What Is HODL in Cryptocurrency? Meaning and Investment Strategy

HODL strategy has firmly entered the lives of many crypto-enthusiasts .This term originated in the crypto community as a meme, but later became a full-fledged investment strategy. The basic idea behind HODL is not to panic when prices fall or try to play on market fluctuations, but to hold assets in anticipation of future growth.

Origin of HODL

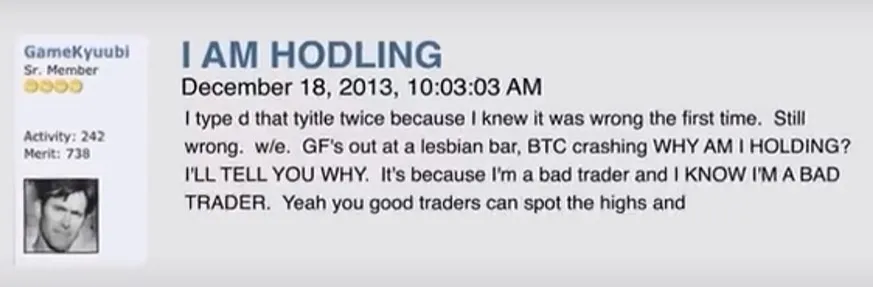

The term HODL originated in 2013 on the BitcoinTalk forum when a user posted a message titled “I AM HODLING”, misspelling the word “holding”. The post quickly became a meme, and the word “HODL” became synonymous with a long-term cryptocurrency investment strategy. The term later came to stand for “Hold On for Dear Life,” which reflects the essence of the strategy - to hold assets despite market fluctuations.

HODL strategy

The HODL strategy involves buying cryptocurrency and holding it for a long period of time, usually several years.

- Principles of HODL strategy

The HODL strategy is based on a few key principles:

-

Long-term investing - buying an asset with an eye toward years, not months or days.

-

Ignoring short-term volatility - even if the price falls sharply, the investor does not sell the asset.

-

Refusal from speculation and trading - does not try to guess market fluctuations and make frequent transactions.

-

Fundamental analysis of assets - choosing cryptocurrencies with good prospects rather than random tokens.

- How to apply the HODL strategy correctly

1. Choosing reliable assets

HODL works best with cryptocurrencies that have strong fundamentals:

-

Bitcoin (BTC) - the most reliable cryptocurrency.

-

Ethereum (ETH) is the largest smart contract network.

-

Other top altcoins if they have long-term prospects and utility.

Risks: Don’t invest in little-known tokens without a proven track record.

2. Portfolio diversification

You should not invest all your funds in one asset. It is better to distribute investments among several reliable cryptocurrencies.

3. using cold wallets

For safe storage of cryptocurrency it is better to use:

-

Hardware wallets (Ledger, Trezor).

-

Software wallets with a private key (Metamask, Trust Wallet).

-

Cold storage (unplugged wallets).

4. Regular buying (DCA - Dollar-Cost Averaging)

To reduce the risks of entering the market at a high price, you can buy the asset in small installments at regular intervals (once a week, month, etc.).

5. Ignoring market noise

The cryptocurrency market is subject to strong fluctuations. To avoid giving in to emotions, it is better not to look at the price on a daily basis, initially have specific profit and loss exit points.

HODL or cryptocurrency trading

Who HODL is suitable for:

-

Beginners who don’t want to get into trading.

-

Investors with a long-term view of the market.

-

Those who want to minimize stress and risk of mistakes.

Pros of trading:

-

Fast profits - you can make money on a daily basis.

-

Flexibility - the ability to adapt to changing market conditions.

-

Use of margin trading - allows you to earn even on a market downturn.

Minuses of trading:

-

High risks - most traders lose money due to mistakes.

-

Stress and emotional pressure - constant price fluctuations can cause nervous tension.

-

Need for training and experience - without market knowledge, trading can lead to losses.

-

Commissions - frequent trades require the payment of commissions on the stock exchange.

Who trading is suitable for:

-

Those who are willing to spend time analyzing the market and learning.

-

Those who can control emotions.

-

Those who want to make money on short-term price movements.

What to choose: HODL or trading:

Choose HODL if:

-

You don’t want to spend a lot of time in the market.

-

You are new to cryptocurrency and don’t know much about trading.

