The «Hillary» strategy

Edmund Hillary was not born on the summit of Mount Everest. His journey began in his youth, with his first ascents in New Zealand. At the age of 20, he conquered Mount Olivier, and by the age of 30 he had become one of the country’s top climbers. In 1953, together with Tenzing Norgey, he was the first to set foot on the highest point on the planet.

Hillary’s success is not an accident, but the result of preparation, perseverance and the right equipment. Oxygen tanks, ropes, crampons - all of these were essential for the assault on Everest. Trading, like mountaineering, requires the same “tools”.

Hillary’s strategy combines simple but reliable indicators to guide you to market peaks while avoiding an avalanche of losses.

Pioneer’s gear

Hillary took only the essentials with him: rubber-soled boots, a sleeping bag, and oxygen. In trading, “equipment” are indicators that cut off market noise and point to acceptable entry points.

1. RSI + Bollinger Bands (M30 timeframe)

- RSI < 30 - oversold signal, like Hillary’s first step on the slope of Mount Everest, foreshadowing the ascent.

- Bollinger Bands - defines overbought and oversold zones, considering volatility as the “weather” on the chart.

The M30 timeframe is chosen for a reason: it smoothes the market noise, giving more accurate signals than the lower intervals.

2. ROC (Rate of Change, M5 timeframe)

The Rate of Change indicator is the “wind gauge” of the strategy. It detects the acceleration of price decline when the chart is not just in the oversold zone, but is rapidly “falling”. The ROC value < -1.5 signals: it is time to get ready for a reversal.

3. RSI levels on M5 - “mountaineering cats”

Cats helped Hillary cling to the icy slopes. In trading, an RSI level 30 crossing from bottom to top confirms a trend change. This signal has been used by market legends:

- Larry Williams, who created the %R indicator and RSI-based strategies.

- George Soros, the master of oscillators for entering trades.

- Linda Raschke, whose RSI tactics are still relevant today.

Climbing tactics

Hillary did not rush up Mount Everest headlong - every step was calculated. In the “Hillary” strategy, position management is based on the principles of multi-takes, where the first take is the break-even point. The order grid is borrowed from the spot ELDER strategy, but with slight changes in order spacing.

Why is it effective?

- Averaging reduces risks when moving against the trend.

- Profit taking at key levels protects against market pullbacks.

Testing the strategy on the market

To prove the reliability of “Hillary”, we tested it on assets from the current showcase of ready-made bots, as in the strategy “Galileo”. Here’s a selection of eight cryptocurrencies, from volatile newcomers to blue chips:

- Aptos (APT): a young blockchain with sharp price “jumps.”

- XRP (XRP): A Ripple token sensitive to news of litigation.

- Cardano (ADA): a platform for the patient with smooth trends.

- Chainlink (LINK): an oracle responsive to partnerships.

- Sui (SUI): a 2023 blockchain full of “price storms”.

- Ethereum (ETH): a DeFi foundation with moderate volatility.

- BNB (BNB): a Binance token, reliable but sensitive to exchange news.

- Bitcoin (BTC): the leader that sets the rhythm for the whole market.

Due to exchange restrictions on minimum order size (details in the Wiki), multi-takes may require an increase in deposit to work. Alternatively, use leverage or increase the deposit per bot, but don’t forget about risk management (instructions).

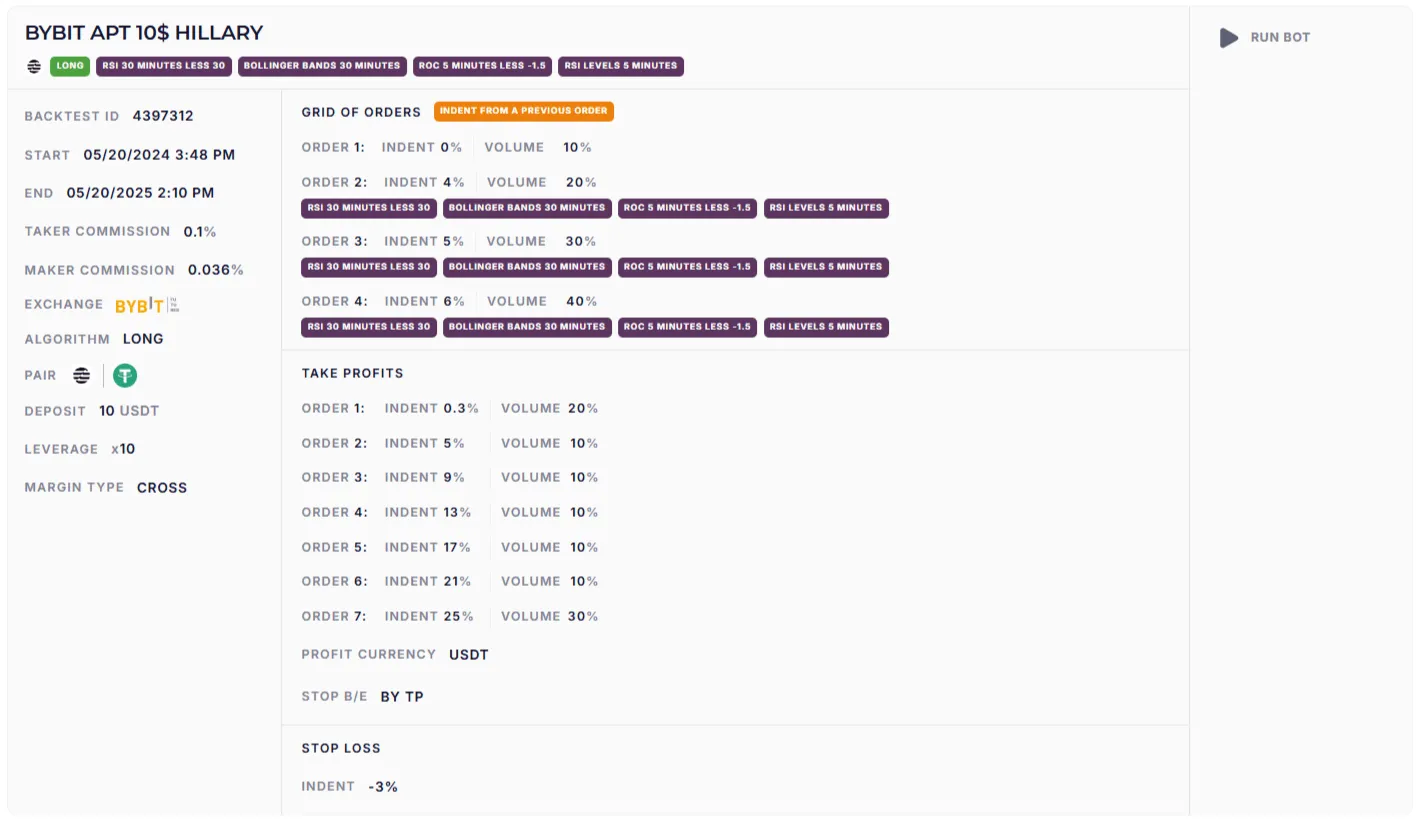

Settings and backtest results for the year:

BYBIT APT $10 HILLARY: ~10% per annum.

BYBIT ADA $100 HILLARY: ~78% APR.

BYBIT LINK $100 HILLARY: ~25% APR.

BYBIT XRP $300 HILLARY: ~60% APR.

BYBIT SUI $600 HILLARY: ~60% APR.

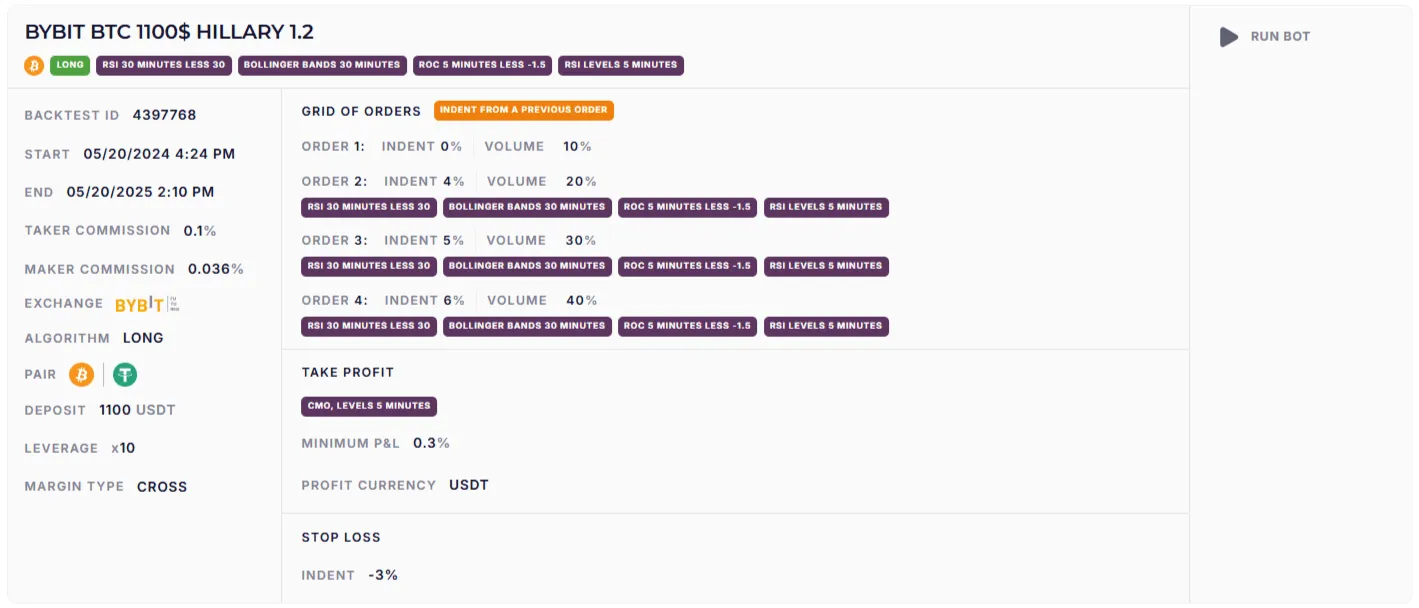

For less volatile assets such as ETH, BNB or BTC, exiting a trade works better with the Chande Momentum Oscillator (M5 timeframe). The indicator is described in the Grid Warlord strategy article. Examples:

BYBIT ETH 600$ HILLARY 1.2: ~30% annualized.

BYBIT BNB $600$ HILLARY 1.2: ~27% annualized, equally effective with multi-takes and Chande.

BYBIT BTC $1,100$ HILLARY 1.2: ~23% APR.

Note the maximum floating loss (MFL) in the tests. Use the guide to calculate leverage risks and profits.

Your Personal Everest

The Hillary Strategy is not just indicators, but a philosophy of discipline and deliberate steps. Just as Edmund Hillary conquered Everest, you can reach market heights with clear rules and reliable “gear.”

Key principles:

- Simplicity: only proven indicators.

- Accuracy: RSI, Bollinger Bands, ROC for entry.

- Control: multi-takes and order grid.

In the “Age of Discoverers” series, we continue to storm new trading peaks. Who knows - maybe your personal “Everest” is already waiting behind the next turn of the chart?

Ready to climb? Customize your bot and start your way to the top!

Stay tuned for more articles in the series - more strategies inspired by great personalities to come!