Newton Strategy

Isaac Newton, who laid the foundations of classical physics, hardly imagined that his laws would find application in trading. However, Newton strategy developed for short positions on the spot market proves that the market, like the Universe, obeys universal principles. In this article from the “Age of discoverers” series, which continues the theme of the «Galileo» strategy, we will analyze how the laws of motion and gravitation help to predict price drops and make money on bearish trends.

1. The law of inertia: why the market keeps falling

Newton’s first law: a body maintains a state of rest or uniform motion until an external force changes it.

Application in trading:

A bearish trend (falling price) has inertia and continues until a catalyst - such as positive news or a surge in buying - appears. The Newton strategy identifies entry points by analyzing moments when selling pressure dominates and buyers are inactive.

How the algorithm works:

- Tracks indicators such as the Chande Momentum Oscillator (CMO) to confirm overbought areas.

- If price begins to decline and indicators signal a likely local trend change, the algorithm opens a short position.

Example: a token is preparing to fall due to negative news. The CMO shows overbought, and the price starts to decline. The trader opens a short position, capitalizing on the further decline.

2. Market gravity: how volumes accelerate the fall

Newton’s Second Law: F = m × a (force equals the product of mass by acceleration).

An analogy in trading:

- “Mass” is trading volume, reflecting selling pressure.

- “Acceleration” is the rate of price change associated with volatility.

The greater the volume of sales, the stronger the “gravity” pulling the price down.

How the strategy works:

- Tracks indicators: global trend (EMA), volatility (Bollinger Bands), momentum (CMO) and Commodity Channel Index (CCI).

- Shorting signal: breakout of the CCI level at high volatility, indicating an accelerated decline.

- The algorithm helps to enter a position at the moment of the beginning of the sellers’ pressure and to fix profits at the lower levels.

Example from practice:

A token loses value due to liquidity outflow. The volume of sales is growing and the price is falling rapidly. A trader, using Newton, opens a short at $10, buys back the asset at $8 and locks in a 20% profit.

3. Action and counteraction: how to avoid the correction trap

Newton’s Third Law: to every action there corresponds an equal counteraction.

In the market:

A strong drop is often followed by a correction - a temporary upward bounce in price. These bounces can be a trap for traders who confuse them with a trend reversal.

How Newton filters signals:

- Analyzes volatility (Keltner Channel) and CCI dynamics to distinguish a weak bounce from a trend reversal.

- If the bounce is insignificant (e.g. price does not go beyond the Keltner Channel boundaries), the algorithm holds a short.

Example:

After the token drops 15%, the price bounces 5%. CCI and Keltner Channel show that this is a temporary correction. The trader keeps the short and makes money when the price continues to fall.

4. Advantages of spot market shorting

Unlike futures, where traders borrow assets and risk liquidation, spot shorting is simpler and safer:

- Low risk: if the price rises, the trader doesn’t lose more than he sold because the position is converted to USDT.

- Flexibility: the order grid from the “ELDER 2.0” strategy is used: selling in installments (10%, 20%, 30%, 40%) in increments of 5% from the previous order minimizes the impact of volatility.

- Simplicity: there is no leverage and therefore no need for collateral margin, which makes the strategy accessible for beginners.

Example:

A trader sells a token at $10, receiving USDT. The price drops to $8, he buys back the asset, locking in a 20% profit. If the price rises, the trader waits for the next order to be executed.