-

You are willing to invest for the long term.

-

You are not concerned about short-term price drops.

Choose trading if:

-

You want to make quick profits.

-

You are willing to study the market and develop analyzing skills.

-

You can handle stress and make quick decisions.

-

You have capital for trading and a high tolerance for risk.

Combined approach:

Some investors use a blended strategy:

-

80% of funds in HODL (BTC, ETH, other promising assets)

-

20% of funds - into trading for short-term profits.

This approach allows you to combine the reliability of long-term investing with the opportunity to make money on short-term market movements.

How to choose a token for HODL strategy

Choosing a cryptocurrency for long-term storage is an important step in the strategy. The main criteria are:

1. Fundamental analysis of the project

Before investing in a token, it is necessary to study the main characteristics of the project.

1.1 The idea and goals of the project

It is important to understand what problem the project solves and what its uniqueness is. It is worth asking a few questions:

-

What benefit does the token bring

-

Whether the project has real use cases

-

How much demand there is for the technology or service it offers

The more significant the problem the project solves, the higher its chances of survival in the long term.

1.2 Project team

The success of a cryptocurrency project largely depends on its creators. One needs to study:

-

Who is behind the project (are they well-known personalities, do they have successful startups in the past)

-

Whether the team has experience in the blockchain industry

-

Are they open to communication, do they have public activities

Proven projects usually have an active team that regularly shares updates with the community.

1.3 White Paper (Whitepaper)

A Whitepaper is a technical document that details the concept of the project. A good project should clearly explain:

-

How the blockchain or platform works.

-

How tokens are distributed.

-

What the project’s vision for the future is.

If there are no specifics in the Whitepaper, but only general phrases - this is a worrying sign.

1.4 Partnerships and Support

If the project cooperates with large companies, exchanges and funds, it increases its reliability. For example, tokens backed by giants such as Binance, Coinbase or Google are more trustworthy.

2. Tokenomics and coin distribution

2.1 Limited or inflationary issuance

-

Cryptocurrencies with limited issuance (e.g. Bitcoin, Litecoin) have more value in the long run because their quantity is limited.

-

Inflationary tokens (e.g. Dogecoin) do not have a limited supply, which can cause their value to decrease due to the constant issuance of new coins.

2.2 How tokens are distributed

It is necessary to examine who owns the majority of the tokens:

-

If a large share is held by developers or venture capital funds, they may sell assets and crash the price.

-

A good sign is an even distribution of tokens among users and investors.

2.3 Practical value of a token

-

What functions does the token fulfill

-

Whether it is used in the project ecosystem (e.g., for staking, payments, voting)

-

Does the token have a real use other than speculation on the stock exchange?

If the token is only needed for speculation, its value may quickly disappear.

3. technical analysis and market indicators

3.1 Market capitalization

-

Large cryptocurrencies (Bitcoin, Ethereum, BNB) are more reliable, but their growth can be slow.

-

Mid-capitalization tokens have growth potential but carry more risks.

-

Small projects (little-known altcoins) can grow dozens of times, but the risk of losing funds is extremely high.

3.2 Liquidity

Liquid tokens are easier to buy and sell. If a coin has a low daily trading volume, it may indicate weak investor interest.

3.3 Where the token is traded

If the cryptocurrency is listed on major exchanges (Binance, Bybit, OKX, HTX, Gate. io, BingX), this increases trust. If the token is only traded on obscure exchanges, it could be a sign of fraud.

4. Community and project support

4.1 Social networks and user activity

Good projects have an active community on Twitter, Telegram, Discord and other platforms. It’s worth checking:

-

How actively the project publishes updates.

-

Whether there is a live discussion among users.

-

How the community reacts to news (real investors or bots).

4.2 Ecosystem development

Projects with a strong ecosystem have a better chance of success. For example, Ethereum supports thousands of applications, which makes it in demand in the long run.

5. Security and Risks

5.1 Project history

If a project has already survived several crises, its resilience is higher. For example, Bitcoin and Ethereum have gone through many market crashes but continued to grow.

5.2 Vulnerabilities to cyberattacks

-

Does the project have a history of hacks and hacker attacks

-

Are security audits conducted regularly

-

What protection is used for the blockchain and wallets

If a project does not perform audits or has already been hacked, the risk of holding such assets increases.

