Spot and futures trading

Create bots in both spot and futures markets

Platform statistics

$ 79 743 086

User profit

47 349 316

Cycles closed

$ 418 429 395

Total deposit of bots

Use Fast-API and connect to exchanges in just a few seconds - start earning money with Veles

Spot and futures trading

Create bots in both spot and futures markets

Risk management

Controls risk and profitability with tools: Stop-Loss to Breakeven, Multi-Takes, Trailing Take Profit

Flexible customisation

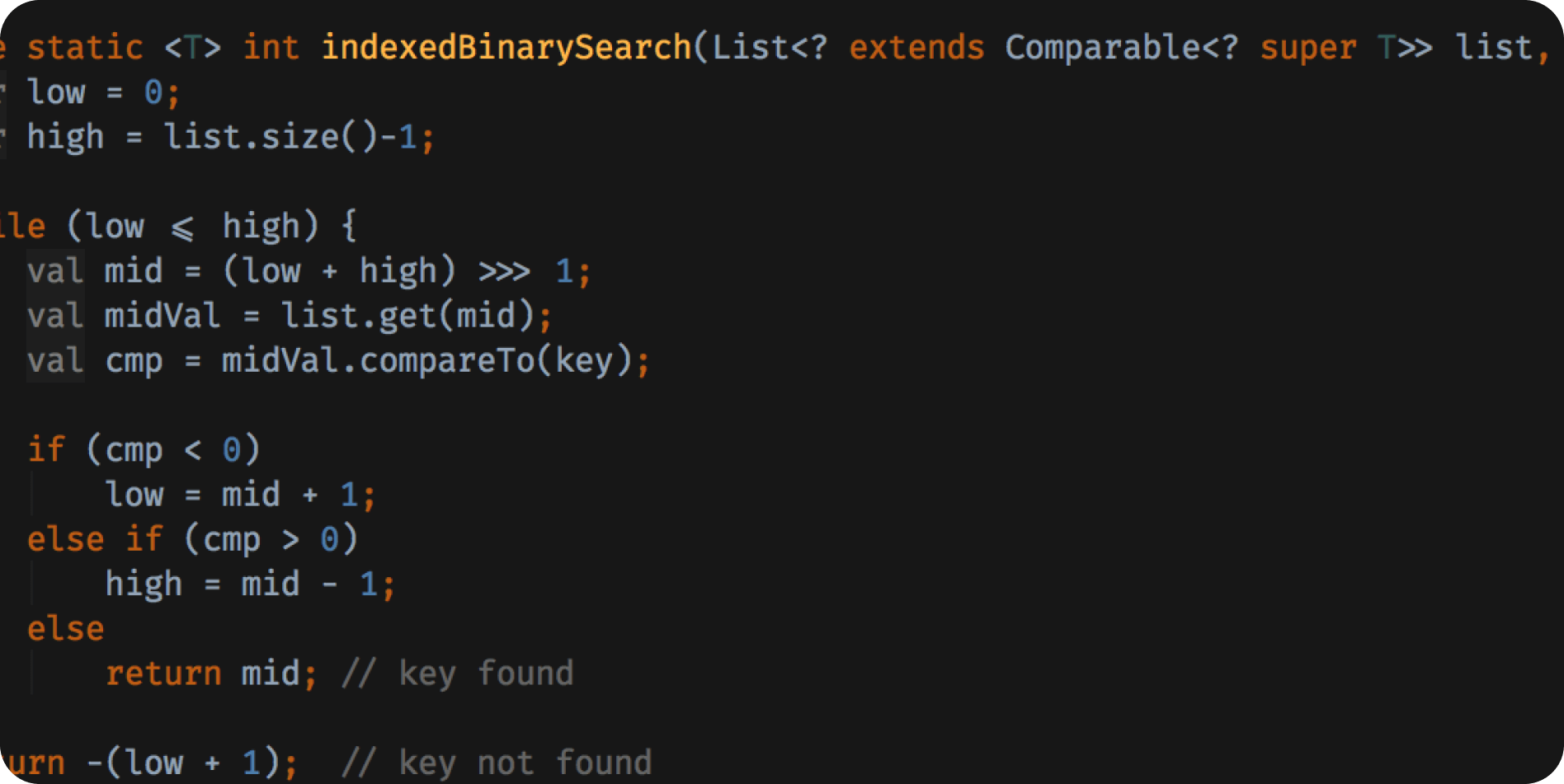

Use and combine different indicators (CCI, MFI, RSI, Bollinger, TradingView signals) for quality trading in any market movement

