ROC indicator in action: «La Catrina» Strategy

The cryptocurrency market, known for its volatility and unpredictability, requires traders not only to be able to react quickly to changes, but also to develop strategies that will help minimize risks and maximize profits. One of these strategies is La Catrina. This strategy is based on three key indicators: ROC (Rate of Change), Supertrend, and Donchian Channel.

The story of La Catrina: Inspiration and memory

The name of the strategy La Catrina was inspired by the story of a young Mexican woman Katrina, who became a symbol of memory and eternal life. Her story of overcoming difficulties can remind us of the importance of perseverance and remembering your successes and failures. These qualities are key for a trader who strives to continuously develop and improve his trading skills.

Strategy Indicators: ROC, Supertrend and Donchian Channel

ROC (Rate of Change) is a technical indicator used to measure the rate of change in the price of an asset. It helps traders understand how quickly the value of an asset is changing, which is an important factor in making decisions about buying, selling, or holding a position. ROC takes positive and negative values, signaling the direction of the trend.

-

A positive ROC value (above zero) indicates that the current closing price of the asset is higher than the closing price ( n ) periods ago. This signals an uptrend and can be a buy signal.

-

A negative ROC value (below zero) indicates that the current closing price of the asset is lower than the closing price ( n ) periods ago. This signals a downtrend and can be a sell signal.

Supertrend is a technical indicator based on the Average True Range (ATR) and the closing price of an asset. It displays a dynamic line that helps traders identify trends and confirm the signals of other indicators. Supertrend helps you filter entry points, which allows you to more accurately identify stable trends and avoid entries, in our case, at local price highs.

The Donchian Channel is a tool developed by Richard Donchian that helps you analyze volatility and determine the start and end of market trends. The Donchian channel consists of three lines: middle (central), upper (resistance) and lower (support). These lines are drawn based on the highs and lows of prices for a certain period of time.

The Donchian channel helps traders determine the best moments to enter and exit trades, as well as assess the strength of the current trend. The channel width indicates the potential volatility of the asset.

Principles of the La Catrina strategy

The La Catrina strategy uses the triple moment principle to get more accurate trade entry signals based on the price movement momentum.

Example of a triple moment strategy

To enter a trade, all three ROC indicators must show positive values. For example:

ROC m15: 2 and higher.

ROC m5: 1 and higher.

ROC m1: 0.5 and higher.

These conditions indicate a moderately strong uptrend or its beginning on all three timeframes.

Filtering entry points

Supertrend is used to filter entry points, trying to avoid entries at local highs.

Let’s set the Supertrend indicator (”trend”, reverse signal) on the m15 timeframe.

Exiting a trade

When we determine the beginning of an impulse movement using the ROC indicator, we can use the reverse signal from the Donchian channel to exit the trade during the correction. This method is similar to Richard Dennis’ Turtle Strategy, which effectively applies breakouts of the boundaries of this indicator.

We will set the reverse signal from the Donchian channel for Katrina on the m1 timeframe.

