Kurchatov Strategy 3.1

In the series “The Age of Pioneers,” we continue to explore the potential of algorithmic trading through the lens of great minds. Today’s hero is Igor Vasilyevich Kurchatov, the Soviet physicist who harnessed atomic energy. The Kurchatov 3.1 strategy is an algorithmic “reactor” that turns market volatility into stable profits. Inspired by Kurchatov’s scientific precision, it uses proven indicators and clear rules to work on most assets. Let’s take a look at how this strategy triggers a chain reaction of success.

Managing market energy

Igor Kurchatov saw the atom not as chaos, but as a source of creation. Similarly, Kurchatov 3.1 seeks opportunities in market fluctuations, using universal settings suitable for most crypto assets. This strategy is for those who want to tame the market with scientific precision. Register on VELES and receive a bonus to launch Kurchatov 3.1 and test its power on your portfolio.

Strategy Reactor

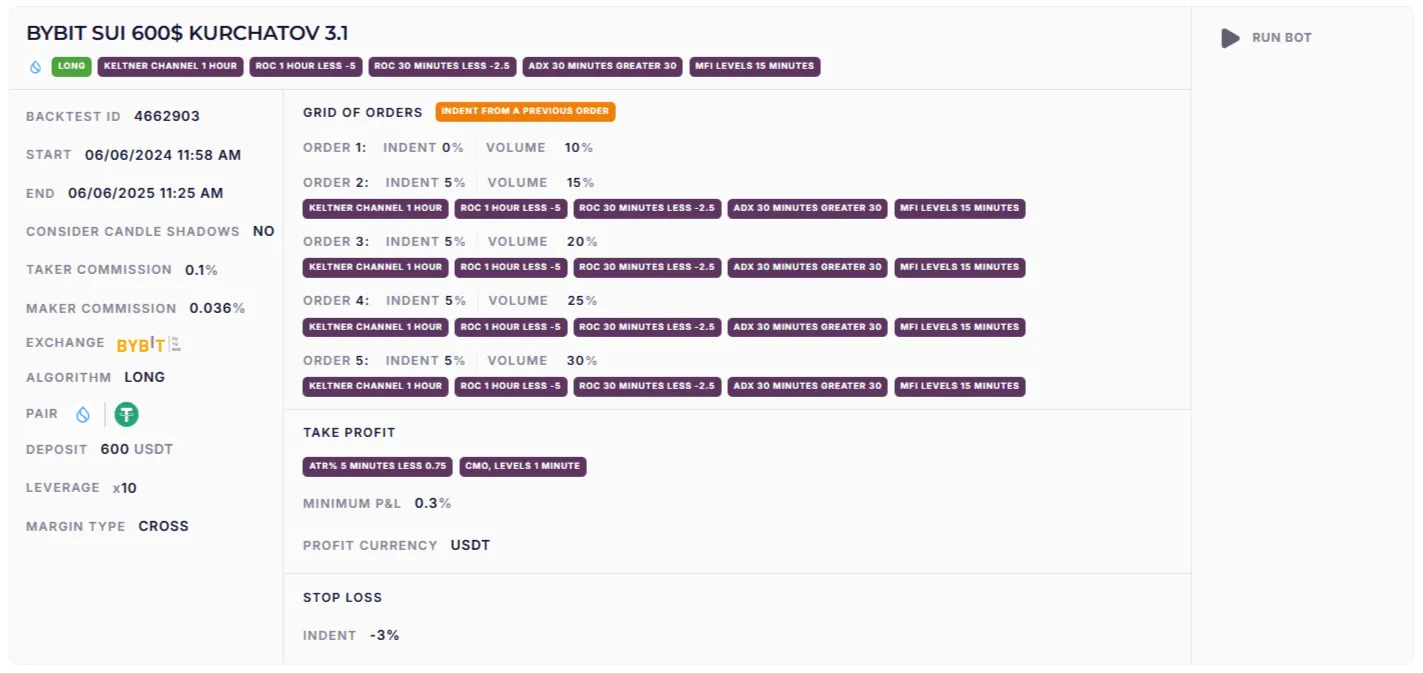

Kurchatov 3.1 is an algorithm for long trading, and its versatility allows settings to be applied to most assets thanks to clear rules and reliable indicators. We use slightly longer timeframes to filter out market noise and increase signal accuracy.

Reaction Launch

- Keltner Channel (1 hour): Defines volatility boundaries, identifying price reversal points.

- ROC (1 hour < -5, 30 minutes < -2.5): Signals strong downward momentum, heralding a rebound.

- ADX (30 minutes > 30): Confirms the strength of the trend for entering dynamic movements.

- MFI levels (15 minutes): Crossing the level from bottom to top is a trigger indicating the start of asset repurchase.

Flexible averaging

Kurchatov 3.1 uses a simple but effective averaging grid of five orders:

This grid is intuitive and easily customizable to your risk management and money management, allowing you to adapt volumes and indents to your goals.

Reaction control

Exiting a trade is like taming an atomic reaction. The position is closed when:

- ATR% (5 minutes < 0.75): Volatility drops, signaling market calm.

- CMO (1 minute): Crossing the level from top to bottom confirms the attenuation of momentum.

- P&L from 0.3% in USDT: A quick exit if the reaction does not go according to plan minimizes losses.

- Stop loss: -3% from the last order to limit risks.

Reactor testing

Results:

There may be few trades, but that’s not a problem. Run Kurchatov 3.1 on different assets after conducting preliminary backtests. This will ensure diversification and reduce risks. Experiment with ROC, ADX, and leverage to adapt your strategy to the market.

Another ticket to the era of pioneers

Kurchatov 3.1 is another step in the era of pioneers, where a scientific approach and clear rules pave the way to profit. Just as Kurchatov harnessed atomic energy, this strategy tames the market, offering traders another universal tool.

Register on VELES, get a bonus, and start your journey to a controlled chain reaction of profits!

Check out other strategies from the “Age of Pioneers” series: