TOP-8 New Cryptocurrencies to Buy in 2025

The cryptocurrency market is replenished with new projects—and, accordingly, new cryptocurrencies—with every cycle and even every day. Sorting out this abundance of information and selecting assets truly worthy of investment is becoming an increasingly difficult task. We share with you a list of the most promising cryptocurrencies to buy in 2025, in which we describe in detail the advantages of each asset.

Why Pay Attention to New Cryptocurrencies

The world of digital assets does not stand still—new cryptocurrencies appear at a staggering speed, bringing fresh ideas, technologies, and solutions to the market. Their growth often exceeds the profitability of older, well-known projects. In a situation where many assets already have huge cryptocurrency capitalizations, it is precisely a new cryptocurrency that can provide multiple growth. It can use new crypto technologies, offer unique architectural solutions, and—most importantly—entry is possible at an early stage, when the price has not yet soared and there are not many sellers. It is into such projects that bold crypto investments for 2025 are directed.

Our list consists of the following assets:

- Parcl (PRCL)

- Saga (SAGA)

- Monad (MON)

- ZetaChain (ZETA)

- Wormhole (W)

- LayerZero (ZRO)

- Celestia (TIA)

- Movement Labs (MOVE)

How We Picked Coins for the List

When selecting coins we focused on several factors: technical innovations, investor interest, liquidity, scaling prospects, and place in sector trends. We paid attention to cryptocurrency forecasts for 2025, team activity, and support from major funds. Data on when the alt-season will start in 2025 is especially important, because it is in such periods that second-tier assets show the greatest growth.

№1: Parcl (PRCL)

Parcl (PRCL) is a unique project in the Web3 world, representing a decentralized trading platform that allows speculation on real-estate prices in real time without buying the property itself. It is the first blockchain protocol of its kind, combining new crypto technologies and global real estate in one solution, in full accordance with the principles of decentralization, transparency, and accessibility.

The main idea of Parcl is to create infrastructure in which any user can invest in or trade the price per square meter of housing in the largest cities of the world, using decentralized assets reflecting these prices. The platform aggregates property-value data from verified sources and forms an accurate index that is updated in real time. This index is turned into a synthetic trading asset that can be interacted with just like tokens on other DeFi platforms.

The project’s decentralized platform operates as fully open and non-custodial. The user always controls his funds through his own wallet, eliminating risks associated with centralized services. In addition, Parcl integrates with the best crypto wallets and decentralized exchanges, providing convenient and secure trading.

Parcl is an example of how Web3 changes traditional markets. This project also provides a new coin into which one can invest not for hype, but for access to an alternative way of interacting with real estate—decentralized, liquid, and technological.

№2: Saga (SAGA)

Saga (SAGA) is a new cryptocurrency underlying decentralized infrastructure designed to scale Web3 applications, including games, DeFi, metaverses, and social networks. The project became one of the most notable launches amid a rapidly developing market in 2024-2025. It offers a unique solution for an overloaded blockchain space where developers find it harder to create stable and scalable dApps.

Saga solves one of Web3’s main problems—low scalability and competition for resources within a single blockchain. Instead of all apps operating on one chain, Saga creates a separate chain for each application. These chains are called Chainlets—autonomous blockchains launched on Saga’s infrastructure and managed by smart contracts. Developers can create a Chainlet literally in minutes, with no need to build their own blockchain from scratch.

The SAGA token serves as payment for launching and maintaining Chainlet chains and is also used for governance through a DAO. This makes it an economically important element of the entire ecosystem and an advantageous position for crypto investment. The capitalization of SAGA cryptocurrencies is already growing actively, and interest from major funds (including Placeholder and Maven11) strengthens trust in the project. Therefore Saga is not just another coin from some project, but a token of a full-fledged platform that offers a unique solution for mass Web3 scaling.

№3: Monad (MON)

Monad (MON) is a new cryptocurrency and at the same time an ambitious Layer-1 blockchain aimed at solving fundamental performance problems that restrain the development of the Ethereum ecosystem and other popular networks. The project creates an architecture combining EVM compatibility and a radical increase in throughput without compromises on decentralization or security.

The idea of Monad is to ensure scalability without needing to move to Layer-2. Unlike other solutions that split load onto extra layers, Monad rebuilds the very execution mechanism of smart contracts. It introduces an optimized virtual machine that can process tens of thousands of transactions per second while preserving support for existing dApps in Solidity. Developers can simply port their projects to the Monad network and immediately get multiple gains in speed and efficiency.

