Taking the Maximum in the Precious Metals Market with New Veles Trading Bots: Gold, Silver, Platinum, and Palladium

Just recently, gold broke through the historical maximum of $5600 per ounce, but by the beginning of February, we saw a logical pullback. The market has become sharper. If strategies worked by inertia in the phase of endless growth, then with current volatility, past settings may yield less profit.

We have adapted the bots to the new reality. Now we are not trying to guess the bottom or the top — our algorithms are tailored to take profit on the fluctuations themselves, regardless of where the trend goes.

Launch Statistics and Quick Bot Links

| Metal | Copy Settings | PnL | Max DD | Max Time in Trade |

|---|---|---|---|---|

| Gold | GOLD Stormi Trend Bot | 20.71% | -10.49% | 22 days |

| OKX Spot Gold | 12.05% | -6.75% | 23 days | |

| PAXG Long CG Bot [UPD] | 20.71% | -5.6% | 21 days | |

| Gold MRC DG Bot | 39.4% | -6.24% | 28 days | |

| Gold ADX + MFI Bot | 52.9% | -3.11% | 18 days | |

| OKX Spot Gold Legacy | 13% | -5.48% | 22 days | |

| PAXG Long CG Bot Legacy | 118.2% | -5.44% | 21 days | |

| Silver | Silver Trend Bot [UPD] | 21.73% | -6.9% | 2 days |

| Silver Trend Bot Legacy | 2.78% | -3.39% | 3 days | |

| Palladium | XPD CCI Selective Bot 🔥 | 3.36% | -9.74% | 5 days |

| Platinum | XPT Kelt Limit Bot 🔥 | 3.36% | -10.43% | 2 days |

In the table above, you can see a ready-made selection of bots with statistics and copy their settings right away. We’ve written more about how they work in the article below.

Updated Bots: Working with Corrections

These settings have been reassembled specifically for the current market situation.

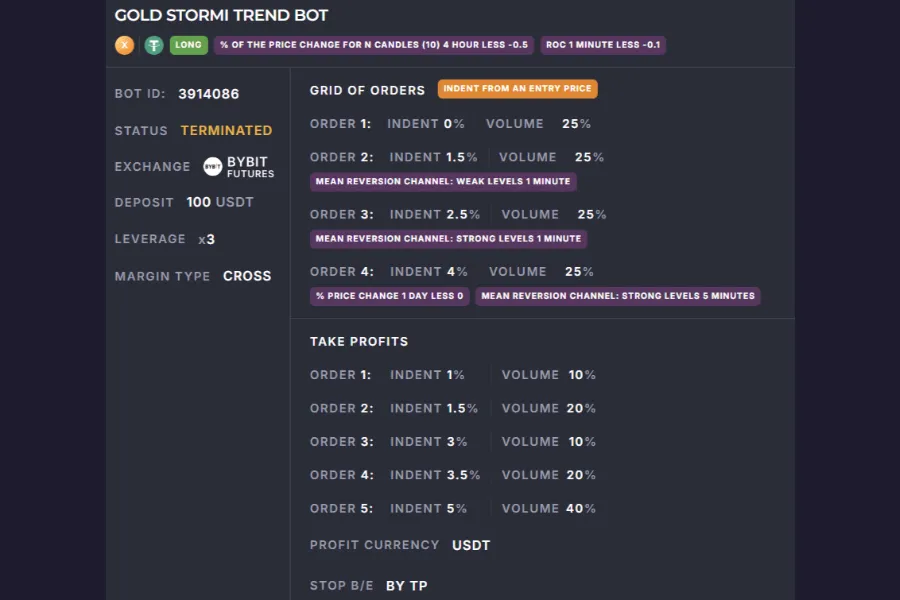

1. GOLD Stormi Trend Bot

Bot for XAUT (Tether Gold) on Bybit. Opens a position expecting a correction, uses multi-takes with stop-loss at breakeven.

