What are trading signals in cryptocurrency

Trading and speculation are the most popular activities in the cryptocurrency environment. Many of the market participants want to have useful practical information for trading, so demand, as always, has created supply and led to the emergence and distribution of trading signals to the masses.

Introduction

First of all, let’s understand the essence of trading signals and who mainly uses them.

Why traders need trading signals

In a rapidly developing crypto market, the ability to react quickly to changes can be a key factor of success. This is where trading signals come to traders’ aid - they are pre-prepared recommendations indicating potentially profitable entry and exit points. These signals help to quickly navigate the information flow, increasing the chances of successful crypto trading.

Who uses signals - beginners, professionals, funds

Trading signals are used by both beginners who want to get support in decision-making and experienced traders seeking to optimize strategies. In addition, cryptocurrency exchanges and investment funds are increasingly integrating crypto signals into their algorithms, improving the efficiency of cryptocurrency algo-trading and empowering investors.

Types of trading signals

There are two main types of signals: manual and automated.

Manual signals

Manual signals are the result of a professional trader’s analysis. This approach relies on experience, intuition and market knowledge, including scalping trading or medium-term forecasts. These cryptocurrency signals are usually published in Telegram channels, forums or paid communities.

Automated signals (bots, algorithms)

Automatic signals are the result of analysis performed by algorithms. They are formed using technical indicators in trading and often come from trading bots or specialized platforms. For example, thanks to the presence of indicators, you can intelligently average a position according to their signals, which allows you to reduce risks and accumulate the necessary position volume.

In the era when algo-trading is becoming clear even to beginners, automated signals are gaining popularity. They minimize human error and work 24/7, especially in automated cryptocurrency trading.

What signals include

The structure of all signals is similar and consists of many technical and fundamental aspects.

Entry point, stop loss, profit targets

Any quality signal starts with the designation of the entry point - the price at which the trader is recommended to open a position. This point is calculated on the basis of analyzing the current state of the market, including technical and fundamental data. In signals, it is indicated either as a specific value or as a price range in which it is safe to enter the transaction.

The next mandatory element is the stop loss - the price level at which the deal is automatically closed to minimize losses. This is one of the key risk management tools, especially in crypto trading signals where volatility can be extremely high. A proper stop loss allows you to protect your deposit and trade with higher confidence.

The final component is profit targets - levels at which the trader is advised to lock in profits. Usually a signal contains one or more targets, giving the flexibility to lock in profits in stages. This helps the trader not to miss out on upside potential, especially if the signal is given against a strong trend or positive news in the sector.

Indicators and signal bases (technology, news, volumes)

The basis for the formation of cryptocurrency signals is based on technical and fundamental factors. In technical terms, technical indicators in trading such as RSI, MACD, moving averages, support and resistance levels are used. These tools help to analyze price behavior, identify trends, overbought or oversold assets and give recommendations on entering and exiting a position.

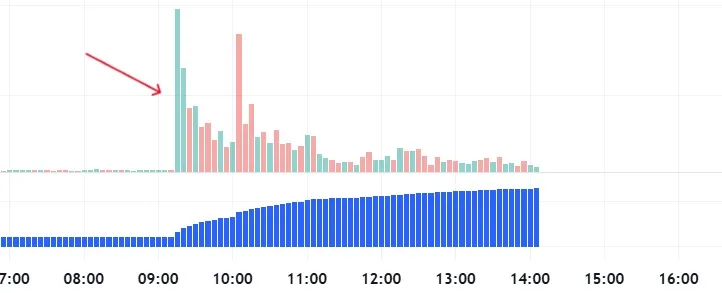

Fundamental analysis, in turn, includes news, events, project updates, partnerships and the launch of new features. For example, a positive statement from a major investor or a listing on top cryptocurrency exchanges can be a reason for a buy signal. Trading volumes also play an important role, confirming the strength of the trend and helping to identify entry points.

Algorithmic systems, especially when it comes to algo-trading cryptocurrencies, use automated analysis methods, including machine learning and statistical models. These crypto signals are generated from massive amounts of data, often faster and more accurate than manual analysis.

