Blockchain bridges - what they are for and how to work with them

The modern cryptocurrency ecosystem is a variety of different blockchain platforms, tokens and cryptocurrencies. Each of them has its own unique characteristics, protocols and rules of operation. However, many market participants have a need for free inter-blockchain transactions and for it to be secure. This was the basic premise behind the development of blockchain bridging technology.

What are blockchain bridges?

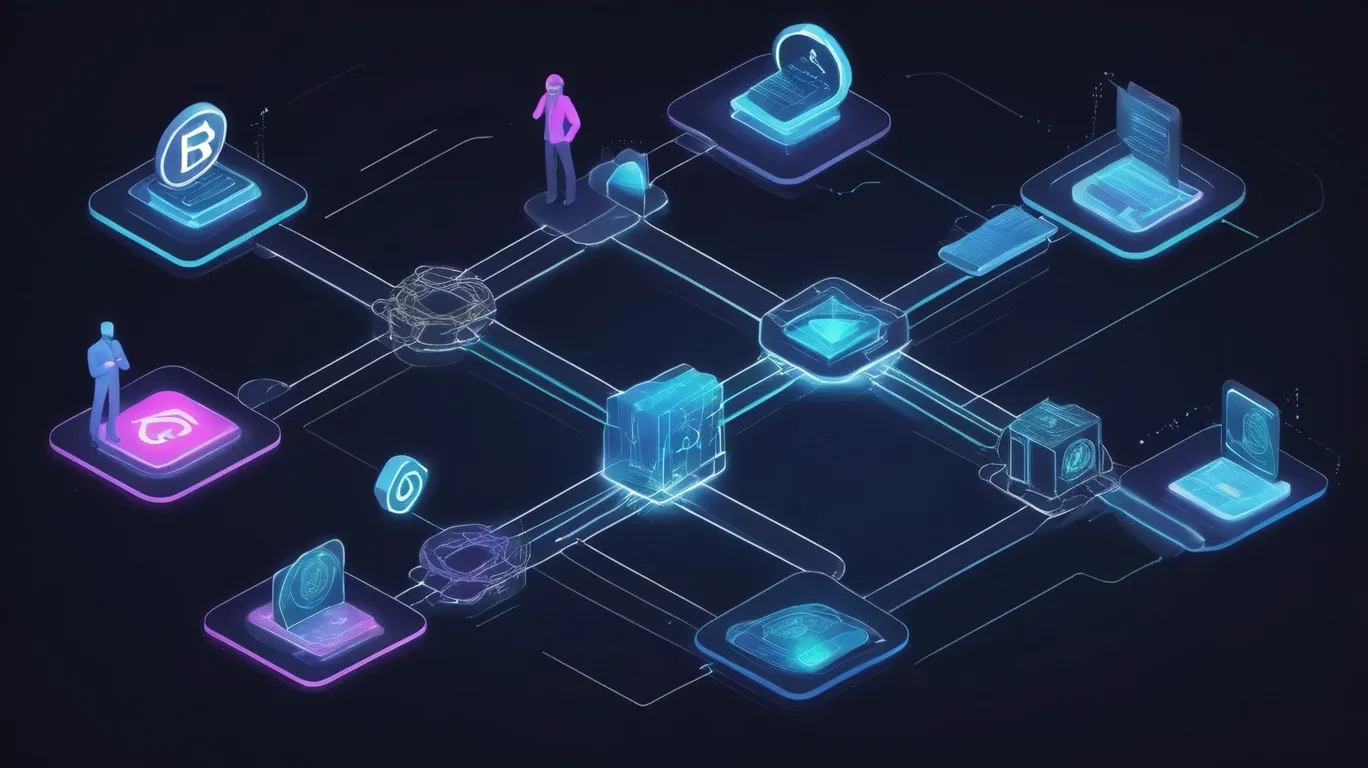

Blockchain bridges are technological capabilities for cryptocurrencies to enable the transfer of digital assets outside of their blockchain protocols. This technology takes on the role of a bridge between different blockchains and allows for the unification of the world of digital assets.

