The «Vega» strategy: a trader's guiding star

The cryptocurrency market is not just a platform for transactions, but a real cosmos where chaos meets opportunity. Here rumors can drive the price up to the sky, and sudden news can bring it down to the abyss. Beginners get lost in endless charts, and experienced traders sometimes miss signals in the whirlwind of volatility. But what if you had a tool to turn this chaos into a clear chart? Meet Vega, a strategy that will become your guiding star.

Named after the brightest star in the constellation Lyra, Vega is inspired by the role of the star of the same name in astronomy: in the 19th century it became the standard for measuring distances and brightness of other luminaries. In trading, this strategy performs a similar task - it helps to navigate in the market elements, highlighting the key moments for entering and exiting trades. It is designed for everyone: for beginners it gives clear guidelines, and for pros - flexibility for fine-tuning.

Vega mechanics: how your market compass works

Vega is not just an algorithm, but a system that teaches you to understand the market through three main indicators. It does not throw you into a maelstrom of signals, but explains their logic, turning trading into a meaningful process.

Market Boundaries: Bollinger Bands

The first reference point is the Bollinger Bands on the 30-minute timeframe (M30). This indicator is based on a moving average and reflects the volatility of the market. The bands show where the price deviates from the norm:

- At the upper boundary: the asset may be overvalued - time to think about selling or pause.

- At the lower boundary: possible undervaluation - a signal to buy.

For beginners, it is like a ruler in school: it helps to see when the market has over-accelerated or, on the contrary, has quieted down, protecting from impulsive decisions.

Trend Strength: ADX

The next indicator is ADX (Average Directional Index) on the 15-minute timeframe (M15). It measures the strength of the trend, helping you understand whether you should enter a trade:

- ADX above 40: strong trend - you can act.

- ADX below 20: the market is sluggish, better to wait.

ADX is your filter: it cuts out the noise and tells you when the movement is really serious.

Controlling momentum: RSI

The Relative Strength Index (RSI) on M15 measures how overheated or cold an asset is:

- RSI < 30: the market is oversold - wait for an upward reversal and get ready to buy.

- RSI > 70: overbought - a downturn is possible, a sell signal.

RSI adds depth: you see not just price jumps, but their energy, which is especially useful for those who are just learning to read charts.

Trend on the radar: Parabolic SAR

A special feature of Vega is the use of Parabolic SAR (Stop And Reverse). This indicator tracks the direction of movement: points below the price signal a rise, points above the price signal a fall. Vega uses SAR on two timeframes.

M5: to accurately enter a trade, confirming the signals of other indicators:

M30: to exit, fixing the end of the local trend:

SAR is your navigator: it helps you not only to catch a wave, but also to get off it in time.

Security and flexibility

Vega takes care of your capital. To lock in profits, it monitors the crossing of Parabolic SAR points: a change of direction is a reason to close a position. If the market fluctuates, an averaging grid based on RSI and Bollinger Bands is activated. It allows you to buy assets on drawdowns, reducing the average price of the position. This is like insurance for beginners who are not yet used to the sharp turns of the crypto market.

The strategy works with most assets. The default leverage is x8 - a balance between profitability and risk, where the deposit and margin remain in a 1:1 ratio. But you can customize it to suit you. For example: x3 for more cautious trading or x10 for aggressive trading. Vega grows with you, adapting to your style.

An important point: asset selection is critical. The liquidity, volatility and behavior of the coin directly affect the risks, especially when trading with leverage. Before you start, study the characteristics of the asset - this is your key to success.

