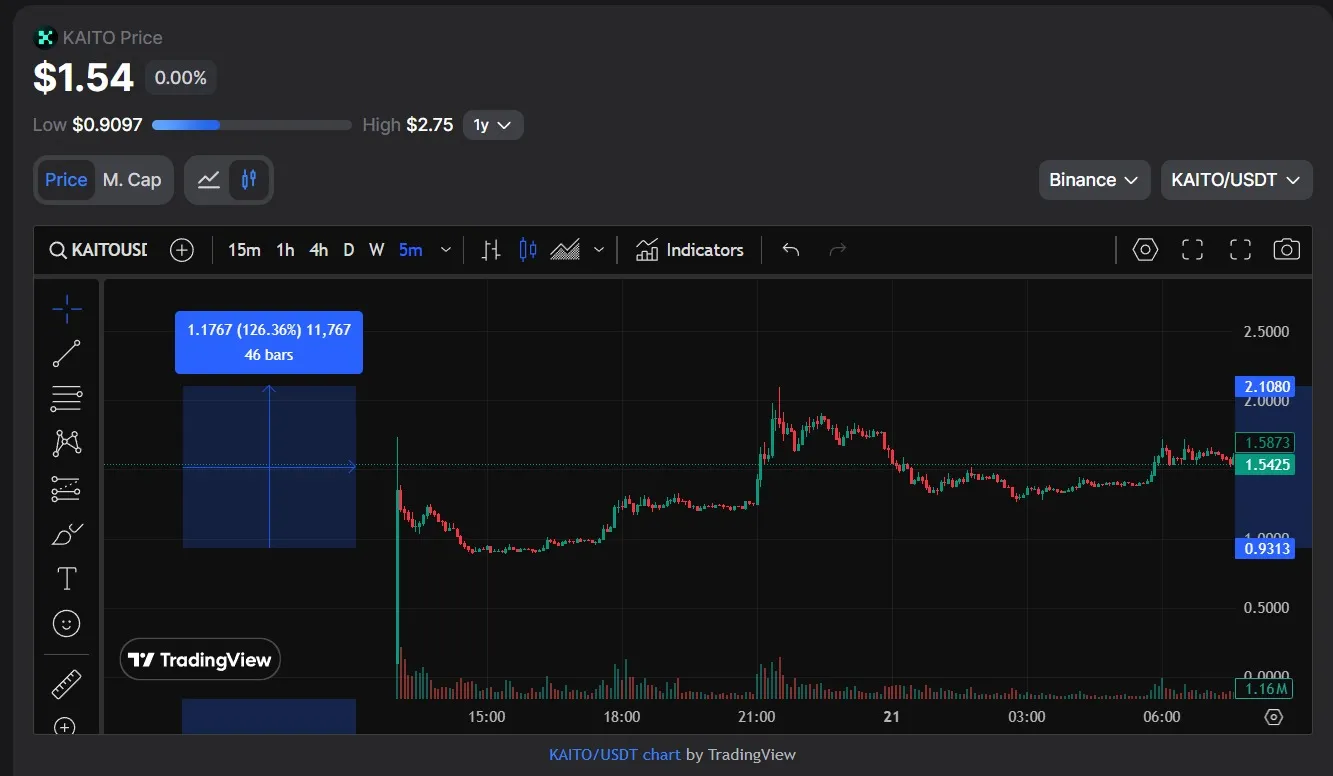

Changes in the price of a cryptocurrency once it is listed

Listing can significantly affect the price of a token. The following scenarios are often observed:

-

Sharp growth - after the listing announcement, investors actively buy the coin.

-

Correction - after a significant rise, there may be a downturn when early investors lock in profits.

-

Long-term growth or decline - depends on the quality of the project and its future development.

How to earn on listings of new coins

1. Trading with the help of cryptobots

How to earn:

The Veles Finance platform provides opportunities to create your own and purchase ready-made trading bots. Also, thanks to the short-spot strategy, you can short on the spot, where the initial coin listings take place.

2. Participation in presales, ICOs, IDOs, IEOs

A pre-purchased token can be sold after going public with a high profit.

Varieties of pre-sales:

-

ICO (Initial Coin Offering) - initial coin offering, conducted by the project itself.

-

IDO (Initial DEX Offering) - token sale through decentralized exchanges (Uniswap, PancakeSwap).

-

IEO (Initial Exchange Offering) - launching tokens through a centralized exchange, such as Binance Launchpad.

How to earn:

-

Find a promising project with a good team and real token application.

-

Buy tokens at a low price at the presale stage.

-

Wait until the coin is released on the exchange and sell it at the first price jump.

Risks:

-

Most ICOs and IDOs turn out to be fraudulent.

-

High competition for participation in IEOs, often requires staking exchange tokens (e.g. BNB on Binance).

-

Possible price drop after listing if the project turns out to be overvalued.

3. Buying tokens in the first minutes after listing

After the coin is released on the exchange, there is often a sharp rise in price due to the excitement.

How to earn:

-

Follow announcements of new listings from the projects and exchanges themselves.

-

Prepare capital in advance to quickly buy token in the first minutes of trading.

-

Sell the token when the price peaks.

Risks:

-

Prices can skyrocket and drop dramatically (Pump & Dump).

-

Exchanges sometimes delay deposits and buying may not be possible at the right moment.

-

High commissions for buying and selling.

4. Long term investing after listing

Some projects continue to grow after listing if they have a strong team and a good business model.

How to capitalize:

-

Study the project’s fundamentals.

-

Buy tokens after listing when the price stabilizes.

-

Hold the asset for a few months or years, waiting for growth.

Risks:

-

Possible prolonged sideways trend or price drop.

