Cryptocurrency scalping: strategies and risks

Scalping in cryptocurrency trading is one of the most popular short-term trading strategies. This trading method is focused on making quick trades in short periods of time often using specialized software when trading manually and cryptobots when automating trading.

What is scalping in cryptocurrency?

Scalping is a trading strategy based on opening and closing positions quickly to make small but frequent profits. Unlike day trading, where trades can last for hours, in scalping positions are held from a few seconds to a few minutes, sometimes longer. The main goal is to pick up small price movements and capitalize on rate differences. Successful scalping requires the use of high liquidity, minimal spreads, accurate technical analysis and scalper software for professional and optimized trading.

Technical analysis for scalping

Technical analysis plays a fundamental role in scalping, as it allows you to find entry and exit points for your trades. Scalpers use the following tools:

One of the most important formations of technical analysis in the market that traders should watch for is the horizontal support or resistance level. What it is, how to identify these levels correctly and trade them, we told you in our blog - Support and resistance levels in trading - how to identify and use them correctly.

-

Scalpers build key levels based on previous extremes and horizontal levels.

-

Use volumes to confirm the strength of the level.

-

Watch for false breakdowns and price reaction to the level.

2. Trend lines and channels

Scalpers identify local uptrends and downtrends.

They use trend channels to enter on pullbacks and bounces.

They watch the slope of the trend line - the steeper the angle, the higher the probability of correction.

- indicators for scalping cryptocurrencies

3.1 Moving Averages (MA)

Used to filter the trend and find entry points.

-

EMA (Exponential Moving Average) 9, 21, 50 - for dynamic support and resistance levels.

-

Crosses of fast and slow MAs give signals for entry (for example, crossing of EMA 9 and EMA 21).

3.2 Volume indicator (Volume)

-

High volume confirms the breakout of levels.

-

A drop in volume during price movement indicates a possible reversal.

-

“Volume clusters” help to identify areas of high interest.

3.3 Stochastic Oscillator (Stochastic Oscillator)

It is used to determine overbought and oversold conditions.

Signals for entry - crossing of Stochastic lines in the zones of 80 (overbought) and 20 (oversold).

3.4 RSI (Relative Strength Index)

-

Values above 70 signal overbought.

-

Values below 30 signal oversold.

-

You can use RSI divergence with the price to look for reversals.

3.5 Bollinger Bands

Bollinger Bands are used to determine volatility.

-

Expanding bands - a signal of high volatility.

-

Narrowing of the bands - a strong impulse is possible.

-

The price often bounces from the channel borders back to the middle line.

3.6. ATR (Average True Range) Indicator

Helps to determine the average range of price movement and set stop losses.

Popular cryptocurrency scalping strategies

There are many strategies in demand among scalpers, all of them depend on the temperament of the person and his capabilities, but there are two of the most popular ones.

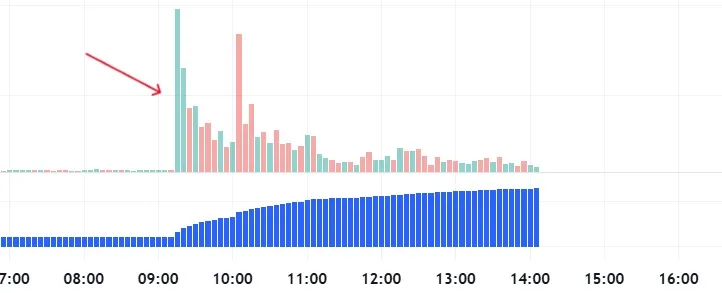

Trading from densities

This method is based on analyzing the stock stack and looking for areas with high liquidity. Traders watch for large buy or sell orders, using them as entry or exit points. If a strong support appears in the stack in the form of a large buy order, it is possible to open a long position with minimal risks, place a stop-loss for this density and if it is realized in the market, exit the transaction at the stop-loss. To find and work out this market inefficiency, scalpers use specialized software (terminals and screeners), which allow you to quickly find these situations and as quickly work them out.

Trading from the market profile

The market profile method helps traders to analyze where the main trading volumes are concentrated and, accordingly, the zones of interest of participants. The main idea is to enter trades near the zones of maximum liquidity, as the price tends to return to these areas. In this strategy, it is very difficult to determine a clear stop-loss in advance, so you often need to act according to the situation, focusing on aggravating or stimulating circumstances in the transaction.

