Who is a hodler in cryptocurrency

The world of cryptocurrencies is full of its own terms, strategies, and approaches to investing. One of the most iconic and interesting terms among traders and investors is hodler. If you are just starting out and want to understand who a hodler is in crypto, how the HODL strategy itself works, how it differs from active trading, and why it is important to know these concepts right now, on the eve of altseason 2025, then this article is for you.

HODL as a strategy

The word HODL is one of the cult terms in the crypto community. If you are thinking about long-term investing, it is important to understand what HODL means.

HODL literally translates as “to hold,” but the word itself appeared due to a typo. In 2013, a user on the Bitcointalk forum wrote a post saying “I AM HODLING” instead of “I am holding” at a time when the price of Bitcoin was falling. Since then, the expression has become a meme and later a full-fledged strategy.

Everyone familiar with the history of the crypto market knows where the expression hodl came from. Yes, it was born out of a joke, but it has become a whole philosophy for crypto investors. Holding means buying cryptocurrency and keeping it despite price fluctuations and manipulation. This approach is ideal for those who believe in long-term asset growth and do not want to engage in active trading.

In highly volatile conditions, such as in the run-up to alt season 2025, the hodl strategy can be one of the most reliable strategies. However, it is important to remember that the market is unpredictable, so before investing, it is worth studying the risks and assessing your goals.

Cryptocurrency trading strategies for beginners

Although HODL is suitable for many, not all investors want to simply hold assets. There are several popular strategies that can be combined with hodl.

- Trading on reversals is a strategy in which traders catch moments of trend reversal. It requires a deep understanding of charts, analysis of indicators, and the ability to identify support and resistance levels.

- Long-term investing (hodl) involves buying promising assets and holding them for months or years, regardless of short-term fluctuations.

- Scalping is a strategy for those who are ready to make dozens of trades a day, profiting from minimal price changes.

- Automatic trading with bots is an approach that saves time and reduces emotional stress. For example, Veles trading bots allow you to customize individual algorithms and analyze the market without being physically present and without unnecessary effort, and with a $5 bonus for your first registration, you can start without any investment at all.

It is important to understand that each strategy requires a different level of knowledge and experience. If you are a beginner, it is best to start with the less risky hodl strategy and gradually learn active trading, relying on analytics and expert assistance.

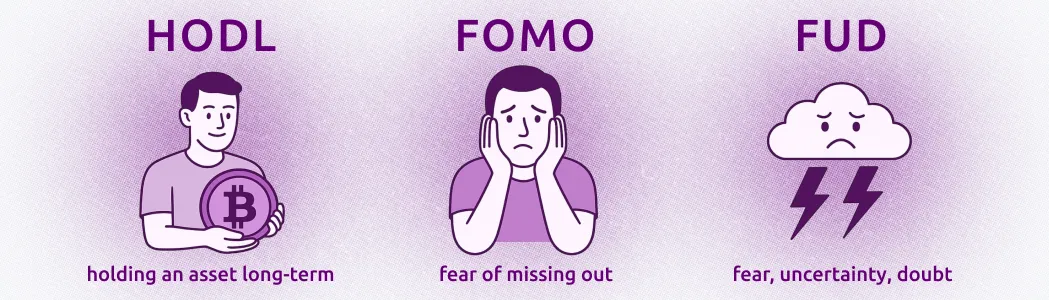

HODL, FOMO, FUD — crypto trader’s dictionary

For a beginner in crypto, understanding specific terminology may not be the most important thing, but it will definitely be part of learning about the crypto market and yourself as a whole. Traders often use expressions such as HODL, FOMO, and FUD, each of which reflects a certain approach or psychological state of the investor.

HODL is a term that, as we have already discovered, has long been a symbol of long-term investment in cryptocurrency. The essence of the strategy itself is simple: hold on to your assets despite temporary market fluctuations, without selling them when prices fall. In the context of investing, hodl means believing in the long-term growth of digital assets and being able to calmly endure the volatility that is inherent in the market. The HODL strategy helps beginners avoid panic selling when prices fall and, at the same time, take advantage of future growth.

Another term is FOMO, which stands for Fear of Missing Out.

In crypto trading, this phenomenon occurs when investors buy assets at their peak, fearing that they will miss out on potential growth. Emotional decisions caused by FOMO often lead to the purchase of cryptocurrency at an inflated price, which increases the risk of losses during a subsequent correction. Awareness of this unfavorable state helps traders keep themselves in check, resist mass panic, and make decisions based on analysis rather than emotions.

FUD is an acronym for Fear, Uncertainty, Doubt. This term describes the impact of negative news, rumors, or unfounded predictions on the market. When FUD spreads, many investors sell their assets, even if the project’s fundamentals remain strong. Understanding that emotions often prevail in the market allows you to assess the situation calmly and not take hasty actions.

Together, knowledge of these terms helps beginners form a competent attitude towards cryptocurrency. The HODLstrategy allows you to build long-term investments, and understanding FOMO and FUD helps you work with psychology — not to give in to panic and not to make rash trades.

For beginners, it is important to combine this knowledge with practical tools such as chart analysis, project research, and the ability to seek help from experts. For example, at Veles, you can get free individual consultation on setting up bots, which will help you use strategies correctly, minimize emotional mistakes, and navigate the market with confidence.

FAQ

1. Who is a hodler in crypto?

A hodler is an investor who buys cryptocurrency and holds it for a long time, regardless of short-term price fluctuations.

2. What does hodl mean?

HODL is a long-term asset storage strategy that emerged thanks to a typo in a 2013 post and became a meme among cryptocurrency traders/investors.

3. What does it mean to hodl cryptocurrency?

Hodling means not selling cryptocurrency, even if the price temporarily drops, in anticipation of long-term growth.

4. How to choose a cryptocurrency trading strategy?

It all depends on your goals. For beginners, the hodl strategy is often recommended, while for experienced traders, reversal trading, scalping, or the use of trading bots are suitable.

5. How to start investing in the 2025 altseason?

It is best to start by studying the market and consulting with experts. At Veles, you can get a free consultation, a bonus upon registration, and access to proven trading bots that will help you automate your strategy.