Shor and long - what is it

The strategy of short and long simultaneously is an approach when a trader opens opposite positions on one or several assets. This strategy allows you to earn both on the rise and fall in price, reducing the dependence on the market direction.

What is short and long in simple words?

To understand what short and long in trading is, imagine the basic idea of buying and selling.

A long is a bet on growth. You buy an asset (such as a cryptocurrency) expecting its price to go up, and later sell it at a higher price. This is what most beginners do: buy cheap - sell expensive. For example, if you bought bitcoin for $90,000 and sold it for $100,000 - that’s a long position, and you made money on the difference.

Now it’s a short. This is a down bet. Imagine that you borrow an asset from the exchange, sell it at the current price, and then, when the price falls, buy it back at a lower price and return it. The difference is your profit. If you “borrow” bitcoin at $100,000 and then it drops to $90,000, you buy it back and make $10,000. That is the short position.

Thus, shorting and longing are two opposite approaches to trading. You can make money in both cases, but it is important to understand when to long and when to short, because the wrong direction can lead to losses. This is especially true in the volatile environment of the crypto market, where trends change quickly, emotions can easily confuse you, and the manipulations of large participants/market makers can be very unpredictable.

Long and Short in trading

Combining long and short positions helps to reduce risk during periods of uncertainty. For example, if a trader opens a long position on bitcoin, but simultaneously holds a short position on altcoin, he protects himself from a possible general market decline. This is especially true when you don’t know when to long and when to short. Modern cryptocurrency trading bots allow you to automate such scenarios and make opening counter positions quickly and efficiently. By the way, to try out this functionality, you can register on the Veles.finance platform and get a welcome bonus to get started. And if there are any difficulties, technical support will help you to understand all the details.

What is a hedge short?

Hedge short is a defensive strategy in which a trader opens a short position in order to compensate for possible losses on the main, most often long position. The word “hedge” itself (from English hedge) means “insurance”. In trading, it is interpreted as the use of an additional transaction directed in the opposite direction from the main one, in order to reduce the risk from market fluctuations.

Let’s imagine that you hold a long position, for example, you bought ether at $2,500 and expect it to grow. But the market is unstable and you fear a short-term correction on the news. In such a case, you can open a short position on the same asset or on another asset that correlates with it. If the price does fall, you lose on the long but gain on the short - this is how the hedging strategy works.

This approach is especially useful during periods of high volatility or on the eve of important events (for example, before the Fed rate news or a macroeconomic report), when a trader cannot predict which way the market will go. Hedging does not necessarily mean making a profit - the main goal here is to limit losses if the market moves against the main position.

Hedge in cryptocurrency can be applied through opening counter positions on different exchanges, in different derivatives or even through the use of cryptocurrency trading bots that automatically short and long at the same time at certain levels. This gives the trader flexibility and the ability to adapt to rapidly changing market conditions. At the same time, it is important to realize that hedge shorting is not just opening a position on the downside. It is a conscious defense against the risk associated with an existing upside bet.

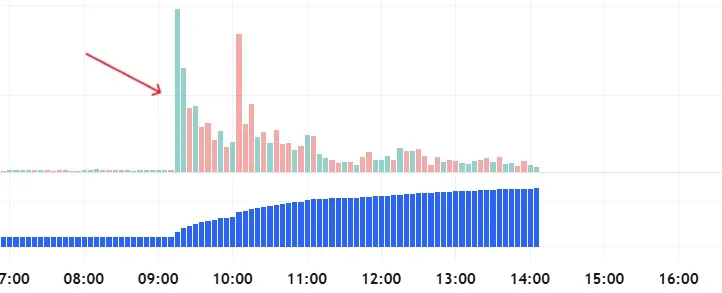

Cryptocurrency trading signals

Before opening a position, a trader looks for signals. They can be technical, based on indicators, or fundamental, related to news. The number of bitcoin longs and shorts on the exchange is often seen as an indicator of crowd sentiment. When there are a lot of longs in the market, a pullback may be expected and vice versa. This is especially important in times of high volatility, when deciding how to trade short correctly, so as not to become a victim of market circumstances.

Indicator for cryptocurrencies: how to choose for shorting and longing

Choosing an indicator for cryptocurrencies is a difficult but easy step for a trader, especially if you are shorting and longing at the same time or working with long and short positions in high volatility conditions. A good indicator does not just show the trend direction or when to enter a trade, but also helps a trader to understand when to go short or long, reduce false entries and manage risk.

If you want to know when to long and when to short, you should pay attention to the types of indicators that are used in professional trading. They are divided into trend indicators, oscillators, volumetric and combined.

Trend indicators, such as moving averages (MA) or exponential moving averages (EMA), help to determine the direction of market movement. For example, if the EMA 50 crosses the EMA 200 from the bottom to the top, it can be a signal for a long position, while the opposite crossing is a signal for a short position. They are especially effective in a steady trend, but can give late signals in flat markets.

Oscillators, such as RSI (Relative Strength Index) and Stochastic, help to determine whether an asset is overbought or oversold. When the RSI rises above 70, the market may be overheated and this is potentially a short signal. If it drops below 30 - an upward reversal may be imminent and a chance to open a long position. This is especially important when you want to trade long and short at the same time, hedging a position.

Volume indicators, such as OBV (On Balance Volume), show whether the price movement is confirmed by volume. They let you know if you should trust the current momentum or if it is a false move, especially if you are using a hedging strategy and trying to capture both sides of the market.

If you use cryptocurrency trading bots, there indicators are built into the algorithms and automated. This allows the bots to react instantly and for you not to miss profitable entries, even when the market changes too quickly.

It is important to remember that no indicator gives a 100% guarantee of profit. The best cryptocurrency strategies 2025 use several indicators in combination to filter signals and get a more accurate picture. It is also important to test the selected tools on historical data (backtests) and make sure that they fit your trading style - whether it is cryptocurrency arbitrage, shorting, longing or opening counter positions.

Finally, always consider the context. An indicator may show one thing, but the market may move differently due to news, high volume or manipulation. Use indicators as an outside help, but not as the only source of decisions. It is in combination with experience, analysis and a well-built strategy that indicators turn into a powerful tool that will help you trade the market with confidence regardless of the direction of your trades.

What is better - long or short trading?

There is no universal answer to the question: long or short? It all depends on the market situation. In a bullish trend it is logical to use longs, and in a bearish trend - shorts. There is an old expression: “Trend is your friend”. However, the strategy of short and long simultaneously allows you not to guess the direction, but to react to the movement and changing market situation.

FAQ

1. What are long and short?

They are types of positions where long is buying with the expectation of growth and short is selling with the expectation of decline.

2. Can I trade long and short at the same time?

Yes, especially when using hedging strategies or arbitrage.

3. When to long and when to short?

In an uptrend it is more reasonable to open long and in a downtrend to open short. Technical signals and news background are also important.

4. What is the right way to trade short?

It is necessary to determine the resistance level and signs of overbought. After that, choose an entry point and set a stop-loss.

5. How does long and short with leverage work?

Leverage increases the volume of the position at the expense of borrowed funds, increasing both profit and possible loss. You should trade with leverage only if you have experience and confidence in the signal.