Bitcoin's outlook for 2024

Bitcoin is the subject of many price predictions, some of which are extremely extreme. No wonder, as the world’s oldest cryptocurrency has come a long way and has met the expectations of many long-term holders. In March 2024, BTC set a new, historic, intraday trading high, surpassing the $69,000 level and even reaching the $73,000 mark.

As we approach the fourth quarter, more and more crypto enthusiasts and outside observers are becoming interested in BTC rate predictions.

In this article, we will take a look at what factors affect the value of bitcoin, expert opinions and possible timelines for reaching new all-time highs.

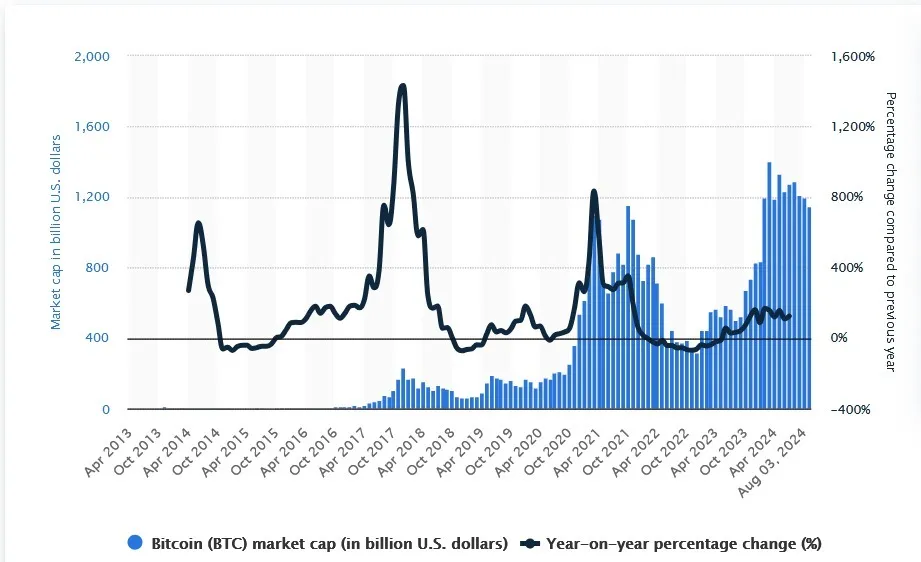

Bitcoin growth rate and capitalization

In early 2024, bitcoin received a strong growth momentum thanks to the approval of the first eleven spot bitcoin-ETFs by the US Securities and Exchange Commission (SEC). This event was the catalyst for the rise in the value of BTC.

Launch of BTC-ETF

However, despite the speculative growth, immediately after the ETF was approved, the bitcoin exchange rate went into a correction. Nevertheless, after the correction, bitcoin began to rise again up to the $73,000 mark.

One of the defining features of bitcoin’s price history is the halving event, which occurs about every four years and reduces the rate at which new coins are created.

The most recent halving occurred on April 19, when the reward for mining a bitcoin block dropped from 6.25 BTC per block to 3.125 BTC per block.

Many investors view the halving event as one of the most important factors affecting the bitcoin price. However, analysts remain cautious.

There is a theory that the four-year halving event is not as significant as many think and that, on the contrary, its alignment with external liquidity cycles makes it a trigger for upward price movement.

Bitcoin capitalization by Statista.com

Factors affecting the exchange rate

The bitcoin exchange rate is influenced by many factors. The main ones include:

- Supply and demand: The main driver of the bitcoin exchange rate is the balance between supply and demand. If demand exceeds supply, the exchange rate rises and vice versa.

- Regulatory changes: Regulatory changes and regulatory measures can have a significant impact on the bitcoin exchange rate. For example, approving ETFs or banning cryptocurrencies in certain countries.

- Global economic conditions: Economic indicators such as inflation and key interest rates also affect the bitcoin exchange rate.

- Technological innovation: Technological developments and the emergence of new cryptocurrency projects can influence the bitcoin exchange rate.

