How to multiply Hamster coins on the exchange? A conservative way from Veles

Imagine that you are the captain of a spaceship traveling to the uncharted galaxies of the cryptocurrency world. Your ship is your portfolio, and the stars and planets are new tokens that can bring you incredible profits. And now, there are two new luminaries on the horizon: Hamster Kombat (HMSTR) and Catizen (CATI). Leading cryptocurrency exchanges such as Binance and Bybit are preparing to list them as early as September 26 and September 20, respectively.

In this article, we will describe a low-risk way of farming new coins on the exchange. This strategy will suit those who do not plan to sell their coins quickly, but intend to wait for their price to rise.

Bots with two options for using this strategy:

The essence of the strategy

Few people know that when trading on the spot market, you can implement a strategy called “spot short”. In fact, you can not short on the spot, but with the help of Veles platform you can reproduce the mechanics of selling an asset with the subsequent purchase of the same volume at a lower price. Hence the name “spot short”.

Simply put, you receive HMSTR or CATI tokens and enter them on the exchange (by the way, the altcoin you bought in the previous bull market is also suitable for the strategy). Then the bot, whose settings we will describe below, will start gradually selling these tokens, while placing buy orders at a lower price. As soon as there is a slight increase, the bot sells these tokens and buys them back.

This way, you can capitalize on the price difference. Let’s say you sold 100 tokens at a price of 0.10, getting 10 USDT. Then you bought the same 100 tokens, but at a price of 0.085, paying 8.5 USDT. You will now have 1.5 USDT free on your balance. You can keep these funds as income or transfer them to the desired asset, gradually accumulating new coins.

What is the risk?

The only risk you may face is selling an asset at a price lower than the token can grow. However, using Veles bots, such a sale will be more profitable than a “hand” sale, as the algorithm will do it quickly and according to predefined conditions.

If you launch the bot immediately after listing and the price goes up, you will sell all tokens at a higher price. In this case, you will only benefit from the sale. That is, you can set up the bot with a wider overlap in case of high volatility.

If we look at the price dynamics of alternative tokens such as NOT and DOGS, we see that after listing, their value usually decreased amid a sell-off among the majority of holders.

It is possible that there will be avalanche selling at the time of HMSTR and CATI listing, which will provide strong resistance to the price rise. This is the scenario that is suitable for applying the spot-short strategy.

Now let’s move on to a detailed description of bot settings that can be applied to any possible scenarios.

How to set up the bot?

The first thing you need to do is to register on the Veles platform and connect the API key. Detailed instructions for each exchange are described in the Wiki.

Then go to Create Bot, the corresponding button is located on the right side of the interface.

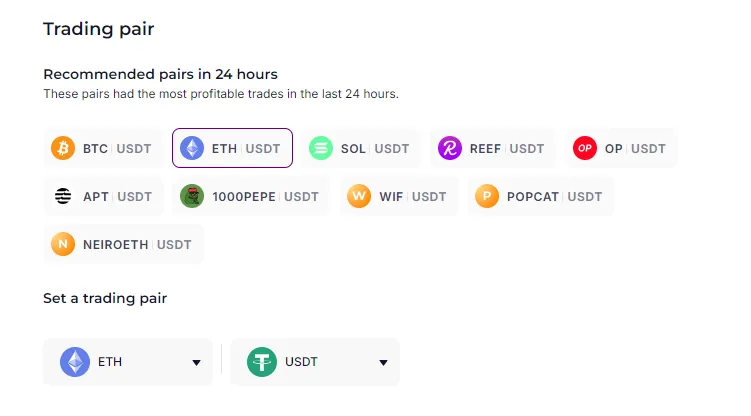

Select the exchange and spot market, and then choose the desired asset. It can be both Hamster coins and Catizen coins. And any other coins that are stored on the spot - especially altcoins hanging in the drawdown will be suitable.

We will show the example of ETH, since at the time of writing the article, Hamster and Catizen tokens are not yet listed on exchanges.

After selecting the exchange we go to search for the desired coin. The Hamster ticker is HMSTR, the Katizen ticker is CATI. Set the amount to be traded, and then proceed to the main bot settings.

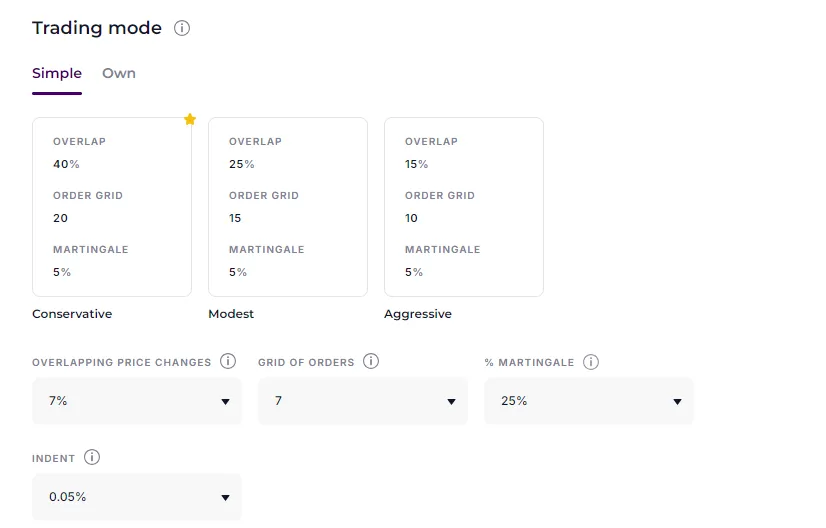

Initially, you need to customize the overlap grid by setting the range in which the bot will buy back the sold out volume. Choose an overlap from 7% to 20%. Such a grid will allow for efficient accumulation. The Martingale parameter is responsible for increasing the volume in each subsequent order. In this way, you can get a good average entry point.

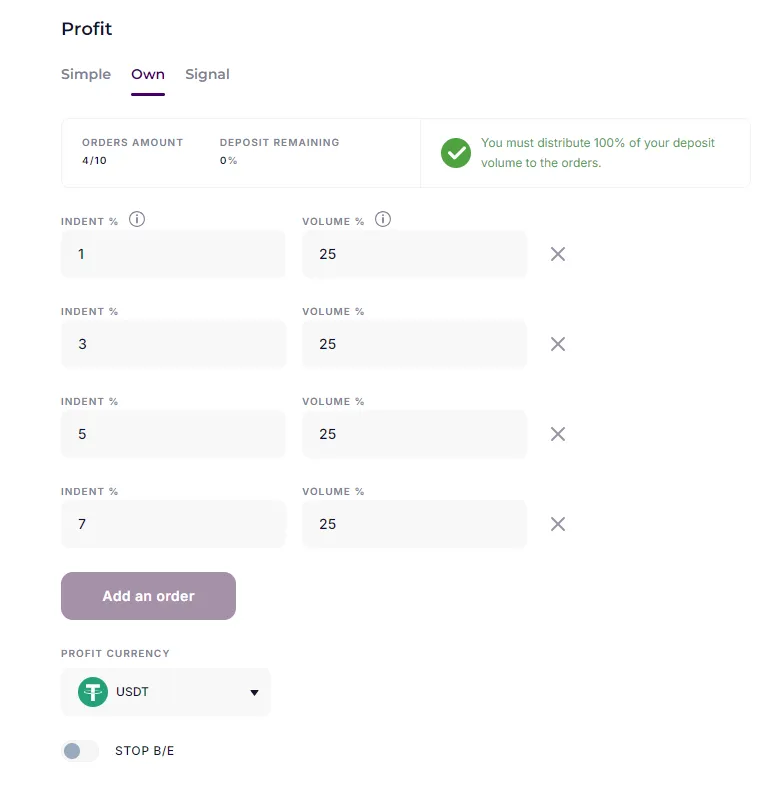

In the Profit setting, set the same grid as in the Trade mode. Select the required token or USDT as the profit currency if you want to earn on the price difference.

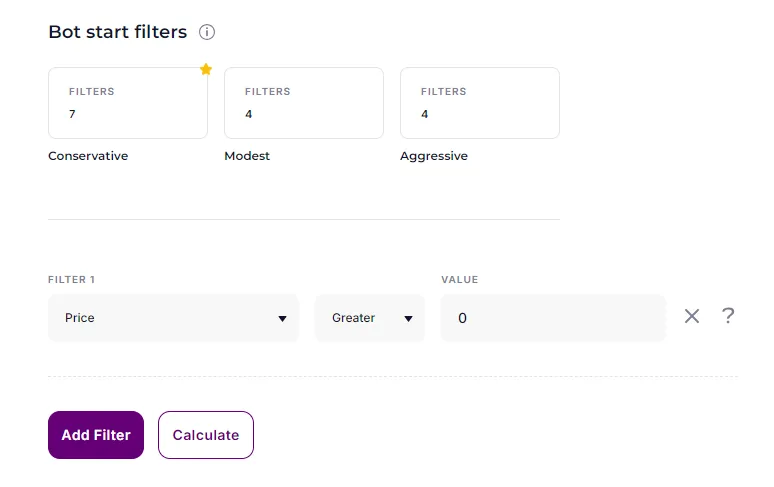

After that, we move on to setting up a signal to trigger the bot. In this case you can go two ways: choose a signal for quick entry by setting the Filter Price > 0, in this case the bot will start trading immediately.

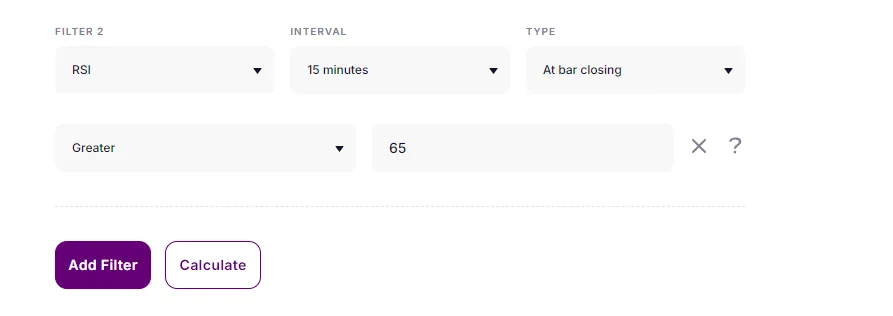

The second approach is to choose an indicator that will assess the overall market condition and open trades only under reasonable conditions. This option can potentially miss some market opportunities, as speed is important when working with new coins that have just appeared on the exchange. However, in this case, the bot will look for the best entry point on an overbought asset.