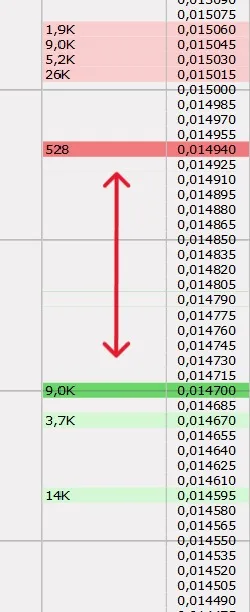

Bid-Ask Spread in Scalping

The spread is the difference between the best bid (Bid) and ask (Ask) price. In scalping, it is important to choose assets with minimal spreads, as even small deviations can significantly affect profits. Liquid trading pairs such as BTC/USDT or ETH/USDT provide low spreads and high order execution speed. Some scalpers on the contrary use illiquid instruments with large spreads, where they earn by finding certain inefficiencies in the stack.

Automation of the scalping process

Since scalping requires a high speed of operation, the automation of this strategy is highly feasible. With the help of trading bots, which are able to make transactions on both spot and futures markets, you can automate trading by setting the necessary parameters in the settings. In this case, the efficiency of the strategy and all settings can be checked using backtests, and only then let the bot go “free swimming” to trade on the market.

Scalping in crypto - how to choose trading pairs?

1. main criteria for selecting trading pairs for scalping

1.1 High liquidity

Liquidity means how quickly you can buy or sell an asset without significant price changes. Market depth, i.e. a large number of orders in the stack, is important for scalping.

How to check liquidity:

-

Look at trading volumes (24h Volume) - the higher the better.

-

Analyze the spread (difference between buy and sell prices).

-

Check the depth of the order book.

Examples of liquid pairs: BTC/USDT, ETH/USDT, BNB/USDT.

Low-liquid pairs: ALGO/BNB, WAVES/BTC, little-known altcoins.

1.2 Low spread

In scalping it is important that the spread is minimal, otherwise each trade will be less profitable. This applies to normal strategies and does not apply to those situations where a large spread is precisely the source of profit for the scalper.

How to check:

-

Open the order stack and see how different the Bid and Ask prices are.

-

Avoid pairs with a wide spread (more than 0.5%).

Best pairs: BTC/USDT, ETH/USDT, SOL/USDT (spread < 0.01%).

Worst pairs: RARE/ETH, AUDIO/BNB (spread can be 1% and higher).

1.3 High volatility

Scalpers make money on price movements, so they need pairs with high volatility. The more the price fluctuates, the more opportunities to enter trades.

Where to watch volatility:

-

The ATR (Average True Range) indicator shows the average range of price movement.

-

On the M1-M5 candlestick chart - if the price is barely moving, trading is not profitable.

-

Look at the percentage changes over the last 24 hours.

Best pairs: BTC/USDT, ETH/USDT, SOL/USDT, XRP/USDT.

Worst pairs: stablecoins (DAI/USDT, USDC/USDT).

1.4 Low trading commissions

With frequent trades, commission plays a big role. Exchanges charge a percentage for each trade, and for scalpers, this can eat up a large portion of profits.

How to lower commissions:

-

Use exchanges with low commissions

-

Pay commissions with the exchange’s internal tokens (BNB on Binance, OKB on OKX).

-

Look for pairs with zero commission (for example, Binance sometimes offers BTC/TUSD with no commission).

The best exchanges: Binance, Bybit, OKX, HTX, Gate. io, BingX (commission ~0.1% or less).

Less favorable exchanges: DEX with high commissions (Uniswap, Jupiter, PancakeSwap).

1.5 Support futures (if using leverage)

Many scalpers trade with leverage (e.g. 10x or 20x). This is only possible in futures markets, not spot markets.

Where to look:

-

Check to see if the exchange supports futures on the selected pair.

-

Watch trading volumes on the futures market (they should be high).

Best pairs: BTC/USDT, ETH/USDT, BNB/USDT.

Worst pairs: low-liquid altcoins (XVG/BTC, SC/BNB).

1.6 Correlation with Bitcoin

Many altcoins follow the movement of BTC. If BTC goes up, they also go up, and vice versa. However, some pairs can move independently.

How to use it:

-

If BTC is flat, you can scalp highly volatile altcoins.

-

If BTC is making sharp moves, it is better to follow it and trade BTC/USDT.

The best pairs when BTC is trending: BTC/USDT, ETH/USDT, SOL/USDT.

Worst pairs: obscure tokens without volumes.

Impulsive scalping

Impulsive scalping is one of the cryptocurrency scalping strategies based on sudden price movements. Traders use news events, report publications, sudden spikes in trading volume, market inefficiencies and technical analysis patterns. The main point of this trading approach is to enter at the highest probable point with a short stop loss and exit after the price momentum, locking in profits.

Trading situations that involve taking only the impulse movement:

-

News (reports of the state, companies, statements of celebrities and other infoprovodov) - characterized by a sharp impulsive movement in one of the directions, followed by a subsequent similar movement in the opposite direction.