The first order is placed when the price decline accelerates and there is no growth for the last 40 hours (filter against buying at highs), subsequent orders are added as the MRC signal strengthens.

Net PnL for period: 20.71%

Max Drawdown: -10.49%

Deposit: 100 USDT (3x Leverage)

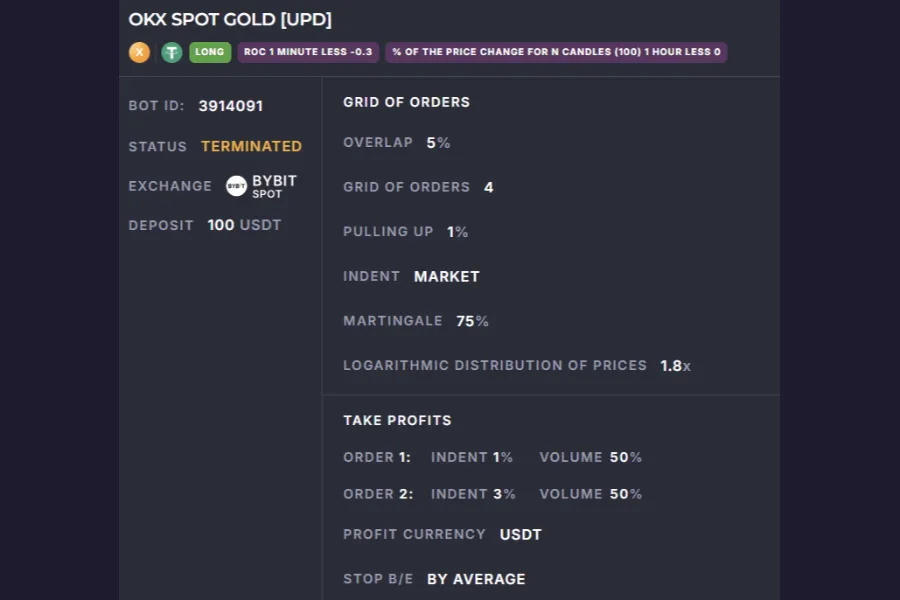

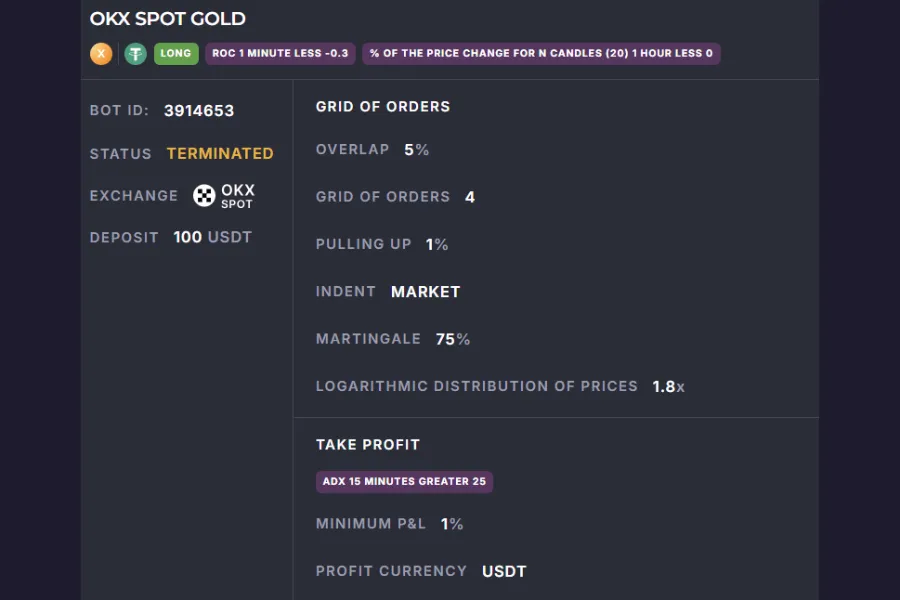

2. OKX Spot Gold

Spot bot for investment holding (XAU/USDT). The asset is purchased using a classic grid of four orders on local pullbacks.