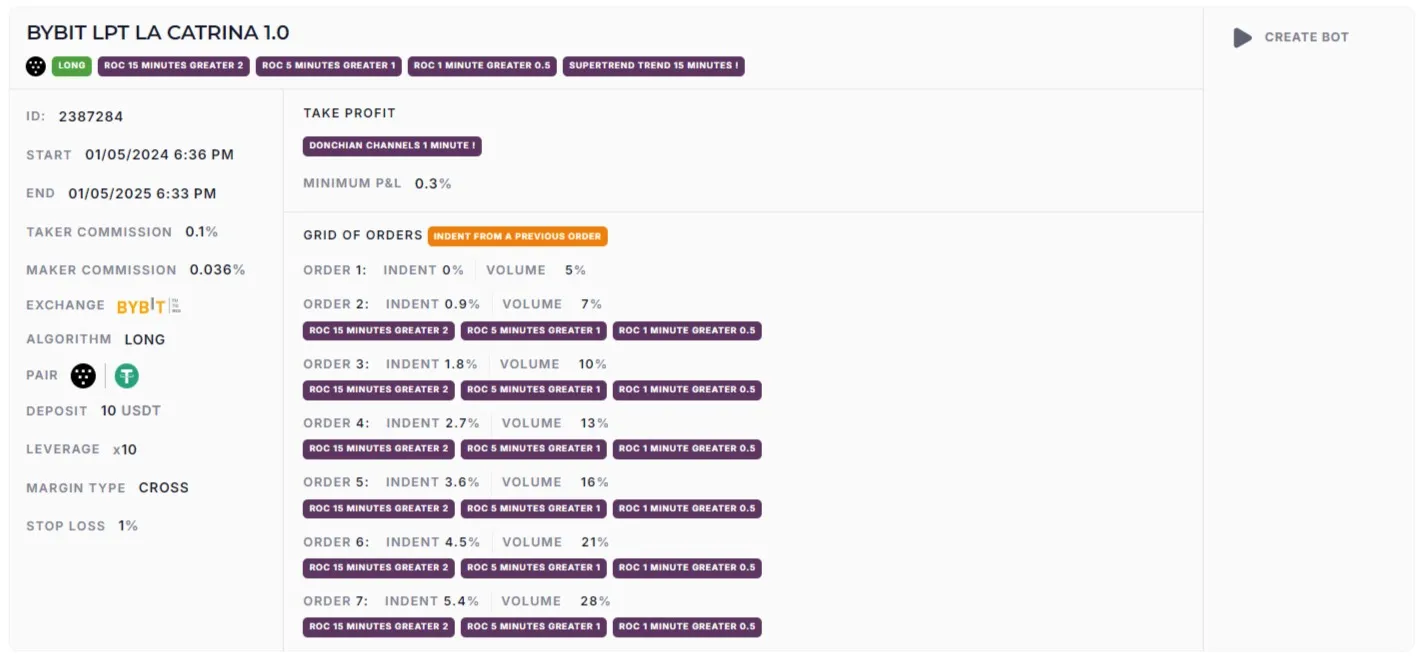

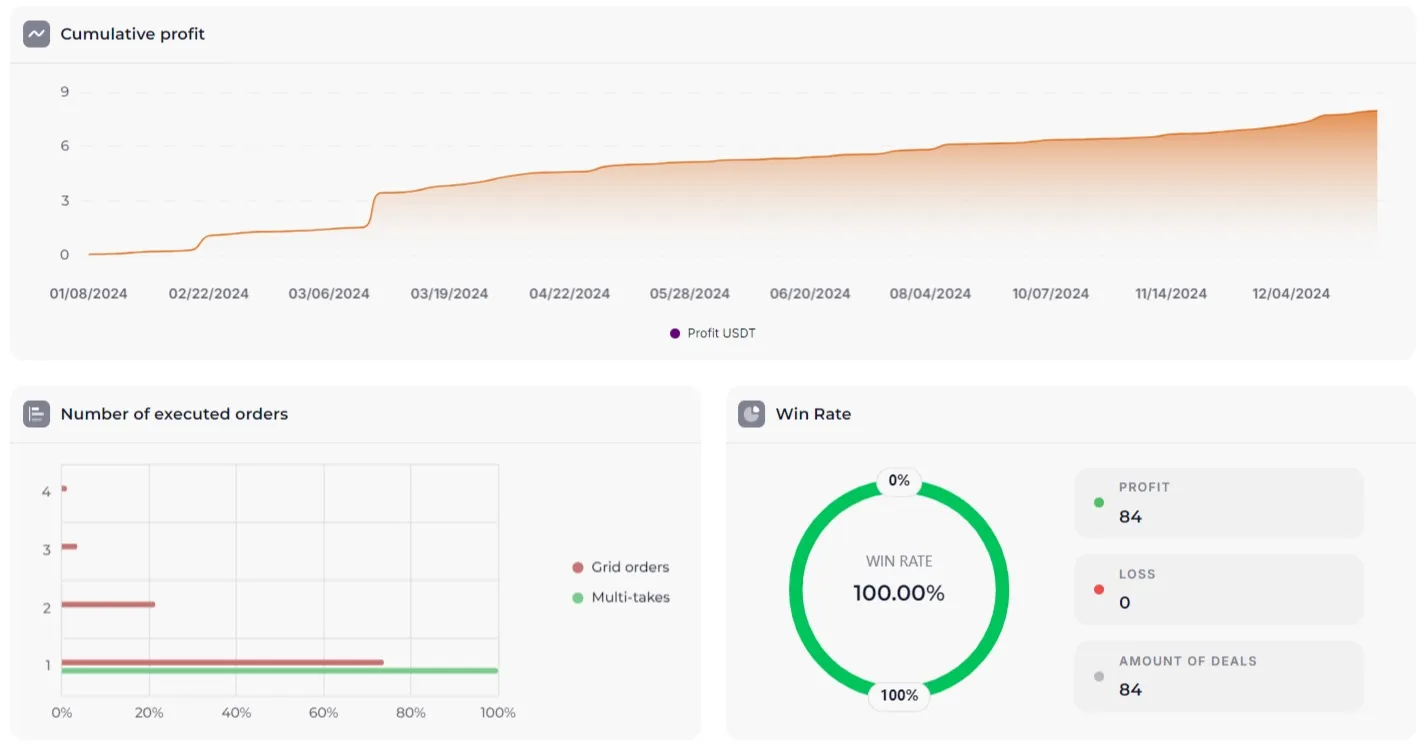

La Catrina strategy settings and annual backtests:

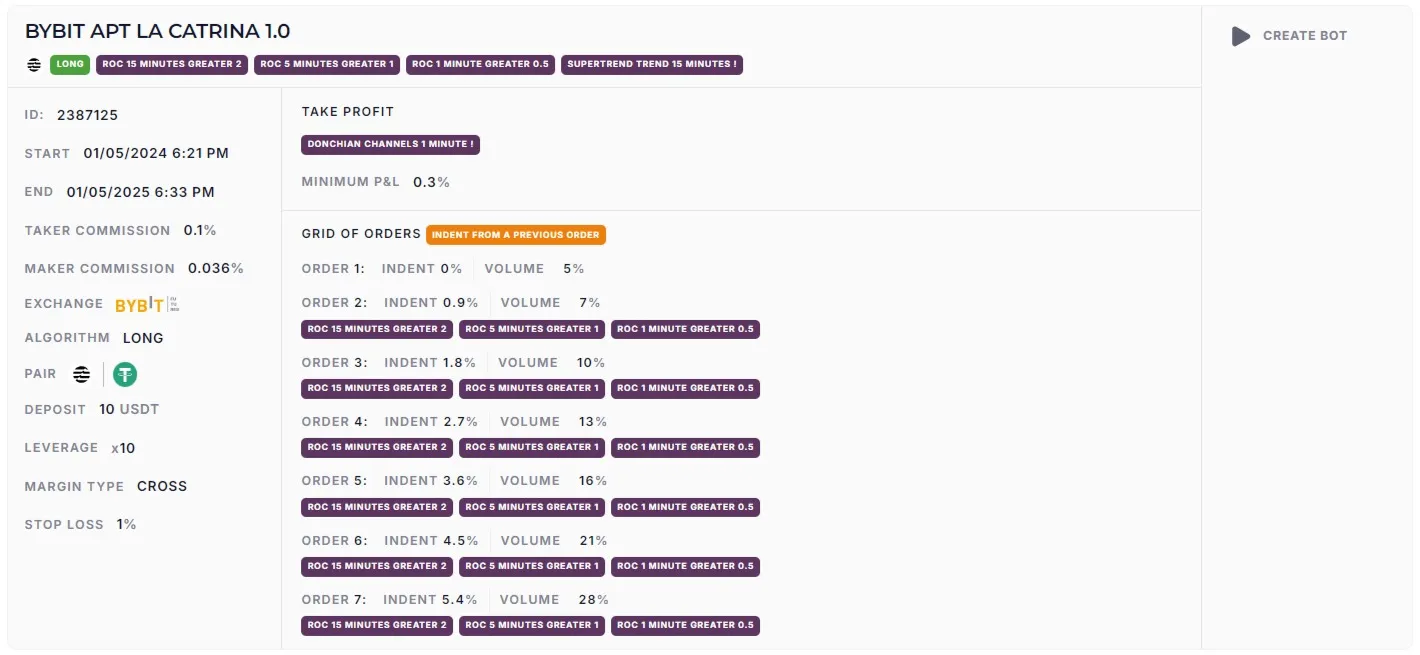

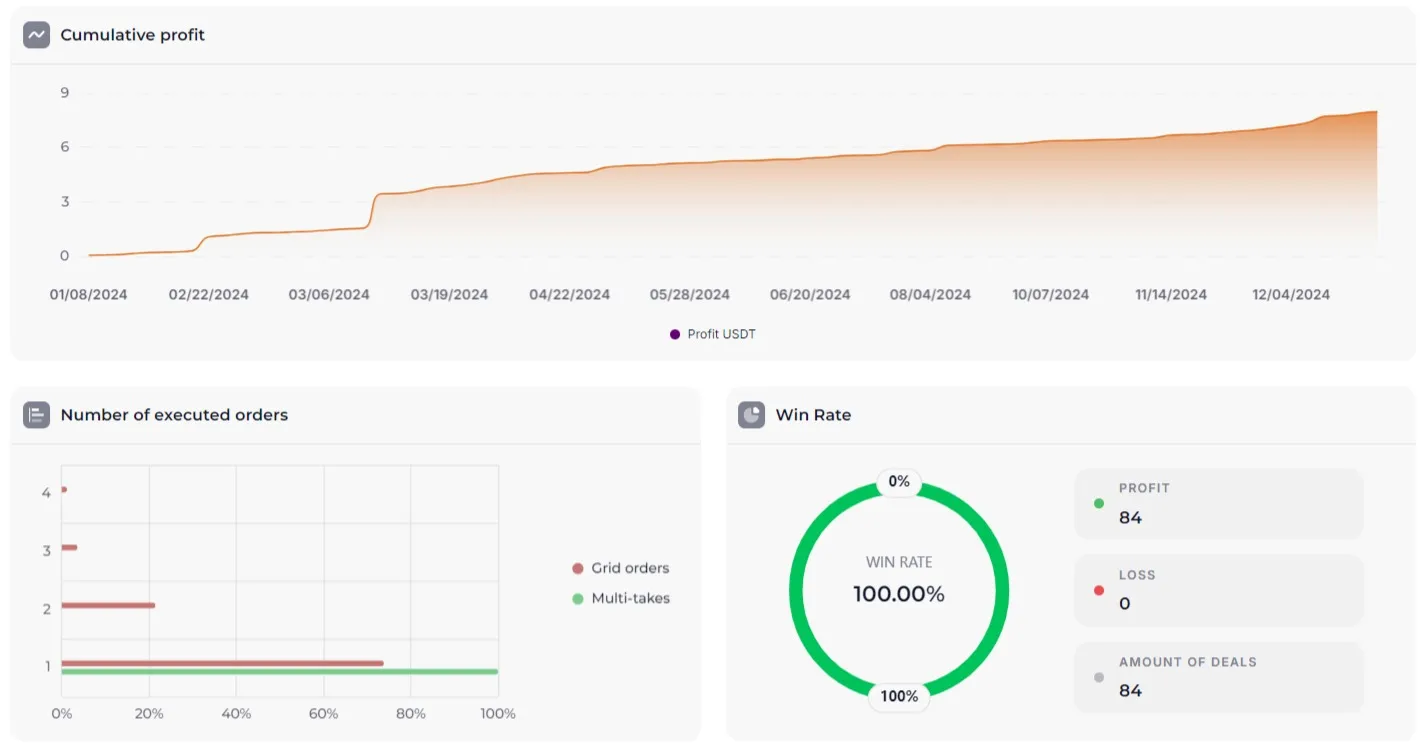

BYBIT APT LA CATRINA 1.0 (~65.54% per annum)