To date the MON token is available only in the test network for the blockchain testnet. Nevertheless, Monad has already attracted interest from major funds, including Dragonfly Capital, and is actively being tested in a private network. It is expected that in 2025 the project will move to a full public launch. The absence of a listing at the moment makes buying MON an interesting strategy for those looking for an asset with technological value and an early entry.

№4: ZetaChain (ZETA)

ZetaChain is a bridge between blockchains—offering a cross-chain platform for asset and message transfer withoutwrappers or proxy tokens. A relatively new coin, it could become Web3’s backbone by uniting chains in a single environment. New partnerships plus major upgrades to the bridge could push ZETA’s price higher even before alt-season.

№5: Wormhole (W)

Wormhole is among the year’s most talked-about projects: a cross-chain protocol linking dozens of blockchains. Launching the W token and revamped tokenomics triggered a surge of users. Wormhole is one of those new coins that can skyrocket when the alt-season index heats up.

№6: LayerZero (ZRO)

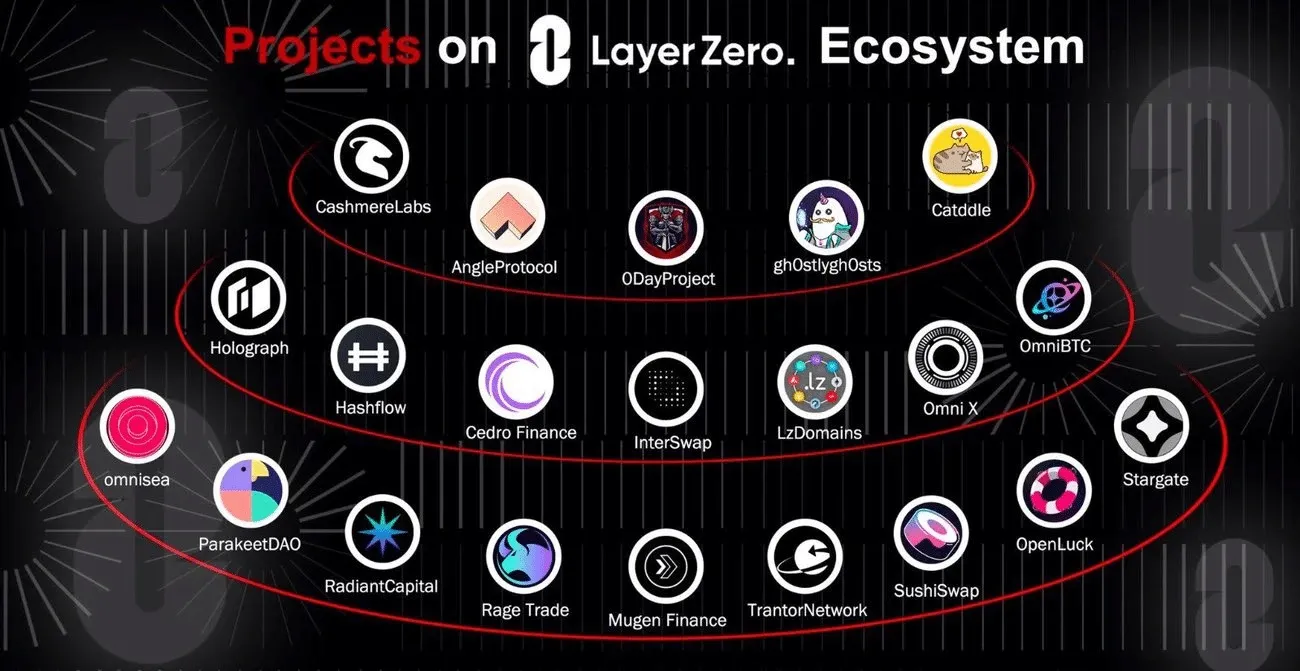

LayerZero (ZRO) is one of the most promising infrastructure projects of 2025. At the core of the platform lies a unique inter-network communication protocol allowing blockchains to “talk” directly, without intermediaries or wrappers. LayerZero seeks to create a single space for all networks—from Ethereum to Solana, from BNB Chain to Avalanche—without sacrificing security and decentralization.

The main task of LayerZero is to provide real cross-chain communication—not bridges or wrapped tokens as before, but the ability to transfer data and assets between networks at the protocol level. This lets projects build multi-chain dApps that can operate simultaneously in several ecosystems. Such new crypto technologies push Web3 forward.