An additional check for the absence of growth over the last 100 hours is included — the bot will not buy at the peak of the hype. Deal closure occurs with two take-profits at 1% and 3%.

Net PnL for year: 12.05%

Max Drawdown: -6.75%

Deposit: 200 USDT (Spot)

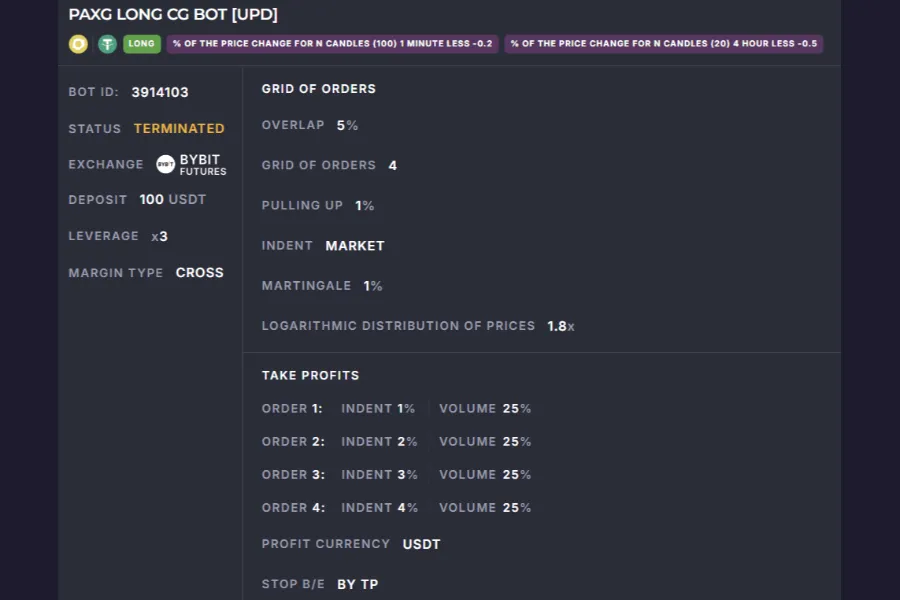

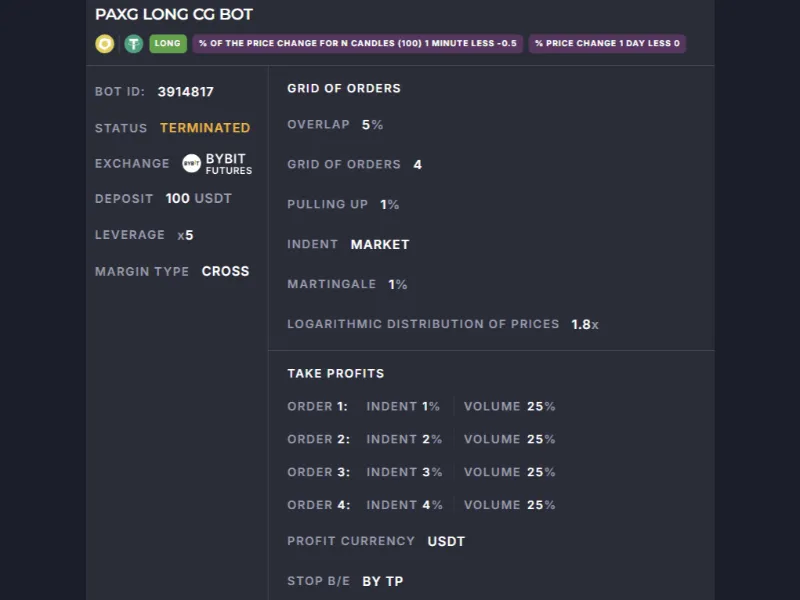

3. PAXG Long CG Bot [UPD]

Aggressive trading bot for tokenized gold PAXG. Spreads a classic grid of four orders on local pullbacks.

