Verification on Binance - why is it necessary and how to pass it

The Binance cryptocurrency exchange is one of the largest platforms providing services for trading cryptocurrencies and more. To ensure the safety of its users and to comply with all international standards of financial regulation, the exchange requires identity verification (KYC). In this article we will look at what KYC is, why it is necessary, what documents you need to prepare and how to pass it step by step on Binance.

What is verification on crypto exchanges (KYC)?

KYC is a procedure to confirm the identity of a user. It is used by financial organizations and cryptocurrency exchanges to comply with all international security standards, implement anti-money laundering (AML) and stop financial crimes. On cryptocurrency exchanges, verification includes checking the documents provided by the user and comparing them with the data provided during registration. This allows exchanges to identify each client and track their financial activity.

To learn more about all aspects of the verification procedure on cryptocurrency exchanges, you can read the article published in our blog - KYC Verification for Cryptocurrencies: What is it and how to pass it?

What is KYC on Binance for?

1. Measures to comply with international regulations and regulatory requirements

Binance is required to comply with laws related to Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT). Many countries require financial organizations to identify users to prevent illegal transactions. KYC helps Binance meet these standards, allowing it to continue operating in multiple jurisdictions. Without customer identification, the exchange risks being blocked in certain countries or facing sanctions.

2. Increased security of the user’s account

KYC procedure protects user accounts from fraud. Identification makes it difficult for attackers to access your account. For example:

-

Even if a fraudster gets hold of your credentials, they cannot withdraw funds without identity verification.

-

A KYC-certified account is easier to recover in case of loss of access, as the exchange will be able to identify you from the documents provided.

3. Curbing fraud and financial crime

KYC helps the exchange to detect suspicious transactions such as:

-

Use of stolen or fake documents.

-

Attempts to launder money through cryptocurrency transfers.

-

Making transactions from banned accounts.

By doing so, Binance reduces the risks associated with illegal activities and builds its reputation as a trustworthy platform.

4. Access to full exchange functionality

Passing KYC gives the user access to the full functionality of Binance. Without verification, the account remains restricted, namely:

-

Deposit and withdrawal limits. Non-verified users can deposit funds, but withdrawal limits will be severely restricted.

-

Access to P2P trading. Only users with a verified identity can buy and sell cryptocurrency directly through Binance’s P2P platform.

-

Participation in staking, lending, and other programs. Some Binance features, such as steaking or participation in lunchepads (ICOs), require KYC.

5. Increased transaction limits

Passing KYC allows users to utilize higher deposit and withdrawal limits. For example, an unidentified user may face a limit on cryptocurrency withdrawals, whereas after passing verification, these limits increase to several tens of thousands of dollars per day.

6. Increasing trust in the platform

KYC procedure promotes the formation of a trusting relationship between the exchange and users. Customers see that Binance takes measures to protect their data and complies with all international regulations and laws. This is especially important for those who work with large sums of money and are looking for a safe platform for cryptocurrency trading.

7. Adapting to the local requirements of different countries

Many countries have their own specific verification requirements. Binance uses KYC to adapt to the laws of most countries around the world. This allows the exchange to operate in different regions, allowing users to access services legally.

What documents are required for verification on Binance?

In order to pass KYC on Binance you will need the following documents:

-

Passport, driver’s license or other government-issued ID.

-

Selfies or a photograph of your face.

-

Proof of actual residential address, you will need - utility bills, bank statements or other documents that will prove your residential address.

Documents should be in good quality, without glare or damage. Please note that the language of the documents should correspond to the country specified at registration.

How to verify on Binance: step-by-step instructions

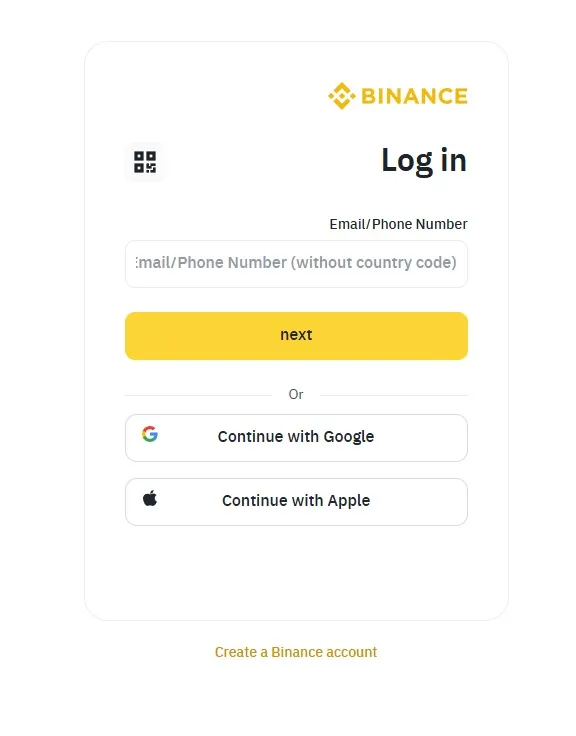

Step 1. Authorization on Binance

-

Go to the official website of Binance exchange or mobile application.

-

Authorize using your account. If you don’t have an account yet, sign up (provide your email/phone number and password code).

