What are blockchain bridges and why are they needed?

Cryptocurrencies carry out their work on the basis of blockchain and each of them is on one of their many types. Therefore, in order to move a cryptocurrency from one network to another, special bridges are used.

What are blockchain bridges

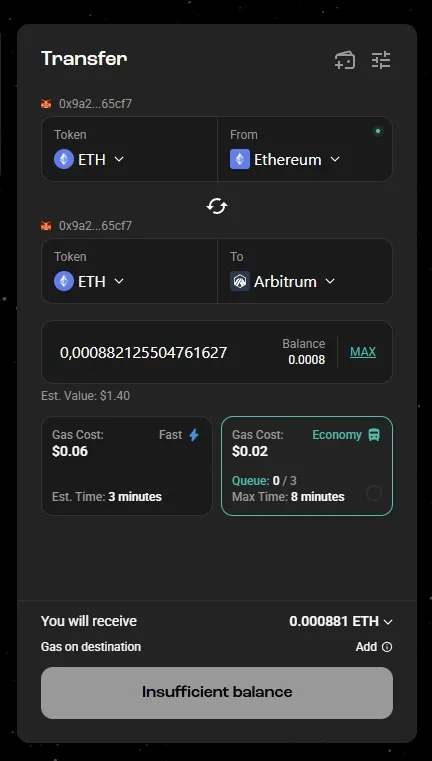

A blockchain bridge is a technology that allows the transfer of assets and data between different blockchain networks. These bridges act as an intermediate layer that provides interoperability between isolated ecosystems (networks) that normally cannot communicate directly with each other.

Why bridges are needed in the Web3 ecosystem

The Web3 ecosystem is evolving rapidly, with more and more blockchains emerging every year. However, most of them exist as isolated networks. Web3 bridges solve this problem by allowing users to move assets and data between different blockchains.

To make the most of such bridges, you can connect specialized bots - intelligent assistants that analyze the market and choose the best moments for transactions between networks.

On the Veles Finance platform, you’ll get $5 to your account to get started with all the available tools without risk.

Blockchain Compatibility Problem

The main problem that blockchain bridges solve is the lack of direct interoperability between networks. Each blockchain is built on its own architecture: it uses unique consensus algorithms, token standards (e.g., ERC-20, BEP-20, DOT), and data processing methods. Because of these differences, blockchains cannot directly “talk” to each other, making it difficult to transfer assets and information.

This is similar to a situation where each city has its own currency, language and transportation system. Without a common exchange and transfer mechanism, residents have to stay within their own borders. A crosschain bridge acts as a universal translator and transportation route, connecting independent blockchains and creating an infrastructure for interoperability.

Without these technologies, Web3 development would be fragmented and limited. It is bridges that make cross-chain solutions possible, where assets, data and functions are not dependent on one particular platform. This is critical for both users and developers who seek to build versatile and scalable decentralized applications.

The way interconnect bridges work

Lock & release tokens (lock & mint)

The most common way in which blockchain bridging works is through the lock & mint mechanism. Tokens are locked in one network and their equivalents are created in another. For example, you lock ETH in Ethereum and receive tokens in the BNB Chain network.

Reverse process (burn & release)

When you want to return assets to the original network, you use the burn & release process. A copy of the token is burned and the original is unlocked. This approach provides balance and prevents duplicate assets.

Use of smart contracts and oracles

Smart contract bridging and decentralized oracles are used to ensure all processes are correct. They monitor events in one network and trigger appropriate actions in another.

Types of blockchain bridges

There are several types of blockchain bridges, each with its own characteristics:

Centralized bridges

Managed by a single organization or platform. Convenient, but raise questions about the security of the bridges.

Decentralized bridges

Operate based on smart contracts and do not require trust in third parties. Are an important part of decentralized crosschain solutions.

Multichain and crosschain bridges

Support multiple blockchains and allow you to move assets between them. A great example is the LayerZero crosschain platform and other Layer 0 solutions.

Examples of popular bridges

Some of the most well-known blockchain bridges:

-

Ethereum Bridge - allows you to connect ETH to other networks.

-

BNB Chain bridge - connects the Binance Smart Chain to other blockchains.

-

Polkadot Bridge - provides cross-chain connectivity in the Polkadot ecosystem.

-

LayerZero Bridge - works at the protocol level and provides high scalability.

Risks and vulnerabilities

Despite the tremendous advantages that blockchain bridges offer, they remain one of the most vulnerable components of the Web3 infrastructure. This is primarily due to the fact that bridges act as a critical point between networks where assets are transferred, and it is at this point that the greatest amount of value is concentrated. This is why the hacking of blockchain bridges has become one of the industry’s top concerns in recent years, with losses running into hundreds of millions of dollars.

One of the main risks is insufficient code security. Since many bridges use complex smart contract bridges, errors in contract logic can lead to exploits. Hackers actively probe such contracts for vulnerabilities to gain access to locked assets. In the case of centralized solutions, centralized bridges, the threat comes not only from external attacks, but also from internal factors: operator errors, corruption, loss of keys - all this can lead to loss of user funds.

Also under threat is the very mechanism of transaction verification between networks. If a bridge uses an unreliable oracle system or has a weak architecture in terms of event validation, it can be manipulated. For example, an attacker could simulate events in one network to issue non-existent tokens in another, upsetting the balance of the system. Such cases have already occurred in large projects, causing serious losses and eroding trust.

The security of bridges also suffers from the “multitrust” problem. Many users think that using a bridge means full automation and decentralization, but in reality most solutions, especially early ones, were hybrid, meaning that some processes were handled manually or through centralized nodes. This meant that trust in bridge was built on trust in the development team rather than transparent technology.

An additional risk remains the human factor: misuse of the bridge, sending funds to the wrong address, lack of understanding of the principles of the mechanism of how the bridge between blockchains works - all this can lead to loss of funds. It is important to remember that the blockchain is not forgiving of mistakes, and in the case of a failed transaction, the user is often left without a refund.

In terms of the future, solving these problems will directly impact the development of crosschain platforms and trust in decentralized bridges.

More resilient solutions are already being created, such as LayerZero bridging, utilizing new layers of verification and improved architecture. However, the risk remains, so both users and developers need to understand the complexity and sensitivity of the blockchain bridge mechanism to minimize losses and ensure stable operation of the Web3 ecosystem.

FAQ

1. What is a blockchain bridge?

A tool for transferring assets between blockchains without intermediaries.

2. What is the difference between a decentralized bridge and a centralized bridge?

The former operates autonomously on smart contracts, while the latter is managed by an organization.

3. Why do we need crosschain solutions?

To combine different blockchains into a single ecosystem.

4. What is asset tokenization?

The process of creating digital equivalents of real assets on the blockchain for free circulation.

5. Which crosschain platform is considered the most trusted?

One of the leaders is LayerZero Bridge due to its architecture and security.