How to analyze the cryptocurrency market

To reach a stable level of trading, you need to understand exactly when to work out one situation or another according to your trading system, so as not to make extra trades and, accordingly, losses. In order to do this, you need to learn to correctly analyze the entire cryptocurrency market.

Why It’s Important to Analyze the Market

The crypto market is known for its high volatility. Without understanding what is happening in the market, it is easy to fall into a trap and incur very serious losses. Competent analysis of the crypto market allows traders not only to make more well-founded decisions, but also to identify the best entry and exit points from a position. Thanks to this, the risk of making non-system trades is reduced and the profitability of trades (win rate) increases.

Technical Analysis (TA)

Technical analysis (or tech analysis) is a method of forecasting price movement using charts and indicators. It is based on the assumption that the price discounts everything and history repeats itself. With the help of TA, traders learn to read crypto charts, determine trends and support/resistance levels.

Among popular tools are moving averages, RSI, MACD and many other indicators for trading.

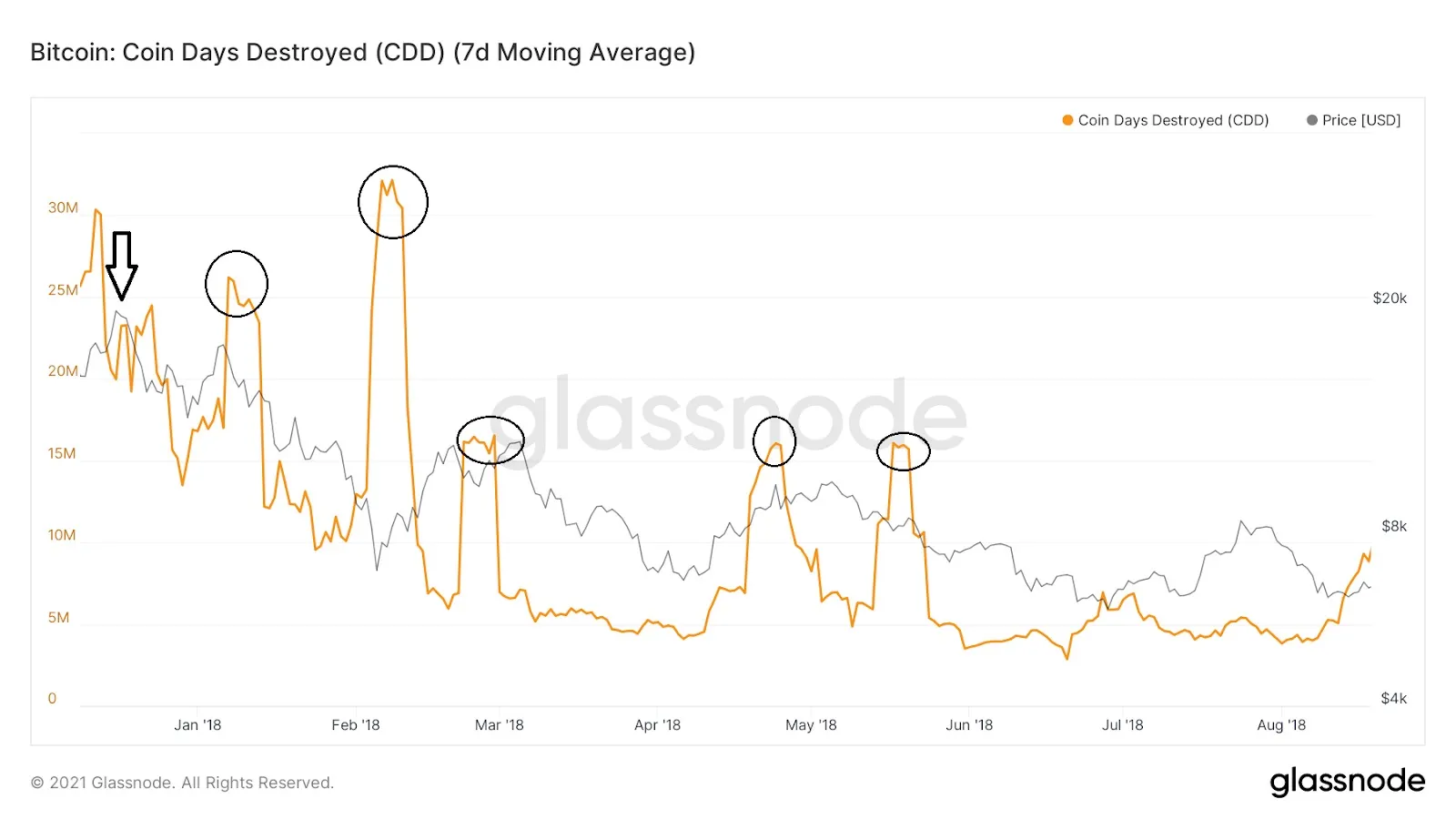

On-chain Analysis

On-chain cryptocurrency data gives an idea of what is happening inside the blockchain: how many active addresses there are, how many tokens are moving, how the balances of large holders are distributed. On-chain analysis makes it possible to understand the real activity of the network and identify moments of accumulation or mass selling that can affect the market. In crypto, this type of analysis is for many an analogue of fundamental analysis, as in the stock market.

Behavioral (Sentiment) Analysis

Sentiment analysis of the market is an assessment of public attitude toward an asset or sector using social networks, news, and the Fear and Greed Index. The Fear and Greed Index is most popular among crypto traders, as it helps determine whether the market is overbought or, on the contrary, is in the fear zone, which can be a good buying opportunity.

How to Combine Different Approaches

For comprehensive analysis and greater objectivity, it is worth combining several methods:

- Technical analysis: determines entry and exit points on the chart.

- On-chain analysis: shows fund flows and activity on the network.

- Sentiment analysis: gives an idea of the mood of market participants.

This approach allows a trader to take into account several factors at once and make a more balanced forecast, without relying only on the limited data of one of the methods.

Beginner Mistakes in Analyzing the Crypto Market

Many beginners, studying how to analyze cryptocurrency, make the same mistakes: complete disregard of fundamental factors, blindly following signals from chats without understanding the logic, overcomplicating analysis with an excessive number of indicators. Another common mistake is the belief that fundamental analysis of cryptocurrencies is not needed for speculative trading. The market is a combination of factors, therefore attention should be paid to many of its aspects and ongoing events to be in context.

How Veles Helps Analyze the Market

The Veles platform provides convenient crypto analysis tools in the form of numerous indicators and settings built directly into crypto bots. In addition, the bots can analyze data on volumes, news, and sentiment indicators, thereby making trading decisions systematic and more objective..

FAQ

How to understand cryptocurrency trading signals?

Study basic indicators, follow the trend, and confirm signals with other methods of analysis.

What is more important for analysis—technicals or fundamentals?

Both. Fundamental analysis of cryptocurrencies shows long-term potential, while technicals show the current price behavior.

How often do you need to analyze the market?

It is better to do this daily if you trade actively, or at least once a week for medium-term strategies.

Where should a beginner start?

With the basic concepts of technical analysis and chart reading to understand price movement.

What mistakes are made most often?

Blindly copying other people’s signals, ignoring news, violating the rules of money management.