How Compound Interest Turns Small Sums into Capital

You are used to thinking linearly. That’s normal. Evolution taught us: take ten steps, move ten meters. Work a shift, get a fixed payment. Our brain handles simple addition perfectly but struggles with exponentials.

Albert Einstein called compound interest the eighth wonder of the world, and not just for a catchy quote. It is the only force in the financial universe capable of turning modest savings into a fortune that allows you to never work again.

The Math That Breaks Your Brain

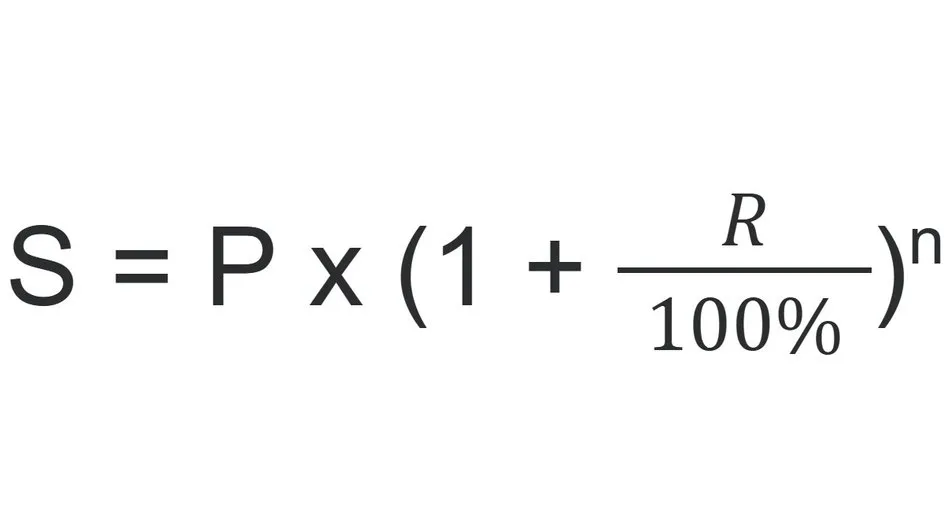

The essence of compound interest is simple: profit generates new profit. Yesterday’s income becomes today’s working capital. Sounds banal? Let’s look at the formula, but don’t be scared:

There is one hidden lever in this equation — the variable n. This is the reinvestment frequency. In a bank, n is fixed at 12 times a year. In trading, you control this variable yourself. The more often you update the bot settings (adding profit to the deposit), the faster the spiral spins. You can do this every day (n=365), but once a week is enough to maintain peace of mind.

Let’s simulate a situation. Imagine you have $10,000. You launch a bot on Veles with conservative settings, aiming for 5% monthly profit.

Let’s consider two paths:

- The Rentier Path (Simple Interest). Every month you withdraw profit ($500) and spend it on restaurants or bills. The deposit body does not change.

- The Capitalist Path (Compound Interest). You don’t touch the profit. Every penny earned is added to the bot’s deposit body.

The difference over a short distance is almost invisible. But look at what happens over a three-year horizon.

| Period (Month) | Rentier Path (profit withdrawal) | Capitalist Path (reinvest) | Capital Difference |

|---|---|---|---|

| Start | $10,000 | $10,000 | $0 |

| 6 months | $13,000 (total) | $13,400 | +$400 |

| 12 months | $16,000 (total) | $17,958 | +$1,958 |

| 24 months | $22,000 (total) | $32,251 | +$10,251 |

| 36 months | $28,000 (total) | $57,918 | +$29,918 |

Look at the numbers closely.

In the first year, you win only a couple of thousand. But by the end of the third year, the reinvestment strategy outperforms the linear approach by more than two times. In the 36th month, the income of the compound interest system will be $2,758 per month. This is five times more than the fixed $500 of the “Rentier”.

This is the snowball effect. At first, you push it with difficulty; it is small and heavy. But then it rolls by itself, sweeping everything in its path.

Mechanics of the Process

There is no magic “make me rich” button. The Veles platform provides the tools, but you remain the pilot. The automatic compound interest function is intentionally absent — this is a protection against uncontrolled risk inflation.

Reinvestment on Veles is a conscious process.