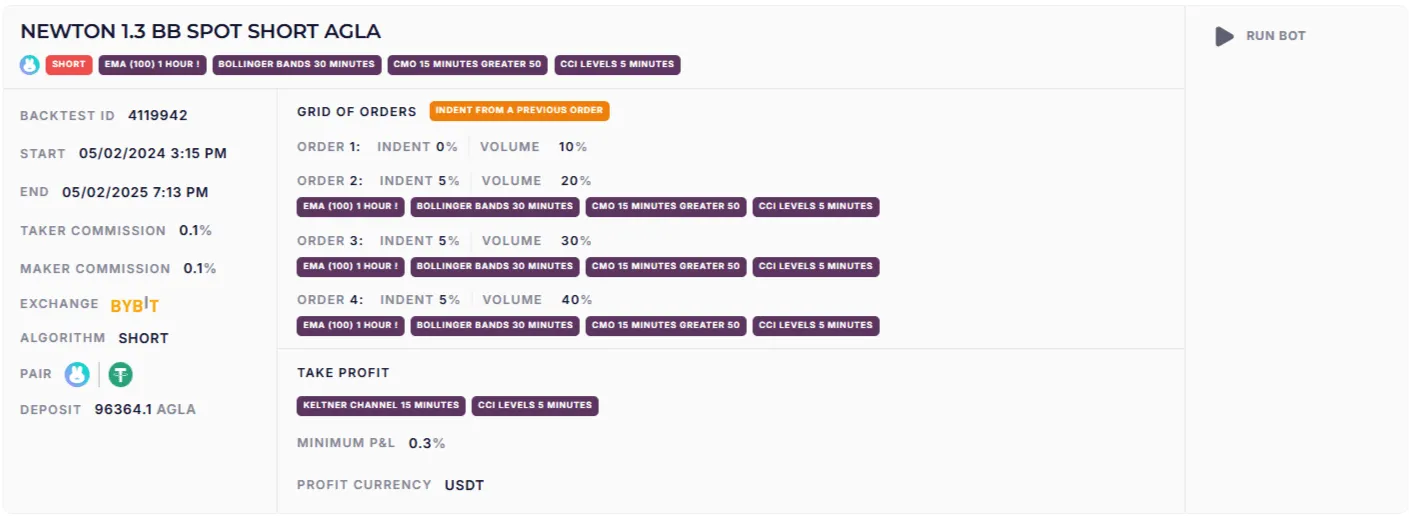

5. Strategy settings

Version: 1.3 BB SPOT SHORT.

Indicators:

- EMA (100, 1 hour): identifies counter-trend entry points. A short is opened if the price is above the EMA, which prevents premature entries.

- Bollinger Bands (30 minutes): measures volatility and overbought/oversold zones.

- CMO (Chande Momentum Oscillator, 15 minutes, >50): confirms price overheating before a reversal.

- CCI (Commodity Channel Index, 5 minutes):

- Developed by Donald Lambert in 1980 to analyze the cyclicality of commodity markets.

- Measures the deviation of price from the mean, helping to identify moments when price tends to return to normal.

- In strategy, it is used to find short-term cycles and confirm reversals (RSI and CCI Levels).

Order Grid:

Take Profit:

- Set by the Keltner Channel (15 minutes):

- Created by Chester Keltner in the 1960s, modernized by Linda Raschke.

- Uses Average True Range (ATR) to adapt to volatility by identifying dynamic support/resistance levels.

- In strategy, helps to lock in profits at lower channel boundaries.

- Confirmed by CCI. Minimum profit: 0.3%.

- If the price continues to fall, the algorithm uses a “confident trailing stop” (CCI + Keltner Channel), following the trend without exiting the trade early.

6. Asset Selection

The strategy is universal but quite effective for moderately volatile, low capitalization assets such as AGLA, MEW, DOGS, JUP, JASMY, APEX, BCH, CYBER, NEON and others. These tokens possess:

- High volatility: prices can fluctuate 10-30% in a day, creating opportunities for shorts.

- Low capitalization: sensitive to news and market sentiment, which increases the fall in negative events.

- Tokenomics: often linked to DeFi, NFT or niche projects, making them “vulnerable” to corrections.

Asset selection recommendations:

- Tokenomics: study token distribution, inflation mechanisms and the proportion of large holders. For example, high concentration in “whales” can trigger a dump.

- Metrics: check the capitalization of the asset, trading volume in 24 hours, turnover supply and liquidity ratio. Low liquidity amplifies a dip, increasing the risk of spikes.

- News: keep an eye on regulatory changes, successes and challenges of the project (asset) or general market sentiment.

Example:

JASMY (IoT) and CYBER (cybersecurity) tokens can fall due to news of regulatory restrictions or technical issues. The Newton strategy catches such movements.

7. Backtest Results

Backtests confirm the effectiveness of the strategy in bear markets:

- Backtest 1: NEWTON 1.3 BB SPOT SHORT AGLA

- Backtest 2: NEWTON 1.3 BB SPOT SHORT MEW

- Backtest 3: NEWTON 1.3 BB SPOT SHORT JUP

The algorithm consistently makes profits by exploiting trend inertia, minimizing false signals.

The gravity of data vs. the chaos of emotion

Newton said, “I can calculate the motion of the heavenly bodies, but not the madness of crowds.” His laws help traders systematize market movements, turning chaos into opportunities. Newton’s strategy uses trend inertia and the “gravity” of market pressure to capitalize on falling prices.

Traders:

- Use bearish trend inertia and the “gravity” of trading volumes.

- Choose moderately volatile assets, taking into account their tokenomics and metrics.

- Study the mechanics of strategy indicators in detail by adding them to the trading terminal chart or in the order grid preview when customizing the bot.

- Customize the parameters to suit your trading style or leave them as they are - and your next trade may become the embodiment of the law of universal gravity.