The ZRO token is the center of the LayerZero ecosystem; it is used to pay for cross-chain messages (fees), for DAO governance, and for node operation. The project developed long without a native token, and its recent launch caused enormous interest in the community. Right after appearing, ZRO became one of the most discussed assets for 2025 thanks to its utility and integration into an already functioning ecosystem.

LayerZero is already used by dozens of major dApps: Stargate, Radiant Capital, Sushi, Rage Trade, and many others—this is not a theoretical development but a live protocol actively used in DeFi. Such scale confers weight on the entire ecosystem and explains why LayerZero is named one of the potential leaders of the top cryptocurrencies in coming years.

№7: Celestia (TIA)

Celestia offers a modular-blockchain concept, separating the data layer from consensus, letting projects launch their own chains without building everything from scratch. This approach is especially relevant during the mining of the newest cryptocurrency, when decentralization and scalability come to the fore. TIA is already listed on many exchanges as one of the fundamental assets suitable for safe investment.

Celestia’s idea is splitting into a Data Availability Layer and other components like computation and smart contracts. Developers can launch their own blockchains without worrying about base consensus or security—Celestia provides it. Technically, Celestia offers a unique data-availability-sampling mechanism ensuring data are indeed available and verifiable without needing full downloads, reducing node load, speeding sync, and making the network lighter and more decentralized.

The project’s token TIA is the network’s native token, used to pay for storing and distributing data and to secure decentralized validation. It serves as collateral in the Proof-of-Stake consensus and participates in network governance, making TIA a vital element of an ecosystem that may underpin hundreds of future blockchains and dApps.

№8: Movement Labs (MOVE)

Movement Labs offers a new architecture based on the Move language focused on security and execution speed. It creates an environment for DeFi applications and gaming protocols from scratch, on a new architecture free from Ethereum’s legacy. With this innovative approach and the recent completion of airdrop recipient unlocks, MOVE may become one of the most promising options among new cryptocurrencies to consider.

Where to Buy New Cryptocurrencies

Buying crypto—especially new coins—in 2025 is easier than ever. The main venues where new coins appear are large centralized exchanges: Binance, Bybit, OKX, HTX, Gate. io, BingX. These often host the first listings of the most anticipated low-cap tokens, giving a chance to enter “at the start.”

Before listing, new projects may distribute tokens via launchpads, IEOs, or airdrops. Such campaigns are announced on project or exchange websites—one way to get into an asset before it hits the wider market. It is crucial to research a project carefully, because new coins often carry risks due to low liquidity and high volatility. Many turn to decentralized venues—Uniswap, PancakeSwap, Jupiter (Solana)—where new 2025 coins can appear even before centralized listings. On DEXs there is no safeguard against fake tokens, so DYOR is critical.

How to Reduce Risk When Trading Crypto

Any financial market is traditionally a dynamic environment with high volatility, where each trader faces price swings, emotional decisions, and risk of loss. To minimize these risks and trade with more confidence—especially amid rising interest in new coins—it’s vital to build a systematic approach. One of the most reliable and effective tools is automated trading via crypto bots such as Veles.

The Veles platform offers trading bots that work 24/7, follow a given strategy, and execute trades precisely without trader intervention. Unlike manual trading, a bot feels no emotions, makes no fatigue errors, and never acts outside the system. Veles bots analyze the market in real time, track signals, support/resistance, apply risk management, and lock in profit per your preset settings. They can be tuned for any scenario—from aggressive trading on volatile assets to moderate strategies with minimal leverage and set stop-losses—everything depends on your preferences and market view.

Using such tools, you can allocate capital wisely, trade several pairs simultaneously, employ multiple strategies, and—crucially—protect yourself from sharp financial and emotional drawdowns. Back-testing and monitoring tools on the platform let you adapt strategies to current market conditions, making crypto investments less risky and more predictable.

What to Invest In for 2025

We hope our list of coins for investing in 2025 has given you food for thought and clarified many points. Each project is unique and always has its own prospects and risks. When choosing assets, don’t rely on loud names, hype, or someone else’s opinion. Conducting your own analysis (DYOR—Do Your Own Research) is the key to avoiding emotional, ill-considered decisions. In an environment of growing interest across sectors, an alt-season in crypto can start suddenly, and only a prepared investor can make use of it.