Action Algorithm:

- Establish a habit. For example, every Sunday morning, with a cup of coffee, you hold a “board of directors meeting” for your personal fund.

- Audit. Go to the exchange. Look at the total Wallet Balance. It is important to separate real profit from “paper” profit (Unrealized PnL). You can only reinvest what is already fixed in stablecoins.

- Calculation. If the bot earned $50, your new deposit body should increase by exactly this amount.

- Adjustment. You don’t have to sit at the monitor. Go to the Veles mobile app, select the bot, click “edit,” and update the deposit amount. It takes one minute.

- Check limits. Veles will automatically recalculate orders. Make sure the first order of the grid meets the exchange’s minimum requirements (usually from 5 to 10 USDT). If the amount is too small, sometimes it is better to accumulate a buffer before changing settings.

- Launch. Save and launch.

You have just pushed the snowball with your own hands.

Scaling Strategies

Compound interest is a universal tool, but it can be used in different ways. The choice depends on your nervous system and financial goals.

Aggressor (100% Reinvest)

All profit goes back into the market.

- Goal: Maximum rapid deposit growth from small amounts.

- Risk: Critical. A mistake, a black swan, or an algorithm failure — and you lose everything. Both the principal and the accumulated profit.

The Golden Ratio (50/50)

We withdraw half of the profit into cash (or a cold wallet), and put half into circulation.

- Psychology: You feel the money. You buy food, clothes, gadgets with it. This reduces anxiety.

- Safety: In parallel with the bot deposit, your reserve fund grows. If the market crashes, you will have a cushion exceeding the initial investment.

Smart Scaling

You change the reinvestment percentage depending on the market phase.

- Bull market: Reinvest 80-100%. The trend forgives mistakes; you need to take the maximum.

- Bear market: Reinvest 0-20%. The main task is to preserve. Profit is stored in stablecoins to buy the bottom.

- Sideways (Flat): Reinvest 50%.

Risk Management: How Not to Lose Everything

Drawdown is the evil twin of compound interest. It also works exponentially, but against you.

Remember the numbers needed for recovery:

- Lost 10% of capital — need to earn 11% to return to zero. Not easy, but it happens in crypto; you can return to previous positions even in a week or month.

- Lost 50% of capital — need to earn 100%. Very difficult.

- Lost 90% of capital — need to earn 900%. Unrealistic.

When reinvesting, you are constantly raising the stakes. If your deposit has grown to $50,000, a 50% drawdown will wipe out $25,000.

Protection Tools on Veles:

- Stop-Loss. It is better to accept a small loss and earn it back in a week than to sit for months with a negative balance. Set a stop of no more than 15-20% of the bot’s deposit.

- Diversification. Never launch one “super-bot” with your entire capital (all-in). Divide the capital into 5-10 parts. BTC, ETH, SOL, MATIC, ATOM. If one coin falls or flies to the sky against your short position, the others will pull the portfolio out.

- Conservatism during growth. If you increase the deposit by 10 times, the settings must become more conservative. The most frequent mistake: pump the deposit with compound interest to $50k, leave the old aggressive settings for $1k (with high leverage), and catch liquidation on the very first correction. Big money requires big safety.

- Overlap. As capital grows, increase the price change overlap parameter. Let the bot earn a little less, but withstand deeper market drops.

The Psychology of Boredom

Successful investing is an unbearably boring activity. George Soros said: “If investing is entertaining, if you’re having fun, you’re probably not making any money.”

It is at this stage that most people break. Humans need dopamine. They start tweaking settings. The result is always the same — liquidation.

Treat Veles bot configuration like a boring factory machine. It simply stamps parts. Your task is to lubricate the mechanisms and not stick your hands under the press. Cold calculation works here.

Remember the famous marshmallow test. Children capable of not eating the marshmallow immediately for the sake of two marshmallows later became more successful in life. Reinvestment is your adult test of endurance. Giving up a new iPhone today for financial freedom in three years.

Conclusion

The Veles platform gives you the machine. Compound interest is the electricity. But you must press the “start” button yourself. Do you have the patience not to pull the plug until the goal is achieved? With our tool, it is much easier.