Tokenomics in cryptocurrency: what it is and why it is important

Tokenomics in cryptocurrency affects the value, demand and sustainability of digital assets. Properly designed tokenomics makes a cryptocurrency attractive to investors and users, while errors in its structure can lead to token devaluation.

What is tokenomics?

Tokenomics (token + economics) is a set of economic factors affecting a token: its issuance, distribution, mechanisms of use, inflation and other aspects. Simply put, it is the economics of a token, which determines its value, utility and sustainability in the long term.

The main elements of tokenomics

Among the important issues of tokenomics are two of them.

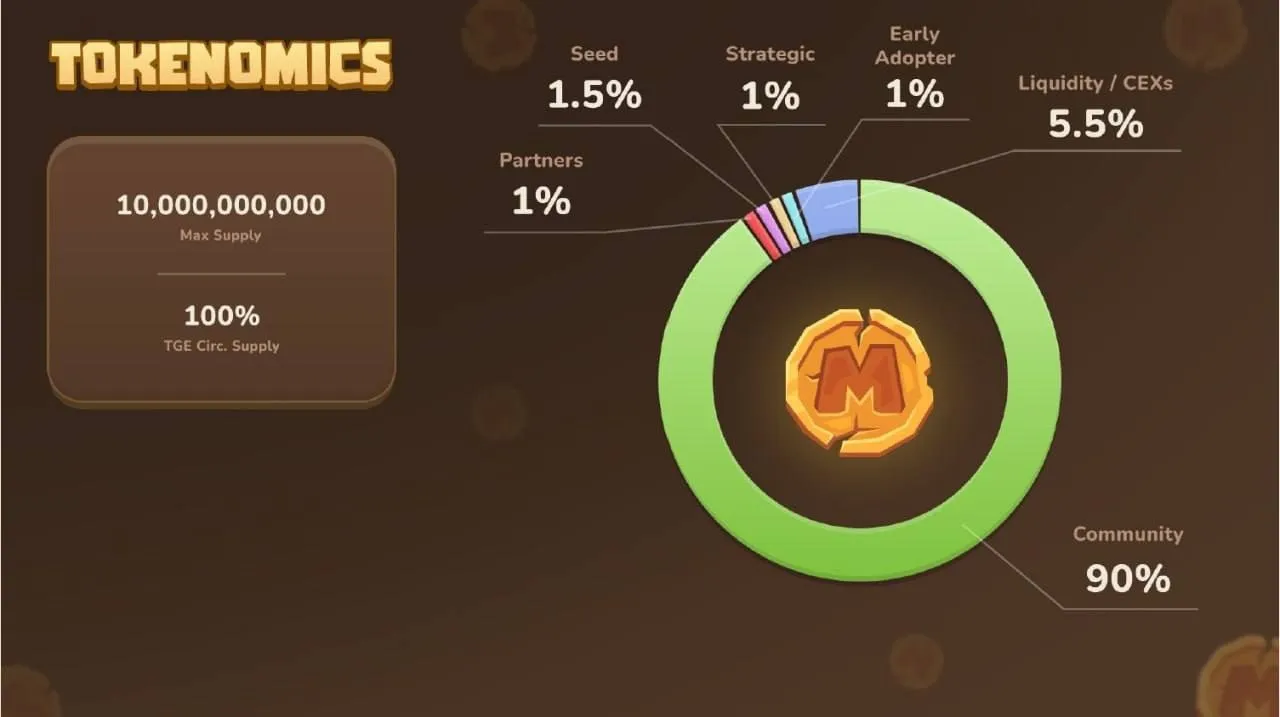

Token issuance and distribution

Issuance is the total number of tokens that can be created within a project. Some cryptocurrencies have a fixed supply (e.g. Bitcoin with 21 million coins), while others can issue new tokens as needed.

The distribution of tokens plays an important role in shaping supply and demand. It includes:

-

A share allocated to the development team

-

Tokens allocated to investors

-

Rewards for miners or stakers

-

Tokens for the ecosystem (e.g. rewards/airdrops for participating in the project)

Burning and inflation mechanisms

Some projects introduce token burn mechanisms to reduce the number of tokens in circulation, creating scarcity and increasing the value of remaining tokens. For example, Binance regularly burns BNB, reducing its total supply.

Inflation is the process of increasing the number of tokens. In some projects, it is regulated by algorithms (for example, Ethereum 2.0 has moved to a model where some commissions are burned, reducing inflation).

How does tokenomics affect price and demand?

Properly constructed tokenomics affects token price and demand through:

1. issuance and supply of tokens

The number of tokens available plays a key role in shaping their price.

- Fixed Supply

If the total number of tokens is limited (like Bitcoin’s 21 million), it creates a shortage, which can drive up the price when demand increases.

- Unlimited Supply

If the number of tokens is not limited, it is important to control their issuance. A high rate of issuance of new tokens can lead to inflation and a lower price.

- Inflation and deflation mechanism

-

Inflationary tokens increase supply (e.g., through steaking or rewards), which can lower the price.

-

Deflationary tokens decrease supply (e.g. through token burning), which drives up the price.

-

Example: BNB uses a burn mechanism, which reduces overall supply and keeps the price rising.