Step 2: Start the verification process

-

After logging into your account, go to the “Identification” section (in the web version it’s the button in the top right corner, in the app - in the “Profile” section).

-

Select the “Verify” option and specify the verification level Standard.

Step 3: Filling in your personal data

-

Enter your full name, residential address and date of birth.

-

Make sure that the data matches the data specified in your document.

Step 4. Upload document

-

Choose one of the document types (passport or driver’s license).

-

Upload a photo or scan of the front and back of your document.

Step 5. Confirm your identity through selfies

-

Use your device’s camera to take selfies.

-

Make sure your face is clearly visible and there are no foreign objects such as glasses or hats.

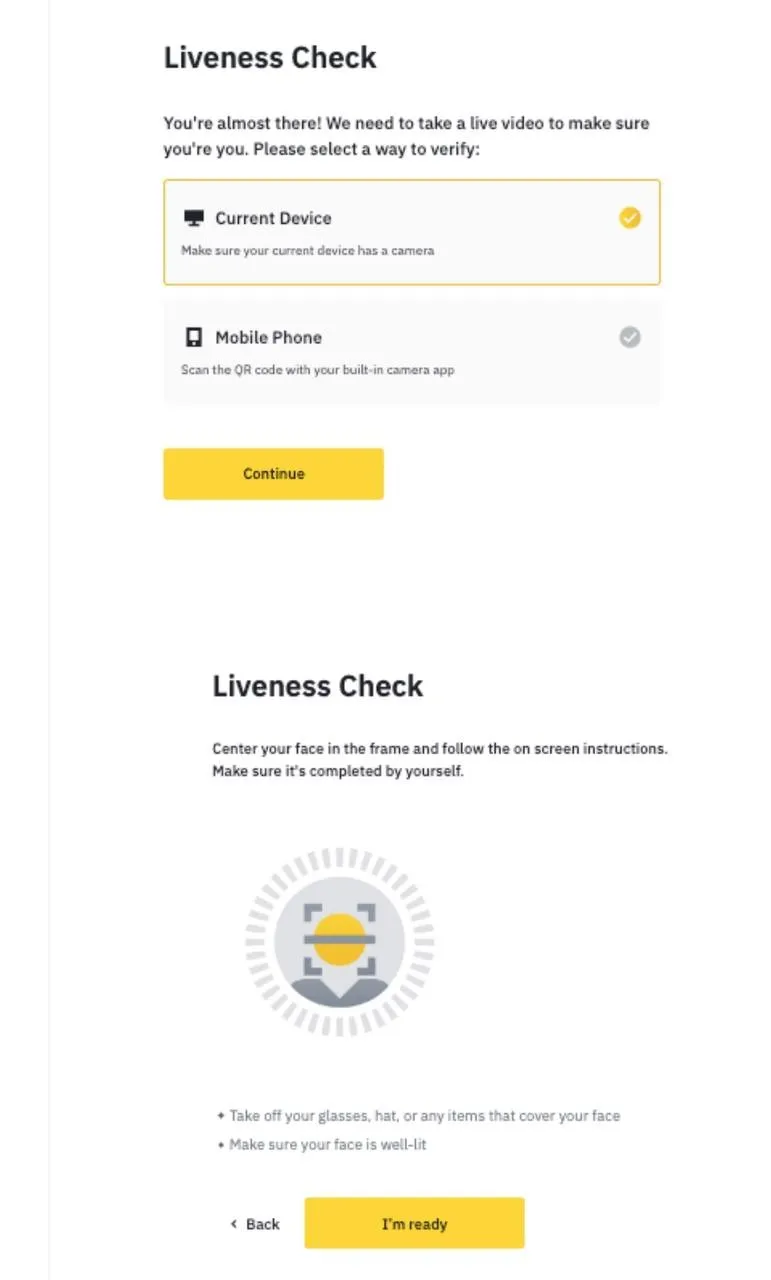

Step 6: Biometric Verification

-

In some cases, the system will ask you to perform a biometric verification.

-

Follow the on-screen instructions - turn your head so that the system recognizes your identity.

Step 7: Waiting for the result

After submitting your documents, the system will start verifying them. The process usually takes from a few minutes to 24 hours. You can find out about the verification status in the “Identification” section of your profile, and you will also receive a notification with the result from the app on your phone.

Conclusion

Having verification on Binance is a necessary aspect for every user, which ensures security and provides access to all the features of the platform. By following these step-by-step instructions, you will easily be able to successfully complete the KYC process and start using the full functionality of the exchange - increased limits, P2P trading and advanced withdrawal functions.

FAQ

1. Can I use Binance without verification?

Yes, but not all the functionality. You will not be able to deposit and withdraw funds or access P2P trading.

2. How long does it take to verify my documents?

As a rule, checks take from a few minutes to 24 hours. In rare cases the process can take up to several days, it depends on the level of workload of the platform.

3. What should I do if my documents are not verified?

Make sure your photos are clear and your profile information matches the documents. Try resubmitting them.

4. Do I need verification to deposit and withdraw cryptocurrencies?

Yes, verification is required for any financial transactions on Binance.

5. Which countries does Binance support for verification?

Binance supports most countries, but some jurisdictions may have additional requirements or restrictions.