Bullish factors

1. Payment Opportunities

Nicholas Shiberras, senior analyst at Collective Shift, points to the increased demand for blockchain space on the Bitcoin network due to new “inscriptions” as a positive development. “Inscriptions” as recent innovations such as ordinals and BRC-20 tokens. The continued development of bitcoin as a payment medium may encourage the adoption of the Lightning Network, which will speed up transactions and make Bitcoin more suitable for payments.

Lightning Network’s 1,212% growth over the past two years and overcoming distribution issues point to growing adoption.

2. Federal Reserve Policy.

U.S. Federal Reserve Chairman Jerome Powell has hinted that the central bank may be reaching the peak of its rate hike cycle, which could be the catalyst for a Bitcoin rally in 2024. According to CME Group, there is a 100% chance of a rate cut before the end of the year.

3. U.S. Election

The US election in November 2024 could be another catalyst for cryptocurrency market growth. Both candidates support the innovative nature of the technology and digital assets to varying degrees

Bear Factors

1. Security

The long-term security of Bitcoin is ambiguous due to declining block reward and controversy over inscriptions that can clog the network.

2. Environmentalism

Environmental implications are also a concern. The White House has proposed a tax of up to 30% on Bitcoin miners in the US. Europe may try to ban the proof-of-work (PoW) mechanism itself.

3. Regulation

Political risks include US hostility to cryptocurrencies and possible government restrictions. Anti-money laundering legislation and KYC requirements could also make compliance more difficult.

Bitcoin Predictions

Several major predictions regarding the future price of bitcoin have been made by prominent figures and institutions:

Optimistic predictions:

- Katie Wood, head of ARK Invest, is most optimistic about bitcoin’s potential of $1,500,000 by 2030. In more realistic scenarios, she predicts $682,800 and $258,500, respectively.

- Bernstein, a private equity firm, predicts bitcoin at $90,000 by the end of 2024, with a peak of $150,000 during 2024-2025.

- Standard Chartered raised its forecast to $150,000 by the end of 2024, with a peak of $250,000 in 2025, after which it will stabilize around $200,000.

- VanEck expects to set a new all-time high in the fourth quarter of 2024, hinting at a price of $100,000.

Skeptical:

- Binance, despite support for the cryptocurrency, predicts more modest growth, no higher than 100,000 usd by 2030.

- JP Morgan is skeptical of bitcoin, predicting a price of $45,000 by the end of 2024.

- Jim Rogers believes that cryptocurrencies, including bitcoin, will come to an end and the price will fall to zero.

- Peter Schiff also expresses pessimism, warning of a possible collapse given the current optimism.

Conclusion

Even despite the potential negative scenarios inherent in any financial markets, many market participants remain very optimistic about bitcoin’s prospects. They generally refer to the macroeconomic backdrop, the April halving event, improved scalability in the Lightning network, spot BTC ETFs, and the overall historical picture of the asset’s price movements.

The variety of forecasts emphasizes the uncertainty of bitcoin’s future. So far, no one can say with certainty who will turn out to be right. Investors should be especially cautious and base their decisions on careful analysis and portfolio diversification. Traders, on the other hand, can use all market situations to achieve a profit.

With Veles algorithmic bots, it is possible to automate processes, customize trading strategies and optimize time budgets.

Frequently Asked Questions

1. What is the value of bitcoin?

Bitcoin is valuable as a decentralized, limited-value, cryptographically protected digital currency. It is beyond the control of governments and banks, making it attractive to those seeking financial freedom and protection from inflation.

2. How can I buy bitcoin?

You can buy bitcoin on cryptocurrency exchanges such as Binance, OKX or Bybit. You need to register, go through verification and fund your account.

3. Which trading strategies are the most profitable?

There is no single “most profitable” strategy. Success depends on individual style, risk profile and the market. Popular strategies include scalping (fast trading), trend trading (buying on a breakout) and arbitrage (buying on one exchange and selling on another). It is important to study the market, test different strategies and manage risk. Test your strategies on the Veles platform.