2. Mechanics of token distribution

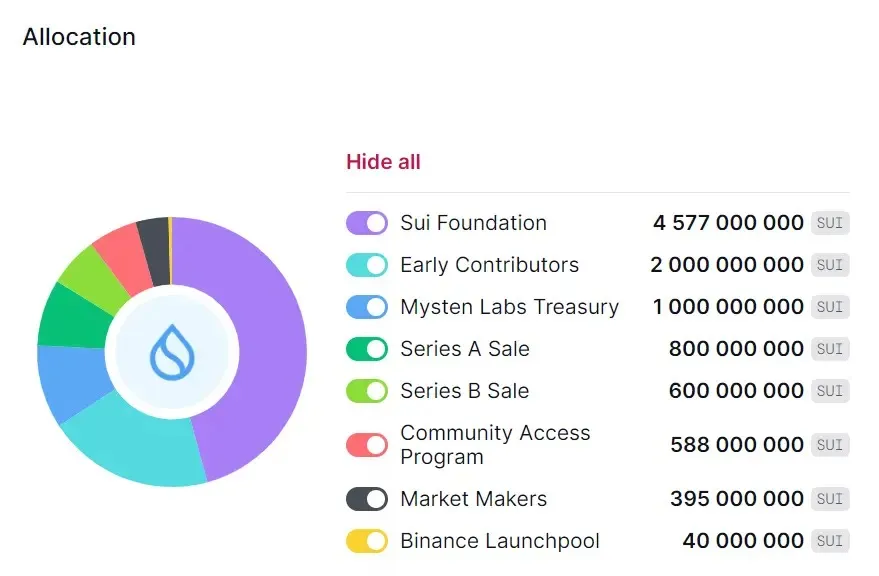

Source: Sui Foundation

- Premine and distribution to early investors

If a large number of tokens are owned by founders or early investors, this can cause the price to drop sharply when they are sold to the market.

- Staking & Yield Farming.

Allow users to earn income for holding tokens by reducing their supply on the market. This can stimulate demand and increase the price.

3. Token Utilization (Utility)

- Token Functionality

The more useful uses a token has, the higher its demand. If a token can be used for payments, paying fees, voting, etc., it increases its value.

- Gamification and NFT

Tokens integrated into gaming ecosystems or NFTs can get high demand if the project becomes popular.

4. Halving and supply reduction mechanisms

-

Halving (reducing rewards to miners) reduces the inflow of new coins, which can lead to higher prices with unchanged demand.

-

Token Burn.

Artificially reducing the supply of tokens increases their scarcity.

Examples of successful tokenomics

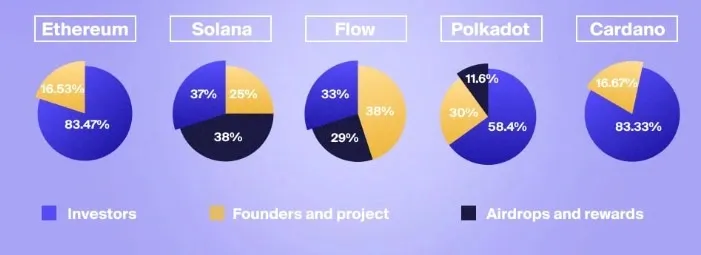

Source: ATAS

Bitcoin (BTC)

Bitcoin is a prime example of a limited-issue token. Its maximum supply is 21 million coins, and the halving mechanism reduces the issuance of new coins every 4 years, increasing scarcity and value.

Ethereum (ETH)

After the Ethereum 2.0 update, a mechanism was introduced to burn some of the commissions, which reduces the total supply and lowers inflation. This makes ETH more attractive for long-term storage.

Binance Coin (BNB)

Binance uses a strategy of regularly burning BNB, reducing its total supply. This leads to an increase in value as demand for the exchange’s token remains high.

ZOO Coin (ZOO)

The tokenomics of the ZOO coin (an internal token of a mini-application in Telegram) is an exemplary example. The project was supposed to airdrop tokens to active users without crashing the coin’s exchange rate and leaving a strategic reserve for future initiatives. ZOO tokenomics consisted of distributing 60% of the total supply to airdroppers and directing the remaining 40% to the development of the project. In this way, the majority was allocated to users, so they were not offended by the size of the reward, while ensuring the future stability of the project through a significant remaining token supply.

Conclusion: How to analyze tokenomics before investing?

It is important to analyze tokenomics before investing:

-

Maximum and current supply (is there a risk of inflation?)

-

Distribution of tokens (who owns most of them?)

-

Burning mechanisms (are there deflationary factors?)

-

Utility of the token (how much is it in demand in the ecosystem?)

Understanding tokenomics helps you make more informed investment decisions and reduce risk.

FAQ

1. What if the token does not have a limited supply?

It is important to evaluate inflation control mechanisms. For example, if a project utilizes token burning or algorithmic issuance, this may support the value of the asset.

2. How do I know the distribution of tokens?

Usually the distribution information is published in the white paper of the project or on specialized sites such as CoinGecko or CoinMarketCap.

3. Which tokenomics models are the most sustainable?

The most sustainable models include limited issuance, burn mechanisms, and deflationary elements such as decreasing supply over time.

4. Can tokenomics affect the investment attractiveness of a project?

Yes, proper tokenomics makes a project attractive to investors because it reduces the risks of token depreciation and promotes long-term growth.

5. How to compare the tokenomics of different projects?

You should analyze the maximum supply, current issue, combustion mechanisms, inflation, distribution of tokens and their utility.