-

Competition from other projects.

-

Regulatory problems or technical errors may cause the project to fail.

5. Arbitrage between exchanges

The price of a token can differ significantly on different platforms after listing.

How to make money:

-

Find exchanges where the price difference for the same token is 5-10% or higher.

-

Buy the coin on an exchange with a lower price.

-

Transfer it to another exchange and sell it at a higher price.

Risks:

-

High fees for deposit/withdrawal and trading.

-

Token transfer time may be too long and the price will change.

-

Exchanges may restrict token withdrawals in the first few days of trading.

6. Use of futures and margin trading

Some exchanges allow you to trade new tokens with leverage.

How to capitalize:

-

Wait for the moment of a sharp rise or fall in price.

-

Take a position (long or short) with x5-x10 leverage.

-

Close the trade when the profit target is reached.

Risks:

-

High volatility can lead to position liquidation.

-

Exchanges sometimes disable margin trading for new tokens.

-

An experienced understanding of the market and technical analysis is required.

How to find a coin before listing

To discover a promising coin before it is listed, you can use such sources:

-

Official websites and social networks of projects - tracking announcements and roadmaps.

-

Forums and communities (Reddit, Bitcointalk) - discussing new projects.

-

ICO, IDO and IEO platforms - CoinList, Binance Launchpad, Polkastarter.

-

Listings calendar - sites like CoinMarketCal display future events of the crypto market.

Delisting cryptocurrency - what is it

Delisting is the removal of a coin from an exchange. This can happen for the following reasons:

-

Low trading volume - the exchange sees no point in supporting the token.

-

Legal problems - violation of legislation or claims from regulators.

-

Scam or problems in the project - fraud or technical failures.

-

Team decision - the project may refuse to trade on a particular exchange.

Advantages and disadvantages of listing

Advantages of listing:

1. Increased liquidity

-

Listing on an exchange allows free buying and selling of the token.

-

Listing on major exchanges increases trading volume.

-

Improves pricing and reduces the difference between the buy and sell price.

2. Access to a broad investor base

-

Exchanges attract thousands of new users willing to invest in the project.

-

Trust from institutional investors increases.

-

Opens up the opportunity to enter the international market.

3. Growing popularity and recognition

-

Listing on a major exchange is an indicator of confidence in the project.

-

The reputation of the project improves, and interest from the media and social networks grows.

-

Opportunity to participate in special exchange programs, such as Binance Launchpad.

4. Attracting new partners

-

Opportunity to cooperate with market makers and liquidity providers.

-

Integration with DeFi platforms and financial services.

-

Simplified access to listing on other exchanges.

5. Access to additional tools and services

-

Possibility to launch trading pairs with different assets (USDT, BTC, ETH).

-

Tools for margin trading, staking, futures.

-

Possibility to include the token in index funds or ETFs.

6. Income generation for the project team

-

Possibility to generate income through commissions from transactions.

-

Initial Exchange Offering (IEO) to attract additional funds.

-

Creating a pool of liquidity on decentralized exchanges.

7. Improving security

-

Large exchanges audit projects, which increases their reliability.

-

Exchanges provide asset storage and protection against hacking.

-

Ability to verify users through KYC reduces fraud.

Disadvantages of listing:

1. High cost of listing

-

Listing on major exchanges can cost $100,000 to $1,000,000.

-

Includes costs for auditing, marketing, legal support.

-

Additional costs of providing liquidity and working with market makers.

2. High approval requirements and complexity

-

Exchanges require extensive documentation, technical audits and financial reports.

-

Active community support, partnerships, stable trading volume are important.

-

Long delays in application review or complete rejection are possible.

3. Risk of price manipulation

-

Large players can artificially inflate or underestimate the price of a token.

-

Possible sharp jumps in value due to high speculative activity.

-

Volatility may discourage long-term investors.

4. Exchange pressure

- The exchange may require certain conditions to be met:

-

Maintaining a certain trading volume.

-

Ensuring liquidity.

-

Participation in the exchange’s marketing programs.

- In case of non-compliance with the requirements, the Exchange may suspend trading or delist.

5. Legal risks

-

Regulation of the cryptocurrency market is constantly changing.

-

An exchange may require KYC/AML compliance, making it difficult for anonymous teams to operate.

-

In some countries, cryptocurrency may be banned or severely restricted.

6. Delisting risk

-

If a token does not meet the requirements of an exchange, it may be delisted.

-

The main reasons for delisting are:

-

Low trading volume.

-

Decrease in popularity and activity of the project.

-

Discovery of vulnerabilities in the smart contract.

- Delisting may lead to a sharp drop in price and loss of investor confidence.

7. Competition with large projects

-

There are already thousands of tokens on large exchanges, and it is difficult for a new project to stand out.

-

It is necessary to constantly maintain the interest of the audience and investors.

-

Without active marketing, competition can lead to low liquidity and a low number of transactions.

Conclusion

Cryptocurrency listing is still an important stage in the development of a project, which opens up new opportunities, but also carries certain risks. It is important for investors to analyze projects carefully, and for traders to use the right strategies and control risks in order to make money on new listings.

Frequently asked questions

1. What is a cryptocurrency listing?

Listing is the process of adding a digital asset to an exchange for trading.

2. How can I make money from a listing?

You can buy coins before listing, trade at the time of listing, or invest in promising projects.

3. Which exchanges are better for listing?

The top exchanges are Binance, Bybit, OKX, HTX, Gate. io, BingX.

4. Why can cryptocurrency be delisted?

Reasons include low trading volume, legal issues, scam or project resolution.

5. Where to find information about future listings?

Use CoinMarketCap, project social networks, exchange announcements and forums.