The principle of blockchain bridges: a user transfers his assets to a special smart bridge contract, after which they are blocked on one side and issued as a “replacement” token on the other. In this way, the user can move their digital assets between different blockchains without compromising their integrity.

Why use them

To understand why blockchain bridges should be used, it is necessary to understand the vector of development of digital assets and the Internet in general. Everything goes to the fact that Internet technologies are uniting with each other and now the most different and remote corners of the network can be connected with each other.

The same is happening in the crypto segment. Currently, besides Bitcoin and Ethereum, there are hundreds of coins and most of them have their own ecosystem, their own rules of use and customized software. After all these projects have been born, started to develop and acquired their users, they now need to be linked together to create a web of digital assets.

The main reasons why users and projects use blockchain bridges are:

1. Investment diversification. The ability to distribute cryptocurrency and NFT products between different blockchain platforms, reducing the concentration of risk.

2. Access to other blockchain ecosystems. For example, the ability to use DeFi applications running on other blockchains without changing the underlying cryptocurrency.

3. Scalability. Moving assets between more scalable blockchains to speed up transactions and reduce fees.

4. Interoperability. Integrating tokens and DApps from different blockchains to create more functional decentralized applications.

5. Liquidity. Access to more liquid markets on other blockchains for traders and investors.

How do cryptocurrency transfers between blockchains work?

Let’s imagine a situation where you want to transfer your bitcoins (BTC) to the Ethereum network. Instead of selling BTC, purchasing ETH and paying transaction fees, you can use a blockchain bridge.

The way it works is that your BTC is blocked in a smart contract post on the source blockchain. In return, equivalent or “wrapped” tokens called Wrapped BTC (WBTC) are issued on the target Erhereum blockchain. These Bitcoins are a tokenized version of themselves, but residing on the Ethereum blockchain and compatible by all its standards. Now “wrapped” Bitcoins (WBTC) can be freely used in the Ethereum ecosystem, for example to participate in DeFI protocols.

In the event that Bitcoins need to be transferred back to the BTC blockchain, you need to send the WBTC back to the bridge address where they are burned and your original Bitcoins will be unlocked in the blockchain and transferred back to your account.

To transfer assets through a bridge such as Binance Bridge, all you need to do is select the source and target blockchain networks, specify the amount, and transfer the cryptocurrency to a dedicated bridge address. You will then be provided with equivalent “replacement” tokens on the desired blockchain.

A key role in this process is played by trusted parties (oracles) who monitor and confirm transactions between blockchains.

Types of blockchain bridges

1. Bridges based on smart contracts. These are the most common type of blockchain bridges. They are implemented as smart contracts hosted on various blockchain platforms. Users interact with these smart contracts to move their assets between networks. Examples of such solutions include Ethereum-Binance Smart Chain Bridge, Polygon Bridge and others.

2. Federated Bridges. These bridges are based on a group of trusted nodes (e.g., representatives of various blockchain projects) that control the process of moving assets between networks. These nodes jointly manage keys to sign transactions between blockchains. Examples include Poly Network, Multichain (formerly Anyswap).

3. Sidechain Bridges. This type of bridge links the main blockchain to its own sidechain, a parallel blockchain network integrated with the main blockchain. Such bridges allow assets to be moved between the main blockchain and its sidechains, which can have higher speeds and lower fees. Examples include Polygon, Ronin (for the Axie Infinity game).

4. Multi-token bridges. This more advanced type of bridge supports the transfer of not only cryptocurrencies, but also other types of tokens (e.g. NFTs) between different blockchains. These solutions typically offer more functionality and flexibility. Examples: Wormhole, Celer Network.

5. Directional Bridges. This category includes one-way bridges that allow assets to move in only one direction, from one blockchain to another. This is less flexible, but in some cases more secure. Examples: Arbitrum One Bridge (from Ethereum to Arbitrum), Optimism Bridge (from Ethereum to Optimism).

Advantages and disadvantages of blockchain bridges

The main advantage of a blockchain bridge is the interoperability of blockchains that are different in structure and nature. It gives the ability to swap digital assets between different and unrelated blockchains and whether they are layer 1, layer 2 or sidechain protocols.