Advantages and disadvantages of HODL

Advantages of HODL:

1. Simplicity of the strategy

HODL is one of the simplest cryptocurrency investing strategies. An investor does not need to monitor market fluctuations on a daily basis, analyze charts or develop complex trading strategies. It is enough to buy a promising asset and hold it for a long time.

2. Less stress

Short-term trading requires constant attention to the market and quick decisions, which can be psychologically exhausting. With HODL investing, there is no need to check the price daily and react to every market movement.

3- Minimal transaction costs

Frequent trading involves paying commissions to exchanges for each trade. With the HODL strategy, minimal transactions are made, which reduces commission costs and increases net profits.

4. historically high returns

Using Bitcoin and Ethereum as examples, we can see that cryptocurrencies show significant growth over the long term. Investors who have held BTC since the 2010s have realized thousands of percent returns.

5. The compound interest effect (staking, DeFi)

Some cryptocurrencies allow passive income through steaking or participation in DeFi protocols. This means that HODL investors can not only preserve assets but also multiply them.

6. Minimizing the influence of emotions

Traders often make mistakes due to emotions, such as selling an asset at the bottom of the market due to panic. HODL helps to avoid emotional trading as the strategy is based on a long-term view.

7. Opportunity to take advantage of tax benefits

In some countries, long-term holding of assets is taxed less than short-term trading. This allows HODL investors to reduce their tax burden.

8. Support decentralization

The more users follow a HODL strategy, the less vulnerable cryptocurrencies are to market manipulation. This strengthens the network and promotes decentralized finance.

Disadvantages of HODL:

1. Long waiting period for profits

HODL is suitable for patient investors. Unlike traders who can make profits on a daily basis, HODL investors must be willing to wait several years for their assets to grow significantly in value.

2. The possibility of missing out on short-term profits

Short-term traders can capitalize on volatility by buying cheap and selling expensive. HODL investors miss these opportunities and may lose out on potential profits.

3. The risk of choosing the wrong asset

Not all cryptocurrencies grow in the long term. Many projects lose relevance over time and some disappear altogether. If an investor chooses the wrong asset, he or she may lose the money invested.

4. Lack of flexibility

HODL investors cannot quickly adapt to market changes. If there is a collapse of the crypto market or a new, more promising project appears, HODL investors may miss the opportunity to reinvest.

5. Possibility of severe capital drawdowns

The cryptocurrency market is very volatile. Investors can see their asset values drop by 50-80% during a bear market. While cryptocurrencies have historically recovered, there is no guarantee that this will happen again.

6. Lack of protection against market manipulation

Large players can artificially inflate the price of an asset (pump and dump) and then crash the market. Traders can exit the position in time, but HODL investors have to wait for the price to recover, which can take years.

7. Loss of access to funds

If an investor stores cryptocurrency in a private wallet and loses the private key or seed phrase, access to the assets cannot be regained. Unlike traditional financial instruments, cryptocurrencies have no backing from banks or regulators.

8. Regulatory risks

The cryptocurrency market remains relatively young and is subject to regulatory changes. Bans on trading or taxation of cryptocurrencies may affect HODL’s long-term strategy.

Conclusion

HODL is one of the most popular strategies among crypto investors to minimize the impact of market volatility. Although it requires patience and endurance, historically, long-term asset holding has yielded significant returns.

As Binance exchange founder, Changpeng Zhao (CZ) said, “If you can’t hold, you’ll never get rich.”

However, it is important to choose assets wisely, diversify your portfolio and consider possible risks.

FAQ

1. What is HODL and its origin?

HODL is a strategy for long-term storage of cryptocurrencies. The term appeared in 2013 due to a typo on the BitcoinTalk forum and became popular among investors.

2. How long to hold cryptocurrency for when HODL?

Typically, investors hold assets for several years, expecting significant growth, but this period can be shorter or longer, depending on their goals.

3. Which cryptocurrencies to choose for HODL?

Preference is given to proven assets such as Bitcoin, Ethereum and other projects that have managed to take their firm positions in the market.

4. What risks are associated with HODL?

The main risks are market volatility, possible regulatory changes and technological issues.

5. Can HODL be combined with other strategies?

Yes, HODL can be combined with trading, staking or pharming to increase returns.