Additionally checks for the absence of price growth over the last 80 hours. Profit is fixed in stages using several take-profits, you will take the movement in parts.

Net PnL for period: 20.71%

Max Drawdown: -5.6%

Deposit: 100 USDT (3x Leverage)

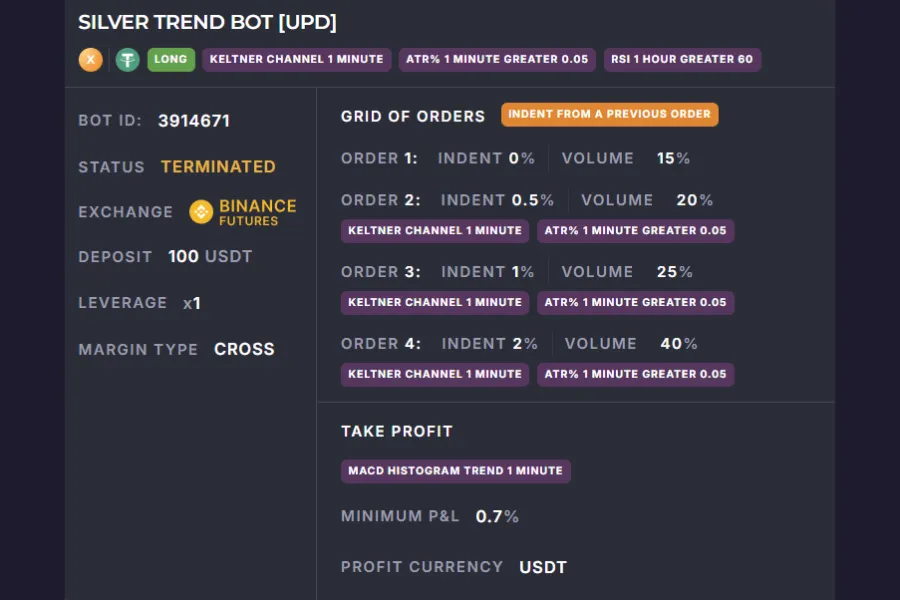

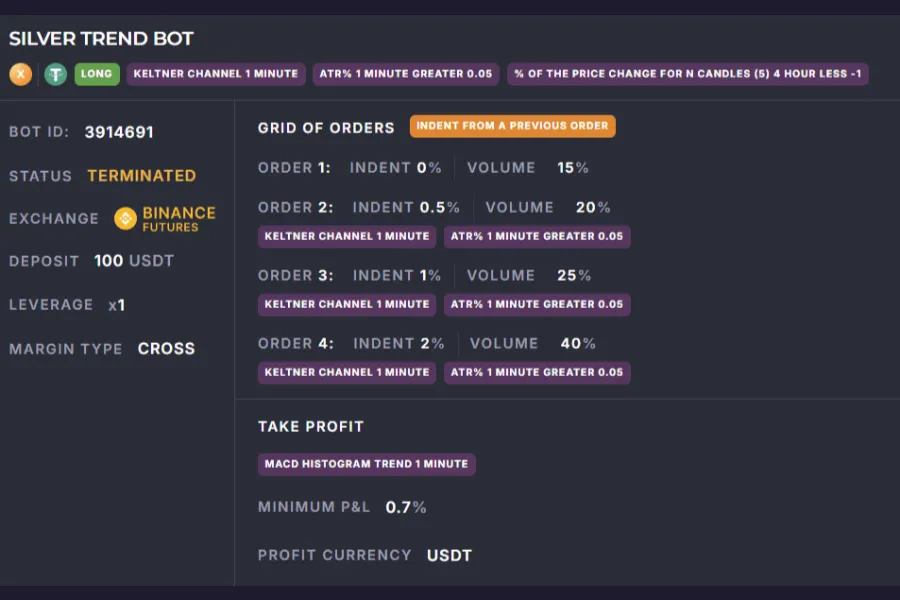

4. Silver Trend Bot [UPD]

Bot for silver with a dynamic grid of orders.

