How to use the Donchian Channel indicator in trading?

Donchian channel remains one of the most popular indicators among traders, which helps to determine volatility and trends in the market. In crypto trading, it is used to analyze the price range of an asset and find optimal points in transactions.

What is the Donchian Channel and how does it work?

Donchian Channel is a technical indicator that was invented by Richard Donchian to determine the market volatility indicator and identify trends. The indicator is based on peak prices over a certain period of time, which allows traders to see the range of price movement.

Learn more about the indicator in our tutorial - Donchian Channel - Veles Help Center.

The indicator includes three lines:

-

Upper curve - shows the maximum price for the selected period.

-

Lower curve - shows the minimum price.

-

Average curve (optional) - average value between two lines (upper and lower)

How to use the Donchian Channel?

This indicator has two main uses in trading.

Trend detection

The Donchian Channel is an excellent tool for trend detection. The main aspects of trend detection using it are:

-

If the price is trading close to the upper boundary of the channel, it indicates the presence of an uptrend.

-

If the price is near the lower boundary, it indicates a downtrend.

-

If the price moves within the middle line, there may be no trend (flat).

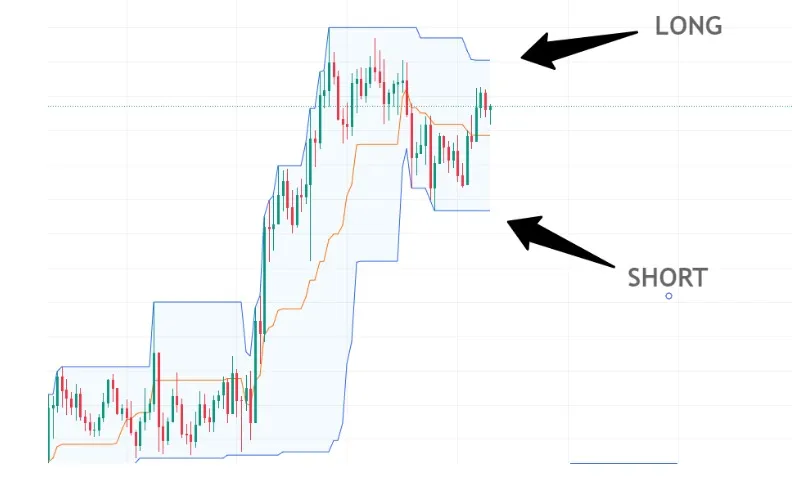

Finding entry and exit points

Market participants use the Donchian Channel to find optimal entry and exit points:

-

Buy: If price breaks through the upper boundary of the channel, there may be an opportunity for a long entry.

-

Sell: If the price breaks the lower boundary, it may mean an opportunity to open a short.

-

Exit: Closing a position when the middle line is broken or when the price returns to the channel.

Trading strategies with the Donchian Channel

1. Trading strategy La Catrina

In this strategy, the Donchian Channel is one of the three indicators used. It helps to take the full potential of the move and prevents you from exiting the trade early, minimizing risk and maximizing profit.

Read about La Catrina strategy and how to use the Donchian Channel with other strategies in our blog - ROC, Supertrend and Donchian Channel Indicators in La Catrina Strategy.

2. Breakout Strategy.

The essence of the strategy: Buy when the upper boundary of the channel is broken and sell when the lower boundary is broken.

3. Countertrend Strategy (Mean Reversion)

Strategy essence: Trading on the bounce from the channel boundaries with the expectation of price return to the middle line.

4. Midline Trading (Pullback Strategy)

Strategy essence: Using the middle line of the Donchian Channel as a support or resistance level.

5. Using the Channel together with other indicators

Advantages and disadvantages of the indicator

Advantages of the Donchian Channel

1. Ease of use

Donchian Channel is easy to interpret even for beginner traders.

2. effectiveness in trend movements

The indicator works well in strong trend conditions.

3. Flexibility in settings

Traders can change the period of the indicator to suit themselves based on their trading strategy.

4. Versatility

This indicator is suitable for different types of markets and time intervals.

5. Suitable for breakout and mean reversion strategies

-

In trend markets it is used to enter on the breakdown of borders.

-

In sideways markets, it is used to find bounces from the boundaries and return to the average line.

Disadvantages of the Donchian Channel

1. High sensitivity to false breakouts

Often the price can briefly go out of the channel boundaries and then return back, which leads to false entries into the deal.

2. Poor performance in a sideways market

When the market is not in a trend, the price can move chaotically between the channel boundaries, giving many false signals.

3. Delayed signaling

Since the channel is based on historical highs and lows, it does not predict price movement, but only displays past data.

4. Does not determine the trend strength

The Donchian channel by itself does not indicate how strong a movement is expected.

5. Requires optimization of parameters

The effectiveness of trading with the Donchian channel depends heavily on the choice of period.

6. Does not work without additional filtering

For the objectivity and accuracy of signals it is necessary to use accompanying indicators.

Conclusion

The Donchian channel can be considered one of the useful tools for crypto trading. However, it is recommended to use it in combination with technical analysis tools necessary for your trading strategy in order to increase its accuracy.

FAQ

1. What is the most appropriate period for the Donchian Channel?

A period of 20 days is often used, but this value can be adjusted differently based on your trading style.

2. Is the Donchian Channel used on low timeframes?

Yes, however on smaller timeframes it can give more false signals due to high volatility.

3. How to distinguish a true breakout from a false breakout?

Use the accompanying indicators to predict a breakout more accurately.

4. What is the best way to use the Donchian Channel with other indicators?

It can be combined with RSI, MACD, ROC to improve signals.

5. Can the Donchian Channel be used by novice traders?

Yes, because it is easy to use and clearly shows market trends.