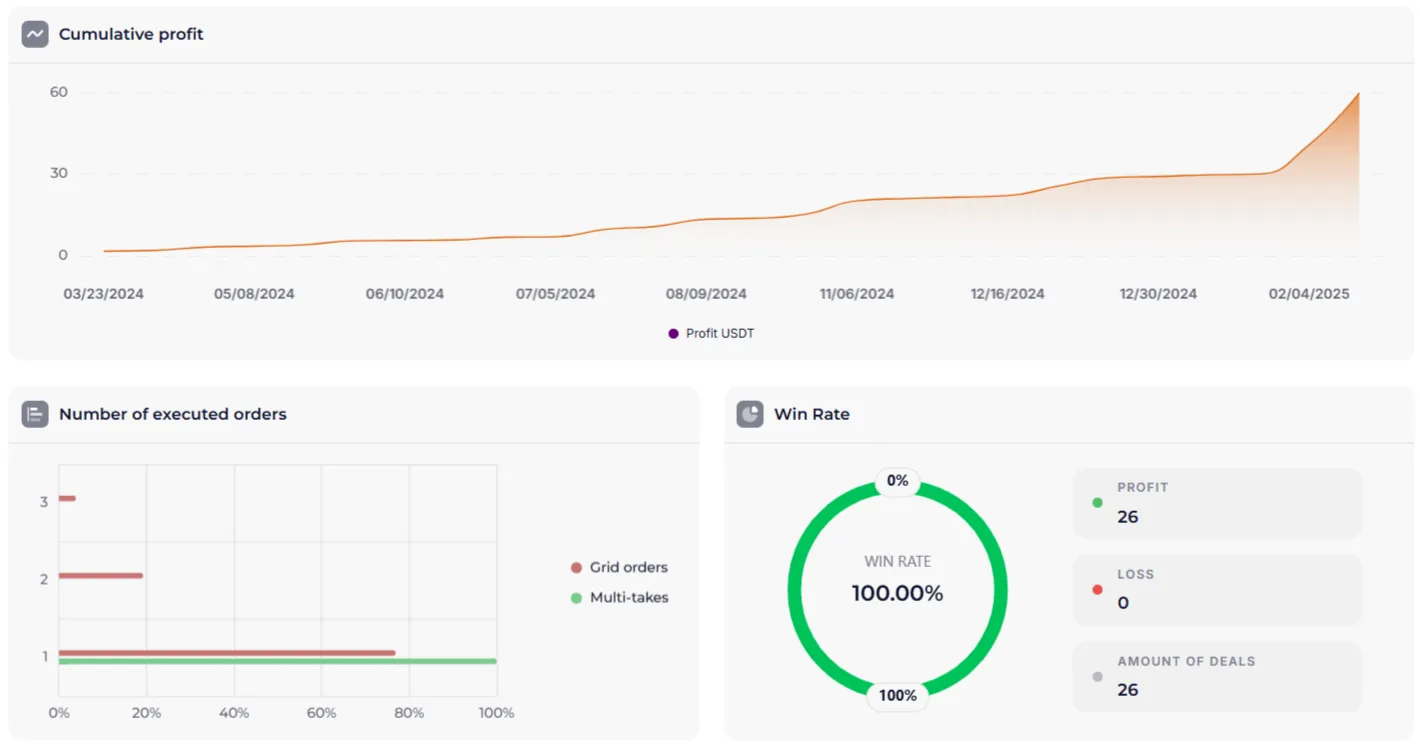

The numbers speak for themselves

Let’s see how Vega performed on backtests:

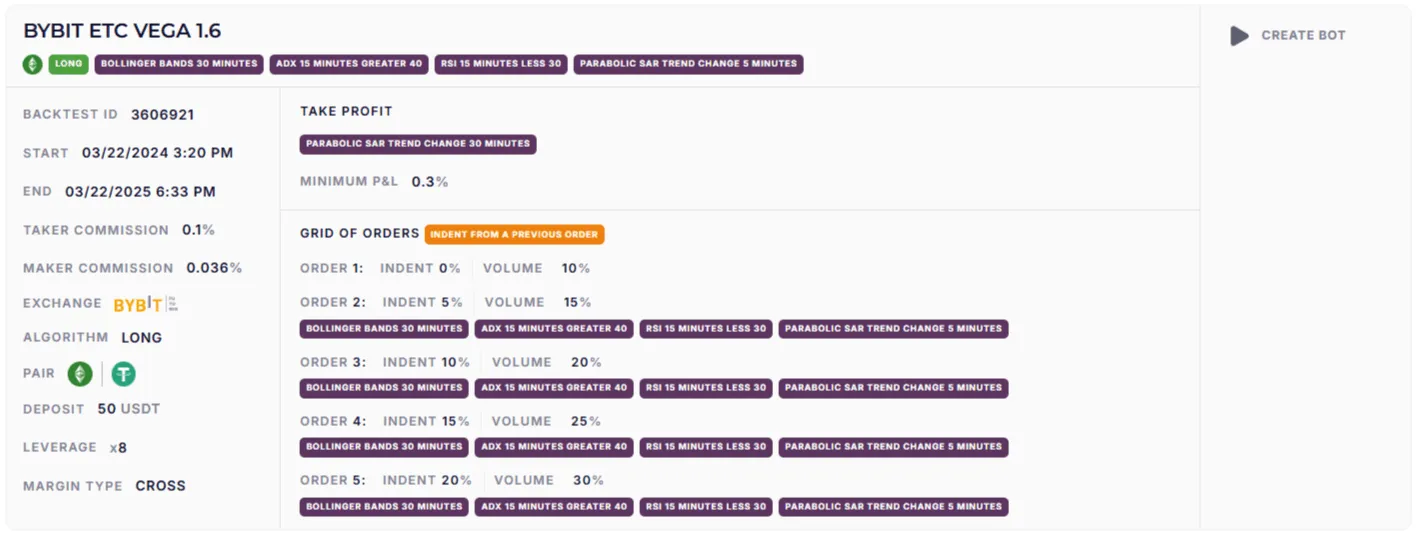

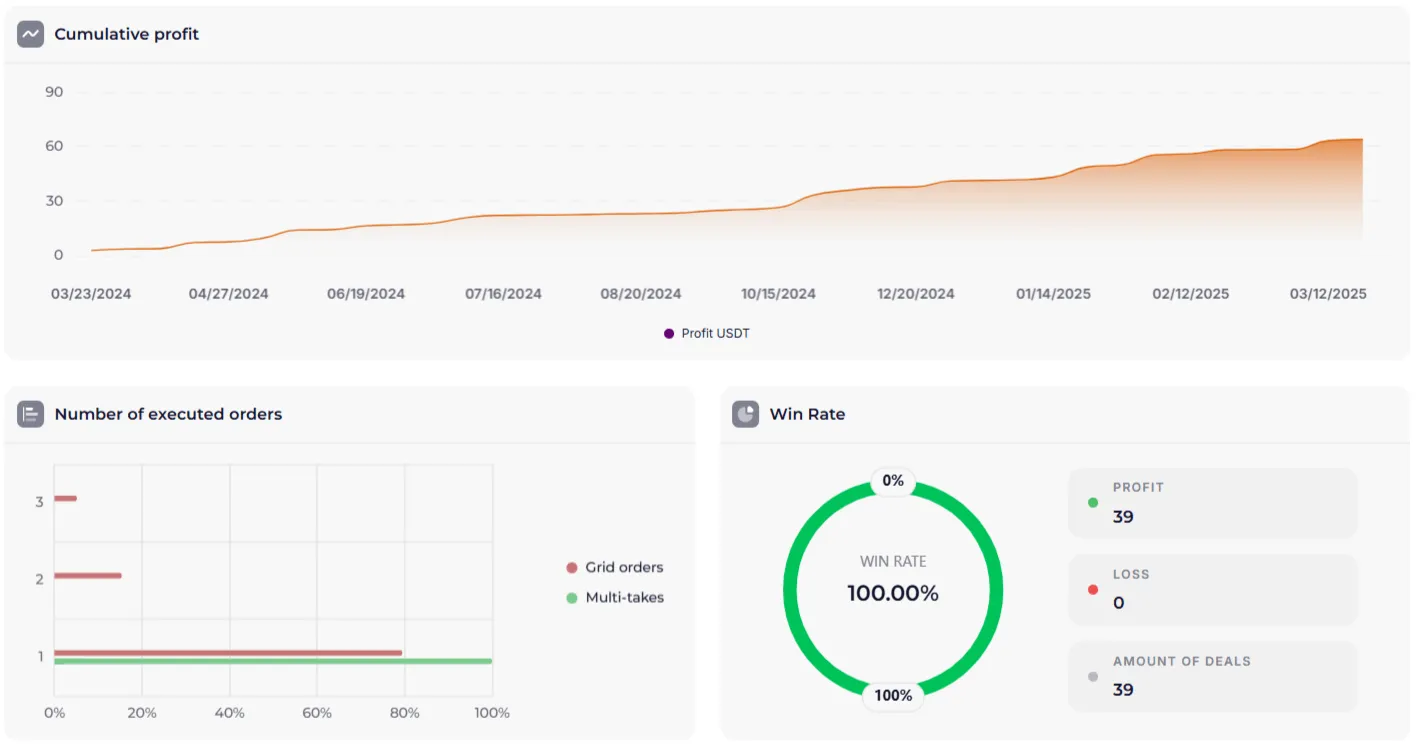

BYBIT ETC VEGA 1.6

https://veles.finance/share/WBjCv

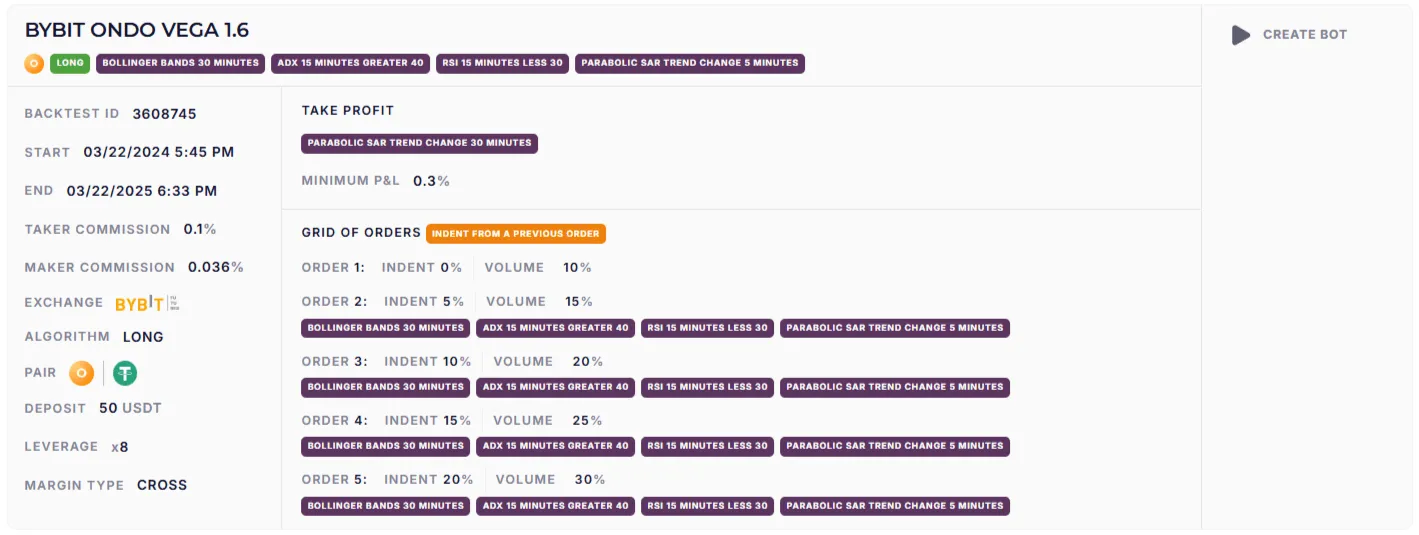

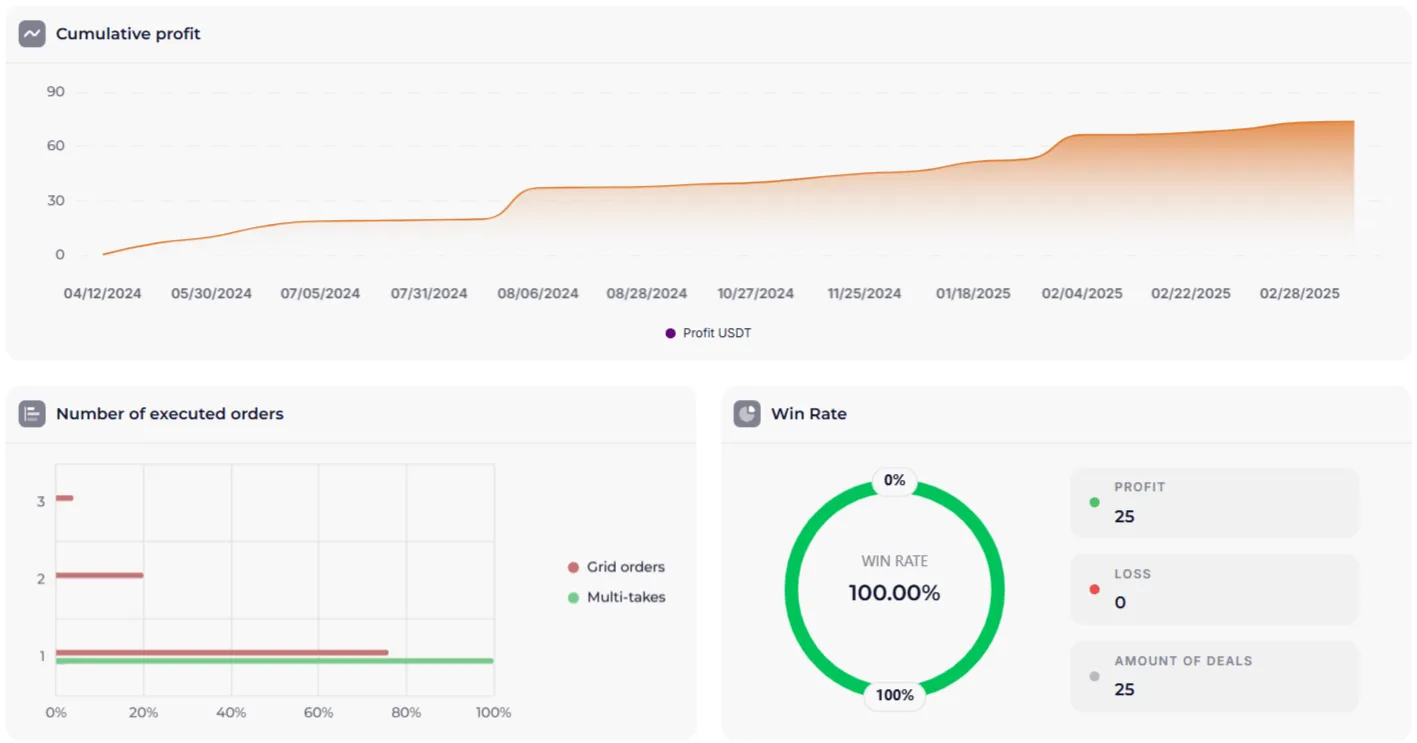

BYBIT ONDO VEGA 1.6

https://veles.finance/share/vNjkW

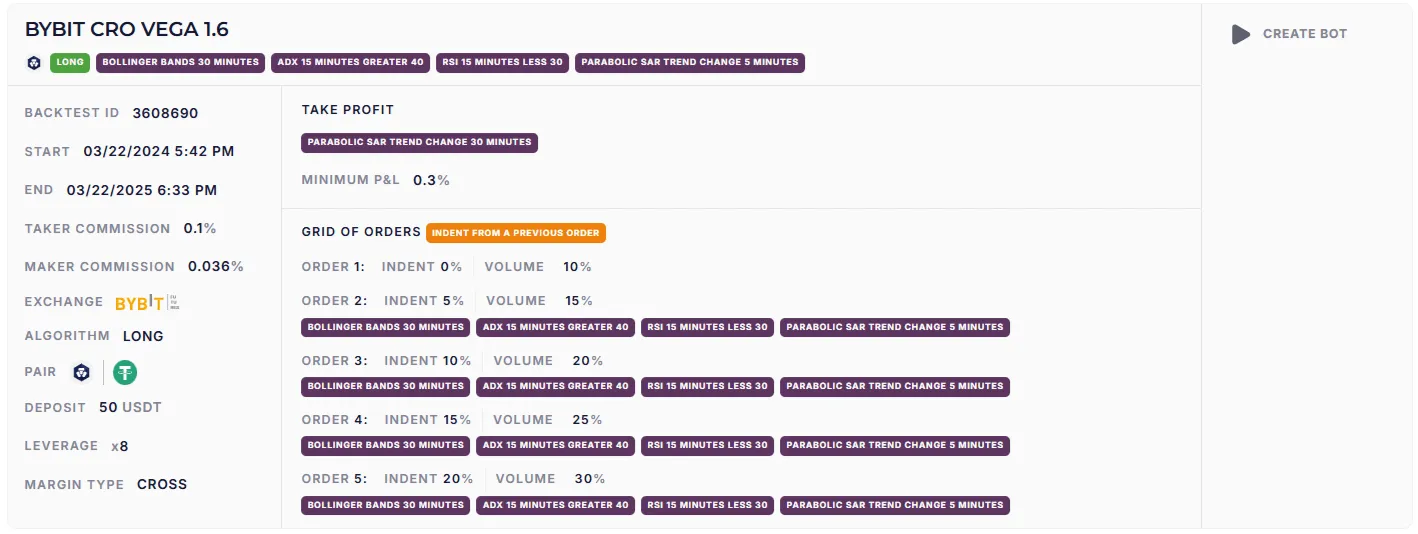

BYBIT CRO VEGA 1.6

https://veles.finance/share/szjPy

The market is fickle, so test Vega on your chosen assets before actually trading. The results depend on the conditions, but the strategy proves to be stable.

Master the market with Vega

Vega is more than an algorithm. It is your partner that turns complex charts into clear signals. It suits both beginners who need clear rules and experienced traders looking for flexibility. With it you don’t just trade - you begin to understand the market, its rhythms and opportunities.

Recommendations for starting out:

Manage risk: don’t allocate more than 1% of your deposit to a single bot.

Control volumes: use a limit on the number of bots in trades to avoid excessive risk.

Trust the system: follow the strategy and keep emotions in check.

Learn Vega from the backtests above or run new ones, customizing the strategy to suit your goals.

Want more ideas?

Check out our strategy articles - new horizons await you there:

Spot strategy «ELDER 2.0» and averaging by indicators

«Bomberman» strategy: arcade spirit in every deal

The path to success starts with understanding

Vega is not a magic “wealth” button, but a tool for those who value structure and analysis. It reminds you that success in trading is not luck, but the result of discipline and informed decisions. Regardless of experience, with Vega you will find your way among the stars of the cryptocurrency cosmos. Start small, test and grow - the market is waiting for those who are ready to understand it.