Monitors the process 24/7

Limits the maximum number of bots running simultaneously to protect your funds

Marketplace

Copy trading strategies and signals of experienced traders

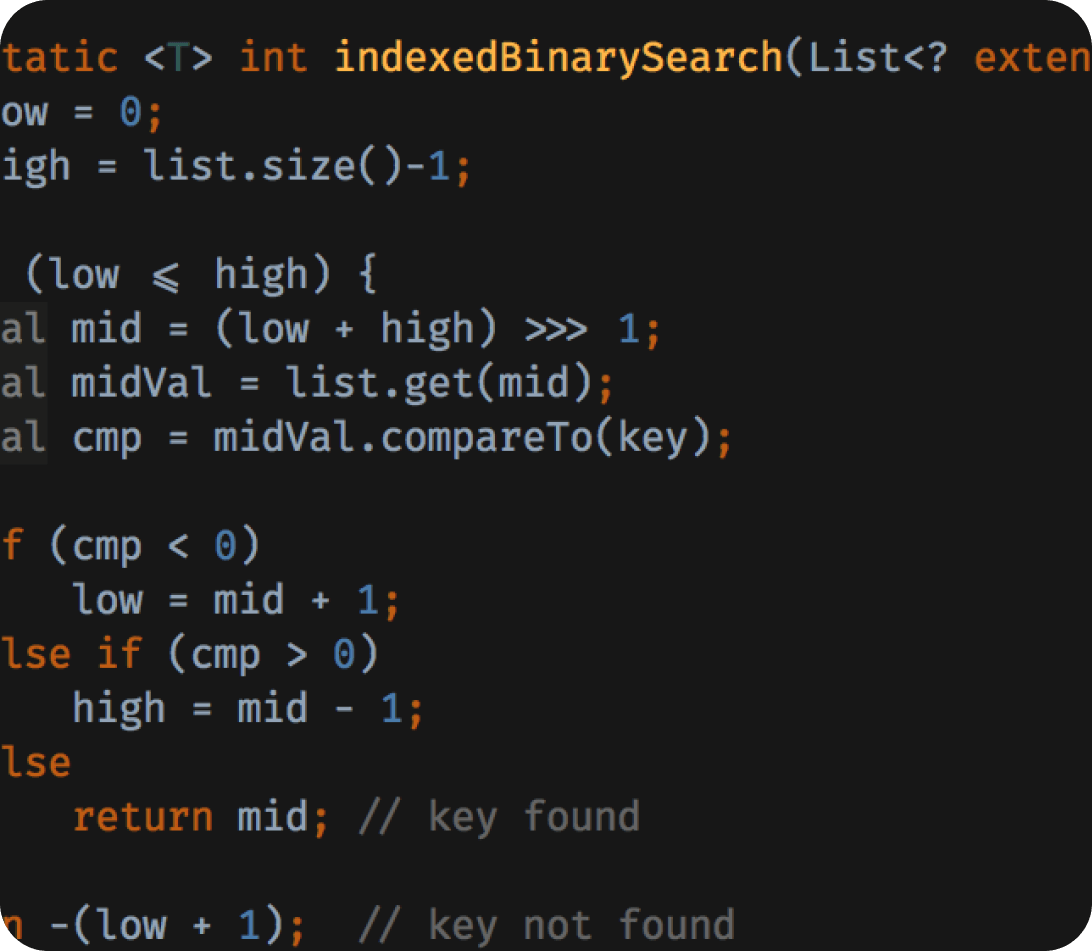

Analyze trades and find profitable results with professional trading strategy testing tool based on historical data

Identify potential pitfalls and weaknesses in your trading strategies

Test your strategies with Veles and avoid the long statistics gathering phase

Analyze your potential profit and loss and optimize your trading bot settings

We take 20% commission from the profit you get while trading with the bot, but not more than $50 per calendar month

Earn 30% of the revenue generated by users you invite.

Your income from a single referral can reach $15 per month

Register using our links and get maximum bonuses from exchanges

F.A.Q

Nothing is clear?

Then sign up for the free Veles consultation!

Media about us