The position is formed taking into account the boundaries of the price channel, increased volatility, and the hourly trend. Each of the four subsequent orders opens on a separate signal. Take-profit fixes taking into account the trend. Makes fast deals.

Net PnL for period: 21.73%

Max Drawdown: -6.9%

Deposit: 100 USDT (Spot)

New Metals: Platinum and Palladium

Added exclusive assets for portfolio diversification.

Important: there is less historical data for assets, tests were carried out on XAG (monthly range).

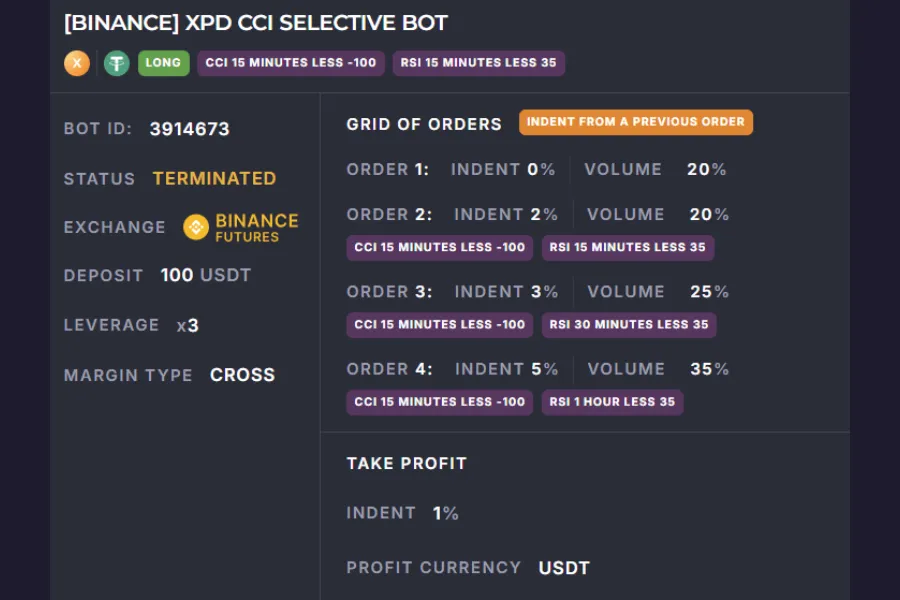

1. XPD CCI Selective Bot

Opens a position based on the Commodity Channel Index (CCI) at local oversold levels.

Each of the three subsequent orders is added when a separate strengthening signal appears. Takes profit with a classic take of 1%.

Net PnL for period: 3.36%

Max Drawdown: -9.74%

Deposit: 100 USDT (3x Leverage)