The second major advantage is more advanced scalability. Some blockchain bridges have the production capacity to handle a large number of transactions.

The advantages are:

1. Increased access to liquidity and ecosystems of other blockchains.

2. Reduced concentration of risk for investors.

3. Increasing interoperability between different blockchain applications.

4. Faster transactions and lower fees when moving assets.

Disadvantages:

1. Risk of vulnerabilities and hacks, due to the complexity of the bridging architecture.

2. Dependence on the reliability and security of trusted nodes.

3. Potential centralization of some bridging solutions.

4. Complexity of auditing and verifying the security of bridges.

Platforms that transfer between blockchains do not have the necessary KYC verification, which increases the anonymity of transactions. But this is also a disadvantage, as it creates the risk of receiving tokens that have been used in illegal activities.

Therefore, when using blockchain bridges, the reputation, security and reliability of a particular solution should be carefully evaluated. Cryptocurrency-related technologies ranging from trading to participation in DeFi projects still have a higher degree of risk.

Prospects for blockchain bridges

Blockchain bridging technology is under active development and shows significant potential. In addition to the fact that the growth of blockchain platforms and applications will drive demand for inter-blockchain interoperability, more advanced and secure bridging solutions are expected to emerge.

The integration of multi-currency bridges in the digital asset world will enable the movement of a wide range of digital assets. Also an important point will be the development of oracle and decentralized bridging technologies will increase the reliability and security of blockchain bridges.

The mass adoption of inter-blockchain transfers could be a key element in creating a unified decentralized Web3 ecosystem. Thus, blockchain bridges are already playing an important role in the development of the cryptocurrency market and will continue to increase their importance in the future.

Popular blockchain bridges

Some of the most famous and popular blockchain bridges:

1. Poly Network - A crosschain bridge that links multiple blockchains including Ethereum, Binance Smart Chain, Polygon, etc.

2. Chainlink Bridge - a bridge integrated with Chainlink oracles to transfer assets between blockchains.

3. Wormhole - an inter-blockchain bridge that supports Ethereum, Solana, Binance Smart Chain and others.

4. Rainbow Bridge - a bridge linking Ethereum and Near Protocol blockchains.

5. Axelar - a universal cross-blockchain protocol that provides asset transfer solutions.

6. Synapse - a multi-currency bridge that supports transfers between Ethereum, Avalanche, Optimism and other blockchains.

Each of these bridges has its own features, strengths and weaknesses, which are important to consider when choosing the right solution. In order to choose the right bridge for your needs, it is necessary to study the functionality of each of them in detail.

Conclusion

Blockchain bridges play a key role in the development of a unified decentralized cryptocurrency and Web3 ecosystem. They make it possible to overcome the limitations of individual blockchain platforms, giving users and projects more freedom and opportunities in managing digital assets.

Despite the existing risks and security issues, blockchain bridge technology continues to be actively developed. More reliable, scalable and functional solutions are expected to emerge in the near future to facilitate the movement of cryptocurrencies and other tokens between different blockchains.

In order for this technology to be used on a mass scale - it is important to both develop it and increase user awareness and trust. Only under favorable conditions can bridges become an integral part of the unified decentralized Web3 economy.

Answers to frequently asked questions

1. Is it safe to use blockchain bridges and how to choose the right one?

To understand how safe it is to use a blockchain bridge, it is necessary to study its reputation on the Internet and make sure that you have not fallen on a phishing site. To choose the right service, it is necessary to study each site in detail, as the functionalities may differ from each other and choose the right solution for yourself.

2. What are the main risks of using blockchain bridges?

In the case of using interexchange pools there is a risk of getting into a scam pool, in which case the funds will be lost forever, also the pool may not have enough liquidity for your needs and you will have to wait for it to get your funds back in the blockchain-recipient. For using blockchain bridges with smart contracts, there are risks of the platform being hacked.

3. What could accelerate the development of blockchain bridge technology?

The renewed interest in Web3 will provide a huge boost to the development of this technology. The main advantage is that it simplifies inter-blockchain transfers of digital assets, and without that, Web3 will be very problematic to exist.