-

Level breakdown - coins in certain market situations accumulate too much liquidity due to stop-losses of participants. When the price overcomes a certain price level (makes a breakout), then all these stop-losses are executed, maybe someone is even liquidated and an impulsive movement occurs.

-

Rebound from the density - at abnormal activity of participants in the coin, from a large bid in the stack can occur impulses up to several percent or on the contrary the realization of this volume on the market by a quick impulse.

-

Pump/dump - due to the work of trading algorithms and robots develop movements of hundreds of percent. During such a movement, both robots and traders can open their positions in anticipation of a pullback (countertrend). With an excessive number of open positions in the opposite direction, the price accelerates and gives the final impulsive movement on stop losses and liquidations of participants. With proper understanding of this market situation, it can be worked out both on the trend and in the countertrend after the final impulse.

Risk Management

Since scalping involves frequent trades, it is important to manage risk effectively:

1.1 Limit the risk per trade

One of the main principles is not to risk a significant portion of capital in a single trade.

Recommendations:

-

The risk per trade should not exceed 1-2% of the deposit.

-

Take into account not only the volume of the position, but also the size of the stop-loss.

-

For example, if the deposit is $1000 and the risk per transaction is 1%, the maximum loss should not exceed $10.

1.2 Use of Stop Loss

In scalping, a strict stop loss is mandatory, as the price can turn sharply.

Recommendations:

-

Set a stop loss depending on the volatility of the asset.

-

Use a dynamic stop-loss (for example, with the ATR indicator).

-

Place a stop-loss behind key support/resistance levels or the nearest extremes.

2. optimal Risk/Reward ratio (Risk/Reward)

Even if some trades are unprofitable, the trader remains in the plus side if the average profit exceeds the average loss.

Recommendations:

-

The minimum risk/profit ratio is 1:1.5 or 1:2.

-

For example, if Stop Loss is 5 pips, Take Profit should be at least 7-10 pips.

-

Do not enter a trade if the profit potential is less than the possible losses.

3. Position volume management (mani-management)

The larger the position volume, the higher the potential profit, but the risk increases.

Recommendations:

-

Calculate the position size depending on the deposit and stop loss size.

-

Do not use too large positions, especially with high volatility.

-

Divide the position into several parts to fix the profit in parts.

Example of position calculation:

If the deposit is $5000, the risk per trade is 1% and the stop loss is 0.5%, the maximum position size is:

$5000 × 1% ÷ 0.5% = $10000 (face value of the position).

4. avoiding margin call (draining the deposit).

Many scalpers use leverage, which increases both profit and risk.

Recommendations:

-

Do not use leverage higher than x3-x5 unless you are experienced.

-

When scalping aggressively on futures, do not exceed x10.

-

Regularly fix profits, so that you do not lose all your earnings because of one mistake.

5. Emotional control and discipline

One of the main causes of losses is emotional trading rather than systematic trading.

Recommendations:

-

Do not try to “win back” after a series of losses.

-

Strictly follow the trading plan and do not enter trades without clear signals.

-

Take breaks after losing streaks to avoid impulsive decisions.

-

Do not succumb to FOMO.

6. Limit the number of trades

The more trades, the higher the load on the trader and the higher the risk of making mistakes.

Recommendations:

-

Limit the maximum number of losing trades in a row (for example, no more than 3-5 in a row).

-

If 3 trades in a row closed in the negative, stop trading for a day.

-

Do not enter the market without a clear signal, even if “it seems to go up”.

7. Recording and analyzing trades

Keeping a trading diary helps to identify mistakes and improve your strategy.

Recommendations:

-

Record the entry and exit of a trade, the reason for entry, the result and emotions.

-

Analyze statistics once a week (percentage of profitable trades, average profit/loss).

-

Improve the strategy by eliminating ineffective patterns and mistakes.

Conclusion

Cryptocurrency scalping is still one of the most effective trading strategies for beginners and experienced traders alike. There are many advantages to this strategy, ranging from the virtually unlimited potential to increase trading volume to the vast number of trading situations to suit any trader’s temperament and capabilities.

FAQ

1. What are the main strategies used in cryptocurrency scalping?

The main strategies include trading from densities, trading from market profile and momentum scalping.

2. What are the most effective indicators for scalping?

Moving averages (EMA, SMA), RSI, Stochastic, trading volumes and horizontal support and resistance levels.

3. How to automate the process of scalping in cryptocurrency?

The use of trading bots, exchange APIs and custom scripts helps to automate the process.

4. How to choose the right trading pairs for scalping?

Choose pairs with high liquidity, low spread, good volatility and low commissions.

5. What are the risks associated with scalping in cryptocurrency?

The main risks include high commissions, order slippage, emotional errors and the impact of news background on the market.