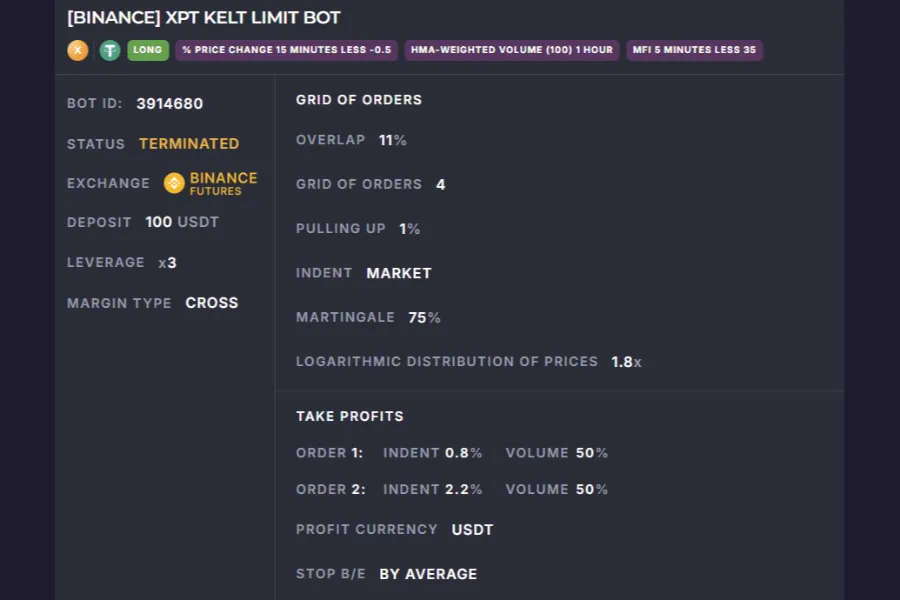

2. XPT Kelt Limit Bot

Entry into a position on a local correction taking into account volumes. Applies a classic grid of four orders with an overlap of 11% (a fairly wide range for safety).

Profit is fixed by two take-profits with a stop-loss mechanism at breakeven.

Net PnL for period: 3.36%

Max Drawdown: -10.43%

Deposit: 100 USDT (3x Leverage)

Classic Bot Collection for an Aggressive Market

Here is our previous collection of bots.

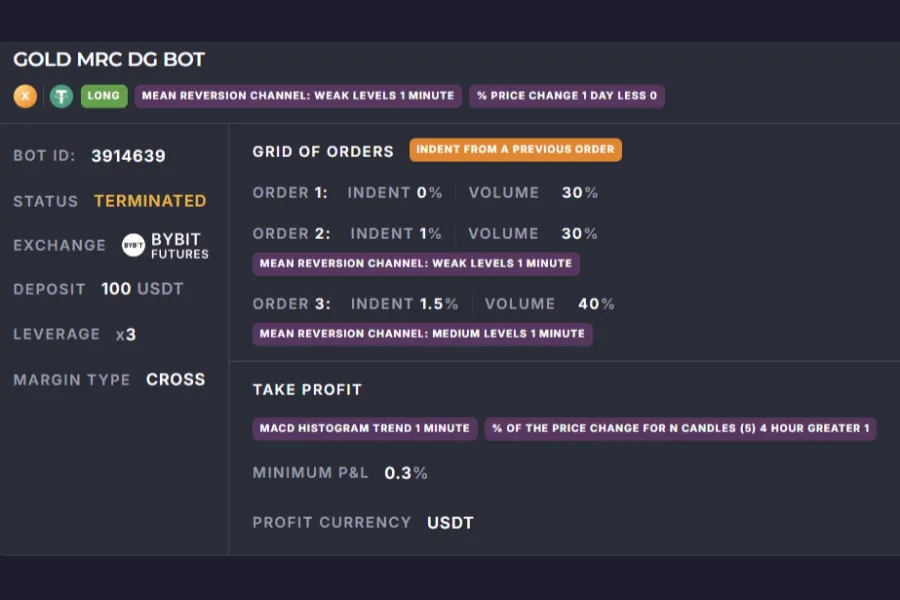

1. Gold MRC DG Bot

Bot for working out a strong upward trend in gold (XAUT) on the exchange. Accumulates a position when touching the lower border of the local price channel.

For each subsequent order, a separate signal is used. Fixes profit taking into account the intense price growth over the last day.