Where to look for trading signals

Cryptocurrency signals can be found in professional analytical communities, Telegram channels, platforms with trading bots, as well as on analytics websites. When choosing a source, it is important to consider its reputation, statistics of successful predictions and openness to verify the history of signals. Many offer free cryptocurrency signals with the option to switch to a paid tariff if necessary.

Benefits and risks

Cryptocurrency trading signals provide traders with the opportunity to make informed decisions based on analytics and experience of professionals or algorithms.

One of the main advantages of such signals is time saving. Traders do not need to conduct in-depth technical analysis or follow the news 24/7 - specialists or automated systems do it for them. This is especially relevant for novice market participants who have not yet fully mastered technical indicators in trading and mechanisms of cryptocurrency algo-trading.

Another plus is an increase in the accuracy of market entries. Competently compiled cryptocurrency signals can significantly increase the efficiency of transactions, especially if they are based on complex analytics. This can be useful both in the spot market and when using, for example, scalpinga trading strategy where every second counts. Many platforms provide both free cryptocurrency signals and premium subscriptions, making the tool accessible to a wide audience.

However, despite the obvious advantages, signals are not without risks.

First, even the best signals do not provide a hundred percent guarantee of the result. The cryptocurrency market is unstable and highly influenced by external factors - from political events to tweets of famous personalities (a vivid example is Ilon Musk). This means that even if there is a signal, a trade may turn out to be unprofitable. It is especially important to understand the risks in automated trading, when signals are processed without human participation.

Another important point is the source of the signal. There are many fraudulent schemes on the market, where under the guise of the best cryptocurrency signals, users are imposed knowingly false or useless recommendations. Therefore, it is important to check the reputation of the author of signals and do not rely solely on one source. In addition, even when using reliable crypto signals, it is necessary to follow the rules of risk management and do not invest all the funds in one transaction.

It is also worth considering that some signals may lag. This is especially true for channels in messengers or social networks, where the speed of publication is critical. In such cases, even accurate analysis can be useless if the trader did not have time to react to the time.

How to use signals competently

Competent use of crypto-signals requires not only technical knowledge, but also discipline, understanding of market logic and the ability to manage risks. Signals are not a magic “earn” button, but one of the tools in a trader’s arsenal, which should be used consciously and systematically.

First of all, it is important to identify the source of signals. Reliable cryptocurrency signals are provided by proven analysts, trading teams or algorithmic platforms. Beginners should start with channels that have a transparent history of signals, success statistics, and explanations for each entry. Little-known telegram channels offering “guaranteed profits” should be avoided, as they are often a trap. Even free cryptocurrency signals can be useful if they are accompanied by analysis and entry logic.

After choosing a signal source, it is important to understand how to apply the signal itself. Each signal contains basic elements: entry point, stop loss, profit targets and often - justification based on technical indicators in trading or news background. It is necessary to strictly observe the suggested levels and not to try to “improve” the signal manually, especially without experience. Deviation from the recommendations reduces the chances of success.

Special attention should be paid to money management. Even the best cryptocurrency signals can be unprofitable. You should not enter the entire deposit in one transaction. Splitting the capital and setting a stop loss protects the trader from unforeseen losses. An effective strategy is not only profitable trades, but also the ability to control losses.

Signals can be used both manually and, for example, through a trading bot for bitcoin or other automatic cryptocurrency trading systems. In the latter case, it is important to set up the bot correctly, especially when it comes to cryptocurrency algo-trading. It is important to test the work of the algorithm to make sure that the signals are processed correctly and at the right time. Automation can be convenient but carries certain risks in automated trading, especially when market volatility is high.

To increase efficiency, it is important to follow the general market situation. For example, in a strong bullish trend, you can shift your focus to signals for cryptocurrency growth, while in a sideways movement, you can focus on short-term trades or scalping. Understanding the current market phase allows you to use signals in a more flexible and adaptive way.

Also, you should not blindly follow every signal. It is useful to form your own opinion, analyze inputs and over time learn to recognize strong and weak signals. This will help not only in improving results, but also in professional growth as a trader.

Competent use of crypto signals is a balance between trust in analytics, your own awareness and effective risk management. With the right approach, signals become not just recommendations, but part of a strategic trading model on cryptocurrency exchanges.