https://veles.finance/share/IWohU

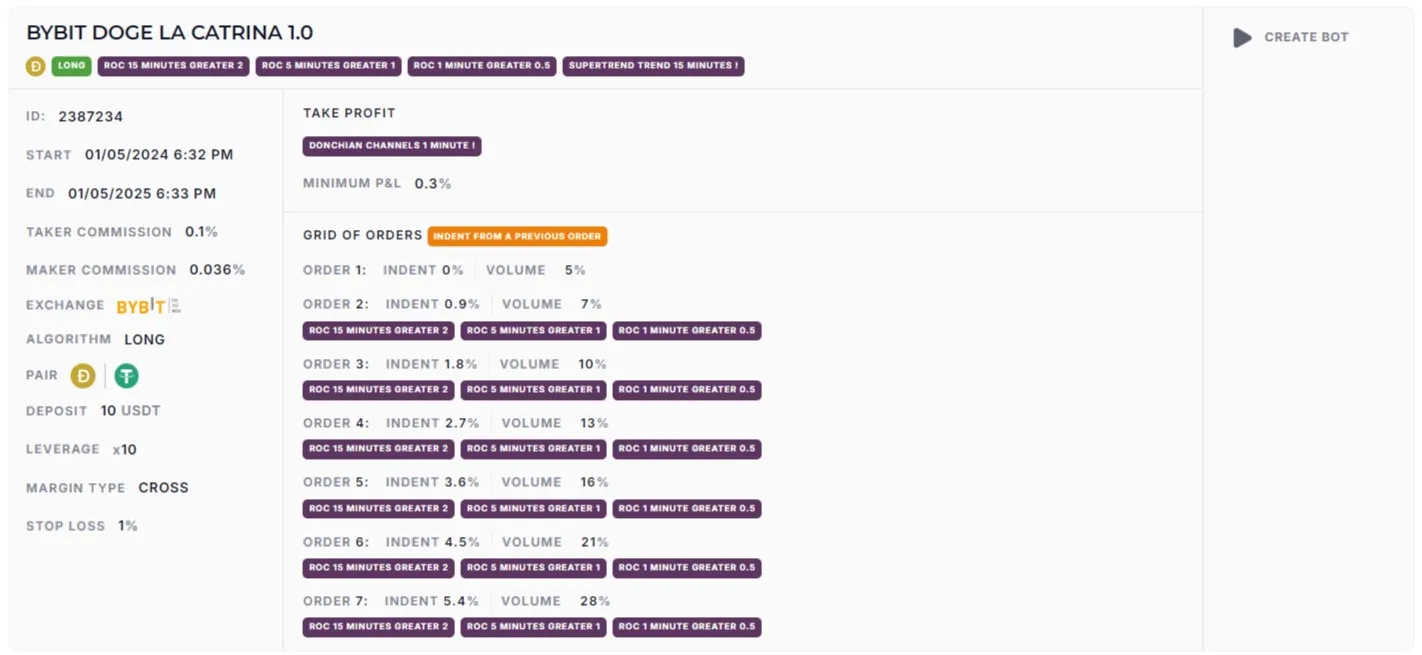

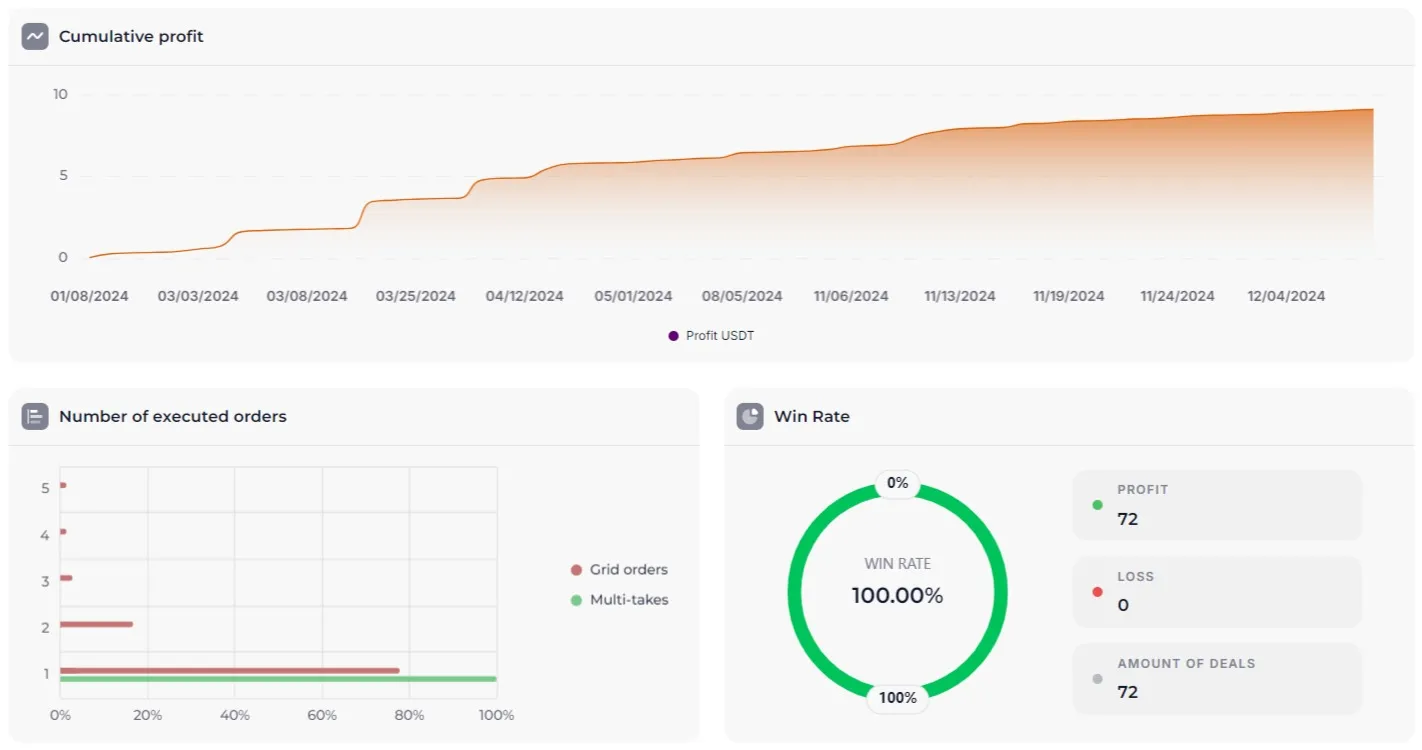

BYBIT DOGE LA CATRINA 1.0 (~81.9% per annum)

https://veles.finance/share/Quhnb

BYBIT LPT LA CATRINA 1.0 (~70% per annum)

https://veles.finance/share/QoZXt

Let’s summarize a little

The La Catrina strategy uses several indicators to analyze the market and identify entry and exit points. The triple moment on various timeframes ensures the accuracy of signals, while Supertrend filters and confirms their values. The Donchian channel helps to draw out the movement and not exit the trade ahead of time, minimizing risks and maximizing profits.

Before applying the La Catrina strategy, you should thoroughly analyze it and test it against historical data. This will allow you to understand how the strategy worked in the past, and minimize possible risks.

When launching a single bot, it is not recommended to risk more than 1% of the deposit to save your capital.

The story of Katrina and La Catrina’s strategy remind us of the importance of learning and adapting. Every trader can achieve success by using the technical analysis tools provided on the Veles platform. La Catrina’s strategy, based on ROC, Supertrend and the Donchian Channel, is an example of how you can effectively analyze the market and make informed decisions.

Remember that every step to success is an opportunity for growth and development. Be attentive to the lessons of the past, keep faith in the future, and move forward with optimism. Every step you take brings you closer to achieving your goals.

I wish you successful transactions and self-confidence!