Max deal duration for period: 28 days

Deals for period: 52

PnL for period (with leverage): 39.4%

Max Drawdown: -18.3 USDT/-6.24%

Deposit: 100 USDT (3x Leverage)

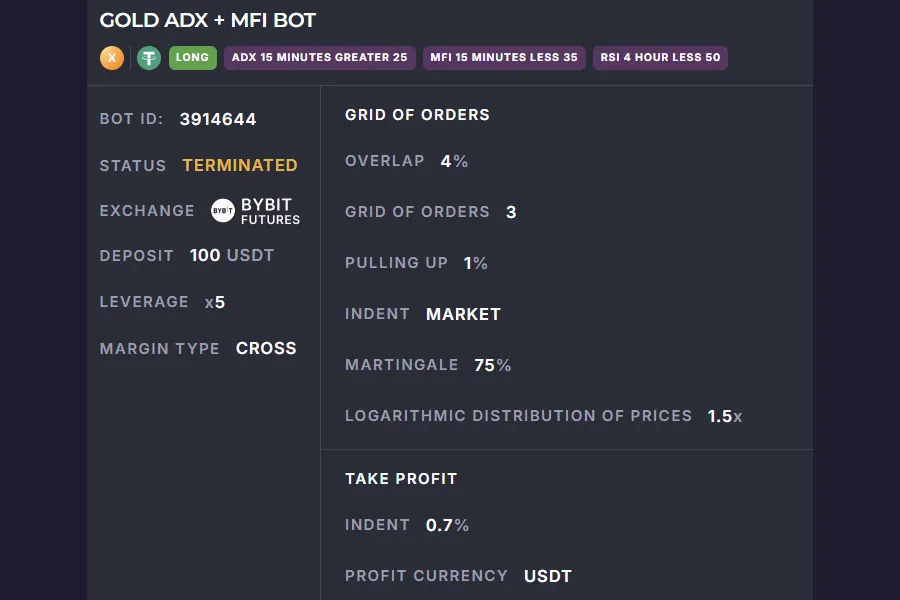

2. Gold ADX + MFI Bot

Aggressive trading bot for working in conditions of strong upward growth. Forms a position using a classic grid of orders, taking into account the dominance of buyers in the trend during a local correction. Additionally checks for the absence of overbought conditions on a higher timeframe. Take-profit target — 0.7%.

Max deal duration for period: 18 days

Deals for period: 53

PnL for period (with leverage): 52.9%

Max Drawdown: -15.3 USDT/-3.11%

Deposit: 100 USDT (5x Leverage)

3. OKX Spot Gold

Bot for investment holding. The purchase of an asset is carried out using a classic grid of four orders on local pullbacks, with an additional check for the absence of growth over the last 20 hours. Closing the deal occurs taking into account the strength of the buyer in the trend.

Max deal duration for year: 22 days

Deals for year: 45

PnL for year: 13% + 1.4% in asset

Max Drawdown: -5.4 USDT/-5.48%

Deposit: 100 USDT

4. PAXG Long CG Bot

Aggressive PAXG trading bot using a classic grid of four orders. Forms a position on local pullbacks, additionally checking for the absence of price growth over the last day. Profit is fixed in stages using several take-profits.

Max deal duration for year: 21 days

Deals for year: 61

PnL for year (with leverage): 118.2%

Max Drawdown: -26.7 USDT/-5.44%

Deposit: 100 USDT (5x Leverage)

5. Silver Trend Bot

Bot with a dynamic grid of orders. The position is formed taking into account the boundaries of the price channel, increased volatility, and local pullbacks. Each of the four subsequent orders opens on a separate signal. Fixes take-profit taking into account the trend.

Important: there is little historical data for the asset. Additional verification was performed on an alternative instrument.

Max deal duration for period: 3 days

Deals for period: 7

PnL for period (with leverage): 2.78%

Max Drawdown: -3.38 USDT/-3.39%

Deposit: 100 USDT (Spot)

What is Important to Consider Before Launching

The updated selection has become more conservative compared to previous versions, but risks remain.

Strong growth in precious metals often precedes crisis scenarios. Be prepared for high volatility.

Bots are configured for correction, but if a global market collapse begins, they must be turned off manually.

Do not overestimate leverage (we recommend no higher than 3x-5x) and be sure to conduct your own analysis.